The socialisation of the banking sector – banking as a public service Lecture to the Institute of Labour Studies , Ljubljana, Slovenia, Thursday 13 March 2014 by Michael Roberts. The main proposition of this lecture is simple: it is to argue that banking should be a public service for the people, whether they work for an employer or run a small business. It should not be a system for engaging in risky financial speculations or making commissions from selling the financial securities of large multinationals or governments. The aim of bankers should not be to increase the returns on the equity of their shareholders or line their own pockets with grotesquely large salaries and bonuses. The lecture argues that this aim can only be achieved through nothing less than full public ownership of the major banks, which must be democratically accountable and controlled by the people and which must act within a national (or even international) plan to meet the social needs of the people, not the profit of a few. Why should banks be commercial operations? What is to stop us turning them into a public service just like health, education, transport etc? Nothing is the short answer. If banks were a public service, they could hold the deposits of households and companies and then lend them out for investment in industry and services or even to the government. It would be like a national credit club. The global banking crash made the worldwide recession worse If banks globally had been under public ownership and engaged only in a plan to provide funds for industrial investment, government infrastructure development and housing, the financial crunch would have been avoided (even if the ensuing global economic slump was not). In its latest Fiscal Monitor, the IMF calculated that around $1.7trn had been spent directly by taxpayers in the advanced economies to ‘bail out’ the banking sector in the financial crisis and so far only €914bn has been recovered through the sale of assets and other revenues collected from the bailed out banks. So 7% of 2012 global GDP has been used and only 3.7% of GDP has been recovered. Indeed, only in the US is the taxpayer anywhere close to getting its money back (at 4.2% of GDP compared to a bailout of 4.8% of GDP spent). In most other economies, the recovery rate is less than 25% after five years.

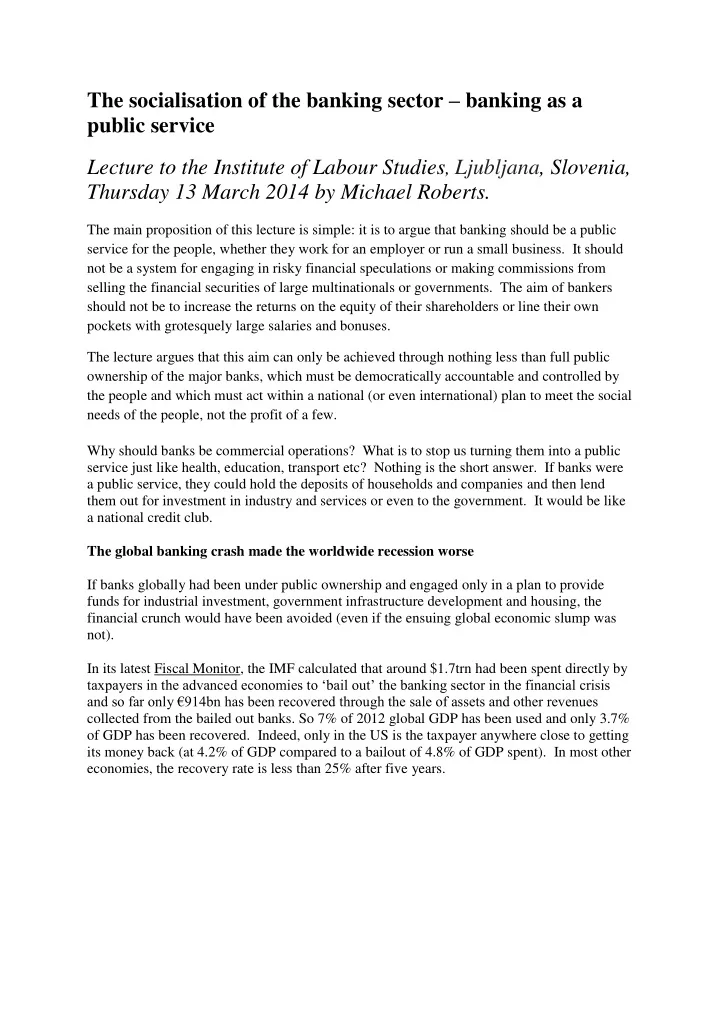

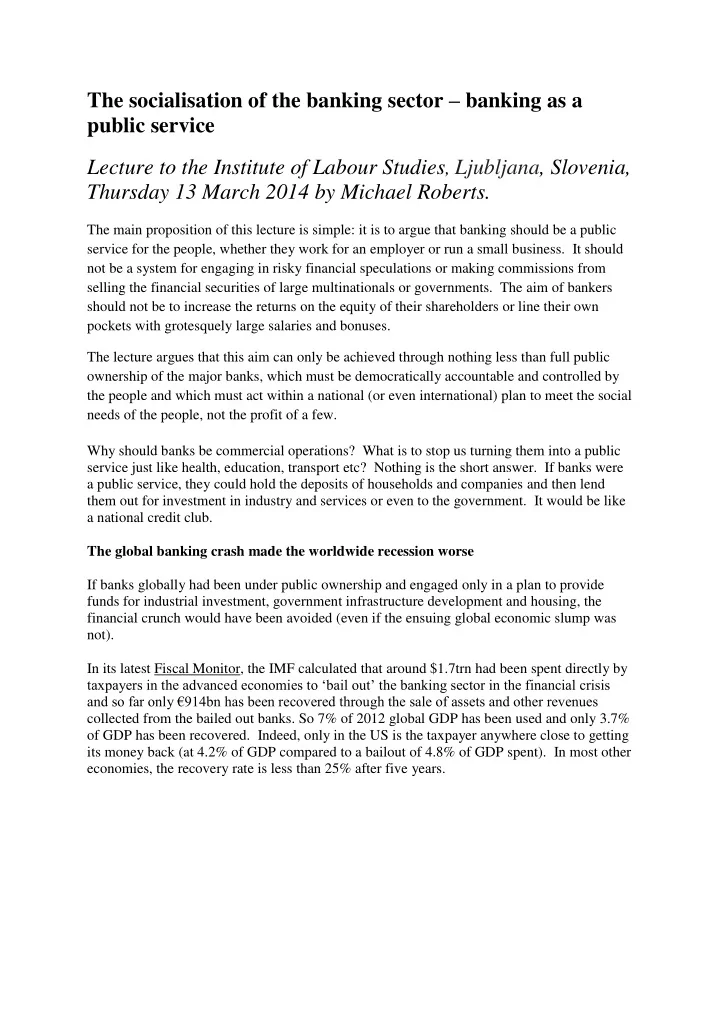

That the global financial collapse made the ensuing Great Recession much deeper and long lasting is suggested by a comparison of the recovery from the Great Recession by the major capitalist economies. In the graph below (produced by the Bank of England), we can see that recovery from recessions on average is achieved within four quarters (red line). If a banking crisis is also involved, then it takes up to 12 quarters (green line). But the Great Recession has been much worse, with only the US getting anywhere near an average recovery (purple line), while the Eurozone and the UK in particular are still way behind. For example, according to Andy Haldane, responsible for financial stability at the Bank of England, reckons that when all the extra long-term and indirect costs have been added in, Britain may have lost between one and five years’ GDP as a result of the banking crisis.

The global financial crash and the ensuing Great Recession that has hit most parts of the world demonstrate the need to bring banks under the social control of the people. Which would have been best: a bailout or a takeover? It’s over five years since Lehman Brothers, one of the big five investment banks in the US, went bust and kicked off a financial collapse that nearly pushed the whole capitalist system into meltdown. Governments insisted that these global banks were ‘bailed out’ with cash, guarantees and loans worth well over $3trn 1 . And households around the world, and now including Slovenia, have had to pay with sharp reductions in their living standards, through job losses, wage cuts, tax increases, and an increased public sector debt servicing Government debt ratios are now at post-war highs. Andrew Haldane has calculated that the major banks have only taken a hit equivalent to 1/20th of low-end estimate of what the banks ought to pay for all the damage they did. Politicians and bankers colluded to lie about the size of crisis to begin with; then they lied about the size of the bailout needed; then they lied about how the bailouts would restore bank lending to households and corporations; then they lied about how healthy the banks were; then they lied about reducing the top bank ers’ bonuses; and then they lied by saying any bailout would be temporary. Capitalist states committed their electorates to providing a permanent guarantee that banks will be bailed out and supported whatever – and the banks remain in private hands. “All of this – the willingness to call dying banks healthy, the sham stress tests, the failure to enforce bonus rules, the seeming indifference to public disclosure, not to mention the shocking lack of criminal investigations into fraud by bailout recipients before the crash – comprised the largest and most valuable bailout of all” ( Taibbi). 2 And where are we now? The banks are still engaged in speculations, are still not regulated properly and are still aimed at making profits for shareholders and not providing a public service for people. “ we have a banking system that discriminates against community banks, makes ‘too big to fail’ banks even to ‘bigger to fail’, increases risk, discourages sound business lending and punishes savings by making it even easier and more profitable to chase high-yield investments rather than to compete for small depositors.” Taibbi It’s a never-ending banking story Indeed, the global banking sector remains deep in the sludge of scandal, corruption and mismanagement, with a new revelation nearly every week. And it continues to fail in its supposed purpose, namely to provide liquidity and credit to households and to businesses to enable them to pay for working capital and investment to grow. 1 IMF 2 Taibbi

Take the UK banks: Barclays has been fined $450m for its part in the so-called Libor scandal, where banks’ traders colluded to fix the interest rate for inter -bank lending, which sets the floor for most loan costs across the world. That rigging meant that local authorities, charities and businesses ended up paying more than they should for loans. HSBC was indicted by the US Congress for laundering Mexican drug gangs money and breaches of sanctions on Iran (as was Standard Chartered). Lloyds Bank, along with all the other banks, has had to compensate customers for misselling them personal injury insurance to the tune of £5.3bn, money that could have been better used to fund industry and keep loan terms down. And there is RBS. This British bank was brought to its knees in the financial collapse by a management led by (Sir) Fred Goodwin, knighted for his services to the banking industry (!). Goodwin was noted for his bullying and his penchant for risk and huge bonuses. He left, but not without taking a fat pension and handshakes from the RBS board, as have all the senior executives of the banks when they have been asked to ‘step down’ following a scandal. Nobody has been charged or convicted in a criminal court for any actions by the these global banks since the scandals and illegal activities were revealed 3 . On the contrary, the banks have shrugged off all these scandals. JP Morgan continued to run a risky trading outfit out of London engaged in outsized trades in derivatives, the very ‘financial weapons of mass destruction’ (to use the world’s greatest investor,Warren Buffet’s term) that triggered the 2008 crisis. The ‘London whale’, as it was called, eventually lost the bank $6bn! The main trader, Bruno Iksil, told his senior executives that he was worried about the “scary” size of th e trades he was engaged in. But they ignored him. And the US supervisors of the bank, the Office of Comptroller of the Currency, supposedly now closely monitoring the banks, also did nothing. Bob Diamond, the former head of Barclays and eventually sacked over the Libor scandal (but only because the then Bank of England governor, Mervyn King insisted), made the statement that “ For me, the evidence of culture is how people behave when no one is looking” . Exactly, and it is clear what the banking culture is, namely to use customers money, taxpayers cash and guarantees and shareholders investments to try to make huge profits through risky assets and then pay themselves grotesque bonuses. And nothing has really changed. A secret report recently found that Barclays bank was still engaged in getting “revenue at all costs” and employed “ fear and intimidation” on staff to do so. “When plunder becomes a way of life for a group of men living together in societ y, they create for themselves in the course of time a legal system that authorises it and a moral code that glorifies it”. 19th century economist Frederic Bastiat And yet the banks want to continue just as before. 3 (see my previous post, http://thenextrecession.wordpress.com/2010/09/15/banking-as-a- public-service/ and http://thenextrecession.wordpress.com/2012/11/19/marx-banking- firewalls-and-firefighters/) .

Recommend

More recommend