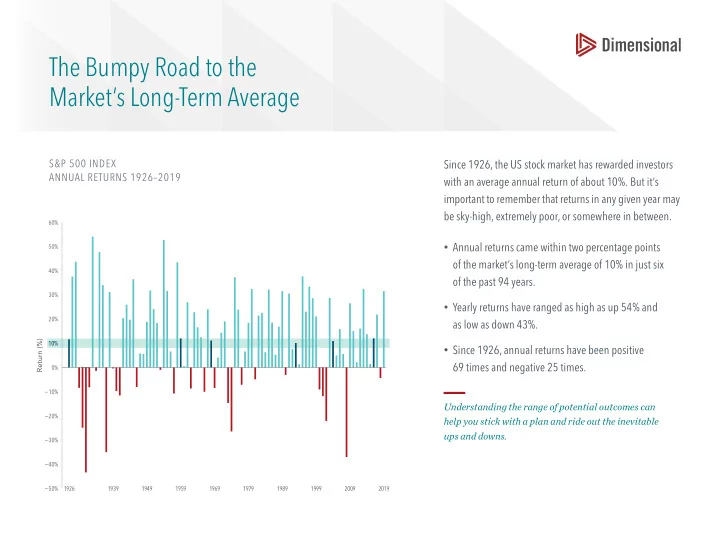

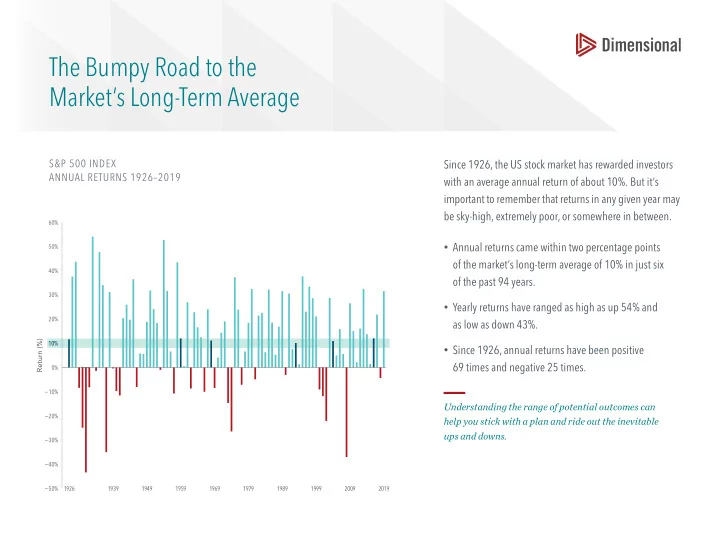

The Bumpy Road to the Market’s Long-Term Average S&P 500 INDEX Since 1926, the US stock market has rewarded investors ANNUAL RETURNS 1926–2019 with an average annual return of about 10%. But it’s important to remember that returns in any given year may be sky-high, extremely poor, or somewhere in between. 60% • Annual returns came within two percentage points 50% of the market’s long-term average of 10% in just six 40% of the past 94 years. 30% • Yearly returns have ranged as high as up 54% and 20% as low as down 43%. Return (%) 10% • Since 1926, annual returns have been positive 69 times and negative 25 times. 0% −10% Understanding the range of potential outcomes can −20% help you stick with a plan and ride out the inevitable ups and downs. −30% −40% −50% 1926 1939 1949 1959 1969 1979 1989 1999 2009 2019

Do Downturns Lead to Down Years? US MARKET INTRA-YEAR DECLINES VS.CALENDAR YEAR RETURNS, Stock market slides over a few days or months may lead January 1, 2000–December 31, 2019 investors to anticipate a down year. But a broad US market index had positive returns in 15 of the past 20 calendar Positive Calendar Year Return Negative Calendar Year Return Largest Intra-Year Decline years, despite some notable dips in many of those years. 34% 31% 31% • Intra-year declines for the index ranged from 3% to 49%. 28% 21% • Calendar year returns improved on those intra-year 17% 16% 16% slides. The steepest declines saw notable recoveries, 13% 13% 12% and in 15 of the 20 years, stocks ended up with gains 6% 5% for the year. 1% 0.5% • Even amid the fjnancial crisis in 2009, a 27% plunge −3% gave way to a 28% gain by the end of the year. −5% −6% −7% −7% −7% −8% −8% −8% −10% −10% −11% −11% −12% −13% −16% −18% Volatility is a normal part of investing. Tumbles may be −20% −20% −22% scary, but they shouldn’t be surprising. A long-term focus can help investors keep perspective. −27% −29% −33% −37% −49% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

History Shows That Stock Gains Can Add Up After Big Declines FAMA/FRENCH TOTAL US MARKET RESEARCH INDEX RETURNS, Sudden market downturns can be unsettling. July 1, 1926—December 31, 2019 But historically, US equity returns following sharp downturns have, on average, been positive. 1-Year Average Cumulative 3-Year Average Cumulative 5-Year Average Cumulative • A broad market index tracking data since 1926 in the US shows that stocks have tended to deliver 71.8% 67.5% positive returns over one-year, three-year, and fjve-year periods following steep declines. • Cumulative returns show this to striking effect. Five 50.1% years after market declines of 10%, 20%, and 30%, the compounded returns all top 50%. 35.6% 32.7% • Viewed in annualized terms across the longest, fjve-year period, returns after 10%, 20%, and 30% declines have 18.6% been close to the historical annualized average over the 16.4% 14.4% entire period of 9.6%. 1 11.6% Sticking with your plan helps put you in the best position to capture the recovery. Return After Return After Return After 10% Market Decline 20% Market Decline 30% Market Decline

1. The average annualized returns for the five-year period after 10% declines were 9.33%; after 20% declines, 9.66%; and after 30% declines, 7.18%. Past performance is no guarantee of future results. Short-term performance results should be considered in connection with longer-term performance results. Indices are not available for direct investment. Their performance does not refmect the expenses associated with the management of an actual portfolio. Market declines or downturns are defjned as periods in which the cumulative return from a peak is –10%, –20%, or –30% or lower. Returns are calculated for the 1-, 3-, and 5-year look-ahead periods beginning the day after the respective downturn thresholds of –10%, –20%, or –30% are exceeded. The bar chart shows the average returns for the 1-, 3-, and 5-year periods following the 10%, 20%, and 30% thresholds. For the 10% threshold, there are 28 observations for 1-year look-ahead, 27 observations for 3-year look-ahead, and 26 observations for 5-year look-ahead. For the 20% threshold, there are 14 observations for 1-year look-ahead, 13 observations for 3-year look-ahead, and 13 observations for 5-year look-ahead. For the 30% threshold, there are 6 observations for 1-year look-ahead, 3-year look-ahead, and 5-year look-ahead. Peak is a new all-time high prior to a downturn. Data provided by Fama/French and available at mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html . Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. Investing risks include loss of principal and fmuctuating value. There is no guarantee an investment strategy will be successful. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. AMERICAS EUROPE ASIA PACIFIC Austin, Charlotte, Santa Monica, Toronto, Vancouver London, Amsterdam, Berlin Sydney, Melbourne, Singapore, Hong Kong, Tokyo MKT-9317 04/20 1777845

Recommend

More recommend