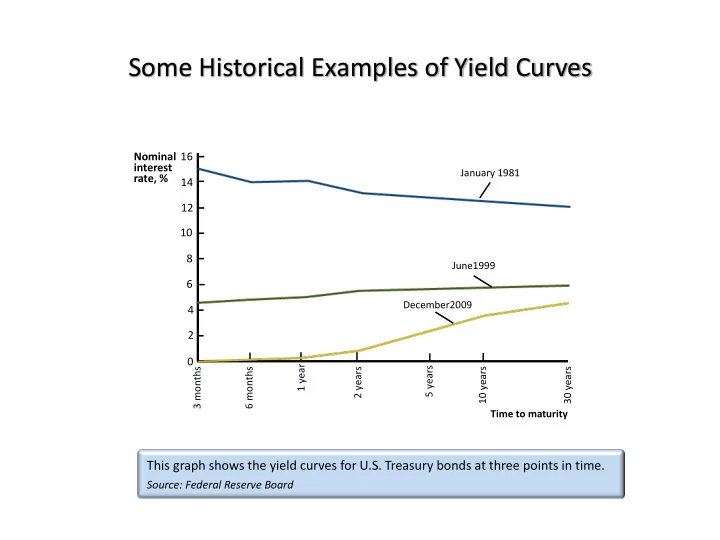

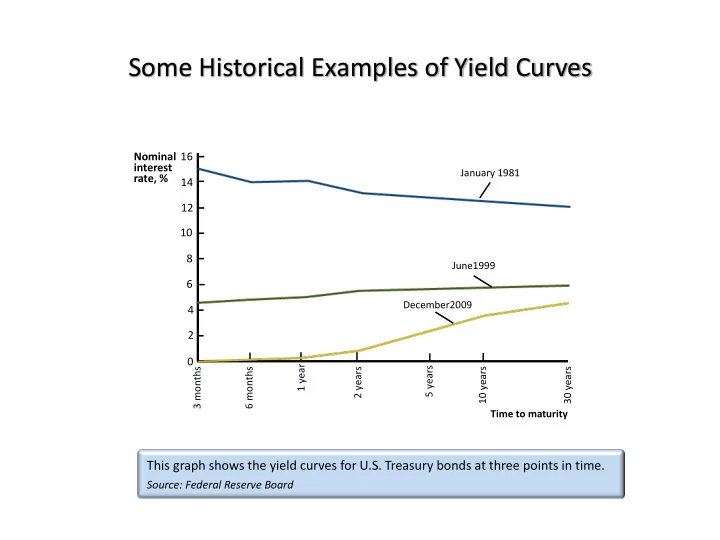

Some Historical Examples of Yield Curves Nominal 16 interest January 1981 rate, % 14 12 10 8 June1999 6 December2009 4 2 0 1 year 5 years 2 years 10 years 30 years 3 months 6 months Time to maturity This graph shows the yield curves for U.S. Treasury bonds at three points in time. Source: Federal Reserve Board

Government Bond Yield Curve, January 18, 2012

For S&P, a bond is considered investment grade if its credit rating is BBB- or higher. Bonds rated BB+ and below are considered to be speculative grade, sometimes also referred to as "junk" bonds

S&P: The general meaning of our credit rating opinions is summarized below. ‘AAA’— Extremely strong capacity to meet financial commitments. Highest Rating. ‘AA’— Very strong capacity to meet financial commitments. ‘A’— Strong capacity to meet financial commitments, but somewhat susceptible to adverse economic conditions and changes in circumstances. ‘BBB’— Adequate capacity to meet financial commitments, but more subject to adverse economic conditions. ‘ BBB- ‘— Considered lowest investment grade by market participants. ‘ BB+ ’— Considered highest speculative grade by market participants. ‘BB’— Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions. ‘B’— More vulnerable to adverse business, financial and economic conditions but currently has the capacity to meet financial commitments. ‘CCC’— Currently vulnerable and dependent on favorable business, financial and economic conditions to meet financial commitments. ‘CC’— Currently highly vulnerable. ‘C’— Currently highly vulnerable obligations and other defined circumstances. ‘D’— Payment default on financial commitments. Note: Ratings from ‘AA’ to ‘CCC’ may be modified by the addition of a plus (+) or minus ( -) sign to show relative standing within the major rating categories.

The High-Yield Spread, 1960-2010

S&P Ratings: Sovereign Debt

Croatia BBB- Negative 2011-11-29 A- Stable 2011-11-29 Curacao Cyprus BB+ Negative 2012-01-13 Czech Republic AA- Stable 2011-11-29 AAA Stable 2011-11-29 Denmark Dominican Republic B+ Stable 2011-11-29 B- Positive 2011-11-29 Ecuador Egypt B+ Negative 2011-11-29 El Salvador BB- Stable 2011-11-29 Estonia AA- Negative 2012-01-13 Fiji B Stable 2011-11-29 Finland AAA Negative 2012-01-13 France AA+ Negative 2012-01-13 BB- Stable 2011-11-29 Gabon BB- Stable 2011-11-29 Georgia Germany AAA Stable 2012-01-13 Ghana B Stable 2011-11-29 CC Negative 2011-11-29 Greece Grenada B- Stable 2011-11-29 Guatemala BB Negative 2011-11-29 Guernsey AA+ Stable 2011-11-29 Honduras B Positive 2011-11-29 Hong Kong AAA Stable 2011-11-29 Hungary BB+ Negative 2011-12-21 BBB- Stable 2011-11-29 Iceland India BBB- Stable 2011-11-29 Indonesia BB+ Positive 2011-11-29 Ireland BBB+ Negative 2012-01-13

Harmonised long-term interest rates for convergence assessment purposes ( 1 ) (percentages per annum; period averages; secondary market yields of government bonds with maturities of close to ten years ( 2 )) Countries Dec. 10 Jan. 11 Feb. 11 Mar. 11 Apr. 11 11-May 11-Jun 11-Jul Aug. 11 Sep. 11 Oct. 11 Nov. 11 Dec. 11 Sources: ECB and European Commission. The latest data are available via Statistical Data Warehouse (SDW): Euro Area, SDW, Long-term Interest Rates Non-Euro Area, SDW, Long-term Interest Rates ( 1 ) As Estonia has a very limited government debt, there are currently no suitable long-term government bonds available on the financial market. See Table 2 for a MFI interest rate indicator for Estonia. ( 2 ) For Cyprus, primary market yields are reported. The same applies to Bulgaria and Romania up to December 2005, Slovenia up to October 2003 and Lithuania up to October 2007. ( 3 ) A harmonised long-term interest rate is presented starting mid-May 2010. Before, the Luxembourg Government did not have outstanding long-term debt securities with a residual maturity of close to ten years. Therefore, the yield on long-term bond(s) issued by a private credit institution with a residual maturity close to 10 years is presented for the period up to mid-May 2010 and is thus not fully harmonised for that period. Euro area Belgium 3.99 4.14 4.21 4.21 4.29 4.21 4.14 4.22 4.11 3.88 4.2 4.84 4.35 Germany 2.91 3.02 3.2 3.21 3.34 3.06 2.89 2.74 2.21 1.83 2 1.87 1.93 Ireland 8.45 8.75 9.1 9.67 9.79 10.64 11.43 12.45 9.57 8.51 8.1 8.51 8.7 Greece 12.01 11.73 11.4 12.44 13.86 15.94 16.69 16.15 15.9 17.78 18.04 17.92 21.14 Spain 5.38 5.38 5.26 5.25 5.33 5.32 5.48 5.83 5.25 5.2 5.26 6.2 5.53 France 3.34 3.44 3.6 3.61 3.69 3.49 3.43 3.4 2.98 2.64 2.99 3.41 3.16 Italy 4.6 4.73 4.74 4.88 4.84 4.76 4.82 5.46 5.27 5.75 5.97 7.06 6.81 Cyprus 4.6 4.6 4.6 4.6 4.6 4.6 5.78 6.25 6.42 7 7 7 7 Luxembourg ( 3 ) 3.32 3.3 3.45 3.47 3.58 3.29 3.15 3.03 2.59 2.27 2.37 2.31 2.27 Malta 4.42 4.51 4.6 4.68 4.73 4.63 4.63 4.59 4.32 4.14 4.26 4.35 4.43 Netherlands 3.16 3.23 3.41 3.42 3.65 3.4 3.28 3.17 2.68 2.34 2.46 2.45 2.38 Austria 3.43 3.54 3.68 3.68 3.76 3.53 3.43 3.35 2.84 2.64 2.92 3.36 3.1 Portugal 6.53 6.95 7.34 7.8 9.19 9.63 10.87 12.15 10.93 11.34 11.72 11.89 13.08 Slovenia 4.11 4.29 4.26 4.3 4.53 4.43 4.58 4.89 4.99 4.86 5.16 6.46 6.9 Slovakia 4.06 4.16 4.24 4.32 4.33 4.33 4.39 4.55 4.55 4.25 4.33 4.71 5.21 Finland 3.19 3.27 3.41 3.45 3.57 3.32 3.29 3.16 2.68 2.35 2.51 2.54 2.52

Greece’s Debt Crisis (B) Interest Rates on 10-Year (A) Greece’s Sovereign Debt Ratings Government Bonds A 8 S&P Interest bond rates, % A- 7 rating Greece BBB+ 6 BBB 5 BBB- 4 Germany BB+ 3 2 BB 2007 2009 2010 2011 2007 2011 2008 2008 2009 2010 Year Year Over 2009-2010, fears that the Greek government might default on its debt caused the country’s bond rating (A) to fall and (B) interest rates on its bonds to rise relative to rates on bonds issued by other European governments. Source: Standart & Poor’s; OECD

U.S. Real Interest Rates, 1960-2010 Real 12 interest BBB corporate bonds rate, % 10 30-year mortgages 8 6 10-year Treasury bonds 4 2 0 90-day Treasury bills -2 -4 1965 1960 1970 1975 1980 1985 1990 1995 2010 2000 2005 Year This graph charts the behavior over time of four interest rates in the United States. Each is a real rate-the nominal rate minus inflation over the previous year. The broad movements in the four interest rates are similar over time. Source: Federal Reserve Bank of St. Louis

International Real Interest Rates, 1960-2009 10 Real interest 8 rate, % Canada 6 4 2 0 -2 USA -4 -6 France -8 -10 1965 1960 1970 1975 1980 1985 1990 1995 2010 2000 2005 Year Real interest rates in the three countries examined here follow the same broad pattern over time. (The real interest rate for each country is the nominal rate on 3-month government bonds minus inflation over the previous year.) Source: International Monetary Fund

Inflation and Nominal Interest Rates Across Countries 80 Nominal interest rate, % 70 Russia 60 Turkey Romania 50 40 Mexico 30 USA Poland 20 10 South Africa Japan 0 10 20 30 40 50 60 70 80 90 100 Inflation rate, % For the 1990s, this graph plots average inflation and the average nominal interest rate on 3-month government bonds in 41 countries. The graph illustrates the Fisher effect: higher inflation raises the nominal interest rate. Source: International Monetary Fund

Recommend

More recommend