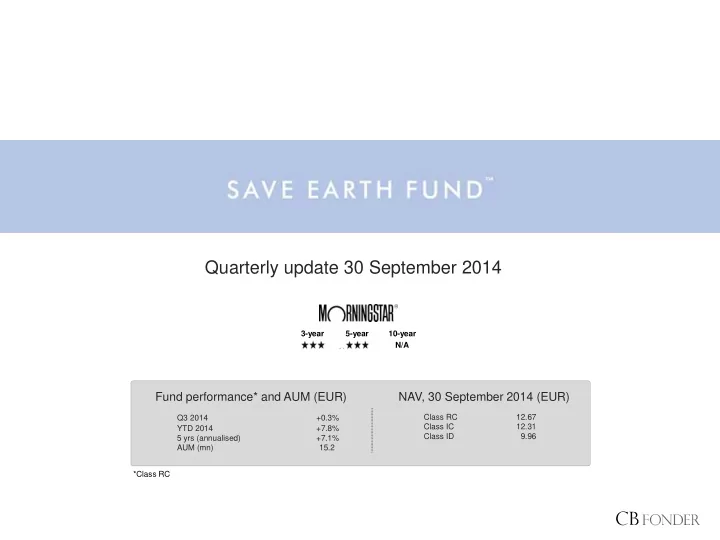

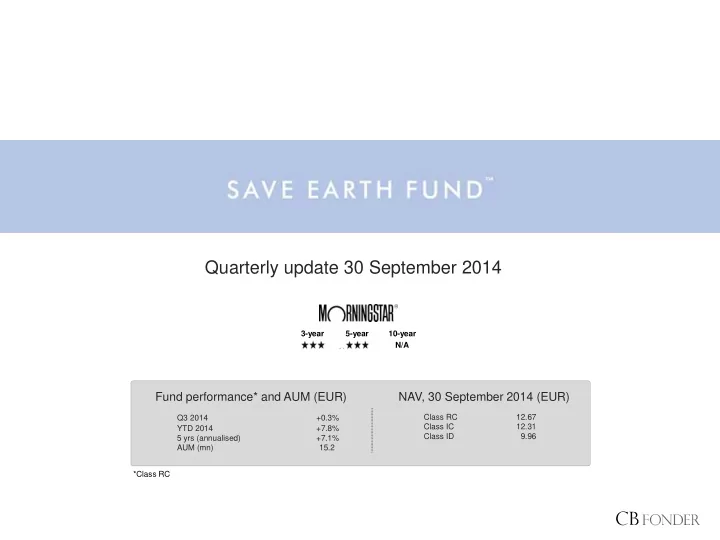

Quarterly update 30 September 2014 3-year 5-year 10-year N/A Fund performance* and AUM (EUR) NAV, 30 September 2014 (EUR) Class RC 12.67 Q3 2014 +0.3% Class IC 12.31 YTD 2014 +7.8% Class ID 9.96 5 yrs (annualised) +7.1% AUM (mn) 15.20 *Class RC

The strategy and the team Save Earth Fund The team About Save Earth Fund A global environmental fund: identifies and invests with the Carl Bernadotte Portfolio manager/owner top managers within renewables, cleantech and water >25 years’ experience Concentrated portfolio (6-10 funds) Born 1955 Benchmark: MSCI World Net Marcus Grimfors Objective: Lower standard deviation than benchmark Portfolio manager Objective: Outperform benchmark over 12 months 6 years’ experience Born 1981 About CB Fonder Alexander Jansson Portfolio manager/CEO Company founded in 1994 6 years’ experience Family owned, acting under the supervision of the Swedish Born 1983 Financial Supervisory Authority Erik Allenius Somnell Guidelines: active, ethical and long-term Business development An ethical framework is applied in the portfolio management 2 years’ experience The team is based in Stockholm, Sweden; fund Born 1984 administration is performed in Luxembourg 2

Investment-case: Three megatrends Cleantech Water treatment Renewable energy • Energy storage • Filtration • Wind • Saving/Efficiency • Solar • Energy infrastructure • Infrastructure • Hydro • Energy efficiency • Transportation • Bio • Geothermal • Emissions control • Smart materials • Recycling & Waste treatment 3

Portfolio management: Multi-Manager Save Earth Fund Every asset manager has a certain skill: one can be a specialist in Swedish Large Caps, another in Emerging Market high-yield debt. To be an expert in every field is hard if not impossible, and generally the complexity increases when analysing lesser developed markets, sectors or companies. Our ambition is to identify the managers that, over time, have performed best-in-class in each region and/or sector in order to deliver the best possible overall performance. To make a simple illustration of this point, we have made a comparison between the personal best marks of Carolina Klüft (successful Swedish heptathlon athlete) and the gold medallists' performance in each individual event in the 2012 London Olympics. Gold, London 12.35 s 2.05 m 21.88 s 20.7 m 7.12 m 69.55 m 1:56.19 2012 Olympics Carolina Klüft 13.15 s 1.95 m 22.98 s 15.05 m 6.97 m 50.96 m 2:08.9 Personal best Carolina’s performances are of course astonishingly good but can in no single event match that of the specialist. Multi-manager, or Fund of Funds, is in others words a method of identifying and selecting specialists with the ambition to deliver a consistently higher return: the whole is greater than the sum of the parts. Source: Wikipedia 4

Environmental strategies as an asset class: a ”satellite” Save Earth Fund Environmental strategies as a complement to a global portfolio - The basic idea of a so called Core/Satellite strategy is to invest a large part of the portfolio in large caps with a similar risk/return profile as the broad market (e.g. MSCI World) and to add smaller positions (10-20% of the portfolio) in niche strategies, so called satellites, with a different risk/return profile. - We argue that environmental strategies in the form of global stocks with strong long-term drivers and an attractive and different risk/return profile, have the right characteristics to fit well in this type of strategy as a satellite/complement to the core in a global portfolio. Compare, for example, with the characteristics of emerging markets. Example of a Core/Satellite -portfolio Bonds EM Environmental strategies Hedge funds Large caps HY Credit in developed markets Real Estate 5

Environmental strategies as an asset class: a ”satellite” Save Earth Fund Environmental strategies as a complement to a global portfolio - The renewable energy index (NEXEUT) and the cleantech index (CTIUS) has clearly differing risk profiles compared to the broad developed market indices (MSCI Europe, MSCI World and MSCI USA). - The water index (S&P Global Water Index), however, has a risk profile in line with the broad developed markets. Seen from that perspective it can be argued that the sector is part of the core rather than the satellites. Risk and return, 10 years (EUR) Risk and return, 2 years (EUR) Source: S&P, MSCI, Reuters 6

The fund in (Swedish) media Save Earth Fund News report about environmental investing and interview with Alexander Jansson EFN, 23 Sep 2014 News report about the water sector and interview with Alexander Jansson EFN, 24 Sep 2014 “’It is mainly companies within renewable energy that has performed really well this year’, says Alexander Jansson, who manages the environmental fund CB Save Earth, which in the last 12 months has returned 26 percent [in SEK] … The portfolio manager do not hold high expectations for the UN Environmental Summit this week. ‘These summits rarely lead to anything positive. Furthermore, we have now reached a more mature stage where the dependence on political decisions has decreased. Renewable energy, cleantech and other similar sectors have come to look more like mature industrials’, he states. ” Swedish business newspaper Dagens Industri, ” Lönsamt att satsa på miljö ”, 24 Sep 2014 N.B. Our translation 7

The sector in the media: The Rockefellers ”goes green” and Save Earth Fund Martin Wolf questions fossil fuel subsidies “ ‘John D Rockefeller, the founder of Standard Oil, moved America out of whale oil and into petroleum,’ Stephen Heintz, president of the Rockefeller Brothers Fund, said in a statement. ‘We are quite convinced that if he were alive today, as an astute businessman looking out to the future, he would be moving out of fossil fuels and investing in clean, renewable energy. ’ ‘With Monday’s announcement, more than 800 global investors – including foundations such as the Rockefeller Brothers, religious groups, healthcare organisations, cities and universities – have pledged to withdraw a total of $50bn from fossil fuel investments over the next five years. ’ The Guardian, “Heirs to Rockefeller oil fortune divest from fossil fuels over climate change”, Sep 22 2014. Read the full article here. “ The report estimates subsidies to fossil fuels at $600bn a year, against subsidies of just $90bn to clean energy. This makes no sense at all. Martin Wolf in Financial Times, ”Clean growth is a safe bet in the climate casino”, Sep 23 2014. Read the full article here. 8

Performance: The fund and indices Save Earth Fund Environmental investments have generally performed well over the past year, which has also been the case for MSCI World, the latter driven by a strengthening US dollar as well as a very strong performance in the US stock market. The index for renewable energy (Wilderhill New Energy Index), the most volatile sector in the comparison, is also the leading performer gaining 23.3% during the last 12 months. Performance for different sector indices, 1 year (EUR) +23.3% +14.7% Source: MSCI, CB Fonder 9

Performance: The fund and peers Save Earth Fund Save Earth Fund’s objective is to offer investors a low risk alternative within a segment characterised by high risk. The fund has, since inception in 2008, had a significantly lower risk than many competitors while delivering a highly competitive return; a combination that results in a high Sharpe ratio. Performance and risk, since inception (EUR)* Sharpe, since inception* Return p.a. Standard deviation Source: CB Fonder, Bloomberg *Monthly data from Bloomberg for the period 2008-06-30 – 2014-09-30, EUR. 10

The portfolio: Largest exposures Save Earth Fund Largest company exposures Market cap, Share of EPS growth, Company Founded/listed Country Sector PEG, 2015 DY € bn AUM* 2015E American Water 1886/2008 USA Water 6.9 2.2% 7.8% 2.4 2.5% Pennon Group 1989/1989 UK Water 4.0 1.8% 13.0% 1.5 4.5% Suez Environnement 1858/2008 France Water 7.3 1.7% 18.3% 0.9 5.0% Arcadis 1888/1995 Holland Cleantech 2.0 1.6% 21.7% 0.6 2.3% Andritz 1852/2001 Austria Renewables 4.3 1.6% 33.2% 0.5 2.4% Veolia Environnement 1853/2000 France Water 7.8 1.5% 66.2% 0.3 3.1% United Utilities 1989/1989 UK Water 7.3 1.5% -8.5% - 5.3% A.O. Smith Corp 1874/1983 USA Water 3.9 1.5% 12.6% 1.5 1.2% Xylem 2011/2011 USA Water 5.3 1.5% 15.3% 1.1 1.4% Geberit 1874/1999 Switzerland Water 9.8 1.5% 6.8% 3.3 2.0% Total/Average 5.9 16.3% 18.6% 1.3 3.0% Due to a concentrated For 2015, high profit growth is Exposure to large companies with a expected, which gives attractive portfolio (6-10 managers; 6 as long history; no mayflies. valuations (given that these of 30 September 2014) our company exposures are fairly numbers are met): PEG ratio of 1.3. A mixture of high-yielding utilities and growth companies. large. *Estimation made from data available on the holdings of underlying funds as well as Save Earth Fund’s exposure to these funds, as of 30 September 2014. 11

The portfolio: Exposure, share of AUM Save Earth Fund Sector allocation, 36 months As of September 2014 Geographical allocation, 36 months As of September 2014 *Including cash in underlying funds. 12

Recommend

More recommend