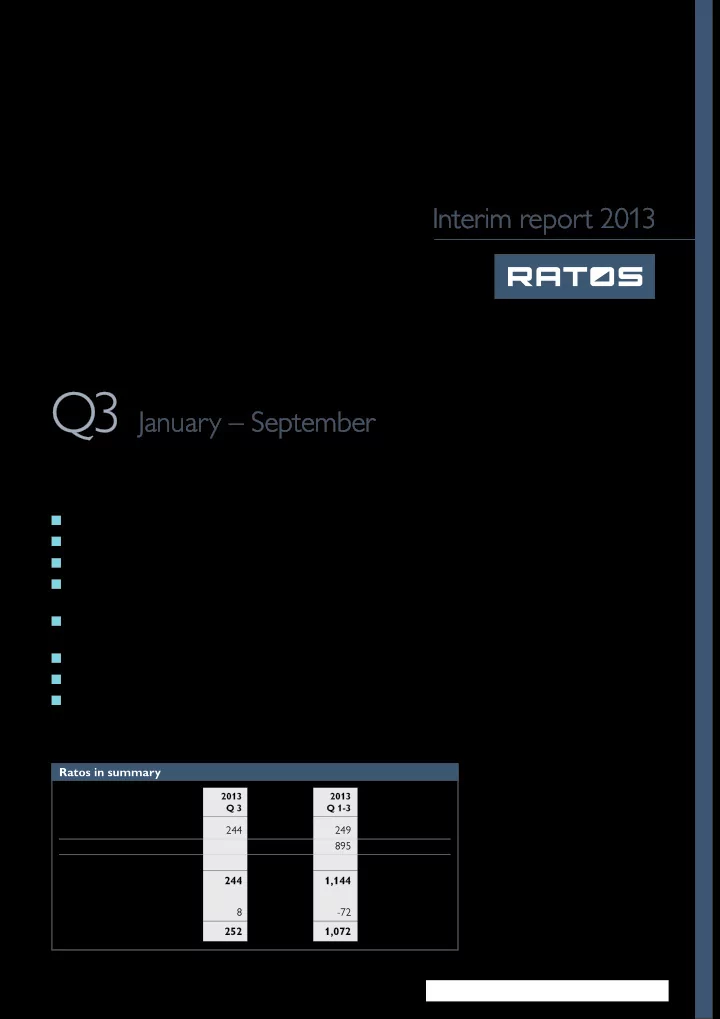

Interim report 2013 Q3 January – September ■ Profit before tax SEK 1,072m (1,056) ■ Earnings per share before dilution SEK 2.81 (3.04) ■ Gradual improvement in holdings ■ Acquisition of HENT and additional investment in Jøtul completed in third quarter ■ Acquisition of Aibel and Nebula and merger of SF Bio and Finnkino completed in second quarter ■ Stofa sold in first quarter – exit gain SEK 895m ■ Issue of preference shares carried out in June ■ Total return on Ratos shares +1% Ratos in summary 2013 2012 2013 2012 SEKm Q 3 Q 3 Q 1-3 Q 1-3 2012 Profit/share of profits 244 114 249 176 -29 Exit gains 978 895 978 978 Impairment -275 -375 Profit from holdings 244 1,092 1,144 879 574 Central income and expenses 8 -20 -72 177 193 Profit before tax 252 1,072 1,072 1,056 767 January – September Ratos interim report 2013 1

Important events Events in the third quarter (SEK 284m) for a holding corresponding to 72%. A possible earn-out payment is contingent on certain profitability ■ In July, the acquisition of the Norwegian construction milestones being achieved company HENT was completed. The seller was Heimdal ■ The acquisition of Aibel announced in December 2012 Gruppen and a number of financial investors. Enterprise was completed in April. Enterprise value for 100% of value for 100% of the company amounted to approximately Aibel amounted to NOK 8,600m. Ratos acquired 32% NOK 450m (approximately SEK 510m), of which Ratos of the company and provided equity of NOK 1,429m provided equity of NOK 307m (SEK 347m) for 73% of the (SEK 1,676m) shares ■ In July, Ratos increased its ownership in Jøtul from 61% to ■ In February, the sale was completed of the subsidiary Stofa 93% by acquiring Accent Equity’s shares. The purchase price for DKK 1,900m (approximately SEK 2,200m) (enterprise amounted to NOK 12m (SEK 13m) value). The sale generated a capital gain for Ratos of SEK 895m and an average annual return (IRR) of 54% ■ Capital contributions were provided to DIAB amounting to SEK 38m, of which SEK 17m in the third quarter and ■ In January, the sale of the remaining subsidiary in Contex SEK 21m in October, and to AH Industries amounting Group, Contex A/S, was completed. The selling price to SEK 7m. As previously announced, a SEK 75m capital (enterprise value) amounted to USD 41.5m (approximately contribution was made to Euromaint in the third quarter to SEK 275m). The winding up of Contex Group has started finance investments in the business and Ratos received a payment of SEK 154m in January. An additional amount of approximately SEK 10m is expected when the winding up is completed. Ratos’s average annual Events in the first and second quarter return (IRR) on the entire investment in Contex Group was ■ In June, a directed new issue was made of 830,000 -16% preference shares at SEK 1,750 per preference share with a ■ In January, Arcus-Gruppen completed the acquisition of the total value of SEK 1,452.5m excluding issue costs. The issue brands Aalborg, Brøndums, Gammel Dansk and Malteser. was made to finance the acquisition of Nebula and HENT as The purchase price (enterprise value) amounted to well as part of the acquisition of Aibel. The new issue was EUR 103m (approximately SEK 880m) and Ratos provided oversubscribed and approximately 6,000 investors received a net amount of SEK 24m. As required by the competition an allocation. The first day of trading was 28 June authorities, Brøndums was sold in June for EUR 11m ■ In May, the merger of the cinema groups SF Bio and Finnkino (approximately SEK 95m) which generated a capital gain in was completed. The new group is owned approximately Arcus-Gruppen of approximately SEK 40m 58% by Ratos and 40% by Bonnier. The merger did not ■ Capital contributions were provided in the first half of the involve a capital contribution year to AH Industries amounting to SEK 33m and to Jøtul ■ In April, the acquisition of Nebula, Finland’s leading provider amounting to SEK 39m of cloud services to small and medium-sized companies, was completed. The purchase price (enterprise value) for 100% More information about important events in the holdings is of the company amounted to EUR 82.5m (approximately provided on pages 8-14. SEK 700m), of which Ratos provided equity of EUR 34m Performance Ratos’s holdings *) 2013 Q 3 2013 Q 1-3 100% Ratos’s share 100% Ratos’s share Sales +5% +2% +5% +1% EBITA +12% +31% +11% +22% EBITA, excluding items affecting comparability -4% +2% -1% +2% EBT -5% +30% -1% +20% EBT, excluding items affecting comparability -20% -9% -17% -14% *) Comparison with corresponding period last year and for comparable units. To facilitate analysis, an extensive table is provided on page 14 with key figures for Ratos’s holdings. A summary of income statements, statements of financial position, etc., for Ratos’s associates and subsidiaries is available in downloadable Excel files at www.ratos.se. January – September Ratos interim report 2013 2

Recommend

More recommend