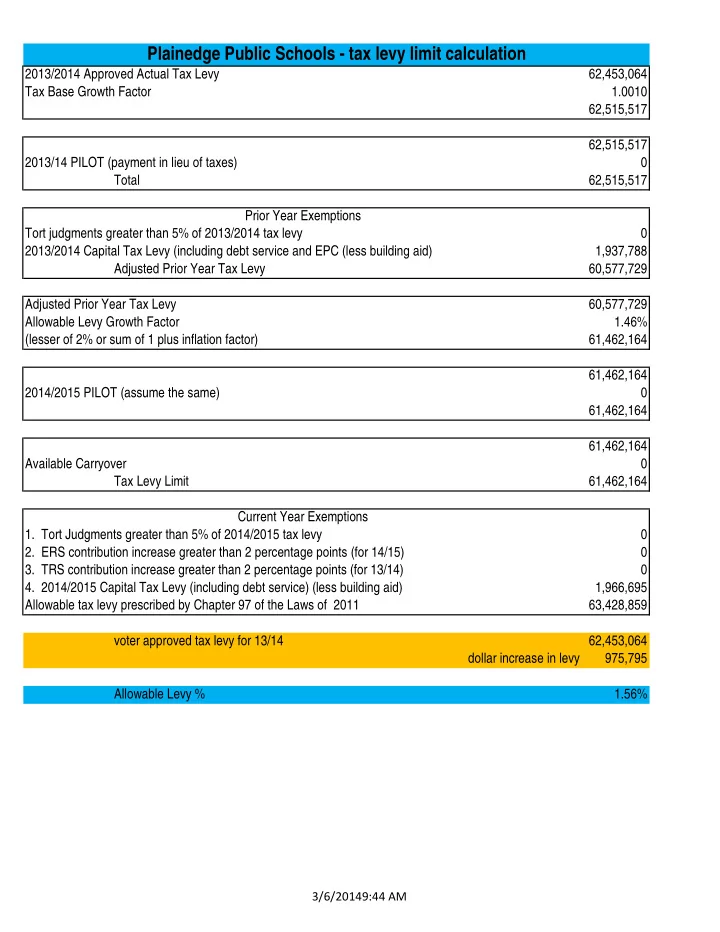

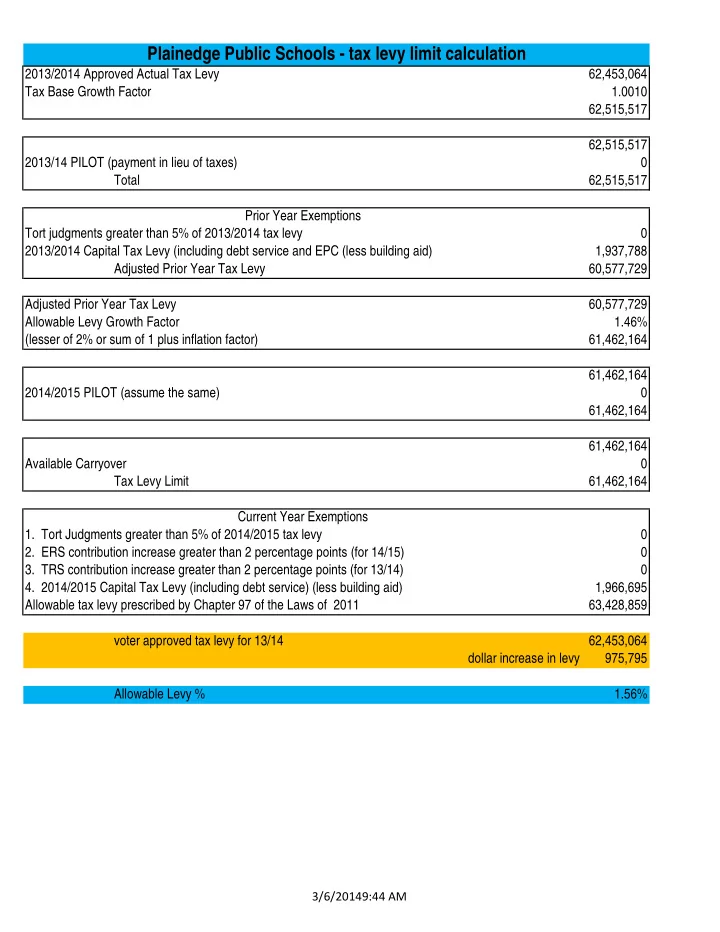

Plainedge Public Schools - tax levy limit calculation 2013/2014 Approved Actual Tax Levy 62,453,064 Tax Base Growth Factor 1.0010 62,515,517 62,515,517 2013/14 PILOT (payment in lieu of taxes) 0 Total 62,515,517 Prior Year Exemptions Tort judgments greater than 5% of 2013/2014 tax levy 0 2013/2014 Capital Tax Levy (including debt service and EPC (less building aid) 1,937,788 Adjusted Prior Year Tax Levy 60,577,729 Adjusted Prior Year Tax Levy 60,577,729 Allowable Levy Growth Factor 1.46% (lesser of 2% or sum of 1 plus inflation factor) 61,462,164 61,462,164 2014/2015 PILOT (assume the same) 0 61,462,164 61,462,164 Available Carryover 0 Tax Levy Limit 61,462,164 Current Year Exemptions 1. Tort Judgments greater than 5% of 2014/2015 tax levy 0 2. ERS contribution increase greater than 2 percentage points (for 14/15) 0 3. TRS contribution increase greater than 2 percentage points (for 13/14) 0 4. 2014/2015 Capital Tax Levy (including debt service) (less building aid) 1,966,695 Allowable tax levy prescribed by Chapter 97 of the Laws of 2011 63,428,859 voter approved tax levy for 13/14 62,453,064 dollar increase in levy 975,795 Allowable Levy % 1.56% 3/6/20149:44 AM

Hover here for sample salary projection Pension Exclusion Calculator Salary Base for bill to be paid in fiscal years beginning 2012:* Available from the Retirement System through a secure online application. For access to the Retirement System State and Local Employee Retirement System (ERS) 7,610,083 Employer Projection and Rates (EPR) Application , email RTEmpSer@osc.state.ny.us or call Beth Wicks at 518-474- 9236 or Patricia Engel at 518-486-3921. (For other levy limit questions, please call the Division of Local Government's Police and Fire Retirement System (PFRS) - Data Monitoring and Analysis Unit at 518-473-0006.) Fall 2012 TRS payments will be based on actual July 1, 2011 - June 30, 2012 salary base. The TRS system does not Teachers Retirement System (TRS) 34,378,907 provide projections of this base. Excludable Percentage: State and Local Employee Retirement System (ERS) 0.00% See "Contribution Rates" Tab for data. (To get the value 0.6%, enter either "0.6%" or "0.006," not"0.6", since 0.6 is Police and Fire Retirement System (PFRS) 0.00% equal to 60%.) Teachers Retirement System (TRS) 0.00% Pension Exclusion: ERS - PFRS - TRS - * NOTE to Calendar Year LGs: Please use the salary base applicable to the bill you will pay in calendar 2012, taken from the Employer Projection and Rates (EPR) Application. If, like most entities, you will pay your 2012-13 bill in December 2012, use the column labeled "Projected Salaries 04/01/2012-03/31/2013" . If, like a few, you will be paying your 2011-12 pension bill in February 2012, use the column labeled, "Salary Estimates 04/01/2011-03/31/2012". However, to minimize risk of audit, please note that you should only do this if you regularly pay your pension bill in February. TRS 11/12 salary base 34,378,907.41 All salaries, minus ERS salaries

ERS/PFRS Retirement Exclusions by Payment Date During Fiscal Years Starting in 2012 TRS Retirement Exclusion Percentage Excluded Pay in For State Fiscal Year ERS PFRS Pay by Percentage Excluded April 1, 2011-March 31, 2012 2.4% 1.4% 1.39% February 2012* September-November 2012 April 1, 2012-March 31, 2013 0.6% 2.2% 0 December 2012 April 1, 2012-March 31, 2013 0.6% 2.2% February 2013 * Applies to calendar year fiscal year entities only, and only that regularly pay in February.

2013-2014 school year debt service/trans to cap 4,670,700.00 building aid/tran aid 2,732,911.93 1,937,788.07 est 2014-2015 school year debt service/trans to cap 4,773,625.00 building aid/tran aid 2,806,929.84 1,966,695.16 2013-2014 Debt Service (G/L code 9901-960-00-0000) 4,190,700.00 Bus Purchases 380,000.00 Gross Dollar of bus purchase from A fund Transfer to capital 100,000.00 Actually spent 4,670,700.00 Building Aid General Formula Aid Output Report Line 7a Regular Building Aid 2,689,919.00 Less: Building Condition Survey Aid (BCS Output Entry 11) 0.00 2,689,919.00 Transportation Aid Transportation formula Aid Output Report Line 79: Total assumed capital exp aidable in 2013-14 81,426.00 Line 32: State share ratio for transportation 0.569 42,992.93 2,732,911.93 2014-2015 Debt Service (G/L code 9901-960-00-0000) 4,093,625.00 Bus Purchases 380,000.00 In budget Transfer to capital 300,000.00 Plan to actual spend 4,773,625.00 Building Aid General Formula Aid Output Report Line 7a Regular Building Aid 2,781,153.00 2,781,153.00 Transportation Aid Estimated transportation aid output report Line 60: Total assumed capital exp aidable in 2014-15 45,302.00 Given: State share ratio for transportation 0.569 25,776.84 2,806,929.84

Recommend

More recommend