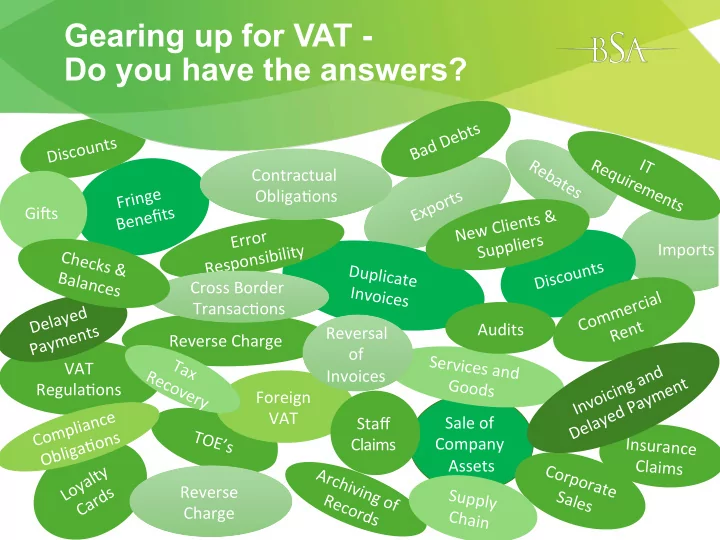

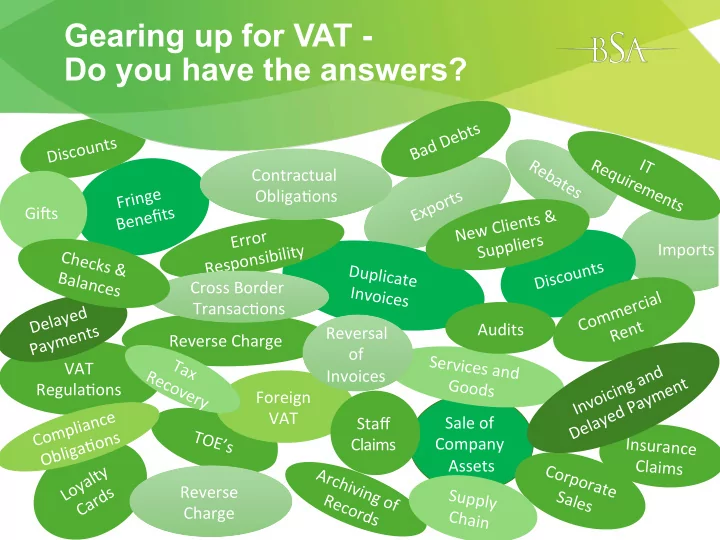

Gearing up for VAT - Do you have the answers? Discounts Contractual Fringe Obliga=ons Benefits GiGs & s t n e i l C w e N r o r s r E r e i l p p y u Imports t S i i l b Checks & i s n o p s e s R t n Duplicate u o Balances c s i D Cross Border Invoices Transac=ons Delayed Payments Audits Reversal Reverse Charge of Services and VAT Invoices Goods Regula=ons Foreign e VAT c n Sale of a Staff i l p m o s TOE’s C n o Company Insurance = Claims a g i l b O Assets Claims C o r p o r a t e Reverse Supply S a l e s Charge Chain

Gearing up for VAT Presentation to the Association of Corporate Council - Middle East Presented by John Peacock Senior Associate – VAT Compliance, Corporate & Real Estate Services 9 April 2017

Topics of Discussion 1. Background 2. What we know – GCC 3. What we know - UAE 4. Common Principles & Provisions 5. Existing Legislation 6. VAT Compliance Litigation 7. Tips 8. Questions and Answers

Background • GCC VAT Framework Agreement – signed by all GCC member states - still await official release • What we know – • All GCC members must implement VAT between 1 January 2018 and 1 January 2019 • Allows for a general framework within which member states can formulate their VAT legislation but also prescribes certain agreed terms, such as the standard VAT rate at 5%, prescribes mandatory exemptions and determines zero rated industry sectors • Grants each GCC member state the right to formulate their own legislation and concessions applicable within that state

Background • Legislative Framework in the GCC • Civil Law systems - codified, classified and structured codes but often lack detail as these often only deal with general principles as influenced by Sharia’ Law • National or Federal Laws – applicable within each GCC state as a whole • Emirate Laws (in the UAE) – applicable only to the respective Emirate in which promulgated • Free Zone Laws, Rules and Regulations – applicable only within the particular free zone • Hierarchy of Laws in the UAE - Federal Laws, Emirate Laws, Free Zone Rules and Regulations • VAT legislation will be implemented at national / federal level

Background • VAT is a self assessment system requiring little effort from the respective states and tax authorities • Responsibility for compliance is the sole responsibility of the “taxable person” for each aspect from registration obligations to the submission of returns to the payment to the tax authority in accordance with the legislation provided • What do states and tax authorities need to do to facilitate implementation? • Provide the legislation • Provide a registration platform • Provide a platform on which to submit returns • Provide a platform for payment • The legislation is not yet available for any of the GCC states however VAT is not an unknown concept and the essential elements and legislative provisions are mostly constant throughout the world

Background VAT legislation for will consist of a composite of : • Empowering legislation – creation of a tax authority (see UAE Federal Decree No. 13 of 2016 – Regarding the Establishment of the Federal Tax Authority) • Procedural legislation – creation of the rules and regulations regulating the procedural aspects relating to taxes, tax reporting and the collection thereof (a Tax Procedures Law expected in the UAE in under 2 weeks) • VAT laws, Rules and Regulations – promulgation of the laws containing the definitions, provisions, and supplemented by the rules and regulations (“expected in “a few months”) • Directives – mainly used to set out matters not specifically dealt with in the VAT law and to supplement procedural matters • Rulings – to regulate and categorize particular circumstances or transactions not contemplated in the legislation and to obtain clarity in advance of transactions • Supplemented by existing legislation (Commercial Companies Law, the Penal Code and the Commercial Transactions Law)

What we know - GCC • The UAE will be ready to implement their VAT system on 1 January 2018 and other GCC countries should implement by the end of the 2nd quarter of 2018 • Various Government Ministers have announced various fact at press conferences, the UAE Ministry of Finance has delivered briefings (and has a number more planned in the next months) and also various VAT forums have been held at which various accounting firms involved in the planning stages have intimated certain specifics • It appears evident that the European VAT model will substantially be followed in the GCC and thus the provisions and regulations applied in the European Union countries will be used as the VAT “blueprint” in the GCC

What we know - GCC • Different rules will apply in each of the GCC states – different jurisdictions with different rules will be especially relevant for imports and exports – also see GCC Common Customs Law • Common reporting system will operate between GCC states – imports and exports will be reported between GCC states • New VAT legislation for the UAE is likely to have similar provisions as contained in the commercial companies law and the penal code will apply as it does not appear that special provisions will be passed to “decriminalize” VAT related offences

What we know - UAE • There will not be any “grandfathering” provisions and liability for VAT will be either the time of supply of services or delivery of the goods - except for certain property lease agreements entered into before the implementation date in the “normal course of business” • Determination of jurisdiction for VAT responsibility – place of supply • Determination of time of supply – upon delivery of goods or completion of delivery of services (with invoice to be issued within 14 days) • Penalties for evasion – up to 500% and up to 72 hour business closure • Definition of a “Taxable Person” – includes offshore companies (implication to licensors and franchisors) • No special provisions for free zones in the UAE – “fenced and unfenced” free zones may have different/special rules but only regarding goods imported and exported therefrom

What we know - UAE • Error corrections on VAT Returns will be allowed to be done online if done within 30 days of submission date (may still incur penalties) • Objections/Appeal process – firstly to Federal Tax Authority (within 20 days) then to review Committee of the Federal Tax Authority then to Courts • The seat of jurisdiction for VAT disputes will be the local courts and thus all submissions and proceedings will be conducted in Arabic • The “taxable person” (company) is the responsible collection agent for the Tax Authority – VAT not collected does not excuse payment to Tax Authority

Common Principles & Provisions REGISTRATION – • Take law as presented – analyze both thresholds and classifications of goods/supplies into standard rated goods and supplies, zero rated supplies/ goods and exemptions • Registration of “VAT Groups” will be allowed – understood that wide discretion will be allowed to group different businesses even in different industry sectors however that this will only be allowed if: • the entities keep separate accounting records • are separately identifiable entities • under same ownership (unsure of subsidiaries) • domiciled in the same country • Group registrations can be frustrated by multiple sponsors • Group registrations will require and limit extent of consolidated group financials and frustrate inter group entries

Common Principles & Provisions INVOICES AND INVOICING - • The “invoice is everything” – correct invoicing is essential to claim legitimate input VAT credits, avoid penalties and audits • Provisions will allow for simplified invoices (“till slips”) but generally invoices must contain the following: • reflect the VAT Registration Numbers of both supplier and customer • contain a stipulation of services/goods delivered • contain the address of supplier • contain the delivery address • The quotation of relevant Article in cases of an exemption • foreign currency invoices must reflect local currency equivalent • Coding will allow for easy change in legislation provisions • Apportionment of Input VAT on certain expenses • Unclaimable Input VAT (caution on posting of entries and disallowance)

Common Principles & Provisions RETURNS - • Will be due quarterly (i.e. first return due – 1 April 2018) • Will be filed online • Information required to be included in VAT Returns will differ from jurisdiction to jurisdiction • VAT Return (UAE) must contain declaration of revenue per Emirate • VAT Returns usually require – • the amount of revenue income at the standard rate and the Output VAT amount • the amount of zero rated revenue income • the amount of exempt revenue income / deemed supplies • the Input VAT amount • a declaration of accuracy of information submitted • Deemed supplies – Output VAT is payable (e.g. gifts, enterprise assets taken for own use, proceeds of execution sales, insurance claims, rights to use goods, intra-group transaction (unless under same registration))

Recommend

More recommend