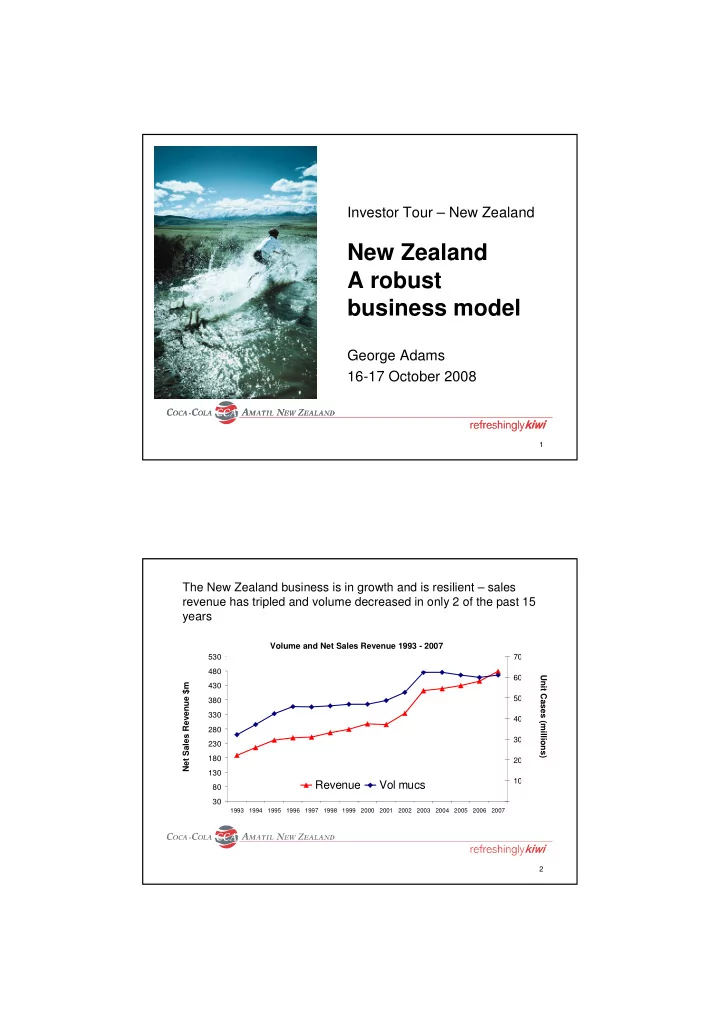

Investor Tour – New Zealand New Zealand A robust business model George Adams 16-17 October 2008 1 The New Zealand business is in growth and is resilient – sales revenue has tripled and volume decreased in only 2 of the past 15 years Volume and Net Sales Revenue 1993 - 2007 530 70 480 60 Unit Cases (millions) Net Sales Revenue (NZD $m) Net Sales Revenue $m 430 Unit Cases (millions) 50 380 330 40 280 30 230 180 20 130 10 Revenue Vol mucs 80 30 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2

The improvement in earnings has been driven by revenue management initiatives, recovery of COGS increases and efficiencies from capital investments Record local currency earnings +20.4% 30% 23.1% 25% Local Currency EBIT Growth 17.4% 17.7% 20% 16.9% 15% 10% 5% 0% -5% -10% -15% -20% H1 H2 H1 H2 H1 2006 2007 2008 % Growth 3 CCA remain on track to deliver a record result in NZ in 2008 – despite the softer H2 macro environment Source: Westpac Q3 Consumer Confidence Survey - September 24 2008 4

CCA has a strong market position especially in CSDs Total NARTD Market by Volume (Jun-08)* 100% 80% Market Share 60% 40% 20% 0% Sports CSD Juice Water Energy Milk Market Size CCA Frucor Private Label Other * Areas in the above diagram are indicative only 5 Significant CSD initiatives will drive EBIT growth over the next few years Project Zero % Contribution to EBIT Growth 25% Alcohol & Coffee Non 20% CSD 30% CSD 25% 2008 – 2010 Key Drivers of EBIT Growth 6

At 18% of volume, multi-pack can CSD volumes are small relative to Australia (at 44%) and are a major growth opportunity Cans % Grocery CSD (Volume) Australia New Zealand 44% 18% 15% 2005 2008 2008 7 Momentum is building with multi-pack can growth accelerating Launched Progressive 30 pack Multi-pack can reset completed in and Foodstuffs 24 pack in 2008 Progressive and Foodstuffs 8

Cold drink availability expansion in Grocery is significant 9 Significant Non-CSD initiatives will drive EBIT growth over the next few years Project Zero % Contribution to EBIT Growth 25% Alcohol & Coffee Non 20% CSD 30% CSD 25% 2008 – 2010 Key Drivers of EBIT Growth 10

The Energy category is 4 times larger in New Zealand relative to Australia – the opportunity is significant Retail Market Value Energy NZ$230m Retail Market Value Energy A$700m 11 And with the launch of Relentless CCA is beginning to become a significant energy player with 21.2% share of the energy category New Zealand’s Large pack energy 2,000 dedicated energy No.2 energy brand 440ml Relentless cooler doors in 1H 2009 12

And momentum will be fuelled by the launch of a second flavour - ‘Relentless Inferno’ Juice based energy hit! 13 The launch of Glacéau and PUMPED will tap the health and wellbeing trend and further build premium in the water category Leveraging the existing brand New product launch strength of PUMP Pump value share of Water category MAT Sep-08 27.3% 29.1% 14

New Zealand Powerade per capita consumption now exceeds Australia and has grown by 35% between 2005 - 2007 Powerade Volume Growth 2.5 Key growth drivers: Unit Cases (millions) 35% CAGR 2.0 • Isotonic launch 1.5 • All Blacks promotional activity 1.0 • Flavour variants 0.5 • Multi- packs to come 0.0 2005 2007 Powerade Consumption Per Capita 14 Australia 12 New Zealand 10 8 6 4 2 0 2000 2001 2002 2003 2004 2005 2006 2007 15 Significant Alcoholic Beverage and Coffee initiatives will drive EBIT growth over the next few years Project Zero % Contribution to EBIT Growth 25% Alcohol & Coffee Non 20% CSD 30% CSD 25% 2008 – 2010 Key Drivers of EBIT Growth 16

Café Direct was acquired in March 2007 doubling the EBIT contribution from the vending business • B2B free-vend coffee provider • Margin on consumables • 40% market share • 1200 outlets and 1500 machines • Integrated with vending operations • Hot beverage 12% of Convenience & Leisure value (RTD) 17 The launch of premium beer and Jim Beam ready-to-drink manufacturing is growing new earnings streams Pacific Beverages NZ has already captured Manufacture of Jim Beam RTD commenced in 4% of the premium beer category* September 2007 *Source ACNeilsen scan Quarter to Sep-08 18

Product innovation and brand development is the key to CCA’s differentiation and driver of the continued volume growth of alcoholic beverages VOL % SHARE VOL % SHARE VOL RANK MANUFACTURER (Aug 08 YTD) +/- YA VOL % CHG YA 1 LION NATHAN 48.8 -0.2 20.8 2 DB BREWERIES 33.3 -2.6 12.4 3 INDEPENDENT LIQUOR 10.9 2.2 52.9 4 COCA-COLA AMATIL NZ LTD 1.8 1.7 5520.7 5 FOSTERS 1.8 0.1 26.2 ALL OTHER 3.5 -1.2 -10.1 Source : Grocery AC Nielsen 19 Significant Project Zero initiatives will drive EBIT growth over the next few years Project Zero % Contribution to EBIT Growth 25% Alcohol & Coffee Non 20% CSD 30% CSD 25% 2008 – 2010 Key Drivers of EBIT Growth 20

Project Zero: Auckland distribution centre delivers capacity until 2020 with reduced costs and improved customer service • Capital investment NZ$80m • 27% increase in pick rates • 1.7% improvement in pick accuracy • 9% improvement in customer service scores • 30% reduction in fleet movements Auckland DC - Commissioned May 2008 21 Project Zero: 2009 initiatives will focus on manufacturing efficiency, SAP implementation and cost-to-serve reduction opportunities Auckland Can Line Upgrade Leveraging our infrastructure investment Hotfill Capability Enterprise and manufacturing efficiency 22

Project Zero: CCA’s investment in customer service is delivering results with the business regularly receiving best supplier in category awards 2004 2005 2006 2007 2008 Awards Coalface Petro HO 1 st 18 th 1 st 1 st 3 rd C&L Coalface Petro Store 2 nd 4 th 7 th 1 st 2 nd Coalface Route 4 th 10 th 8 th 1 st 5 th Best Customer No Entry 3 rd 2 nd 1 st 1 st Service Inbound Customer Best Customer No Entry No Entry No Entry 2 nd 1 st Contact Service Outbound Centre Overall Supreme No Entry No Entry No Entry 1 st 1 st Best Customer Service PEL Supplier of the 3 rd 1 st 1 st 2 nd tba Year Grocery NARGON Best - - 1 st 2 nd tba Supplier 23 Priorities for 2009 are: • Revenue management initiatives to ensure recovery of COGS increases • Leveraging asset base to deliver efficiencies and increasing capacity • Further develop the CSD multi-pack can strategy • Grow energy market share • Develop premium water offerings (Glacéau / Pumped) • Alcoholic beverages – increase in customer and brand availability 24

Recommend

More recommend