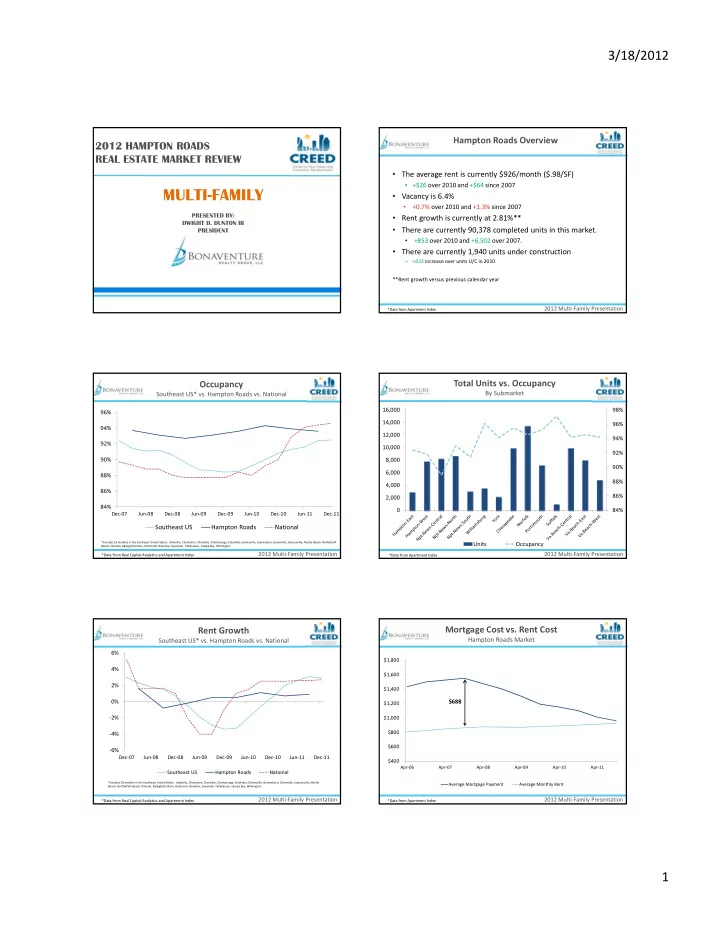

3/18/2012 Hampton Roads Overview 2012 HAMPTON ROADS REAL ESTATE MARKET REVIEW • The average rent is currently $926/month ($.98/SF) • +$26 over 2010 and +$64 since 2007 MULTI-FAMILY • Vacancy is 6.4% +0.7% over 2010 and +1.3% since 2007 • PRESENTED BY: • Rent growth is currently at 2.81%** DWIGHT D. DUNTON III • There are currently 90,378 completed units in this market. PRESIDENT +853 over 2010 and +6,502 over 2007. • • There are currently 1,940 units under construction +833 increase over units U/C in 2010 – **Rent growth versus previous calendar year 2012 Multi ‐ Family Presentation *Data from Apartment Index Occupancy Total Units vs. Occupancy By Submarket Southeast US* vs. Hampton Roads vs. National 16,000 98% 96% 14,000 96% 94% 12,000 94% 92% 10,000 92% 90% 8,000 90% 6,000 88% 88% 4,000 86% 86% 2,000 84% 0 84% Dec ‐ 07 Jun ‐ 08 Dec ‐ 08 Jun ‐ 09 Dec ‐ 09 Jun ‐ 10 Dec ‐ 10 Jun ‐ 11 Dec ‐ 11 Southeast US Hampton Roads National *Includes 19 markets in the Southeast United States: Asheville, Charleston, Charlotte, Chattanooga, Columbia, Gainesville, Greensboro, Greenville, Jacksonville, Myrtle Beach, Norfolk/VA Units Occupancy Beach, Orlando, Raleigh/Durham, Richmond, Roanoke, Savannah, Tallahassee, Tampa Bay, Wilmington 2012 Multi ‐ Family Presentation 2012 Multi ‐ Family Presentation *Data from Real Capital Analytics and Apartment Index *Data from Apartment Index Mortgage Cost vs. Rent Cost Rent Growth Hampton Roads Market Southeast US* vs. Hampton Roads vs. National 6% $1,800 4% $1,600 2% $1,400 0% $688 $1,200 ‐ 2% $1,000 $800 ‐ 4% $600 ‐ 6% Dec ‐ 07 Jun ‐ 08 Dec ‐ 08 Jun ‐ 09 Dec ‐ 09 Jun ‐ 10 Dec ‐ 10 Jun ‐ 11 Dec ‐ 11 $400 Apr ‐ 06 Apr ‐ 07 Apr ‐ 08 Apr ‐ 09 Apr ‐ 10 Apr ‐ 11 Southeast US Hampton Roads National *Includes 19 markets in the Southeast United States: Asheville, Charleston, Charlotte, Chattanooga, Columbia, Gainesville, Greensboro, Greenville, Jacksonville, Myrtle Average Mortgage Payment Average Monthly Rent Beach, Norfolk/VA Beach, Orlando, Raleigh/Durham, Richmond, Roanoke, Savannah, Tallahassee, Tampa Bay, Wilmington 2012 Multi ‐ Family Presentation 2012 Multi ‐ Family Presentation *Data from Real Capital Analytics and Apartment Index *Data from Apartment Index 1

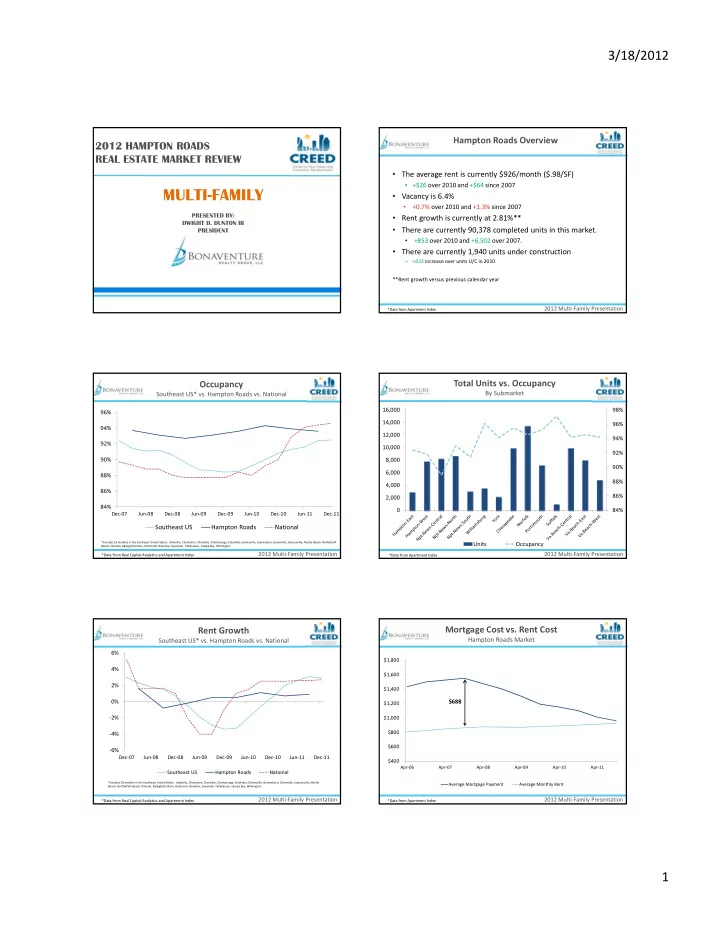

3/18/2012 Mortgage Cost vs. Rent Cost Multi ‐ Family Drivers Hampton Roads Market $1,800 Despite record low home mortgage rates, credit still remains tight • without the best credit history and capability to make a large $1,600 down payment. $1,400 Cost of home mortgages may soon meet or dip under the cost to $443 • rent in our market; but only for few qualified loan applicants. $1,200 ($248) $1,000 Homeownership rates continue to fall. • $800 The apartment sector’s recovery is supported by favorable • demographic trends such as echo boomers, government $600 sponsored entity financing and a limited supply pipeline. $400 Apr ‐ 06 Apr ‐ 07 Apr ‐ 08 Apr ‐ 09 Apr ‐ 10 Apr ‐ 11 Household formation dropped to 500,000 from 2008 ‐ 2010, well • below the long ‐ term average of 1.2 million. Average Mortgage Payment Average Monthly Rent Average Rent of New Construction 2012 Multi ‐ Family Presentation 2012 Multi ‐ Family Presentation *Data from Apartment Index *Data from National RE Investor Average Rents by Age Hampton Roads Market Breakdown Hampton Roads Market $1,400 Market Unit Breakdown Market Unit Breakdown (Age) Existing Units 5+ Years 90,378 82,754 $1,300 95% 91% $1,200 $1,100 $359 Planned Units Lease Up Units U/C 2,563 1,458 1 ‐ 5 Years 1,940 3% 6,166 2% $1,000 2% 7% Total Market Pipeline % Total Units in Market $900 6% 5% Average $800 4% $700 3% 2006 2007 2008 2009 2010 2011 2% Lease Up 1 ‐ 5 Years 6+ Years Total Market Apr ‐ 07 Oct ‐ 07 Apr ‐ 08 Oct ‐ 08 Apr ‐ 09 Oct ‐ 09 Apr ‐ 10 Oct ‐ 10 Apr ‐ 11 Oct ‐ 11 2012 Multi ‐ Family Presentation 2012 Multi ‐ Family Presentation *Data from Apartment Index *Data from Apartment Index Vacancy by Age Submarket Scorecard Hampton Roads Market 8% 2011 vs 2010 Market Health Pipeline 6 ‐ Month Change in Change in Submarket Total Units Market Grade** Units Absorption* Occupancy Rent/Month 7% NN South 3,040 248 60 1.90% $3.00 3 Williamsburg 3,554 0 57 0.50% $26.00 3 Chesapeake 9,886 1,078 174 ‐ 0.80% $23.00 3 6% Norfolk 13,341 1,289 29 ‐ 1.10% $67.00 3 Hampton East 2,933 0 97 0.60% $5.00 2 NN North 8,612 336 89 0.10% $5.00 2 5% York 2,216 0 17 0.90% $14.00 2 VA Beach West 4,830 224 ‐ 7 1.00% $41.00 2 Hampton West 7,768 120 90 ‐ 1.70% $14.00 1 4% NN Central 8,216 234 ‐ 211 ‐ 2.20% $30.00 1 Portsmouth 7,192 216 ‐ 68 ‐ 0.60% $25.00 1 Suffolk 1,010 304 ‐ 9 ‐ 0.90% ‐ $14.00 1 3% VA Beach Central 9,837 276 ‐ 134 ‐ 1.40% $9.00 0 VA Beach East 7,943 178 ‐ 58 ‐ 0.50% $20.00 0 Total 90,378 4,503 126 ‐ 0.30% $19.14 2% 2006 2007 2008 2009 2010 2011 1 ‐ 5 Years 6+ Years Total Market = Total of 4 Achievable for 4 Categories 2012 Multi ‐ Family Presentation 2012 Multi ‐ Family Presentation *Data from Apartment Index *Data from Apartment Index 2

3/18/2012 National Transaction Overview Transaction/Buyer Trends 2011 • Volume: $51.4 billion • 2011 Transaction Breakdown Hampton Roads • 88% Private Capital (19)* Multi ‐ Family Transactions • +47% year ‐ over ‐ year • 6% REIT (1) 25 • 6% Community • # of Properties: 3,361 Properties Redevelopment Corp (1) 20 • 2010 Transaction Breakdown • +43% year ‐ over ‐ year 15 • 80% Private Capital (4) • 20% University (1) • Price per Unit: $101,204 10 • National Average CAP: ~6.3% • +5% year ‐ over ‐ year 5 • CAP Rate: 6.3% 0 2005 2006 2007 2008 2009 2010 2011 • ‐ 25bps year ‐ over ‐ year Total Transactions *One Portfolio Transaction accounts for 9 properties under Private Capital 2012 Multi ‐ Family Presentation 2012 Multi ‐ Family Presentation *Data from Real Capital Analytics *Data from Real Capital Analytics Apartment Mortgage Originations Transaction/Buyer Trends by Lender Hampton Roads • 2011 Transaction Breakdown • 88% Private Capital (19)* Multi ‐ Family Transactions • 6% REIT (1) 25 • 6% Community Redevelopment Corp (1) 20 • 2010 Transaction Breakdown 15 • 80% Private Capital (4) • 20% University (1) 10 • NO Transaction Growth w/o Great 5 Atlantic Management 0 • National Average CAP: ~6.3% 2005 2006 2007 2008 2009 2010 2011 Excluding Great Atlantic Including Great Atlantic *One Portfolio Transaction accounts for 9 properties under Private Capital $88.3B $52.5B $68.8B $91.6B 2012 Multi ‐ Family Presentation 2012 Multi ‐ Family Presentation *Data from Real Capital Analytics *Data from Marcus & Millichap 2012 Apt Report What Does it All Mean? • Lenders want to lend to multi ‐ family projects. • SFH Mortgages may be affordable, but not necessarily accessible • Tenants are moving from Class B/C properties, to class A. • Class A rents are increasing much faster than B/C— can it continue? • Construction pipeline remains in check ‐ Can developers be trusted to overdue a good thing 2012 Multi ‐ Family Presentation 2012 Multi ‐ Family Presentation 3

Recommend

More recommend