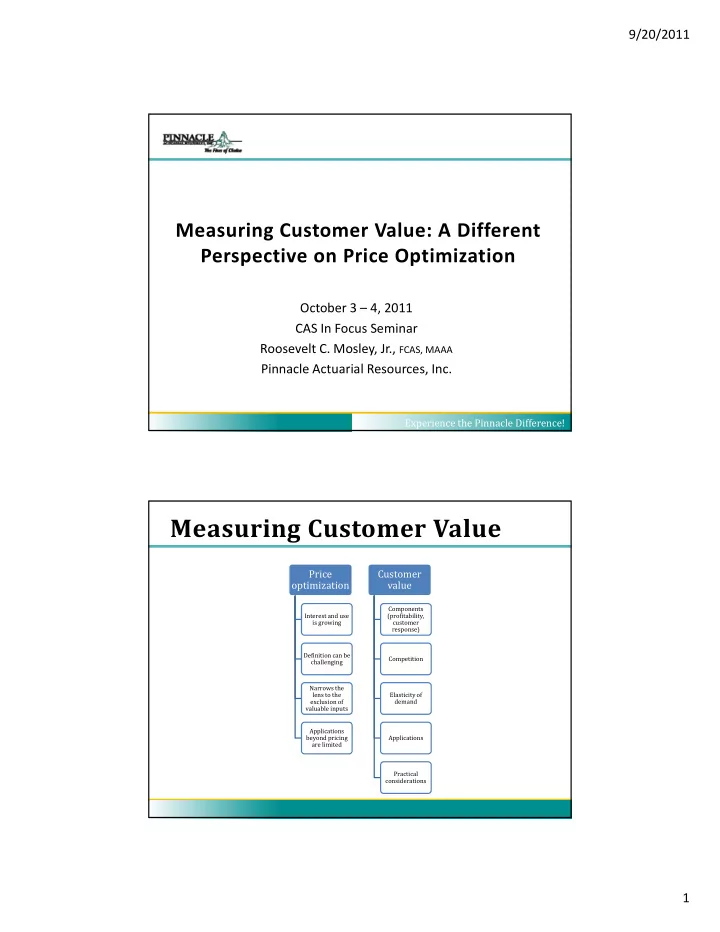

9/20/2011 Measuring Customer Value: A Different Perspective on Price Optimization October 3 – 4, 2011 CAS I F CAS In Focus Seminar S i Roosevelt C. Mosley, Jr., FCAS, MAAA Pinnacle Actuarial Resources, Inc. Experience the Pinnacle Difference! Measuring Customer Value Price Customer optimization value Components Interest and use (profitability, is growing customer response) Definition can be Competition challenging Narrows the lens to the Elasticity of demand exclusion of valuable inputs Applications beyond pricing Applications are limited Practical considerations 1

9/20/2011 What is Price Optimization? Google Definitions � Integration of demand side pricing into an overall pricing strategy � Offering each customer the right price to achieve pricing and profit goals � The process of setting prices to maximize a pre-defined measure of customer value d fi d f l subject to a company’s strategic and business objectives Definition � Optimize Optimize 1. to make as effective, perfect, or useful as possible 2. to make the best of � Optimization : a mathematical technique for finding a � Optimization : a mathematical technique for finding a maximum or minimum value of a function of several variables subject to a set of constraints, as linear programming or systems analysis Source: www.dictionary.com 2

9/20/2011 Expanded Definition � XXXX optimization : mathematical technique for finding the best XXXX (most effective, perfect, most useful maximum minimum) subject to a set of useful, maximum, minimum) subject to a set of constraints � XXXX = � Price � Marketing strategy � Claim settlement process Cl i ttl t � Claim fraud identification � Underwriting process � Price change Expected Profit Curve Actually profit that is optimized Optimal Profit subject to price subject to price and other Expected Profit constraints. Price 3

9/20/2011 Constraints � Profitability: corporate goals � Growth � Success of marketing efforts � New business hit ratios � Loyalty : retention ratios � Competitive : competitor price AND operational considerations � Future : lifetime value implications � Actuarial : not excessive, not inadequate, not unfairly A i l i i d f i l discriminatory � Regulatory: must operate within parameters of the law Limits of Price Optimization � Focus is necessarily on price � What am I really optimizing? � What am I really optimizing? � Practical implications of price optimization are unclear � Application to other areas of a company is a challenge challenge � What happens when the optimal price is significantly different than the price I can charge? 4

9/20/2011 Expanding the Focus Cross Sell Pricing Customer C stomer Service Sale Ongoing Retention Marketing Quote Servicing Underwriting Claims Scenarios 1. Price Change Only 2. Price, New Business and Renewal Re-underwriting Changes 3. Complete System Changes Defining Customer Value Instead of focusing solely on price, expand the lens to including pricing as expand the lens to including pricing as well as broader company considerations 5

9/20/2011 What is a Valuable Customer? � Low claim frequency risks � Niche customer � Customer segment where rates are adequate � Customer segment a company is / is not successful writing � Measures: historical or short term, aggregate Issues With Current Customer Value Definitions � Can be subjective � Short term view � Short term view � Ignores longer term potential value � Complicates long term changes � Can hinder implementation of more advanced insurance techniques � Pricing advances � Optimization 6

9/20/2011 Customer Value Definition Expected Value of Existing Business P P 1 x (1 – C 1 ) (1 C ) R R 1 x P 2 x (1 – C 2 ) P (1 C ) R 2 x P 3 x (1 – C 3 ) R P (1 C ) EVEB = ------------------------ + -------------------------------- -------------------------------- + (1 + r) (1 + r) 2 (1 + r) 3 P i = profit at time i = Premium – E(Loss) - Expense C i = Probability of cancellation during period i R i = Probability of renewal at the end of period i r = discount rate Potential Customer Value Definition Value of Quoted Business : VQB = VEB x P(Co) Q Q ( ) P(Co) = probability of converting quoted business Value of Targeted Business P(Q)x VQB VTB = --------------------------- (1 + r) tl (1 + r) tl P(Q) = probability of targeted business receiving a quote tl = time lag between being targeted and receiving a quote 7

9/20/2011 Elements of Insurance Customer Value Elements of Insurance Customer Value Expected profit Customer Response (Likelihood of Retention/Conversion/Marketing Success) Influence of Competition Influence of Price Changes 8

9/20/2011 Expected Profit E(Profit) = Premium – E(Cost) � Premium set by the company � Premium - set by the company � E(Cost) � For setting premiums � Modeled loss costs by techniques accepted by industry and regulators � Variables used limited by regulatory/public acceptance, operational considerations � For purposes of determining E(Profit) � For purposes of determining E(Profit) � More advanced techniques can be used � List of potential variables is “unlimited” Modeling Expected Cost – Expanded Considerations Use All Available Information Use Additional/Advanced Techniques � Decision trees � Rating � Underwriting � Neural networks � Marketing � Clustering � Agency � Principal components � Billing � Association analysis � External (demographic, etc.) � Endorsement activity � Endorsement activity � Payment history � Portfolio information 9

9/20/2011 Examples of Additional Significant Cost Variables –Auto Analysis � Presence of additional lines (home, commercial, health) � Additional line loss experience � Scheduled property � Amount of insurance � Age of home � Prior property claims � Prior property claims � Home occupancy type � Umbrella indicator Auto Indicated Claim Frequency 10

9/20/2011 Comprehensive Severity Model Comparisons Linearity creates issues at the extremes Expenses � Some are difficult to vary by risk � Subtract fixed dollar amount can change relative � Subtract fixed dollar amount – can change relative profitability but maintains order � Subtract fixed percentage of premium or expected loss – maintains relative probability � Expenses that could vary by risk � General claim expenses G l l i � Marketing expenses � Customer service expenses 11

9/20/2011 Difference Between “Full Model” and “Rating Plan Model” 15.3% 18.9% Distribution of Expected Profit 12

9/20/2011 Customer Response Process Marketing Effort Quote Sale Renewal Quote Renewal Customer Response Models Quoting Analysis Analysis of the likelihood of a prospective insured obtaining an insurance quote from A l i f h lik lih d f i i d b i i i f you Conversion Analysis Analysis of the likelihood of a insured that has received a quote purchasing insurance from you Retention Analysis Analysis of the likelihood of a current insured renewing with you 13

9/20/2011 Quoting Analysis � Analyze characteristics of shoppers and quoters � Characteristics � Internal company information l i f i � External demographic information � Credit profiles � Marketing profiles � Identify insureds to target � Can be done at different levels (individual target, geographic area, risk segment target) One Way Summary – Means of Entry 14

9/20/2011 Quoting Analysis Example – Vehicle Year Response Percentage 15

9/20/2011 Retention/Conversion Characteristics � Traditional Rating Factors � Agent/Distribution Channel Issues � Class � Territory � Satisfaction with � Limit � Limit Agent/Service Agent/Service � Insurance Score � Distance to Agent � Claims history � Independent vs. Captive vs. � Violation history Direct � Account Characteristics � Market Conditions � Number of Years Insured � Competitive Position � Number of Policies � Inflation � Account Size � U/W Cycle U/W Cycle � Renewal Pricing Change / New Business Price � Brand Value (company & Difference competitors) Conversion Analysis Example Example 2.000 1.766 1.800 1.483 1.600 1.431 1.408 1.400 1.200 1.000 1.000 Relativit 1.000 0.800 0.600 0.400 0.200 0.000 <missing> 0 1 2 4 6 EDUCATION Relative Likelihood 16

9/20/2011 Retention Analysis Influences on Customer Value � Price changes � Impacts expected profit p p p � Also impacts expected customer conversion and retention � Interaction of these elements can produces unanticipated changes in customer value � Competitive position � Influences ability to write/retain risks � Ultimately impacts premiums charged � Depends on more than just price � Changes over time and varies by type of risk 17

Recommend

More recommend