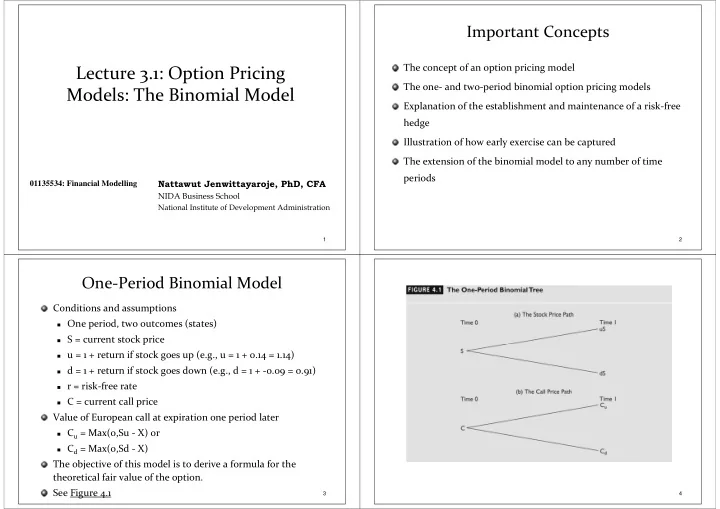

Important Concepts The concept of an option pricing model Lecture 3.1: Option Pricing The one ‐ and two ‐ period binomial option pricing models Models: The Binomial Model Explanation of the establishment and maintenance of a risk ‐ free hedge Illustration of how early exercise can be captured The extension of the binomial model to any number of time periods Nattawut Jenwittayaroje, PhD, CFA 01135534: Financial Modelling NIDA Business School National Institute of Development Administration 1 2 One ‐ Period Binomial Model Conditions and assumptions One period, two outcomes (states) S = current stock price u = 1 + return if stock goes up (e.g., u = 1 + 0.14 = 1.14) d = 1 + return if stock goes down (e.g., d = 1 + ‐ 0.09 = 0.91) r = risk ‐ free rate C = current call price Value of European call at expiration one period later C u = Max(0,Su ‐ X) or C d = Max(0,Sd ‐ X) The objective of this model is to derive a formula for the theoretical fair value of the option. See Figure 4.1 3 4

One ‐ Period Binomial Model (continued) One ‐ Period Binomial Model (continued) The option is priced by combining the stock and option in a risk ‐ free hedge portfolio such that the option price (i.e., C ) can be inferred from other known values (i.e., u, d, S, r, X ). We construct a hedge portfolio of h shares of stock and one short call. These values are all known so h is easily computed Current value of portfolio: Since the portfolio is riskless, it should earn the risk ‐ free V = hS ‐ C rate. Thus The objective of the hedge portfolio (i.e., the riskless portfolio of stock and options) is to develop the formula for C. V(1+r) = V u (or V d ) Substituting for V and V u At expiration the hedge portfolio will be worth V u = hSu – C u , where C u = Max(0, uS – X) (hS ‐ C)(1+r) = hSu – C u V d = hSd ‐ C d , where C d = Max(0, dS – X) Substituting for h, If we are hedged, these must be equal. Setting V u = V d and solving for h gives 5 6 One ‐ Period Binomial Model (continued) One ‐ Period Binomial Model (continued) An Illustrative Example Thus, the theoretical value of the option is S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 First find the values of C u , C d , h, and p: C u = Max(0,100(1.25) ‐ 100) = 25 C d = Max(0,100(.80) ‐ 100) = 0 This is the theoretical value of the call as determined by the stock price, exercise price, risk ‐ free rate, and up and down factors. h = (25 ‐ 0)/(125 ‐ 80) = 0.556 Note how the call price is a weighted average of the two possible call p = (1.07 ‐ 0.80)/(1.25 ‐ 0.80) = 0.6 prices the next period, discounted at the risk ‐ free rate . The call’s value if the stock goes up (down) in the next period is weighted by the factor p (1 ‐ p). Then insert into the formula for C: The probabilities of the up and down moves were never specified. They are irrelevant to the option price. 7 8

One ‐ Period Binomial Model (continued) A Hedged Portfolio Short 1,000 calls and long 1000 h = 1000(0.556) = 556 shares. See Figure 4.2. Value of investment: V = 556($100) ‐ 1,000($14.02) $41,580. (This is how much money you must put up.) Stock goes up to $125 Value of investment = 556($125) ‐ 1,000($25) = $44,500 Stock goes down to $80 Value of investment = 556($80) ‐ 1,000($0) = $44,480 You invested $41,580 and got back $44,500, a 7 % return, which is the risk ‐ free rate. 9 10 One ‐ Period Binomial Model (continued) One-Period Binomial Model (continued) An Overpriced Call An Underpriced Call Let the call be selling for $15.00 Let the call be priced at $13 Your amount invested is 556($100) ‐ 1,000($15.00) Sell short 556 shares at $100 and buy 1,000 calls at $13. = $40,600 This will generate a cash inflow of $42,600. You will still end up with $44,500, which is a 9.6% At expiration, you will end up paying out $44,500. return. This is like a loan in which you borrowed $42,600 and Everyone will take advantage of this, forcing the call paid back $44,500, a rate of 4.46%, which beats the price to fall to $14.02 risk ‐ free borrowing rate. 11 12

Two ‐ Period Binomial Model We now let the stock go up/down another period so that it ends up Su 2 , Sud or Sd 2 . See Figure 4.3. The option expires after two periods with three possible values: 13 14 Two ‐ Period Binomial Model (continued) After one period the call will have one period to go before expiration. Thus, using a single ‐ period model, it will worth either of the following two values In a single ‐ period world, a call option’s value is a weighted average of the option’s two possible values at the end of the next period. 15 16

Two ‐ Period Binomial Model (continued) Two ‐ Period Binomial Model (continued) The price of the call today can again be calculated as a weighted average An Illustrative Example of the two possible call prices in the next period (even if the call does not Input: S = 100, X = 100, u = 1.25, expire at the end of the next period); d = 0.80, r = 0.07 Su 2 = 100(1.25) 2 = 156.25 Sud = 100(1.25)(0.80) = 100 Sd 2 = 100(0.80) 2 = 64 In summary, the two ‐ period binomial option pricing formula provides the The call option prices are as option price as a weighted average of the two possible option prices the follows next period, discounted at the risk ‐ free rate. The two future option prices, in turn, are obtained from the one ‐ period binomial model. •The hedge ratios are different in the different states: 17 18 Two ‐ Period Binomial Model (continued) Two ‐ Period Binomial Model (continued) Therefore, the value of the call today is The two values of the call at the end of the first period are The value of p is the same, (1+r ‐ d) / (u ‐ d) , regardless of the number of periods in the model. 19 20

American Calls and Early Exercise Extensions of the Binomial Model The multi ‐ period binomial model is an excellent opportunity to American Calls and Early Exercise illustrate how American options can be exercised early. Pricing Put Options Consider the American call where S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 (the same as the American Puts and Early Exercise previous European call) Dividends, European Calls, American Calls, and Early Now we must consider the possibility of exercising the call early. Exercise At time 1 the European call values were C u = 31.54 when the stock is at 125 Extending the Binomial Model to n Periods C d = 0.0 when the stock is at 80 The Behavior of the Binomial Model for Large n and a When the stock is at 125, the call is in ‐ the ‐ money by $25, but it Fixed Option Life is still lower than holding value. So not early exercise it. The value of the American call today is now the same at 21 22 Pricing Put Options American Calls and Early Exercise The binomial model can easily Pricing a put with the binomial model is the same accommodate the early exercise of procedure as pricing a call , except that the expiration an American call by simply payoffs are computed by using put payoff formula . comparing the computed value (holding value) and intrinsic value Consider a European put where (exercise value), and select the greater value. S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 American Call Path American Call Path In our example the put prices at expiration are; Exercise or intrinsic Exercise or intrinsic 23 24 value = $0 value = $25

Pricing Put Options Pricing Put Options P=(1+0.07-0.80)/(1.25-0.80) The two values of the put at the end of the first period are Therefore, the value of the put today is 25 26 American Puts and Early Exercise American Puts and Early Exercise The multi ‐ period binomial model is an excellent opportunity to The binomial model can easily illustrate how American options can be exercised early. accommodate the early exercise of an Consider the American put where American put by simply comparing S = 100, X = 100, u = 1.25, d = 0.80, r = 0.07 (the same as the the computed value (holding value) previous European put) and intrinsic value (exercise value), Now we must consider the possibility of exercising the put early. and select the greater value. At time 1 the European put values were P u = 0.00 when the stock is at 125 P d = 13.46 when the stock is at 80 When the stock is at 80, the put is in ‐ the ‐ money by $20 so exercise it early. Replace P u = 13.46 with P u = 20. The value of the American put today is higher at Exercise or 27 28 intrinsic value

Recommend

More recommend