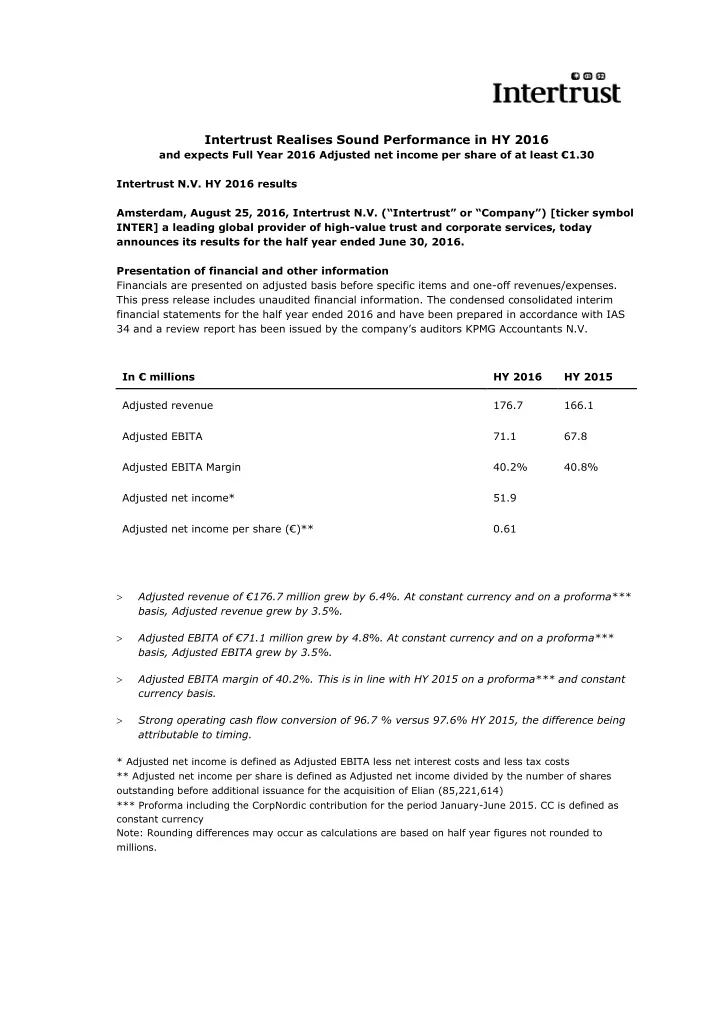

Intertrust Realises Sound Performance in HY 2016 and expects Full Year 2016 Adjusted net income per share of at least €1.30 Intertrust N.V. HY 2016 results Amsterdam, August 25, 2016, Intertrust N.V. (“Intertrust” or “Company”) [ticker symbol INTER] a leading global provider of high-value trust and corporate services, today announces its results for the half year ended June 30, 2016. Presentation of financial and other information Financials are presented on adjusted basis before specific items and one-off revenues/expenses. This press release includes unaudited financial information. The condensed consolidated interim financial statements for the half year ended 2016 and have been prepared in accordance with IAS 34 and a review report ha s been issued by the company’s auditors KPMG Accountants N.V. In € millions HY 2016 HY 2015 Adjusted revenue 176.7 166.1 Adjusted EBITA 71.1 67.8 Adjusted EBITA Margin 40.2% 40.8% Adjusted net income* 51.9 Adjusted net income per share (€)** 0.61 Adjusted revenue of €176.7 million grew by 6.4%. At constant currency and on a proforma*** basis, Adjusted revenue grew by 3.5%. Adjusted EBITA of €71.1 million grew by 4.8%. At constant currency and on a proforma*** basis, Adjusted EBITA grew by 3.5%. Adjusted EBITA margin of 40.2%. This is in line with HY 2015 on a proforma*** and constant currency basis. Strong operating cash flow conversion of 96.7 % versus 97.6% HY 2015, the difference being attributable to timing. * Adjusted net income is defined as Adjusted EBITA less net interest costs and less tax costs ** Adjusted net income per share is defined as Adjusted net income divided by the number of shares outstanding before additional issuance for the acquisition of Elian (85,221,614) *** Proforma including the CorpNordic contribution for the period January-June 2015. CC is defined as constant currency Note: Rounding differences may occur as calculations are based on half year figures not rounded to millions.

David de Buck, Chief Executive Officer of Intertrust, commented: “ I am pleased with our sound results for the first half of this year. We continue to see a solid pipeline of business and reiterate our guidance for 2016 that the full year Adjusted net income per share will be at least €1.30. An important development in th e second quarter is the successful acquisition of Elian. Preparations for integration are well underway and we expect to close the transaction in September. We are excited about the prospects for cross-selling and synergies from the integration of Elian and Intertrust. Elian will significantly strengthen our capital markets and funds capabilities, reinforcing our global leadership.” Highlights HY 2016 On June 6, Intertrust announced its agreement to acquire Jersey-based regional trust and corporate services provider Elian for £435 million (€ 557 million). The transaction is on-track to close before the end of September, pending regulatory approvals. An integration project is fully operational with several functional workstreams preparing for closing . Financing of the transaction was successful and included: €122 million in a share offering on June 13, 2016; o syndication of 2 new debt acquisition facilities, one for £94 million and the other for o €147.5 million to a group of nine banks. Intertrust opened a sales office in Chicago in January, and is gaining a foothold in the region with Mid-western multinationals. CorpNordic integration was completed in Q1 – annualis ed synergies of €0.9 million have been achieved and the activities show growth in line with expectations. Completed rollout of the Business Application Roadmap (BAR) IT project. Irish AIFMD ManCo services were successfully launched in HY 2016 and the onboarding of funds is ongoing. 2 Intertrust N.V.

Key Financials Q2 and HY 2016 % Change % Change % Change % Change Q2 Q2 HY HY (reported) (Proforma (reported) (Proforma 2016 2015 2016 2015 and CC 10 ) and CC 12 ) Adjusted revenue 1 (€m) 88.8 84.5 5.1% 3.1% 176.7 166.1 6.4% 3.5% Adjusted EBITA 1 (€m) 35.1 34.2 2.9% 2.5% 71.1 67.8 4.8% 3.5% Adjusted EBITA 1 margin 39.6% 40.4% -85.2bps -24bps 40.2% 40.8% -59.5bps -0.9bps Operating free cash flow 2 (€m) 36.1 34.9 3.4% 72.6 69.6 4.4% Cash conversion ratio including strategic capital expenditure (%) 3 94.9% 93.6% 123.9bps 94.8% 93.5% 125.3bps Cash conversion ratio excluding strategic capital expenditure (%) 4 97.1% 97.1% -5bps 96.7% 97.6% -91.7bps Adjusted Net Income (€m) 26.4 na 51.9 na Adjusted Net Income per share (€) 5 0.31 na 0.61 na Basic Earnings per share (€) 6 0.08 na 0.27 na Profit (loss) after income tax (€m) 7.1 4.6 56.2% 23.0 7.6 203.1% No. of entities 7 (000's) 38.6 41.4 -7.0% Average Adjusted revenue per entity (ARPE) 8 (€k) 9.2 8.0 14.4% No. of full-time equivalents (FTE ’ s) 7 1705.1 1608.5 6.0% Adjusted revenue per FTE (€) 207.2 206.5 0.3% Total reported net debt 9 278.1 na Total net debt 10 excl. net proceeds of the issue of shares 398.9 na Net leverage ratio 11 excl. net proceeds of the issue of shares 2.63 na 1. Adjusted financial information before specific items and one-off revenues/expenses. 2016 figures include CorpNordic acquisition 2. Defined as Adjusted EBITDA – Maintenance capex 3. Defined as Adjusted EBITDA less capital expenditure, including strategic capital expenditures/ Adjusted EBITDA 4. Defined as (Adjusted EBITDA less capital expenditure, excluding strategic capital expenditures) / Adjusted EBITDA 5. Adjusted Net Income per share is calculated as Quarterly or Half Year Adjusted EBITA less net interest costs and less tax costs divided by the number of shares outstanding (85,221,614) before the additional issuance of shares 3 Intertrust N.V.

Recommend

More recommend