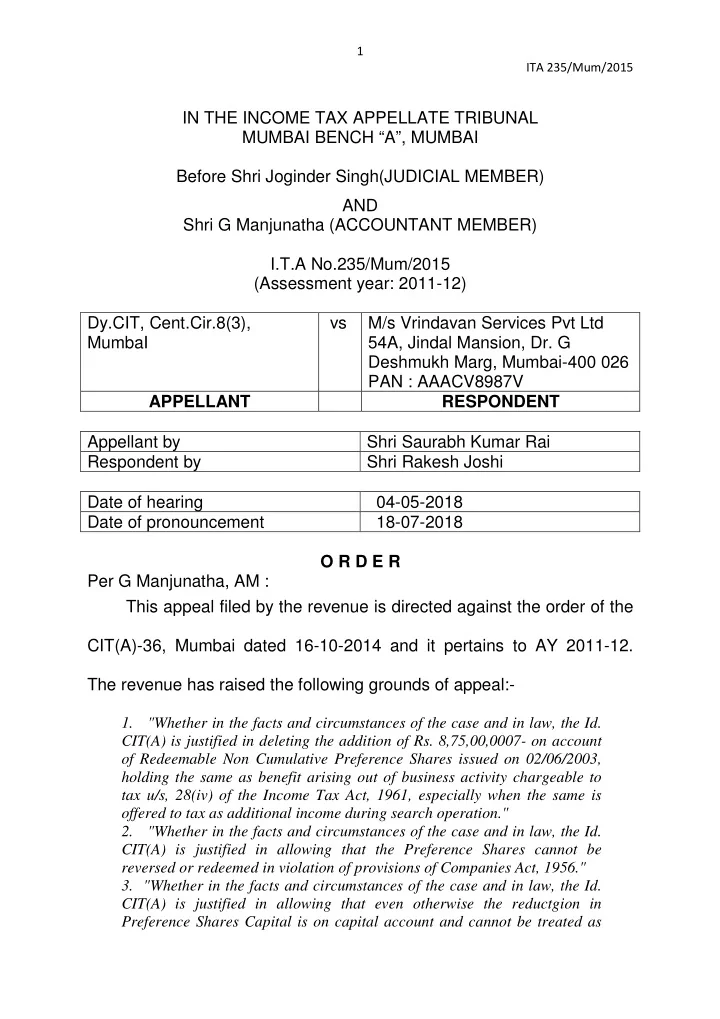

1 ITA 235/Mum/2015 IN THE INCOME TAX APPELLATE TRIBUNAL MUMBAI BENCH “A”, MUMBAI Before Shri Joginder Singh(JUDICIAL MEMBER) AND Shri G Manjunatha (ACCOUNTANT MEMBER) I.T.A No.235/Mum/2015 (Assessment year: 2011-12) Dy.CIT, Cent.Cir.8(3), vs M/s Vrindavan Services Pvt Ltd MumbaI 54A, Jindal Mansion, Dr. G Deshmukh Marg, Mumbai-400 026 PAN : AAACV8987V APPELLANT RESPONDENT Appellant by Shri Saurabh Kumar Rai Respondent by Shri Rakesh Joshi Date of hearing 04-05-2018 Date of pronouncement 18-07-2018 O R D E R Per G Manjunatha, AM : This appeal filed by the revenue is directed against the order of the CIT(A)-36, Mumbai dated 16-10-2014 and it pertains to AY 2011-12. The revenue has raised the following grounds of appeal:- 1. "Whether in the facts and circumstances of the case and in law, the Id. CIT(A) is justified in deleting the addition of Rs. 8,75,00,0007- on account of Redeemable Non Cumulative Preference Shares issued on 02/06/2003, holding the same as benefit arising out of business activity chargeable to tax u/s, 28(iv) of the Income Tax Act, 1961, especially when the same is offered to tax as additional income during search operation." 2. "Whether in the facts and circumstances of the case and in law, the Id. CIT(A) is justified in allowing that the Preference Shares cannot be reversed or redeemed in violation of provisions of Companies Act, 1956." 3. "Whether in the facts and circumstances of the case and in law, the Id. CIT(A) is justified in allowing that even otherwise the reductgion in Preference Shares Capital is on capital account and cannot be treated as

2 ITA 235/Mum/2015 Business Income of the previous year." 2. The brief facts of the case are that the assessee is a private limited company, engaged in the business of trading in shares and securities, leasing out property held as investment, etc., filed its return of income for AY 2011-2 u/s 139(1) on 20-09-2011 declaring Nil income. A search and seizure action was carried out u/s 132 of the Income-tax Act, 1961 in JSW group of cases on 16-03-2011. During the course of search, books of account and documents belonging to the assessee company were found and seized. During the course of search, the assessee gave declaration of income in a group of cases as per which, an amount of Rs.8.75 crores towards write back of preference shares has been offered as undisclosed income in assessee’s case. However, the assessee has not admitted any income in respect of undisclosed income admitted during the course of search, while filing return of income. Therefore, the AO called upon the assessee to explain as to why additional income declared during the course of search shall not be added. In response to notice, assessee filed details submissions, as per which the assessee stated that the company has received loan from M/s South India House Investments Ltd, during the period 19-05-2003 to 30/05/2003 as subscription money towards preference shares. The company has allotted 87,50,000 2.5% redeemable non cumulative

3 ITA 235/Mum/2015 preference shares of Rs.10 paid up each to the said applicant. The said shares were alive and outstanding in the books of VSPL on 16-03-2011 and compulsorily redeemable prior to 01-06-2003. Owing to search action, to buy peace and avoid litigation, the assessee has agreed for disclosure of undisclosed income of Rs.8.75 crores by writing off redeemable non cumulative preference shares in its books of account. But facts remain that, such redeemable preference shares cannot be redeemed before the specified period, as per provisions of section 80 of Companies’ Act, 1956. The assessee also stated that the said admission during the course of search is of mistaken understanding of facts, therefore, without any further evidence found during the course of search, only on the basis of admission of the assesse, a receipt in the nature of capital receipt cannot be taxed u/s 28(iv) of the Income-tax Act, 1961. 3. The AO, after considering relevant submissions of the assessee and also taking into account materials collected during the course of search, including statement recorded u/s 132(4) and subsequent declaration letter filed by the assessee dated 01-06-2011 observed that in principle, the assessee has admitted sum of Rs.8.75 crores is no longer payable to M/s South India House Investments Ltd. There has been no retraction by the assessee on this issue till date. Since the

4 ITA 235/Mum/2015 amount is no longer payable, it was held that it is a benefit directly arising out of business activity of the assessee and, therefore, chargeable to tax u/s 28(iv) of the Income-tax Act, 1961. 4. Aggrieved by the assessment order, assessee preferred appeal before the CIT(A). Before the CIT(A, assessee has filed elaborate written submissions which has been reproduced by the Ld.CIT(A) at para 5 on pages 4 to 9 of his order. The sum and substance of the arguments of the assessee before the Ld.CIT(A) was that at no stretch of imagination, a capital receipt being redeemable non cumulative preference shares can be considered as benefit derived out of business connection and is taxable u/s 28(iv) of the Income-tax Act, 1961. 5. The Ld.CIT(A), after considering relevant submissions of the assessee and also relying upon the decision of Hon’ble Bombay High Court in the case of Vodafone India Services Ltd (WP) No.871 of 2014 held that preference share capital received in financial year 2003-04 is capital in nature and cannot be taxed u/s 28(iv) of the Income-tax Act, 1961. The relevant portion of the order of CIT(A) is extracted below:- 6.6 The oral and written arguments made by the appellant's AR have been considered. It is undisputed fact that appellant received share application money of Rs 8.75 crores FY 2003-04 from South India Investment Limited in FY 2003-04, The appellant company had allotted 87,50,000 2.5% redeemable non-cumulative shares of face value 10/- to said investor on 2.06.2003. A copy of share certificate has been seized during search action. As per terms of preference shares, the same are redeemable at the option of appellant before 2.06.2023. It is the case of appellant that the shares were allotted in FY 2003-04 and redeemable in FY 2023-24. As on date of search, the preference shares were outstanding in the books of appellant. The appellant submits that as per provisions of Companies Act, 1956 preference shares can only be

Recommend

More recommend