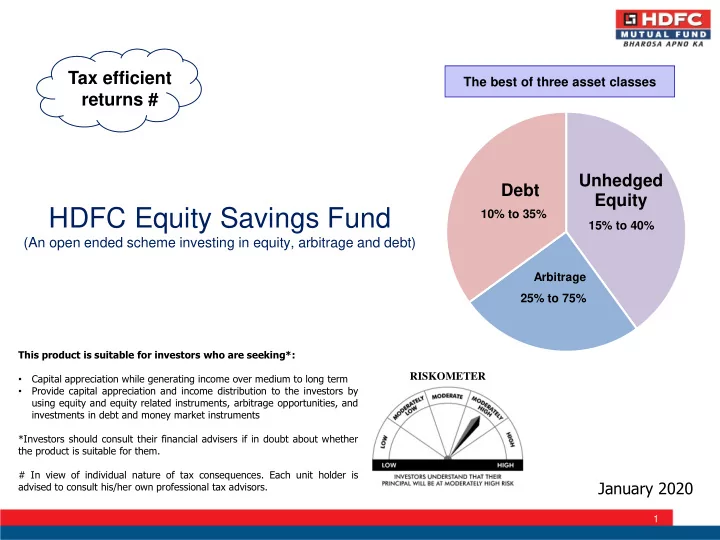

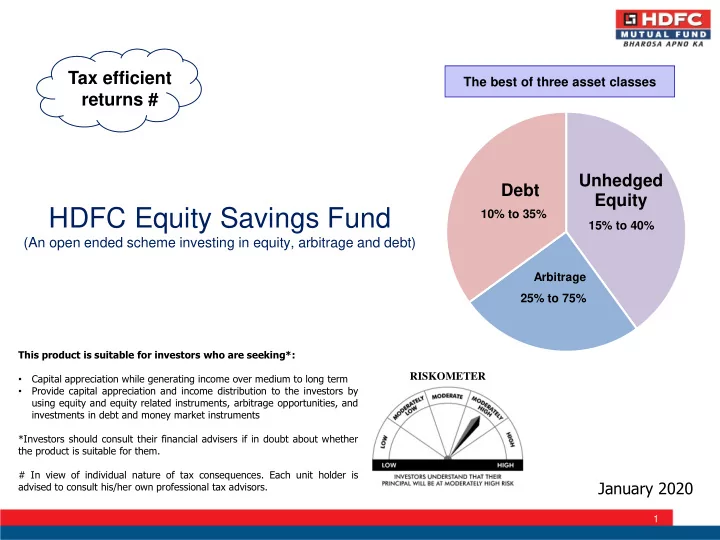

Tax efficient The best of three asset classes returns # Unhedged Debt Equity HDFC Equity Savings Fund 10% to 35% 15% to 40% (An open ended scheme investing in equity, arbitrage and debt) Arbitrage 25% to 75% This product is suitable for investors who are seeking*: Capital appreciation while generating income over medium to long term RISKOMETER • Provide capital appreciation and income distribution to the investors by • using equity and equity related instruments, arbitrage opportunities, and investments in debt and money market instruments *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. # In view of individual nature of tax consequences. Each unit holder is January 2020 advised to consult his/her own professional tax advisors. 1

Content HDFC Equity Savings Fund (Slide 3 – 5) Fund Positioning (Slide 6 – 8) Returns Profile, Suitability and Taxation (Slide 9 – 11) Statutory Disclosures (Slide 12 – 18) Economy and Market Outlook (Slide 19 – 26) 2

Why HDFC Equity Savings Scheme? A Fund with an optimal mix of equity, debt and arbitrage opportunities • Long Term Growth – Controlled equity allocation to take advantage of the long term potential of equities (15-40%) • Regular Income – Debt securities (10-35%) and arbitrage opportunities (25-75%) reduce volatility and aid regular income • Low Fund Volatility – Fixed Income exposure and hedged equity exposure (arbitrage) reduces fund volatility inherent to directional equity exposure • Efficient Taxation – Better tax efficiency than debt funds # • Diversified Asset Allocation – Regular balancing between asset classes based on market conditions and outlook HDFC Mutual Fund/AMC is not guaranteeing return on investments made in the scheme. # In view of individual nature of tax consequences, each unit holder is advised to consult his/her own professional tax advisors 3

Investment Strategy and Fund Positioning Risk Quotient • Equity Strategy • Maintains an effectively diversified portfolio • Follows a multi cap strategy, flexibility to invest across large cap, midcap and small cap stocks • Fixed Income Strategy • The fixed income portion is invested in corporate bonds and bank perpetual bonds and GILTS • The maturity profile of debt portion depends on interest rate outlook. • Equity Arbitrage Strategy • Hedged equity allocation to gain from spread between future and spot prices Equity Funds Product Return Hybrid Equity Funds Equity Savings Funds Hybrid Debt Funds Debt Funds Product Risk The current investment strategy is subject to change depending on the market conditions. For complete details on investment strategy, refer SID/KIM of the scheme. For complete portfolio details visit www.hdfcfund.com # Provided the scheme meets the criteria as an equity oriented scheme as per prevalent Income tax laws. HDFC Mutual Fund/AMC is not guaranteeing return on investments made in the scheme. In view of individual nature of tax consequences. Each unit holder is advised to consult his/her own professional tax advisors. 4

Performance Scenario Analysis of Hybrid Portfolio Strategy Scenario Analysis Assumed Un-hedged Equity Portion returns (35% weight) 25% 20% 15% 12% 10% 5% 0% -5% -10% -15% -20% 6% 12.7% 10.9% 9.2% 8.1% 7.4% 5.7% 3.9% 2.2% 0.4% -1.4% -3.1% Assumed Hedged + Fixed Income 7% 13.3% 11.6% 9.8% 8.8% 8.1% 6.3% 4.6% 2.8% 1.1% -0.7% -2.5% returns (65% weight) 8% 14.0% 12.2% 10.5% 9.4% 8.7% 7.0% 5.2% 3.5% 1.7% -0.1% -1.8% How to read the table? Lets take an example of the cell shaded in red Arbitrage & Fixed Income: 7% return * 65% exposure = 4.6% contribution; Equity: 12% return * 35% exposure = 4.2% contribution Performance of the Hybrid Portfolio Strategy = 8.8% return The scenarios of hybrid portfolio of equity, arbitrage and fixed income provided in the table above does not in any manner offer any assured returns and is subject to market risks. The above scenario analysis does not take fund expenses into account. The rates of return shown are assumed figures and not to be construed as actual returns and/or guaranteed returns. HDFC Mutual Fund/AMC is not guaranteeing returns on investments made in the Scheme. The information provided herein is used to explain the concept and is given for illustrative purposes only. The same is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as an investment advice to any party. Past performance may or may not be sustained in future. 5

HDFC Equity Savings Fund - Portfolio Positioning Gross Equity Exposure 68.7% Hedged Equity Exposure (Arbitrage) 30.1% Unhedged Equity Exposure 38.6% Monthly Average AUM (Rs in crores) 4346 Equity (Unhedged) Debt Total Number of stocks in the Average Maturity* 44 1.82 years Portfolio Top 10 Holdings (%) 29.1 Macaulay Duration* 1.59 years Large Cap (%) 34.2 1.47 years Modified Duration* Mid Cap (%) 2.2 Yield to Maturity* 7.82% Small Cap (%) 2.4 Data as on Dec 31, 2019. For complete portfolio details refer www.hdfcfund.com * Computed on the invested amount for debt portfolio. 6

HDFC Equity Savings Fund - Portfolio Positioning Sectoral Holding - Unhedged OW/ Sector Rationale Exposure UW Corporate The recognition phase of NPAs is largely over; with falling Banks & OW slippages and increasing resolution of NPAs, provisioning costs Corporate Bank & Financials 8.6 Financials are expected to fall sharply. Change in CERC (Central Electricity Regulatory Commission) Utilities 7.2 Utilities OW regulations; capacity - led growth; very attractive valuations versus history. Industrials 6.0 Increase in tariffs and more to come for the larger gas transmission companies; positive outlook for refining margins; Energy OW marketing companies trading at very attractive valuations on low Energy 4.6 expectations Massive infrastructure spending thrust announced by Government Information Technology 4.3 Industrials OW of India; order books remain strong for most companies in the sector; resolution of IBC cases in core sector will aid capex cycle. Retail Bank & Financials 3.0 Retail Banks Underweight on NBFCs due to an inherently risky business model UW & Financials and high valuations Materials 2.4 Adverse action from US FDA has resulted in uncertainty. Growth Health Care UW in India business has continued, albeit a lower pace; R&D Consumer Staples 1.2 expenses are also increasing and margins are under pressure. Auto sector is facing multiple headwinds. The transition to BSVI Health Care 0.7 will lead to higher vehicle prices and is a near term headwind. EVs are likely to emerge as a threat in 3Ws followed by 2Ws over the Consumer UW next few years. Consumer Discretionary 0.7 Discretionary Non auto consumer durable companies face headwinds such as lower demand and increased competition leading to lower 0 5 10 margins. Data as on Dec 31, 2019. For complete portfolio details refer www.hdfcfund.com; OW – Overweight, UW - Underweight 7

HDFC Equity Savings Fund - Portfolio Positioning Top 10 Holdings – Unhedged Equity Portfolio Classification by Rating Exposure Class(%) – Debt Exposure Name Of the Instrument Sector % to NAV Short Term Deposits as margin for 7.59 Futures & Options NTPC Limited Utilities 4.33 Infosys Limited Information Technology 4.09 A+ & below 6.64 ICICI Bank Ltd. Corporate Bank & Financials 3.92 State Bank of India Corporate Bank & Financials 3.89 AA+ 6.08 Reliance Industries Ltd. Energy 3.25 AAA/AAA(SO)/A1+/A1+(SO) 3.48 & Equivalent Larsen and Toubro Ltd. Industrials 3.06 HDFC Bank Ltd. Retail Bank & Financials 3.00 Cash, Cash Equivalents and Net 3.45 Current Assets GAIL (India) Ltd. Utilities 1.35 ITC Ltd. Consumer Staples 1.22 AA/AA- 2.34 Vedanta Ltd. Materials 1.04 Sovereign 1.65 Total 29.15 Data as on Dec 31, 2019. For complete portfolio details refer www.hdfcfund.com 8

Return Profile & Suitability 3 Year Rolling Returns (15 th Dec 2015* – 31 st Dec 2019) Suitability Particulars % Number of Observations 255 The fund is suitable for conservative and Less than 6% 0 risk averse investors looking for moderate participation in equity markets Greater than 6% 255 Minimum 6.02 Maximum 12.56 The fund is an ideal alternative to Average 9.37 traditional saving options Std. Deviation 2.09 Investors having an investment horizon of The fund has delivered an average return of 9.37% based on 3 year rolling basis with very low volatility. 2-3 years The fund has delivered greater than 6% return in 100% observations based on 3 rolling basis. * Returns have been shown since 15 th Dec’15 as there was a change in the fundamental attributes of the scheme viz; from HDFC Multiple Yield Fund, open ended Income Scheme to HDFC Equity Savings Fund. For complete performance details, please refer slide 14-17. 9

Recommend

More recommend