Economic aspects of variable renewable energy sources Lion Hirth neon | MCC | PIK 5 December 2014 JRC workshop hirth@neon-energie.de

ö

Wind & sun deliver 15+% of electricity in some regions Global wind power capacity Share of wind + solar in selected power systems Global solar power capacity Data source: REN21 (2014), IEA (2014) Data source: IHS (2013) Wind and solar power have been Wind and solar power combined now supply more than 15% of growing strongly. electricity in several power systems. Lion Hirth 3

Identify, explain, and quantify the economic consequences of wind and solar power variability. What are the economic implications of variability? ... in terms of (integration) costs? ... in terms of value (loss)? ... in terms of optimal deployment? Lion Hirth 4

1. Economics of Electricity 2. Integration costs 3. Market value 4. Optimal deployment Lion Hirth 5

1. Economics of electricity Lion Hirth 6

Electricity is a homogenous commodity … • For consumers, electricity from different power plants is identical. • Physics: “a MWh is a MWh“ • No physical delivery – ‘electricity pool’ • Power exchanges • The law of one price applies At one moment, a MWh from wind turbines has the same value as a MWh from a coal-fired plant. Lion Hirth 7

... and at the same time heterogeneous : prices vary ... … w.r.t. lead -time … over time … across space Day-ahead prices in Germany for one week Day-ahead prices in Texas for one moment in time Imbalance spread in Germany in 2011/12 The electricity spot price varies The price varies between real-time The price varies between locations. between hours. and day-ahead. Lion Hirth 8

Physics shapes economics Electromagnetic Kirchhoff‘s laws Physics Frequency stability energy Arbitrage Storage Transmission Flexibility constraint (storing electricity is costly) (transmitting elect. is costly) (ramping & cycling is costly) Dimension of Time Space Lead-time heterogeneity (price differs between hours) (price differs btw locations) (btw contract & delivery) Lion Hirth 9

Source: updated from Hirth et al. (2014): Economics of electricity time At a given time, location, and lead-time, electricity is a hour T perfectly homogenous good “ One year “ … hour 2 hour 1 space … node 1 node 2 node N “ One power system “ Lion Hirth 10

The marginal value of output varies among generators Long-term marginal value: the marginal value of output of a technology ($/MWh), accounting for timing, location, and uncertainty of generation: 𝑈 𝑂 Τ ′ = 𝑤 𝑗 𝑗,𝑢,𝑜,𝜐 ∙ 𝑞 𝑢,𝑜,𝜐 𝑢=1 𝑜=1 𝜐=1 On average, a MWh from wind turbines has a different value than a MWh from a coal-fired plant. Source: updated from Hirth et al. (2014): Economics of electricity They produce Any economic assessment (cost-benefit, profitability) of different economic electricity generation technologies needs to account for goods differences in value of output ( € /MWh). Lion Hirth 11

Three tools ignore value differences Levelized cost (LCOE) Grid parity Multi-sector models € /MWh € /MWh (1) (2) Retail price Grid (1) … parity (2) Power (PV) generation cost (3) … Wind Coal-fired time Input-output table (IAMs, CGEs, …) turbine plant often it is readers, not authors, that misinterprete these tools Lion Hirth 12

Ignoring value differences introduces two biases • ignoring value differences (erroneously) favors low value technologies • base-load generators are favored relative to peak- load generators (“base load bias”) • at high penetration rates, VRE technologies are favored relative to dispatchable generators (“VRE bias”) Source: updated from Hirth et al. (2014): Economics of electricity Base-load and high-penetration VRE are the technologies with relatively low-value output. Lion Hirth 13

System LCOE: one metric for cost and value Economic Integration costs System LCOE comparison € /MWh Net minus Value gap Average Inte- Wind Wind Inte- Wind Wind Coal electricity gration market System System LCOE gration System price Costs value Costs LCOE LCOE LCOE Lion Hirth 14

Concluding: Economics of electricity Electricity is a peculiar economic good • paradox: homogeneous and heterogeneous • value difference between generators • “a MWh is not a MWh” and ”wind is not coal“ • economic assessments need to account for these value differences • not specific to VRE (“gas is not coal either “) Common tools ignore the value difference • LCOE • grid parity • (simple) multi-sector models This introduces two biases • base load bias: nuclear & CCS look better than they are • VRE bias: wind and solar power look better than they are (at high penetration) a closer look at the economic value of wind and solar power generation Lion Hirth 15

2. Integration costs Lion Hirth 16

Three intrinsic properties of variable renewables Milligan et al. 2011, Borenstein 2012, Sims et al. 2011, ... Bound to certain Property Output is fluctuating Forecast errors locations + + + Lead-time Electricity Time Space (prices differs w.r.t. to lead-time heterogeneity (price differs between hours) (price differs btw locations) btw contract & delivery) “Costs” due to “Profile costs “ “ Balancing costs “ “ Grid-related costs “ properties (“ shaping costs “) (“ imbalance costs “) (“ locational / infrastructure costs “) it is the interaction of VRE variability and price heterogeneity that is costly Lion Hirth 17

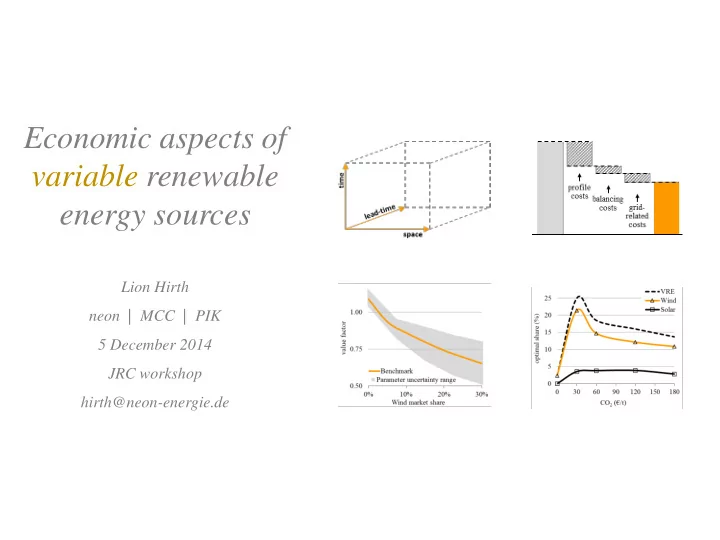

The properties (often) reduce the value of VRE output € /MWh Source: updated from Hirth et al. (2015): Integration costs revisited Integration costs Effect of timing Effect of forecast Effect of errors location Average Profile Balancing Grid- Wind electricity Costs Costs related market price Costs value Lion Hirth 18

Profile costs: driven by reduced utilization of capital Residual load duration curves Decreased utilization Source: updated from Hirth et al. (2015): Integration costs revisited Source: updated from Hirth et al. (2015): Integration costs revisited Lower utilization implies higher specific At high VRE shares, the other (residual) power ( € /MWh) capital costs. The utilization effect is plants are utilized less. the largest economic impact of VRE. Lion Hirth 19

Lit review: profile costs are the largest component (in thermal power systems at high penetration rates) Profile costs Balancing costs Source: updated from Hirth et al. (2015): Integration costs revisited Source: updated from Hirth et al. (2015): Integration costs revisited Profile costs reach ~20 € /MWh at 30 – 40% Balancing costs reach ~4 € /MWh at 30 – 40% penetration rate. They grow at 0.5 € /MWh per penetration rate, growing at 0.04 € /MWh per percentage-point – a tenth of profile costs. percentage-point. Lion Hirth 20

Concluding: Integration costs The value of VRE is affect by variability • it is the interaction between VRE variability and electricity price heterogeneity that is costly • at low penetration, these costs can be negative (increase the value) • at high penetration rates, they are usually positive and can become high: 25 – 35 € /MWh at 30 – 40% wind penetration Profile costs are largest component • profile costs are ~ 5 times larger than balancing cost and increase ~ 10 times faster • profile costs are mostly driven by reduced utilization of physical capital – not cycling or ramping of power plants • much of the existing literature looks at secondary phenomena a closer look at profile costs Lion Hirth 21

3. Market value Lion Hirth 22

Value factor: the relative price of wind power Wind in Germany Base price Wind Revenue Value Factor ( € /MWh) ( € /MWh) (1) 2001 24 25* 1.02 ... ... ... ... 2013 38 32 .85 Simple Wind- Ratio of average weighted these two average Lion Hirth 23

The value drop Value factor Value Factor = Market value / base price ? Source: updated from Hirth (2013): Market value. Based on German day-ahead spot-price data 2001 – 2013 The relative value of electricity from wind and solar power is reduced as their market share grows. Lion Hirth 24

The mechanics behind the value drop Residual load Load (net load) Variable cost ( € /MWh) Open cycle 20 GW Wind Market-clearing price 30 € /MWh Combined Size of the drop: cycle i) amount of (natural wind generation, Reduced price gas) ii) shape of the Hardcoal Lignite merit-order Nuclear curve, CHP iii) ... Source: updated from Hirth (2013): Market value Capacity (MW) Lion Hirth 25

Recommend

More recommend