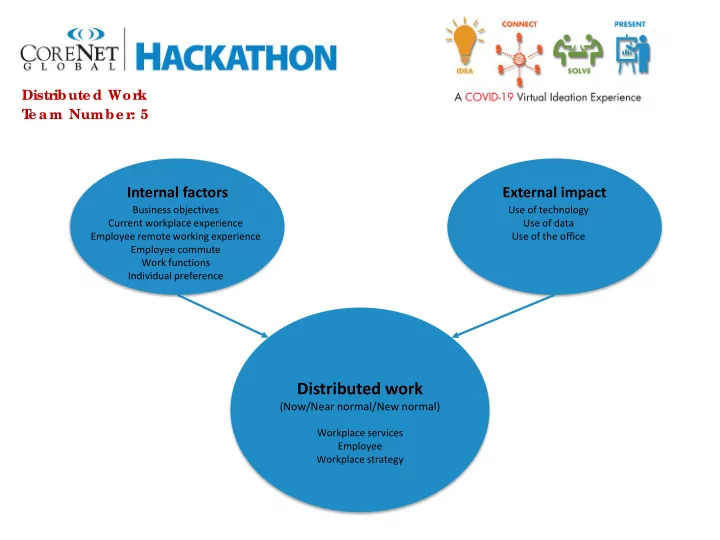

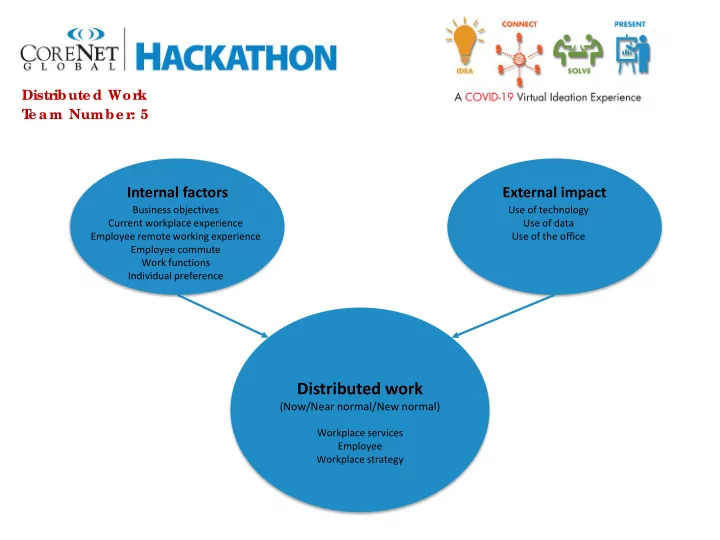

Distribute d Work T e a m Numbe r: 5 Internal factors External impact Business objectives Use of technology Current workplace experience Use of data Employee remote working experience Use of the office Employee commute Work functions Individual preference Distributed work (Now/Near normal/New normal) Workplace services Employee Workplace strategy

Distribute d Work PESTEL analysis T e a m Numbe r: 5 Now (From Covid until Office Return) NEAR NORMAL (Office Return 6 months) NEW NORMAL (Post 6-18 months after return) Political Lockdown Rules – New way of working and Living: PPE Required In offices and public places New Laws address cleaning • • • Lockdown / Policing / Quarantine Temperature taking Medical Profession revamp • • Regulation: PPE Wearing Forced political decision, rather than the RIGHT thing to do Workplace HSE now applied at home • • • Economic Fear of job loss/earning Risk Job Security improvement New jobs for some • • • Cost Value Efficiency – GRE Real Estate Portfolios Return to work and wages improve Y-o-y Salary increases discussed • • • questioned Travel Ban continues/Limited Bonus discussions continue • • Employees Furloughed: Reduced Salary/No Work Benefits packages change to include work experience Some professions look into Leaner teams • • • Employees: Reduced Salary – Less Motivation solutions/Technology improvements for home Serviced offices/Flex up down leases/Terms on leases – • • Travel Bans – Savings on Company Travel (Airlines affected) Global recession continues except for FMCG, Life sciences, challenged • • Perceived productivity is higher in some sectors Tech and logistics Some professions/job types will cease to exist. • • Construction continues with skeleton staff (country Construction will continue – developers may need financial Wages stagnate --> cost of living reduces • • • specific) restructuring Construction spacial distancing implementation • Social Home Schooling/Children at home Challenges: requirement Office utilisation only 20-50% Office becomes a space for social collaboration • • • for flexible working hours Children remain at home through summer / Return to Utilisation in office remains lower than pre-covid • • Isolation – effects to wellness school September? People priorities self over work, part time work, more time • • Ground Hog Day – Monotony Social distancing remains but more lax with family/leisure --> 4 day week prevails. • • Family/Friends – Virtual Socialising only General wellness improvements until winter in Northern Graduate impact: new way of socialising • • • Employees: Working from Home – Overworked / Tired / Hemisphere WFH is socially acceptable • • Productivity WFH policies incl. funding for employee’s home office • Technological Mobile Workforce : Increase in Laptop(s) + Mobile Devices Video conferencing remains Video conference remains norm • • • Connectivity/Bandwidth - Restrictions. Provision of data PCs become replaced – workforce DRP (disaster recovery Travel peaks and than drops off to a lower than pre covid • • • cards (depending on bandwidth/location) plans) average VOIP Increase Drive to train and teach virtual collaboration Agile hub offices increase • • • Video conference increase Non-video call collaboration gains traction Automation becomes the new norm (robotics) • • • Smart buildings : implementing smart sensors, contactless Policy for teleworkers incl. Reimbursement of home • • building entry internet Environmental Social Environment: Workplace Experience – do people Workplace will have sptcial distancing Travel peaks and than drops off to a lower than pre covid • • • have Study Pollution improves/Air quality – Less commuting but use of average • Less Commuting / Travel– Less Pollution car will increase in some areas Pollution improves/Air quality – Less commuting • • Increased Air Quality Canteens – Limited services • • Cleaning – Visible in workplace and more frequent • Legal Labour law – Employee contracts are followed (country Labour law – % Employee contracts are amended to more RE Case Law change – Force Majeure clauses redefined – • • • specific) home working to use office as touchdown Long Stop Dates questioned Regulatory Move to more flexible contracts in GRE • •

Distribute d Work Impacts description T e a m Numbe r: 5 Impacts Now NEAR NORMAL NEW NORMAL Workplace N/A Covid 19 additional Resources continue to impact WS Operating costs begin to stabilise • • services Change control on existing FM contracts --> increased costs Collaboration space gets larger, but for less people (less dense) • • (IFM) CAPEX investment to adapt offices for return to work Office utilisation lower than pre Covid • • Teams operating in two environments --> home and office. Office becomes “drop in” centre and monthly onsite meetings increase • • Employee's home set up deployment creating peak days in utilisation • Wellness: Investing in additional cycle/running facilities (locks and showers) Typical Monday Meetings collaboration shift to throughout week • • Rapid deployment of smart workplace tech I.e occupancy sensors On site amenity space becomes more popular as social space --> demand • • Assertive workplace comms and mandatory policies. Active management and more variety and innovation • enforcement. WS becomes data hungry to start DRP/Strategy Planning: Collection and • Strategic encouragement to return workforce to the office – analysis of realtime workplace performance data is mandatory --> birth of the • Branding/Fun/Beneifts Workplace Performance Manager Catering Facilities onsite remain closed/limited • Employee N/A Active commuting prevails --> walking, cycling and running Active commuting prevails --> walking, cycling and running • • impact Driving will increase to maintain social distancing outside major metropolitan Driving will increase to maintain social distancing outside • • cities I.e. London, Paris, Berlin etc. major metropolitan cities I.e. London, Paris, Berlin etc. Digital collaboration and working continues Use of apps to determine non-peak times I.e. city mapper etc. Staggered • • Work Force Reduction (WFR) kicks in commutes into workplaces • Decentralisation: City Living is questioned for Surburbia. House renters move • into larger homes, with a study space, outside expensive location Workplace N/A Portfolios under close review – LTP vamped up Workplace strategy (layout, worksettings) does a 180, more space, no/limited • • strategy Immediate reaction unlikely due to “traditional Lease constraints”/Terms workstations. • Those with existing options in flex providers, will utilise memberships in suburban Location strategy changes from 'how do people get to the office' to 'how do • • areas (closer to where people live, outside city centres) – Hub offices may increase people stay away from the centralised office‘ (?) Companies preparing Disaster Recovery Plans • Flex Leasing is highly considered in LTP Considerations for new leasing models: Flex up/down, less traditional • • Smart Building Investment becomes a key topic leasing/hub offices/reduction in office space • Technology is the new hot topic in buildings – OpEx increases to convert to smart With workplace environment changing to collaboration the “future of office • • buildings development” will come into question Technology and Smart Buildings becomes new Occupier criteria • Sector Specific Considerations FMCG, Life sciences, Tech and logistics, public sector --> continue growth plans The workplace is no longer seen as the differentiator between companies. • • but with constraints on social distancing CRE sphere of influence/responsibility is now Total. Home, work and • CRE teams in reactive mode everything in between. • Investment in coaching teams to work effectively whilst working remotely or • Other sectors focus on changing business strategy to survive and grow in the new with a split population. New roles within organisations, that sit outside IT, • normal --> CRE teams not a priority until outcome is clear. CRE and HR. Scrum master approach. IT departments future role as stand along function challenged •

Distribute d Work T e a m Numbe r: 5 Employee Impact – Employee Profiles B C D A E Those that don’t Those that don’t Those that want to Those that remain Those that have to have to want to undecided Including those who: Like being seen Including those who: • Including those who: Including those who: Including those who: Enjoy/Need Collaboration Have a job profile that • Have accepted a home • • Are unsure what is Are anxious about the • • Thrive around others service the office: • working contract – Job “deemed” to be the near normal Enjoy time at the office Cleaners, Security, profile right thing to accept Enjoyed homelife • over home Facilities Are in middle adulthood • for their career Do not have a job profile • Are in young adulthood • life stage and invested in Enjoyed Homelife for home work • life stage without proper home office solution 50/50 Job Profilers • home office solution Enjoy the new work/life • Need the initial office • balance stimulation post lockdown

Recommend

More recommend