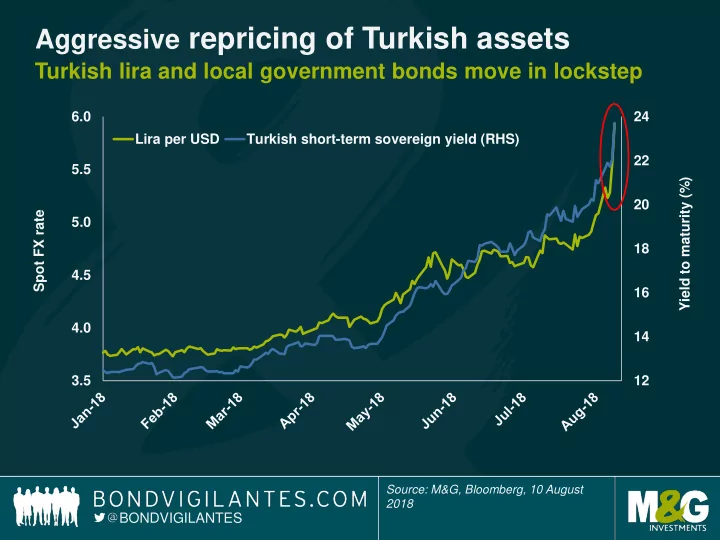

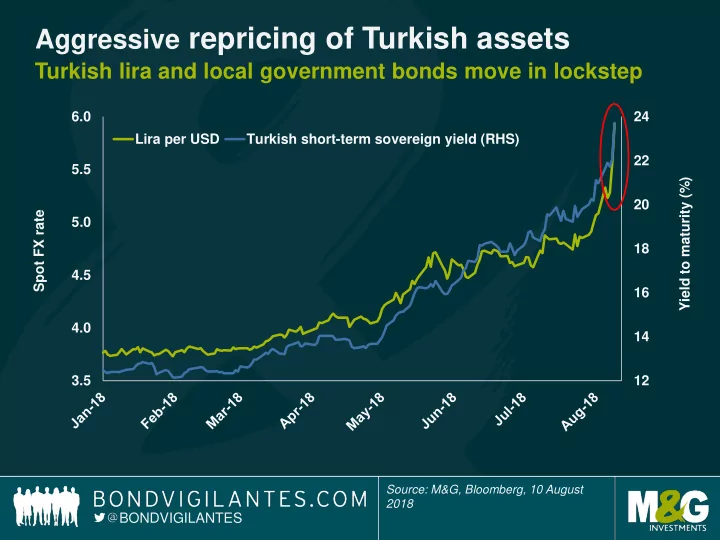

Aggressive repricing of Turkish assets Turkish lira and local government bonds move in lockstep 6.0 24 Lira per USD Turkish short-term sovereign yield (RHS) 22 5.5 Yield to maturity (%) 20 Spot FX rate 5.0 18 4.5 16 4.0 14 3.5 12 Source: M&G, Bloomberg, 10 August 2018 BONDVIGILANTES

EM Currencies: Idiosyncratic tails within a USD rally Best YTD Total Returns vs USD (%) -4 -2 0 2 4 6 8 10 12 Mexican Peso 11.09 Clombian Peso 5.21 Malaysian Ringgit 1.55 Peruvian Sol 1.2 Hong Kong Dollar 0.6 Tahi Baht -0.96 Singapore Dollar -1.14 Romanian Leu -1.69 Chinese Rinminbi -1.89 Taiwanese Dollar -2.3 Worst YTD Total Returns vs USD (%) Turkish Lira -23.5 Argentine Peso -20.31 Brazilian Real -9.41 Russian Ruble -9.4 Hungarian Forint -6.21 South African Rand -4.57 Polish Zloty -4.52 South Korean Won -3.51 Indian Rupee -3.24 Czech Koruna -3.1 Philippine Peso -2.95 -25 -20 -15 -10 -5 0 Source: Bloomberg, 9 August 2018 BONDVIGILANTES

European banks feel Turkish pressure Banks’ contingent convertible spreads jump wider 700 BBVA Co-Cos UniCredit Co-Cos 600 Z-spread (bps) 500 400 300 200 Source: M&G, Bloomberg, 10 August 2018 BONDVIGILANTES

Recommend

More recommend