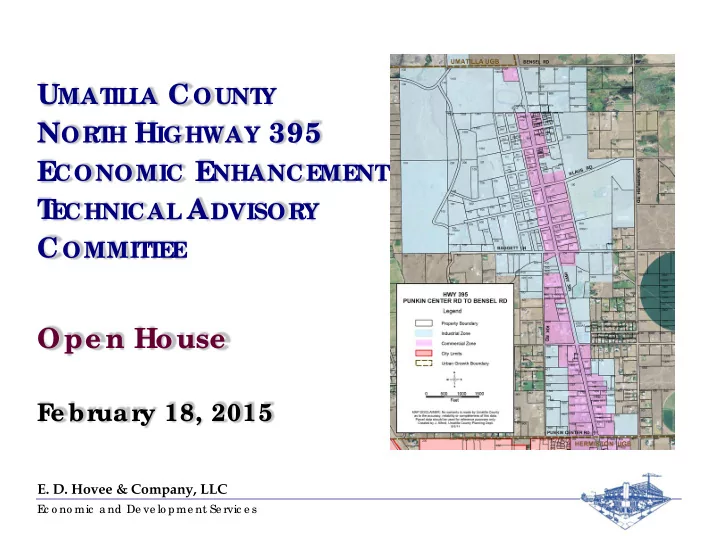

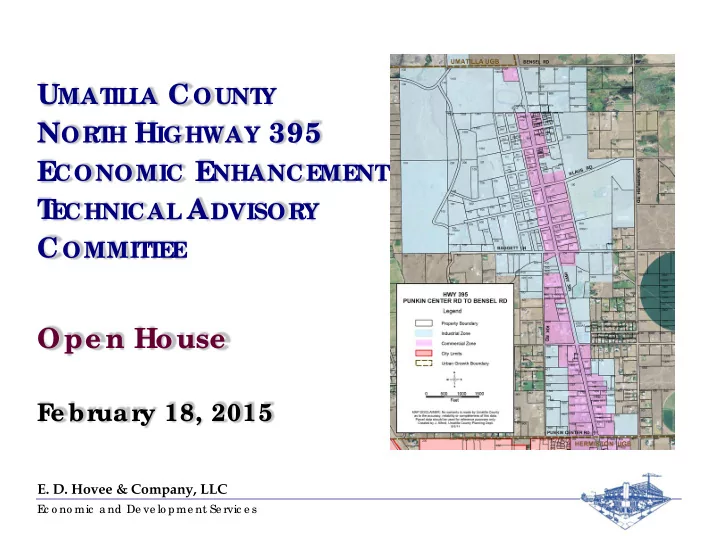

U MAT A C OUNT Y IL L N ORT H H IGHWAY 395 E CONOMIC E NHANCE ME NT T A DVISORY E CHNICAL C OMMIT E T E Ope n House F e brua ry 18, 2015 E. D. Hovee & Company, LLC E c o no mic a nd De ve lo pme nt Se rvic e s

Me e ting Disc ussio n T o pic s 1. Welcome (Bill Elfering – Umatilla County Commissioner) 2. Opening Remarks (Steve Watkinds, TAC member) 3. Open House Objectives (Tamra Mabbott – Planning Director) Background & Purpose of 395 North Economic Enhancement • Role of Technical Advisory Committee (TAC) • Overview of Draft Economic Development / Planning Study • Your Questions & Comments • 4. Draft Report Overview (Eric Hovee – Consultant) Information Baseline (Profile, Stakeholders, Best Practice Review) • Redevelopment Scenarios (with Draft Implementation Agenda) • 5. Question & Answer Discussion (All Attendees) • TAC Member Comments • Questions, Comments, Suggestions • Next Steps - 2 -

Re po r t Intr o duc tio n Objectives: TAC Member Affiliation Bryan Medelez BJK Transport • Viable approach to Steve Watkinds Columbia Court Club Highway 395 North Ken Dopps E Oregon Machine Zeno Marin Hendon Construction redevelopment Vicky Villareal Krome Trucking Arlin Phillips NW Crane Service • Template applicable Byron Grow Payless Lumber statewide Shane Clayson Pioneer William Kik Sanitary Disposal • Grounded in sound Deon Magnuson Sears analysis & tool box Kari Christiansen Sherrill Chevrolet Bill Elfering U.C. Commissioner resources -3 -

Info r matio n Base line : Owne r ship • 861 total acres • 267 tax parcels • 21 owners w/ 2/3 of land area (largest is BLM) 709 acres zoned for industrial, 152 commercial - 4 -

Info r matio n Base line : Valuatio n • $51.7 million assessed valuation (RMV) • Vacant land 37% of land area / 8% of RMV • Highly improved land 30% of land area / 63% of valuation - 5 -

Base line : Ro ads • Mix of state, county, public & private roads • Internal network of public streets & private roads • 395 & portions of internal system paved • Most of internal system consists of gravel & dirt roads - 6 -

Info r matio n Base line : RMV Be nc hmar k • < 20% of 395N is zoned C vs 30% Hermiston • RMV of C-land 3x valuation 395 N, I-comparable Comparative Employment Land Area & Real Market Valuation (RMV ) Sc e na rio Ac re a g e RMV RMV/ Ac re 395 North Study Area Commercially Zoned 152.13 $22,411,110 $147,316 Industrially Zoned 709.33 $29,242,470 $41,225 Total 861.46 $51,653,580 $59,961 $0 City of Hermiston Commercially Zoned 470.48 $202,142,790 $429,652 Industrially Zoned 412.15 $24,381,500 $59,157 Combination Zoned 693.22 $54,893,080 $79,186 Total 1,575.85 $281,417,370 $178,581 - 7 -

Info r matio n Base line : Jo bs Be nc hmar k Study Area & 97838 Zip Code Employment (2013) 2013 Emplo yme nt NAICS Emplo yme nt Se c to r 395 No rth 97838 Zip % o f T o ta l 23 Construction 86 323 27% 31-33 Manufacturing 73 1,517 5% 11, 42 Agriculture & Wholesale Trade 426 2,256 19% 44-45 Retail Trade 109 1,461 7% 48-49 Transportation & Warehousing 249 1,741 14% Real Estate & Professional, Scientific & 53-54 18 370 5% Technical Svcs Admin & Support, Waste Mgmt & 56, 62 163 2,287 7% Remediation Svcs, Health Svcs 71-72, 81 Leisure, Hospitality & Other Svcs 49 1,238 4% 21-22, 51-52, Other Remaining Sectors NA 1,799 NA 55, 61, 92 (not represented in 395 North) Total Employment 1,173 12,992 9% - 8 -

Stake ho lde r Inte r vie ws 11 Interviews (TAC members) Focus on: • Strengths & Weaknesses • Opportunities • Tool Box Resources • Comparables & Metrics • Priorities for Action - 9 -

Str e ngths & We akne sse s Strengths: Weaknesses: • Local & regional growth • Excessive 395 speeds • Good retail location • Poor internal streets • Central for ag-business • Lack of municipal water (fire flow) & distribution • Lack of sewer • Large, low cost sites • Zoning w/limited flexibility • Lower taxes • Unkempt image • Water & septic viability • Uncertain regulatory roles Comments: Comments: “Current building is not insurable” “Quick access” “Look of the town … haphazard” “North side is better… tried & true” - 10 -

Oppo r tunitie s Comments: Economic Development : • Business expansion “Will get more • Added highway corridor retail / service (w/ infrastructure) of what we have” Infrastructure & Design: “Need • Street calming (speeds, signals, landscape, lights) cohesive help, • Water system improvements (short / long term ) but low cost” • Wastewater options (from engineered to public solutions) “Make the area more eye- • Internal street network (both sides of 395) appealing” • Business appearance (facades to front yards) “Name Promotional Activities: recognition is important” • Question of need (little need to value of corridor branding) “Move city • Added highway corridor retail (especially w/ critical mass) limits to Organizational Capacity: Bensel” • Yes, to do! (done before, agency roles, regional marketing) - 11 -

T o o ls, Co mpar able s & Me tr ic s Tools: Comparables: Metrics (for success): • Public roles to • S Hermiston (industrial) address fire flows • Business • Umatilla Depot • ODOT 395 competitiveness (national / tri-state involvement & expansion markets) • Internal street • Attraction of new • Port of Morrow network similar business (heavy industrial, champions • Solving critical rail, barge) • Wastewater infrastructure • Downtown technical support questions Hermiston • Planning for (local retail) municipal & Tri-Cities treatment (malls) • Possible park / • Non-local open space? (success stories?) - 12 -

Be st Pr ac tic e s Oregon: Across the U.S. State Resources: National Scope: • DLCD – RSTs, state significance • Federal – EDA, CDBG, TIGER, EPA • ODOT – TIB, TGM, refinement plan • Non-profit – NMSC, APA, ULI, LISC • Business Oregon – loans, land & • Form-based / performance zoning infrastructure, tax incentives Mid-West / East Coast: Local Jurisdiction Resources: • Rust-belt aggressive programs • LID / EID West Coast: • GO bonding • Industrial – PDX Airport Way, • Urban renewal – tax increment Seattle Duwamish, Long Beach • Regulatory incentive – SDC, zoning • Washington – CERB / LIFT • Public / private partnership • California – sales tax increment Few communities focused on West coast more limited industrial corridor revitalization experience w/ industrial corridors (more emphasis to date on commercial) (outside metro areas) - 13 -

Be st Pr ac tic e s (Adde d De tail) Hood River Take-Aways: • Commercial: vision, customization, design, cooperation, leveraging Portland’s Airport Way • Industrial: quality look plus functionality, infrastructure, incentives Long Beach, CA • Oregon: adapt existing tools to corridor setting - 14 -

Be st Pr ac tic e s (Adde d De tail) Customize To Fit the Business & Community: Source: International City Managers Association, Public Management, October 2011 - 15 -

Re de ve lo pme nt Sc e nar io s A) Status Quo: B) County/Owner C) Urban Partnership: Incorporation: Assumes continuation of existing trends & Maximize opportunity as Assumes eventual jurisdictional roles a non-urban industrial & transition to UGB status commercial corridor & annexation Advantages: Advantages: Advantages: • Minimal public • Better chance to fix • Most rapid build-out expenditure need infrastructure • Highest job & tax • Alternative C / I • Improved corridor base, better image sites elsewhere image & tax base Disadvantages: Disadvantages: Disadvantages: • Increased tax rates • Less opportunity for • Won’t maximize w/annexation ag/retail expansion build-out potential • Requires most • Continued highway public-private • Funding & inter- safety & image cooperation jurisdictional issues support? - 16 -

Re de ve lo pme nt Sc e nar io s 395 North Potentials (@ Build-Out) Valuation Scenarios: A. Status Quo B. County/Owner Partnership C. Urban Incorporation - 17 -

De ve lo pme nt T o o l Bo x Tool Box Resources: Frame of Reference A. Planning & Regulatory B. Technical Assistance Incentive Types: • Place-based C. Funding • Business-based D. Workplace • Employee-based E. Best Practice/Case Study - 18 -

Imple me ntatio n Age nda (12-3-14) TAC Review & Recommendation: Start w/ Scenario B-County/Owner partnership , transitioning to C-urban incorporation Implementation Agenda Short-Term (1-3 Yrs) Mid-Term (3-10 Yrs) Long-Term (10-20 Yrs) • 395 North Corridor • Internal Street • 395 North Paving & Improvements Network Refinement Plan • Water Capacity & • UGB Expansion & • Water Fire Flow Plan System Plan Annexation • On-Site Wastewater • Wastewater Plan • Organizational Review Assistance • UGB Expansion Plan • Zoning Review • Business Association • 395 North Business Advocacy Association • Corridor Branding - 19 -

Recommend

More recommend