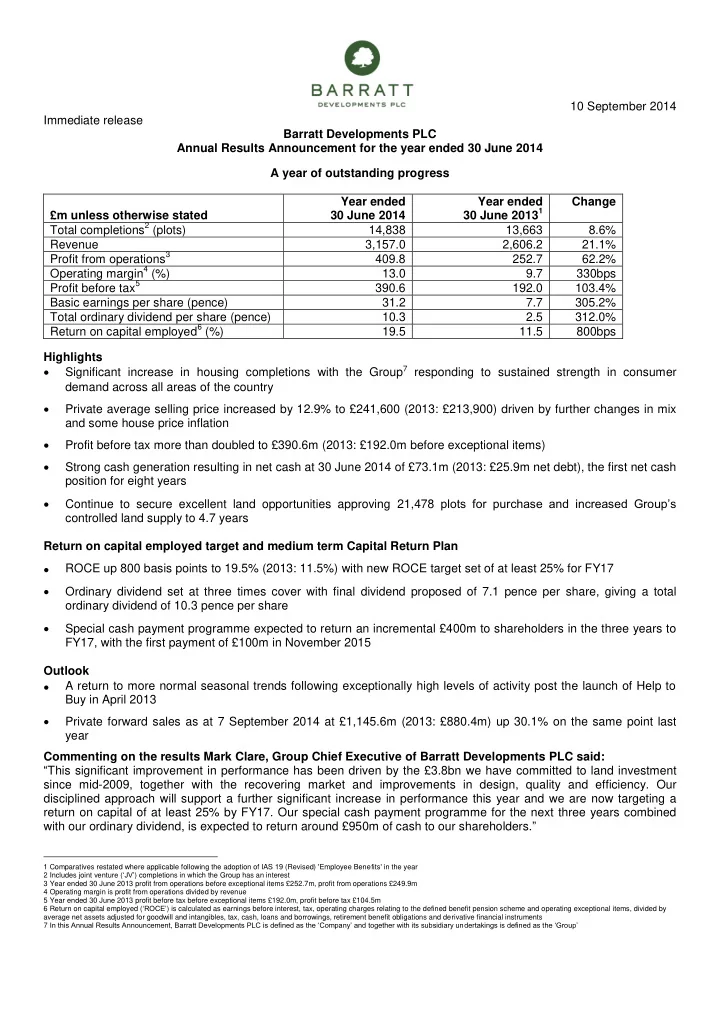

10 September 2014 Immediate release Barratt Developments PLC Annual Results Announcement for the year ended 30 June 2014 A year of outstanding progress Year ended Year ended Change 30 June 2013 1 £m unless otherwise stated 30 June 2014 Total completions 2 (plots) 14,838 13,663 8.6% Revenue 3,157.0 2,606.2 21.1% Profit from operations 3 409.8 252.7 62.2% Operating margin 4 (%) 13.0 9.7 330bps Profit before tax 5 390.6 192.0 103.4% Basic earnings per share (pence) 31.2 7.7 305.2% Total ordinary dividend per share (pence) 10.3 2.5 312.0% Return on capital employed 6 (%) 19.5 11.5 800bps Highlights Significant increase in housing completions with the Group 7 responding to sustained strength in consumer demand across all areas of the country Private average selling price increased by 12.9% to £241,600 (2013: £213,900) driven by further changes in mix and some house price inflation Profit before tax more than doubled to £390.6m (2013: £192.0m before exceptional items) Strong cash generation resulting in net cash at 30 June 2014 of £73.1m (2013: £25.9m net debt), the first net cash position for eight years Continue to secure excellent land opportunities approving 21,478 plots for purchase and increased Group’s controlled land supply to 4.7 years Return on capital employed target and medium term Capital Return Plan ROCE up 800 basis points to 19.5% (2013: 11.5%) with new ROCE target set of at least 25% for FY17 Ordinary dividend set at three times cover with final dividend proposed of 7.1 pence per share, giving a total ordinary dividend of 10.3 pence per share Special cash payment programme expected to return an incremental £400m to shareholders in the three years to FY17, with the first payment of £100m in November 2015 Outlook A return to more normal seasonal trends following exceptionally high levels of activity post the launch of Help to Buy in April 2013 Private forward sales as at 7 September 2014 at £1,145.6m (2013: £880.4m) up 30.1% on the same point last year Commenting on the results Mark Clare, Group Chief Executive of Barratt Developments PLC said: “ This significant improvement in performance has been driven by the £3.8bn we have committed to land investment since mid-2009, together with the recovering market and improvements in design, quality and efficiency. Our disciplined approach will support a further significant increase in performance this year and we are now targeting a return on capital of at least 25% by FY17. Our special cash payment programme for the next three years combined with our ordinary dividend, is expected to return around £950m of cash to our shareholders. ” 1 Comparatives restated where applicable following the adoption of IAS 19 (Revised) 'Employee Benefits' in the year 2 Includes joint venture ( ‘JV’ ) completions in which the Group has an interest 3 Year ended 30 June 2013 profit from operations before exceptional items £252.7m, profit from operations £249.9m 4 Operating margin is profit from operations divided by revenue 5 Year ended 30 June 2013 profit before tax before exceptional items £192.0m, profit before tax £104.5m 6 Return on capital employed ( ‘ROCE’ ) is calculated as earnings before interest, tax, operating charges relating to the defined benefit pension scheme and operating exceptional items, divided by average net assets adjusted for goodwill and intangibles, tax, cash, loans and borrowings, retirement benefit obligations and derivative financial instruments 7 In this Annual Results Announcement, Barratt Developments PLC is defined as the ‘Company’ and together with its subsidiary undertakings is defined as the ‘Group’

Certain statements in this document may be forward looking statements. By their nature, forward looking statements involve a number of risks, uncertainties or assumptions that could cause actual results to differ materially from those expressed or implied by those statements. Forward looking statements regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. Accordingly undue reliance should not be placed on forward looking statements. There will be an analyst and investor meeting at 9.00am today at Deutsche Bank, 1 Great Winchester Street, London, EC2N 2DB. The presentation will be broadcast live on the Barratt Developments corporate website, www.barrattdevelopments.co.uk, from 9.00am today. A playback facility will be available shortly after the presentation has finished. A listen only function will also be available. Dial in: 0800 953 1287 International dial in: +44 (0) 1452 560 297 Access code: 84241416# Further copies of this announcement can be obtained from the Company Secretary’s office at: Barratt Developments PLC, Barratt House, Cartwright Way, Forest Business Park, Bardon Hill, Coalville, Leicestershire, LE67 1UF. For further information please contact: Barratt Developments PLC David Thomas, Group Finance Director 020 7299 4896 Analyst/investor enquiries Susie Bell, Head of Investor Relations 020 7299 4880 Media enquiries Patrick Law, Group Corporate Affairs Director 020 7299 4892 Liz Morley, Maitland 020 7379 5151 2

Chairman's Statement A year of outstanding progress This has been a year of outstanding progress for the Group. In addition to stronger market conditions, we have benefitted from the underlying improvements we have embedded in the business. As a result, our profitability 8 has more than doubled, we have hit our return on capital target two years early and have improved our margins significantly. An improving market The UK housing market has continued to recover with strength now being seen in all regions. Mortgage lending has improved and the Government’s Help to Buy scheme has had a positive effect in increasing the construction and sale of new housing. We were particularly pleased to see that in March, the Help to Buy (Equity Loan) scheme due to finish in 2016 was extended to 2020. This provides the industry with more continuity, an important consideration given the investment timescales involved in buying and developing land. The varied rates of recovery across different regions of the UK have been challenging for policy makers. In this context, the measures introduced by the Bank of England in June to limit high loan to value lending appear well targeted. We welcome a policy environment that provides greater stability in the longer term, which enables us to drive sustainable improvements in our returns. An improved operating performance During the year we have continued to benefit from the substantial improvements we have made to our operating performance. Acquiring land suitable for development on the right terms is the fundamental building block of our business. Whilst the land market has become more competitive, in particular in the South East, the quality and disciplined approach of our land teams means that high margin land in attractive locations continues to be secured. The new sites already in production are exceeding our target returns. There is no doubt that increasing volumes across the industry have put pressures on our supply chain. I am pleased that the long term relationships with our suppliers have ensured that we have been able to work through these issues with little disruption to our business. At the same time, operating costs remain under control with a continued focus on process improvement, driven by the cost advantages of our centralised procurement systems, standardised build processes and IT systems. Building quality homes During the year we have increased our focus on design and the quality of the homes that we build. The Board believes that this customer-first ethos provides a competitive edge in terms of customer preference and pricing, whilst driving out costs resulting from poor build quality. For the tenth successive year the National House- Building Council (‘ NHBC ’) has awarded our site managers more Pride in the Job Awards than any other housebuilder. We are the only major housebuilder to achieve the Home Builders Federation (‘HBF’) Five Star recommendation from customers for five consecutive years. We are committed to Building for Life 12, the new Government endorsed design standard. Our employees The recent progress of the Group could not have been achieved without the talent and hard work of our employees. On behalf of the Board, I wish to thank our employees for their efforts that underpin the quality, the safety and the success of our operations. We are committed to continuing the investment in the development of our people, which is at the heart of creating a great place to work. 8 Profit before tax £390.6m (2013: £192.0m before exceptional items) 3

Recommend

More recommend