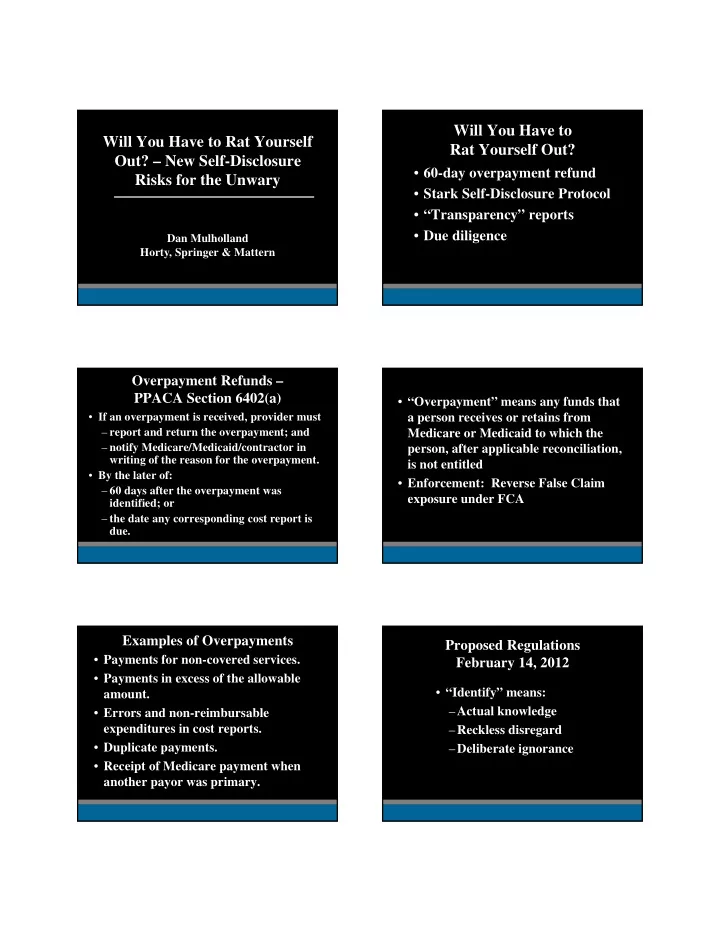

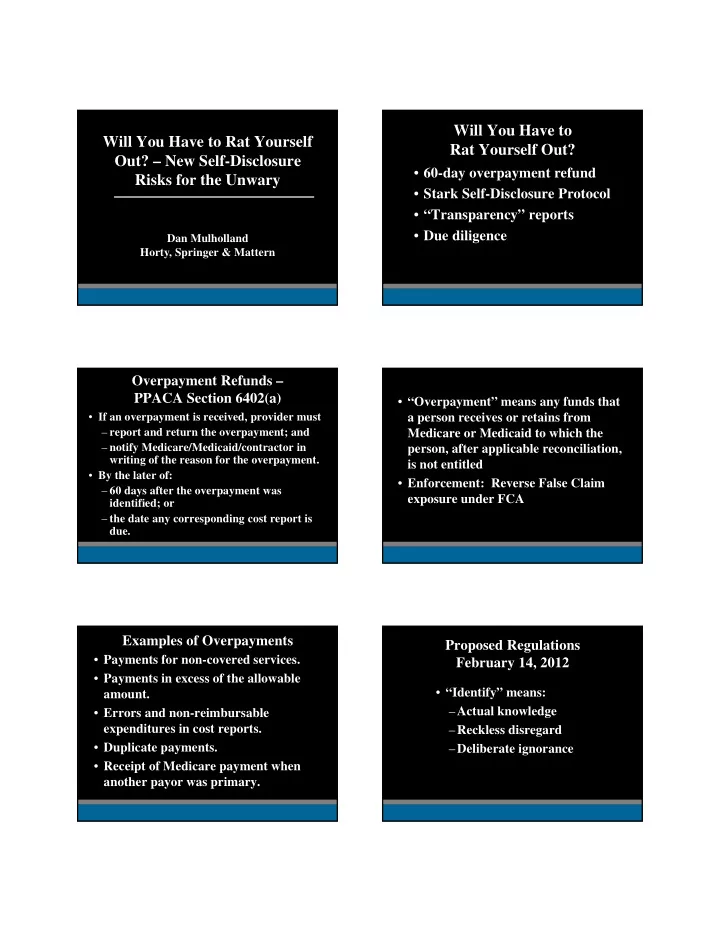

Will You Have to Will You Have to Rat Yourself Rat Yourself Out? Out? – New Self-Disclosure • 60-day overpayment refund Risks for the Unwary • Stark Self-Disclosure Protocol • “Transparency” reports • Due diligence Dan Mulholland Horty, Springer & Mattern Overpayment Refunds – PPACA Section 6402(a) • “Overpayment” means any funds that • If an overpayment is received, provider must a person receives or retains from – report and return the overpayment; and Medicare or Medicaid to which the – notify Medicare/Medicaid/contractor in person, after applicable reconciliation, writing of the reason for the overpayment. is not entitled • By the later of: • Enforcement: Reverse False Claim – 60 days after the overpayment was exposure under FCA identified; or – the date any corresponding cost report is due. Examples of Overpayments Proposed Regulations • Payments for non-covered services. February 14, 2012 • Payments in excess of the allowable • “Identify” means: amount. – Actual knowledge • Errors and non-reimbursable expenditures in cost reports. – Reckless disregard • Duplicate payments. – Deliberate ignorance • Receipt of Medicare payment when another payor was primary.

Stark Self-Disclosure Protocol – What You Have To Give CMS PPACA Section 6402(a) • how the error was discovered • a description of the corrective action plan • Voluntary program – tolls 60-day • reason for the refund refund requirement • whether the provider has CIA or is under OIG Self-Disclosure Protocol • May result in a reduction of liability • timeframe and the total amount of refund • Medicare claim control number • Much more complicated than OIG self- • Medicare NPI number disclosure protocol under AKS • refund in the amount of the overpayment; and • if statistical sample was used, description of • Could take years to resolve methodology Factors to be considered in reducing Stark Self-Disclosure Components amounts owed: • Nature and extent of the improper or • Description of actual or potential illegal practice violation • Timeliness of self-disclosure • Financial analysis • Cooperation in providing additional • Certification information • Litigation risk • Financial position of the disclosing party Transparency Reports – Who Is Covered? PPACA Section 6002 • “Applicable Manufacturers” of Requires disclosure of: covered drugs, devices, biologicals or medical supplies • Payments or transfers of value by • “Covered Recipients” manufacturers • Physician ownership of manufacturers and – Physicians group purchasing organizations – Teaching hospitals

Examples of Reportable Items Who Is Covered? • Consulting fees • “Payment or other transfer of value” - • Compensation for services other transfer of anything of value to a than consulting covered recipient unless through a • Honoraria third party and manufacturer does not know about it • Gifts • Investments by physicians or family • Entertainment members • Food • Travel (including specified destination) Effective Dates Where Does Information Go? Annual reports to HHS Regulations issued November 2011 • • Publicly available on searchable Reports begin March 31, 2013 • • government website Penalties for Non-Compliance Due Diligence Risks Failure to report: Other party reviews physician • • CMP of $1,000 to $10,000 for each arrangements payment/ownership interest not reported Uncovers real or imagined regulatory • • Up to $150,000 per year violations Knowing failure to report: Demands self-disclosure as condition of • the deal going through • CMP of $10,000 to $100,000 for each payment/ownership interest not reported, Could affect value if penalties are • up to $1,000,000 per year assessed • Risk of qui tam actions

How to Mitigate Due Diligence Risk Review and fix problem arrangements • before due diligence begins Joint defense/common interest agreement • Manage internal/external • communications carefully Anticipate likely regulatory reviews •

Recommend

More recommend