Waimakariri at 80,000 Residents: Shaping the way ahead and what - PowerPoint PPT Presentation

Waimakariri at 80,000 Residents: Shaping the way ahead and what does it mean for business? ENC Network Briefing 28 July 2016 Simon Markham, Manager Strategy & Engagement Simon Hart, Business & Centres Manager Agenda Simon Markham

Waimakariri at 80,000 Residents: Shaping the way ahead and what does it mean for business? ENC Network Briefing 28 July 2016 Simon Markham, Manager Strategy & Engagement Simon Hart, Business & Centres Manager

Agenda Simon Markham � WDC Planning horizons and issues arising � Population growth prospects � Current spatial plan framework � Business and jobs � Growth opportunities and risks / sum up Simon Hart � Business and Centres programme

WDC Planning Horizons � 1 – 10 – 30 year timeframes � Annual Plan – programme and projects for the coming year � Long Term Plan – ten year plan and budget for major activities and capital works – refreshed every 3 years � District Plan – Zoning, policies and rules for land use – reviewed every 10 years – due for review now � Infrastructure Strategy – 30 year strategic outlook for long life assets ($1.5 Billion under management) � District Development Strategy (DDS) – non-statutory process to ‘tie it all together’ – refresh 2016/17

Some Key Issues to Address � Directions for planned growth of major towns: o e.g. Disperse or concentrate growth across main towns? o e.g. What role can and should intensification play? � Future scope/scale of town centres � New business areas to provide for job growth? Where? � Strategic transport within the District as well as to/from State highways/Christchurch? � Rural subdivision & land use?; Rural-resid. development? � Strategic community facilities and greenspace? � Look and feel of our living environments?

Waimakariri District – Population change 120,000 100,000 80,000 60,000 40,000 20,000 0 1986 1991 1996 2001 2006 2013 2016 2018 2023 2028 2033 2038 2043 Actual and medium projection from 2018 High projection Source: Statistics New Zealand

We grow mainly by Migration Year Population – recent 5 year increase due to 5 year increase due and projected medium natural increase to net migration growth 2001 37,900 1,400 3,500 2006 44,100 1,200 4,900 2013 52,300 960 5,270 2018 60,500 690 7,500 2023 64,600 600 3,500 2028 68,500 440 3,500 2033 72,100 130 3,500 2038 75,300 -340 3,500 2043 78,000 -840 3,500 2048 80,200 -1,270 3,500 Source: Statistics NZ

Age Structure Change 1996-2043 90,000 80,000 70,000 60,000 Number of people 50,000 40,000 30,000 20,000 10,000 0 1996 2001 2006 2013 2018 2023 2028 2033 2038 2043 0-14 yrs 15-39 yrs 40-64 yrs 65+ yrs Source: Statistics NZ medium projection for Waimakariri District

Age Structure % Share 1996-2043 2016 40% 35% 30% Per cent of total population 25% 20% 15% 10% 5% 0% 1990 2000 2010 2020 2030 2040 2050 0-14 yrs 15-39 yrs 40-64 yrs 65+ yrs Source: Statistics NZ medium projection for Waimakariri District

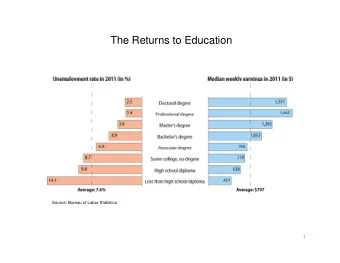

Strong growth in older age groups in most Council Areas � Between 2011 and 2031, ALL ‘growth’ in 56 of NZ’s 67 Territorial Authorities (84 percent) projected to be at 65+ years; all other age groups (combined 0-64 yrs) projected to decline • c.23 of these TAs likely to experience overall decline • c.12 likely to experience both net migration loss and natural decline � Of the remaining 11 TAs : • 95+% of growth at 65+ (Christchurch; Whangarei) • 60-63% growth at 65+ (Waikato; Palmerston Nth; Waimakariri) • 44-46% growth at 65+ (Wellington; Selwyn; Tauranga) • 36-37% growth at 65+ (Auckland; Hamilton; Queenstown) Source: Bill Cochrane, Waikato University Population Studies Centre 9

New Housing

Residential land Supply Current Target – Buffer amount of 250 ha/3,000 lots (five years supply at recent uptake rate) Current Amount = 3,600 potential vacant lots Need to look at through DSDS are we providing the right living environments given changing demographics?

Business Land Supply Current Target – buffer amount of at least 50 hectares of new /vacant business land (5 years supply on recent uptake) Current Amount = 115 hectares Need to look at through DDS are we providing the right business environments in the right locations? Source: ENC Business Attraction Flyer

Jobs and Businesses: 2000-2015 16000 14000 12000 10000 Number 8000 6000 4000 2000 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Businesses units Employee count

Businesses without employees 5000 4536 4467 4386 4344 4500 4323 4302 4305 4302 4143 4044 3855 4000 3639 3500 3306 3144 3087 3039 3000 2500 2000 1500 1000 500 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

1878 Agriculture/forestry/fishing 2055 1584 Manufacturing Comparison 2916 between 147 Utilities 300 those 1716 Construction 3576 working 2697 (jobs) and Wholesale/retail 3873 those living 561 Accommodation/cafés 969 (resident 369 Transport/communications workers) 1383 in the 1575 Business services 3597 District by 318 Government/defence 978 sector, 2331 (2013 Census) Community/education/health 3900 900 Recreation/personal services 1488 231 Not specified 843 0 500 1000 1500 2000 2500 3000 3500 4000 4500 Daytime Usually resident

Home and Work Usually Resident Labour Force 2006 2013 2001 Usual Place of Work Number Percent Number Percent Number Percent Waimakariri District 7,686 41.7 9,033 41.0 11,439 44.2 Christchurch City 7,416 40.2 8,931 40.5 10,725 41.5 3,339 18.1 4,065 18.5 3,711 14.3 Other 18,441 100.0 22,029 100.0 25,875 100.0 Total Source: Statistics NZ, Usually Resident Population place of residence and place of work data

Northern and Western Corridors $535M - $585M upgrade in northern and western corridors 2014- 2020

Red Zone Opportunities

Construction Related Jobs: Greater Christchurch Dec-15

Sum Up � Its time to plan longer ahead than recently � Continuing relatively high growth is likely � Not just ‘where’ but amenity and community important � But marked change in population/household structure will impact business in many ways � Strong recent business growth but much more needed to secure vitality and satisfaction � Some real opportunities and risks � Seeking to engage with business through DDS process

Business and Centres Programme Simon Hart, Business and Centres Manager

Internal Systems & Business Sector Customer Service Engagement Culture Business & Centres Council Strategies Local Economic and Plans Development

Business Sector Engagement Business Sector Engagement Business Sector Engagement Business Sector Engagement � Central/Key Point of Contact For Business Customers � Improving Council’s Business Friendliness � Key Town Centre Case and Project Management & Leadership

Easily Easily Self Self Project Project Monitoring Monitoring Accessible Accessible Assessment Assessment Central/Key Central/Key Advisory Advisory and and Council and Council and – Regulatory – Regulatory Point of Point of Group (PAG) Group (PAG) Feedback Feedback Regulatory Regulatory Approvals Approvals Contact Contact Process Process Process Process Information Information Guide Guide

Internal Systems, & Customer Service Internal Systems, & Customer Service Internal Systems, & Customer Service Internal Systems, & Customer Service Culture Culture Culture Culture � Improvement of Internal Systems and Processes � Further Research, Business Surveying, Information Gathering and Analysis (In Conjunction with ENC) � Better Business Communications (Internal and External)

$100,000,000 $200,000,000 $300,000,000 $400,000,000 $500,000,000 $600,000,000 $700,000,000 $800,000,000 $900,000,000 $0 Four Avenues Riccarton Papanui/Northlands Hornby Rangiora Belfast Supa Centa Shirley Rolleston Kaiapoi Barrington Linwood Halswell Lincoln New Brighton Akaroa YE June 2015 YE June 2012 YE June 2009 Woodend/Pegasus Lyttelton

Local Economic Development Local Economic Development Local Economic Development Local Economic Development � 2012 Local Economic Development Strategy Implementation progress reported to LED Group � LED Group now focused on providing advice and feedback aimed at longer term plans – District Development and Town Centre Strategies � Working with ENC on Development of Business Attraction Programme and the District Visitor Strategy � Need to Grow ‘Information/Knowledge Database’ through Relationships, Research and Analysis – Production of Targeted Resources

Relevant Council Strategies and Plans Relevant Council Strategies and Plans Relevant Council Strategies and Plans Relevant Council Strategies and Plans

Current Town Centre Projects Current Town Centre Projects Current Town Centre Projects Current Town Centre Projects � Rangiora Town Centre Car Parking – Short, Medium, Long Term � Review of Town Centre Plans - Kaiapoi 2016/17 & Rangiora 2017/18 � Town Centre Wi-Fi Project – Oxford, Rangiora, Kaiapoi, Woodend

Questions

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.