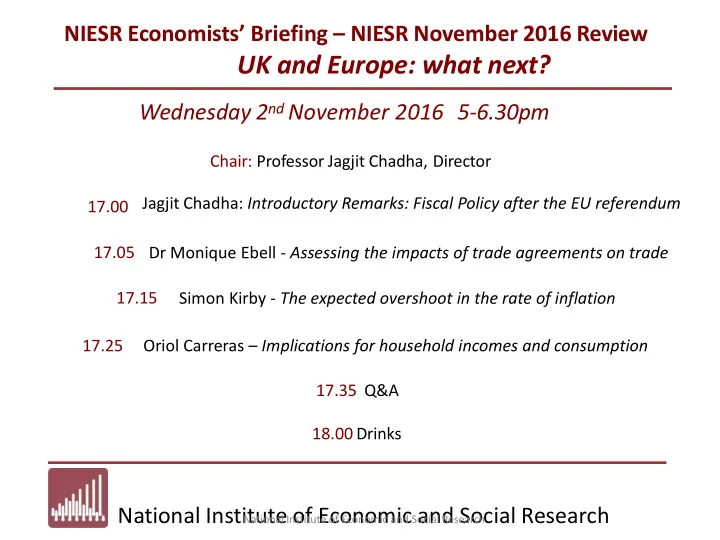

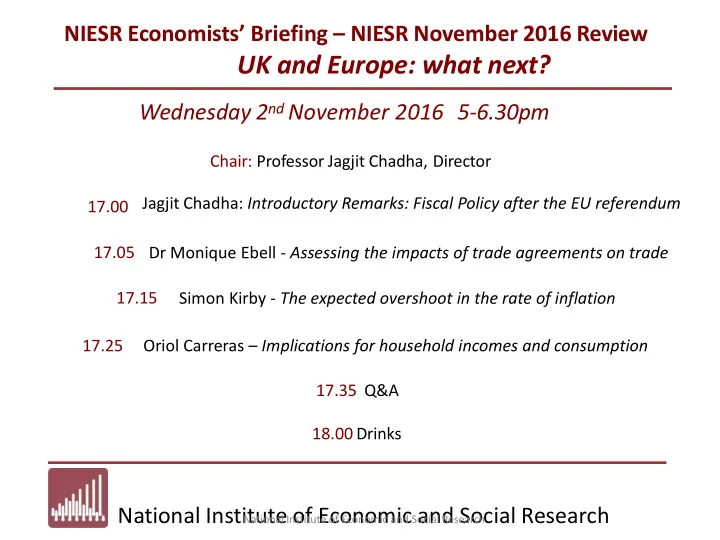

NIESR Economists’ Briefing – NIESR November 2016 Review UK and Europe: what next? Wednesday 2 nd November 2016 5-6.30pm Chair: Professor Jagjit Chadha, Director 17.00 Jagjit Chadha: Introductory Remarks: Fiscal Policy after the EU referendum 17.05 Dr Monique Ebell - Assessing the impacts of trade agreements on trade 17.15 Simon Kirby - The expected overshoot in the rate of inflation 17.25 Oriol Carreras – Implications for household incomes and consumption 17.35 Q&A 18.00 Drinks National Institute of Economic and Social Research National Institute of Economic and Social Research

Fiscal Policy after the Referendum Jagjit S. Chadha, NIESR National Institute of Economic and Social Research

Exchange Rate: Shock Absorber National Institute of Economic and Social Research

Debt Levels and Costs of Service National Institute of Economic and Social Research

20 th Century Debt Consolidations National Institute of Economic and Social Research

Monetary-Fiscal Framework • Inflation jointly determined by monetary-fiscal arrangements • Monetary Framework undermined somewhat by political comments • Fiscal Framework is AWOL – need to explain level, composition, ownership of debt stock • Institutional design helps flexibility not constrains • Credibility will be tested by inflation and any fiscal expansion National Institute of Economic and Social Research

Assessing the Impact of Trade Agreements on Trade Monique Ebell, Ph.D. NIESR 1 November 2016 National Institute of Economic and Social Research

Costs and Benefits of ‘Hard’ Brexit Assess the impact on UK trade of: • Leaving the EEA single market • ‘Trading with the World’, negotiating new free trade agreements with 3 rd countries. Key point: • EEA single market involves harmonisation of regulation, free movement of labour, capital • Ordinary FTAs generally less comprehensive National Institute of Economic and Social Research

Main Findings UK may find it difficult to replace the lost trade from leaving the EEA single market: 1) Leaving the EEA single market is associated with substantial decreases in trade, both for goods and for services. 2) Trading with the world? Ordinary FTAs are associated with: • No increase in services trade • Comparatively small increases in goods trade National Institute of Economic and Social Research

‘Hard’ Brexit Estimated reductions in trade with other EEA members from leaving the EEA single market: Goods Services Single market --> WTO rules with EU 58% - 65% 61% - 65% Single market --> FTA with EU 35% - 44% 61% - 65% Estimated reductions in total trade: Goods Services Single market --> WTO rules with EU 32% - 36% 24% - 26% Single market --> FTA with EU 20% - 25% 24% - 26% National Institute of Economic and Social Research

Trading with the World? Estimated increases in bilateral trade with 3 rd countries from forming a new FTA: Goods Services WTO rules FTA with 3 rd country 26% - 66% 0% Estimated increase in total trade from forming new FTAs : Goods Services WTO rules FTA with China 2% - 5% 0% WTO rules FTA with USA 3% - 8% 0% WTO rules FTA with Australia 0.2% - 0.5% 0% WTO rules FTAs with entire non-EEA WORLD 11% - 29% 0% National Institute of Economic and Social Research

The fine print • 2014 data on bilateral exports from 42 countries, covering 87% of the UK’s trade: o All 34 OECD countries, including 23 of EU-28 o BRIICS: Brazil, Russia, India, Indonesia, China, South Africa plus Malaysia and Hong Kong • Gravity regression equation for bilateral exports 𝑌 𝑗𝑘 : • 𝑌 𝑗𝑘 = 𝑓𝑦𝑞 𝛾 0 + 𝛾 1 𝑒𝑗𝑡𝑢 𝑗𝑘 + 𝛾 2 𝑐𝑝𝑠𝑒 𝑗𝑘 + 𝛾 3 𝑚𝑏𝑜 𝑗𝑘 + 𝛾 4 𝑑𝑝𝑚𝑝𝑜𝑧 𝑗𝑘 +𝛾 5 𝑡𝑏𝑛𝑓𝑑𝑝𝑜𝑢 𝑗𝑘 + 𝜀 1 𝐹𝐹𝐵 𝑗𝑘 + 𝜀 2 𝐺𝑈𝐵 𝑗𝑘 + 𝛽 𝑗 + 𝛿 𝑘 National Institute of Economic and Social Research

Compare to HMT’s Results Reductions in goods trade with other EEA members NIESR HMT EU Single market --> WTO rules with EU 58% - 65% 54% Single market --> FTA with EU 35% - 44% 42% Reductions in service s trade with other EEA members NIESR HMT EU 19% Single market --> WTO rules with EU 61% - 65% 14% Single market --> FTA with EU 61% - 65% Key distinction: HMT use data from 1981-2009, 195 countries But the single market has evolved in 90s and 00s! National Institute of Economic and Social Research

More fine print • Use latest methods • Poisson Pseudo-Maximum Likelihood (PPML) estimation to deal with observations of zero trade, particularly important for services trade. • Instrumental Variables (IV) approach to deal with endogeneity, i.e. that might be more likely to form trade agreements with countries we already trade a lot with. • Use measures of political stability from Polity IV project as instruments: strongly correlated with EEA membership, but not correlated with bilateral trade. National Institute of Economic and Social Research

‘Hard’ versus ‘Soft’ Brexit 1) ‘Hard’ Brexit • Substantial losses in both goods and services trade from leaving the EU/EEA single market 2) ‘Trading with the world’ • No increase in services trade from ordinary FTAs • Modest increase in goods trade from ordinary FTAs Bottom line: ‘Hard’ Brexit is likely to be costly. Difficult to see how lost trade from leaving the EU/EEA single market could be replaced with a series of ordinary FTAs. National Institute of Economic and Social Research

Regression Results – Services (Probit) (Gravity) (3) FTA_services 0.001 -0.129 EEA 0.951*** 1.033*** Distance -4.415*** -0.613*** -0.997*** Border -0.994*** 0.401*** 0.147 Lang official -1.422*** 0.545*** 0.538*** Colony -1.167*** 0.253** 0.238** Samecont 0.207 -0.022 Durable -0.016*** Polcomp -0.449** 0.218 Constant 15.548*** 9.269*** 12.309*** (pseudo) R 2 0.688 0.883 0.883 National Institute of Economic and Social Research

Regression Results – Goods (Probit) (Gravity) (3) FTA_goods 0.228*** 0.430*** EEA 0.915*** 0.859*** Distance -4.415*** -0.576*** -0.888*** Border -0.994*** 0.698*** 0.587*** Lang official -1.422*** 0.183 0.074 Colony -1.167*** 0.189* 0.254*** Samecont 0.604*** 0.445*** Durable -0.016*** Polcomp -0.449** 0.082* Constant 15.548*** 15.133*** 17.202*** (pseudo) R 2 0.688 0.912 0.921 National Institute of Economic and Social Research

The expected overshoot in the rate of inflation National Institute Economic Review Issue 238, November 2016 Simon Kirby National Institute of Economic and Social Research

Forecast Summary National Institute of Economic and Social Research

The outlook for inflation 7 Forecast 6 5 Per cent 4 3 2 1 0 -1 -2 2005 2007 2009 2011 2013 2015 2017 2019 2021 Nov 16 - NIESR Aug 16 - BoE Aug 16 - NIESR Source: NiGEM and Bank of England forecasts Note: BoE report period forecasts for only 3 years ahead National Institute of Economic and Social Research

Sterling’s depreciation (15% in 4 months) Price inflation 12 40 CPI (LHS) 9 30 Output 12-month change (per cent) PPI (LHS) 12-month change (per cent) 6 20 3 10 0 0 -3 -10 Input PPI (RHS) -6 -20 2007 2009 2011 2013 2015 Source: NiGEM database and forecast Source: ONS. Note: CPI is Consumer Price Index; PPI is Producer Price Index. National Institute of Economic and Social Research

Core inflation around long-run average CPI inflation fan chart (per cent per annum) Headline and core CPI inflation rates 6 7 Forecast 12 month change (per cent) 5 6 5 4 4 3 3 2 2 1 1 0 0 -1 -1 1997 2000 2003 2006 2009 2012 2015 -2 2005 2007 2009 2011 2013 2015 2017 2019 2021 Core Headline Source: NiGEM simulations Source: ONS National Institute of Economic and Social Research

References Forbes, K., Hjortsoe, I., and Nenova T., (2015) ‘The shocks matter: improving our estimates of exchange rate pass- through’ Discussion Paper No.43, Monetary Policy Committee Unit, Bank of England. Kirby, S., Carreras, O., Meaning, J., Piggott, R. and Warren, R. (2016) ‘Prospects for the UK economy’, National Institute Economic Review , No. 238, pp. F46-78. Kirby, S., and Meaning, J., (2014) ‘Exchange rate pass -through: A view from a global structural model’, National Institute Economic Review, No. 230, pp F59 – 64. National Institute of Economic and Social Research

Implications for household incomes and consumption National Institute Economic Review Issue 238, November 2016 Oriol Carreras National Institute of Economic and Social Research

Real disposable income growth 4 Forecast 3 2 Per cent per annum 1 0 -1 -2 -3 -4 2004 2008 2012 2016 2020 RPDI Per capita RPDI National Institute of Economic and Social Research

Real consumer wage 150 Forecast 145 140 135 130 1997 = 100 125 120 115 110 105 100 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 National Institute of Economic and Social Research

Real consumer spending growth 4 Forecast 3 2 Per cent per annum 1 0 -1 -2 -3 -4 2004 2008 2012 2016 2020 Consumption Per capita consumption National Institute of Economic and Social Research

Recommend

More recommend