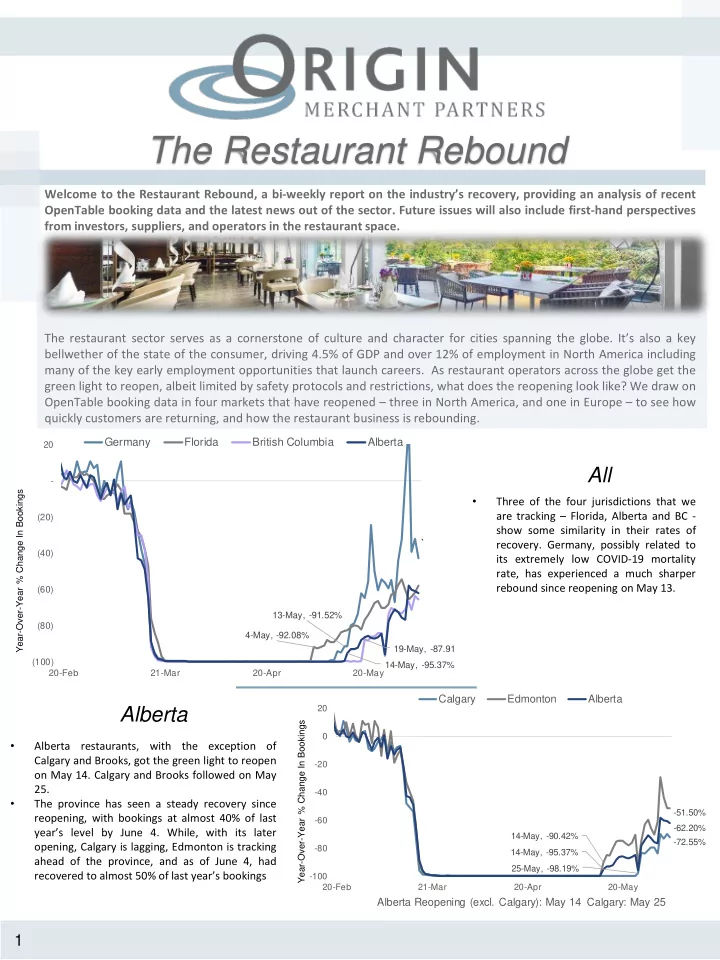

The Restaurant Rebound Welcome to the Restaurant Rebound, a bi-weekly report on the industry’s recovery, providing an analysis of recent OpenTable booking data and the latest news out of the sector. Future issues will also include first-hand perspectives from investors, suppliers, and operators in the restaurant space. The restaurant sector serves as a cornerstone of culture and character for cities spanning the globe. It’s also a key bellwether of the state of the consumer, driving 4.5% of GDP and over 12% of employment in North America including many of the key early employment opportunities that launch careers. As restaurant operators across the globe get the green light to reopen, albeit limited by safety protocols and restrictions, what does the reopening look like? We draw on OpenTable booking data in four markets that have reopened – three in North America, and one in Europe – to see how quickly customers are returning, and how the restaurant business is rebounding. Germany Florida British Columbia Alberta 20 All - Year-Over-Year % Change In Bookings • Three of the four jurisdictions that we are tracking – Florida, Alberta and BC - (20) show some similarity in their rates of ` recovery. Germany, possibly related to (40) its extremely low COVID-19 mortality rate, has experienced a much sharper rebound since reopening on May 13. (60) 13-May, -91.52% (80) 4-May, -92.08% 19-May, -87.91 (100) 14-May, -95.37% 20-Feb 21-Mar 20-Apr 20-May Calgary Edmonton Alberta 20 Alberta Year-Over-Year % Change In Bookings 0 • Alberta restaurants, with the exception of Calgary and Brooks, got the green light to reopen -20 on May 14. Calgary and Brooks followed on May 25. -40 • The province has seen a steady recovery since -51.50% reopening, with bookings at almost 40% of last -60 -62.20% year’s level by June 4. While, with its later 14-May, -90.42% -72.55% opening, Calgary is lagging, Edmonton is tracking -80 14-May, -95.37% ahead of the province, and as of June 4, had 25-May, -98.19% recovered to almost 50% of last year’s bookings -100 20-Feb 21-Mar 20-Apr 20-May Alberta Reopening (excl. Calgary): May 14 Calgary: May 25 1

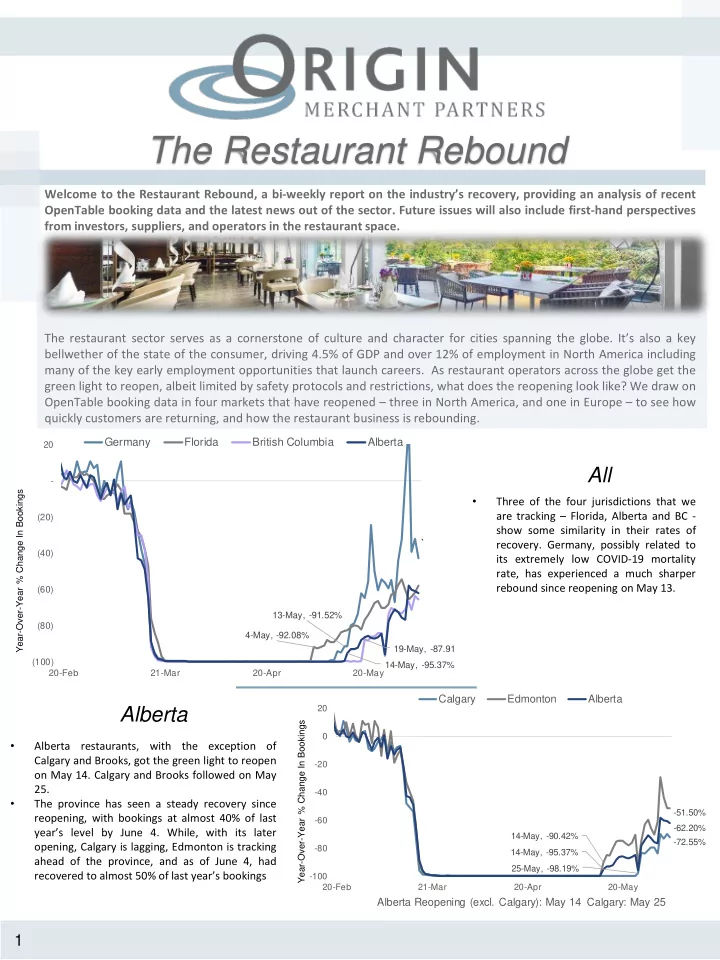

The Restaurant Rebound British Columbia Vancouver 20 British Columbia Year-Over-Year % Change In Bookings 0 • A few weeks into its reopening on May 19, after a slow start, BC restaurants are on the road to a -20 rebound. • By June 4, bookings across the province had -40 rebounded to almost 35% of last year's levels. Surprisingly, given the city's vibrant restaurant -60 scene, Vancouver restaurants appear to be -65.55% lagging the rest of the province, still down 79% 19-May, -87.91 -80 -78.95% as of June 4. 19-May, -93.02 -100 20-Feb 21-Mar 20-Apr 20-May British Columbia Reopening: May 25 Florida Florida Naples Tampa 20 • Florida allowed restaurants to open at Year-Over-Year % Change In Bookings 0 25% capacity on May 4, increasing to 50% capacity on May 18. The use of outdoor patio seating was encouraged, with no -20 capacity restriction stipulated, although social distancing protocols still need to -36.49% -40 be in place. -47.28% • The state has seen a steady rebound -58.19% since reopening, with bookings at 42% of -60 4-May, -77.05% last year's by June 4. Certain cities have 4-May, -80.27% rebounded well beyond state levels. -80 Tampa, for example, had recovered to 66% of bookings by June 4, with a number of stronger days preceding that. 4-May, -92.08% -100 20-Feb 21-Mar 20-Apr 20-May Florida Reopening: May 4 20 Germany München Germany Year-Over-Year % Change In Bookings 0 • -20 Germany, which appeared to weather the pandemic better than much of Europe, allowed a gradual -40 -42.77% reopening of restaurants, -48.53% commencing May 13, 2020 • Since its reopening, Germany has -60 seen a remarkable rebound. As of June 4, Germany's bookings were at 13-May, -91.52% -80 60% of last year's levels, with a few 13-May, -99.99% preceding days spiking considerably higher. -100 20-Feb 21-Mar 20-Apr 20-May Germany Reopening: May 13 2

Food Services in the News • Canadian June restaurant reopenings include: PEI June 1 Manitoba June 1 (indoor dining open following patio dining reopening on May 4) Nova Scotia June 5 Sask. June 8 Ontario June 12 (patio dining only, and excluding GTA and bordering regions) Quebec June 15 (excluding Montreal and two other regions, which will open June 22) • The much-anticipated acquisition of food delivery service Grubhub by Uber appears to have hit a snag. On Monday, CNBC reported that the two companies were disagreeing over potential antitrust concessions that might be required to complete the deal. • Leger Marketing Inc. conducted a web survey from June 5th to June 7th, 2020, asking 1,523 Canadians and 1,001 Americans, 18 years of age or older, about their levels of comfort with restaurant reopenings. In Canada, almost 70% responded that they were comfortable with restaurants reopening with restrictions. Full survey results are here. • What does the spike in consumer use of delivery apps mean for restaurants? This New York Times article reveals some hard truths. • And last but not least, we report on the reopening experiences of restaurant operators with locations in BC, Alberta, Florida and Texas in Lessons from Early Reopenings. Origin Restaurant Team: Jim Osler CharlesPennock Lindsay Adam Weiss Principal Principal Principal arles.pennock@originmerchant.com lindsay.weiss@originmerchant.com jim.osler@originmerchant.com t:416-800-0784 t: 416-800-0798 t: 416-775-3656 Karen Fisman Perry Caicco Director, Business Development SeniorAdvisor karen.fisman@originmerchant.com perry.caicco@originmerchant.com t: 416-775-3658 3

Recommend

More recommend