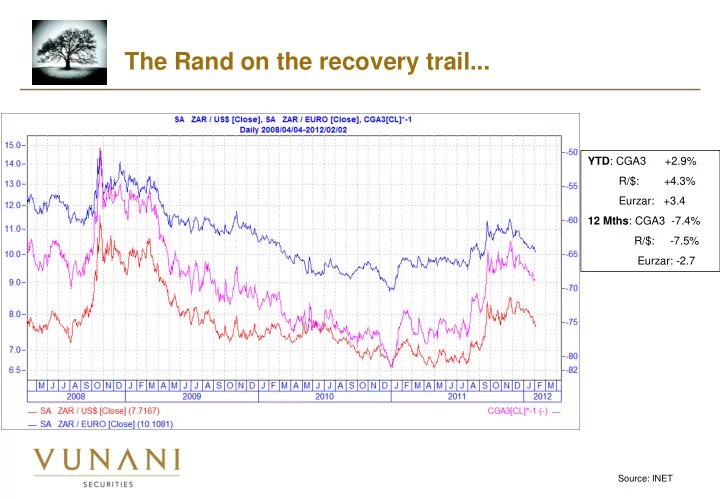

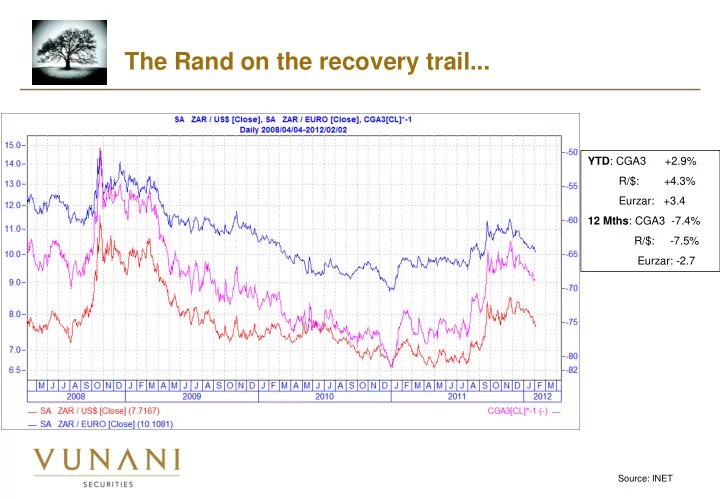

The Rand on the recovery trail... YTD : CGA3 +2.9% R/$: +4.3% Eurzar: +3.4 12 Mths : CGA3 -7.4% R/$: -7.5% Eurzar: -2.7 Source: INET

Inflation: near a cyclical peak…. Sources: SARB, STATSSA & Vunani Securities calculations

Accommodative monetary stance: Negative real interest rates... Source: INET & Vunani calculations and forecasts

Government Finances. Summary table of national revenue, expenditure and borrowing for the month ended 31 December 2011 2011/12 2011/2012 Best Case 2011/2012 Worse Case Revised Year to date Based on previous Deviation Proportional: Deviation R thousand estimate year proportional Months Revenue 718 542 150 526 826 838 748 003 022 29 460 872 702 435 785 (16 106 365) Expenditure 888 018 255 648 091 344 868 743 804 (19 274 451) 864 121 792 (23 896 463) Budget deficit(-)/surplus(+) (169 476 105) (121 264 506) (127 353 677) 42 122 428 (161 686 007) 7 790 098 Extraordinary receipts 3 380 000 3 796 489 3 380 000 3 380 000 - Extraordinary payments (520 000) (492 895) (520 000) (520 000) - Net borrowing requirement (166 616 105) (117 960 912) (124 493 677) 42 122 428 (158 826 007) 7 790 098 Financing of the net borrowing requirement Domestic short-term loans (net) 22 000 000 33 661 979 29 738 702 7 738 702 44 882 639 22 882 639 Domestic long-term loans (net) 135 067 000 101 034 430 135 029 789 -37 211 134 712 573 -354 427 Foreign loans (net) (2 363 000) (2 479 876) 3 782 285 6 145 285 (3 306 501) (943 501) Change in cash and other balances (- increase) 11 912 105 (14 255 621) (44 057 099) (55 969 204) (17 462 703) (29 374 808) Total financing (net) 166 616 105 117 960 912 124 493 677 (42 122 428) 158 826 007 (7 790 098) 5.36%/GDP vs. 5.5% revised budget estimate Source: National Treasury & Vunani calculations and forecasts

Equity Market Scenarios. Rolling twelve months equity performance Base case Spot Rolling twelve months ending: Rolling 2 yr 31-Jan-12 30-Jan-13 31-Jan-14 average/year FTSE/JSE Alsi Index 33792 39173 43862 Exit PER (X) 13.42 13.7 13.3 EPS 2518.51 2853.5 3303.4 EPS growth (%) 34.78 13.3 15.8 Growth in FTSE/JSE Alsi index (%) 15.9 12.0 13.95 Bull case Rolling twelve months ending: 31-Jan-12 30-Jan-13 31-Jan-14 FTSE/JSE Alsi Index 33792.48 45967 51727 Exit PER (X) 13.42 16.1 15.7 EPS 2518.51 2853.5 3303.4 EPS growth (%) 13.3 15.8 Growth in FTSE/JSE Alsi index (%) 36.0 12.5 24.28 Bear case Rolling twelve months ending: 31-Jan-12 30-Jan-13 31-Jan-14 FTSE/JSE Alsi Index 33792.48 32379 35997 Exit PER (X) 13.42 11.3 10.9 EPS 2518.51 2853.5 3303.4 EPS growth (%) 13.3 15.8 Growth in FTSE/JSE Alsi index (%) -4.2 11.2 3.50 Sources: INET & Vunani calculations and forecasts

Supporting Comments. Cash Higher risk appetite justifies reduction in high cash holding. Upped from underweight to neutral. Domestic inflation cycle, international interest rate prospects Bonds and potential prescribed assets positive for bonds Quoted Property Improved prospects justifies going overweight Our preferred asset class… Equities Added support of Rand weakness largely out, but still cheap. Nevertheless, we'd rather bet on Offshore Equity domestic equity instead… In spite of global sovereign debt concerns its lack of correllation with domestic equities justifies a Offshore Bonds fairly high holding - slightly underweight.. Not worth while… Offshore Cash Superior prospects above industrials, but potential earnings disappointment suggests one probably SA Resources shouldn't have too aggressive an overweight allocation. Good prospects from oversold levels… SA Financials SA Industrials Demanding PER; recommend underweight SA Med/Small Time to start nibbling… Companies Prime rate adjustment either way before the end of 2012… Not-my-base case Sources: INET & Vunani calculations and forecasts

European bond yields... Source: INET

The Rand weakening towards parity… Rand/$ vs. purchasing power parity (PPP) R/$ R/$ 12 12 11 11 F PPP Rand (Base: 1970) 10 10 9 9 Actual/Base case (R/$) 8 8 7 7 6 6 5 5 4 4 3 3 2 2 1 1 0 0 Jan-71 Jan-73 Jan-75 Jan-77 Jan-79 Jan-81 Jan-83 Jan-85 Jan-87 Jan-89 Jan-91 Jan-93 Jan-95 Jan-97 Jan-99 Jan-01 Jan-03 Jan-05 Jan-07 Jan-09 Jan-11 Source: INET & Vunani calculations and forecasts

Risk premia … Source: SARB & Vunani Securities 10 -4 -2 0 2 4 6 8 Jul-99 % Oct-99 Jan-00 Apr-00 Jul-00 Oct-00 Jan-01 Apr-01 Jul-01 Oct-01 Jan-02 Apr-02 Jul-02 Oct-02 Jan-03 Apr-03 Jul-03 Oct-03 Jan-04 Apr-04 Jul-04 Oct-04 Jan-05 Apr-05 Country risk premium Currency risk premium Sovereign risk premium (based on 10y US nominal yield) Jul-05 Oct-05 Jan-06 Apr-06 Jul-06 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 % Apr-11 Jul-11 10 -4 -2 0 2 4 6 8

Sovereign risk comparison Source: SARB & Vunani Securities 0 2 4 6 8 Jul-99 % Oct-99 Jan-00 Apr-00 Jul-00 Oct-00 Jan-01 Apr-01 Jul-01 Oct-01 Sovereign risk premium (based on 5y US nominal yield) Sovereign risk premium (based on 10y US nominal yield) Jan-02 Apr-02 Jul-02 Oct-02 Jan-03 Apr-03 Jul-03 Oct-03 Jan-04 Apr-04 Jul-04 Oct-04 Jan-05 Apr-05 Jul-05 Oct-05 Jan-06 Apr-06 Jul-06 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 % Apr-11 Jul-11 0 2 4 6 8

Negative output gap… Source: Vunani Securities -4.2 -3.2 -2.2 -1.2 -0.2 0.8 1.8 2.8 3.8 4.8 5.8 Mar-90 % Dec-90 Sep-91 Jun-92 Mar-93 Dec-93 Sep-94 Jun-95 Mar-96 Dec-96 Sep-97 Output Jun-98 Mar-99 gap Dec-99 Sep-00 Jun-01 Trend Mar-02 Dec-02 GDP Sep-03 Jun-04 Mar-05 Actual Dec-05 Sep-06 GDP Jun-07 Mar-08 Dec-08 Sep-09 Jun-10 Mar-11 Dec-11 Sep-12 F Jun-13 % 0.8 1.8 2.8 3.8 4.8 5.8 -4.2 -3.2 -2.2 -1.2 -0.2

Inflation: Housing & utilities the main culprit… Source: Statssa & Vunani Securities

The ultimate goals... Source: NPC National Development Plan, 11 November 2011

The battle plan... Source: NPC National Development Plan, 11 November 2011

The job creation strategy. Source: NPC National Development Plan, 11 November 2011

The plan for infrastructure. Source: NPC National Development Plan, 11 November 2011

Economy and employment targets Source: NPC National Development Plan, 11 November 2011

World Economy: Indebtedness & Leverage. Source: IMF Global Financial Stability Review, September 2011

World Economy: Sovereign Debt, Market & Vulnerability Indicators. Source: IMF Global Financial Stability Review, September 2011

BER’s inflation expectations (annual averages)… Source: INET

Significant downward shift in yield curve…

Yield spreads Source: SARB & Vunani Securities 1000 1200 1400 1600 200 400 600 800 0 Jan-98 Spread above US bonds (points) May-98 Sep-98 Jan-99 May-99 Sep-99 Jan-00 May-00 Sep-00 Jan-01 May-01 Sep-01 Jan-02 May-02 Sep-02 Jan-03 May-03 Sep-03 Jan-04 May-04 South African 20y yankee bond spread JPMorgan EMBI+ Sep-04 Jan-05 May-05 Sep-05 Jan-06 May-06 Sep-06 Spread above US bonds (points) Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 200 400 600 800 1000 1200 1400 1600 0

Response of consumer prices to a $10/barrel oil price increase… Source: SARB Quarterly Bulletin, March 2011

Government debt held externally. Source: IMF.

World Economy: World Economic Outlook Projections. Source: IMF World Economic Outlook, September 2011

BRICS:. Source: IMF Global Financial Stability Review, Sept. ‘11

US federal debt… GROSS GOVERNMENT DEBT At the end of fiscal year, in trillions of dollars President Year Government debt Debt limit Actual Debt George 2001 Estimated debt 5.77 5.95 W. Bush 2002 Debt limit 6.20 6.40 2003 $14 294bn 6.76 7.38 2004 $14 345 $15 476 7.35 8.18 2005 Debt limit reached 7.91 2006 on May 16 8.45 8.97 2007 8.95 9.82 2008 9.99 10.62/11.32 Barack 2009 11.88 12.1/12.39 Obama 2010 13.53 14.29 2011 15.48 BIGGEST CREDITORS: TOP HOLDERS OF US TREASURY BONDS As of end May, in billions of dollars: China Japan Britain 1159.8 912.4 346.5 Source: Business Report, 26 July 2011

US Debt growing at an alarming rate… www.usdebtclock.org or www.usdebtclock.org/world-debt- clock Source: US Debt Clock.Org

US Debt by 2015: base case scenario… Source: US Debt Clock.Org

Spot the declining GFCF/GDP ratio! Source: Budget Review, 2011

Recommend

More recommend