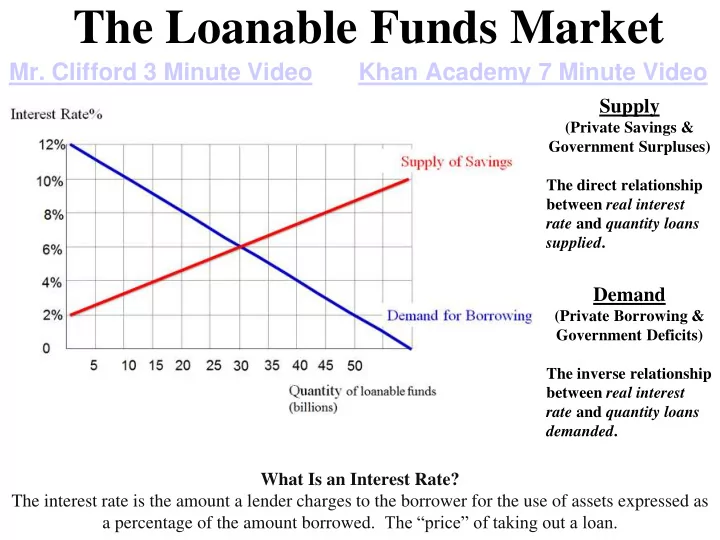

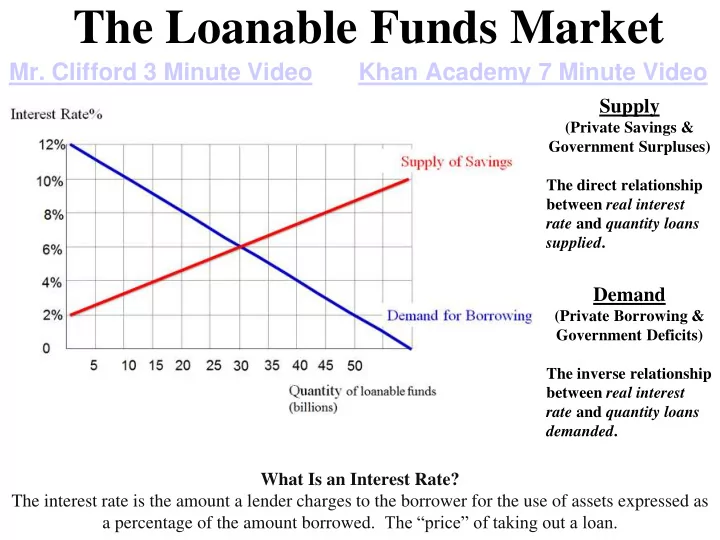

The Loanable Funds Market Mr. Clifford 3 Minute Video Khan Academy 7 Minute Video Supply (Private Savings & Government Surpluses) The direct relationship between real interest rate and quantity loans supplied . Demand (Private Borrowing & Government Deficits) The inverse relationship between real interest rate and quantity loans demanded . What Is an Interest Rate? The interest rate is the amount a lender charges to the borrower for the use of assets expressed as a percentage of the amount borrowed. The “price” of taking out a loan.

Loanable Funds Market At the equilibrium real interest rate (nominal rate – inflation rate), the amount borrowers want to borrow equals the amount lenders want to lend. Real Interest S Lenders/Savers Rate r e D Borrowers/Investors Q Loans Quantity of Loans

Loanable Funds Market Shifters Demand Shifters Supply Shifters 1. Changes in borrowing 1. Changes in private by consumers savings behavior 2. Changes in borrowing 2. Changes in public by businesses savings (surpluses) (investment spending) 3. Changes in foreign 3. Changes in borrowing investment (ex: more by the government inflow of foreign (ex: deficit spending) financial capital) Demand for loans comes from borrowers/investors Supply for loans comes from lenders/savers

Example #1: China Reduces Purchases of US federal Bonds Less foreign financial inflow & the supply of loanable funds falls. Real Interest Rates RISE & Quantity of Loans DROPS Real S 1 S Lenders Interest Rate r 1 r e D Borrowers/Investors Q 1 Q Loans Quantity of Loans

Example # 2: If the US government runs a surplus, what will be the impact on the loanable funds market? Show the results on the graph below. How will this change impact GDP? Example #3: If the government increases tax credits for new homeowners, what will the impact be on the loanable funds market? Show of the graph below. Show of the graph below. How will this impact GDP?

Example # 2: If the government runs a surplus, what will be the impact on the loanable funds market? Show the results on the graph below. How will this change impact Real Interest Rates & GDP? S will Shift RIGHT to S1 Real Interest Rates will FALL, & GDP will INCREASE because investment (“I” in C+I+G+NX) increases will lower interest rates Example #3: If the government increases tax credits for new homeowners, what will the impact be on the loanable funds market? Show of the graph below. How will this impact Real Interest Rates & GDP? D will Shift RIGHTto D1 Real Interest Rates RISE & GDP will FALL because i nvestment (“I” in C+I+G+NX) drops as interest rates grow

Example #4: What will happen to the demand and supply for loanable funds if there is political instability? (Ex: Venezuaela) Demand and Supply Real BOTH shift IR S 1 S - Demand will decrease as worried consumers and businesses borrow/invest less ir - Supply will decrease as worried foreigners take R money out of the country (This is called “capital D flight ”) D 1 Impact on real interest rate is Quantity of Loans unclear Quantity of loans falls

2010 FRQ #1

2010 FRQ #1 ANSWER VIDEO

2010 FRQ #1 ANSWER

BONUS Practice FRQ

BONUS Practice FRQ ANSWER

BONUS Practice FRQ ANSWER

Recommend

More recommend