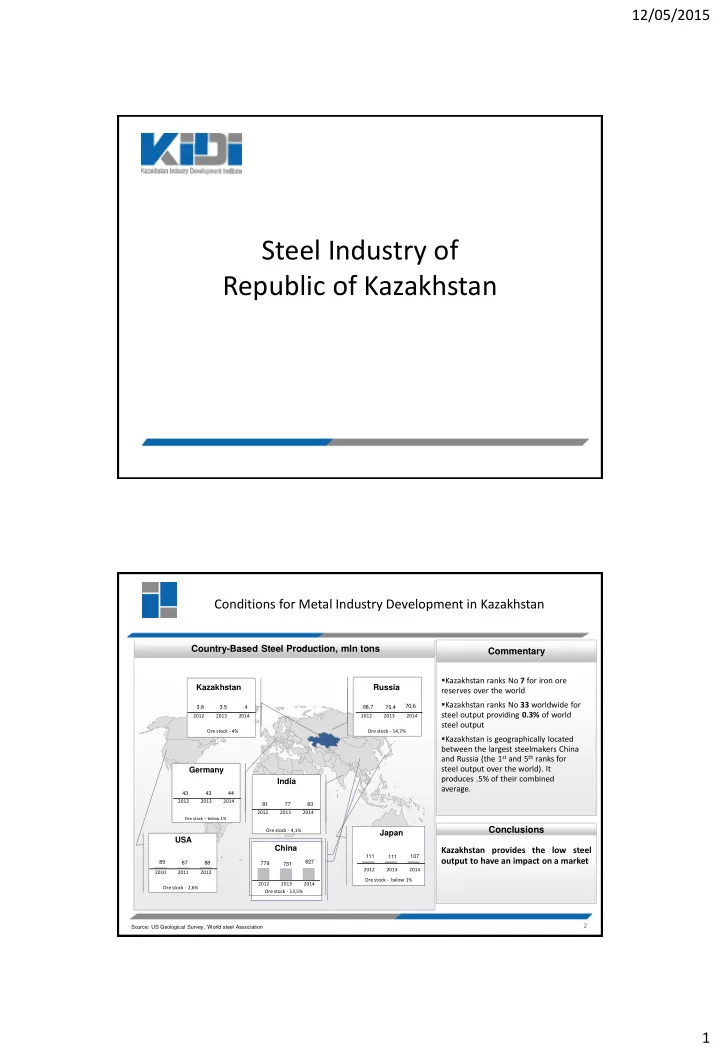

12/05/2015 Steel Industry of Republic of Kazakhstan Conditions for Metal Industry Development in Kazakhstan Country-Based Steel Production, mln tons Commentary Kazakhstan ranks No 7 for iron ore Kazakhstan Russia reserves over the world Kazakhstan ranks No 33 worldwide for 70,6 3.8 3.5 4 68,7 70,4 steel output providing 0.3% of world 2012 2013 2014 2012 2013 2014 steel output Ore stock - 4% Ore stock - 14,7% Kazakhstan is geographically located between the largest steelmakers China and Russia (the 1 st and 5 th ranks for steel output over the world). It Germany produces .5% of their combined India average. 43 43 44 2012 2013 2014 81 77 83 2012 2013 2014 Ore stock – below 1% Conclusions Ore stock - 4,1% Japan USA China Kazakhstan provides the low steel 111 107 111 output to have an impact on a market 89 87 88 779 827 731 2012 2013 2014 2010 2011 2012 Ore stock - below 1% 2012 2013 2014 Ore stock - 2,6% Ore stock - 13,5% 2 Source: US Geological Survey, World steel Association 1

12/05/2015 Output Indices of Raw Steel in Kazakhstan for 2005-2014 Designed Capacity and Output of Raw Steel, tons Capacity Output Consumption 8.0 7.0 6.0 7.0 6.8 6.4 6.4 6.3 5.0 6.2 5.9 5.7 4.0 4.8 4.8 4.4 4.3 4.4 4.2 4.1 4.2 [ЗНАЧЕНИЕ] 3.0 3.9 4.0 3.8 3.6 3.5 3.5 3.5 3.6 3.4 3.3 2.0 3 1.0 0.0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Commentary Conclusions Covering a ten-year period an average steel output of 3.95 mln tons provides an excess capacity of 2.35 There is 10% decrease in steel industry output, mln tons. 8% in consumption and 16% in capacity over Steel output to a greater extent depends on a the last 10 years. product demand at local and international markets However, the production in 2014 increased for as well as on investments in modernization of 8.3% inefficient and energy-consuming capacities. The industry is marked by absolete of assets, poor Underuse of production capacities: 67.9%, performance and high energy consumption. (worldwide average 80%) 3 Source: CS MNE RoK, Calculation: KIDI JSC Asset Base Arrangement; Industry Issues Map of Key Metal Ores and Non-Ferrous Metal Ores Production Areas. Key Issues Transportation Directions Key steel productions are concentrated in Central and North Kazakhstan. Key Low utilization of capacity export directions – Russia, China, Iran Heavy wear of capital assets Russia High energy-consumption and labor- intensive production (1.5-1.8 times higher) СКО Land-locked country Акмолинская Павлодарская Relatively poor infrastructure обл. обл. Костанайская обл. ЗКО Lack of long term funds Атырауская обл. Lack of qualified labor ВКО Карагандинская обл. Актюбинская обл. Mono cities Алматинская область Main Conclusion Кызылординская Мангистаус - кая Жамбыльская обл. обл . обл. While helping the industry to restructure Iran and modernize, considering the social China factors, the Government does support local enterprises providing relatively small advantages and preferences Existing Product Export Directions Existing Railway Traffic 4 Source: KIDI JSC 2

12/05/2015 State Ferrous Metallurgy Development Government Assistance Tools RoK State Program of Industrial and Innovative Development for 2015-2019 1 Goal: Support measures aimed to investments Sustainable development and providing conditions for diversification and competitive growth of ferrous metallurgy promotion (14 tools). 2 Targets: Support measures aimed to export 1. Competitive growth through diversification and modernization. promotion (21 tools). 2. Product differentiation, rolled steel and metal works’ quality improvements in mass market segment. 4 3. Creation of new competitive high value-added production facilities. Support measures aimed to handling an 4. Providing investment projects with required infrastructure. issue of no or lack of funding for 5. Reduction in import of steel products as a result of national competitive production development. production development. 6. Export incentives and participating in global value chains. 3 7. Providing industry with qualified labor including technicians. Support measures aimed to innovation Key Indices (2019/2012): incentives (19 tools). Gross Value Added +37% Labor Productivity +15% 5 Government assistance measures aimed Total Value of Export +3% to industry infrastructure development. Number of Employed +6,2 thous. people Key Projects: Government assistance measures aimed - Increase of steel production up to 6 mln tons per year. 7 to reduction of transport and logistics - Hot Briquetted Iron Output up to 1.8 mln tons. and energy costs. - Reaching the capacity for steel reinforcing up to 1.3 mln tons and for tubular products – 0.7 mln tons. 5 Source: RoK State Program of Industrial and Innovative Development for 2015-2019 3

Recommend

More recommend