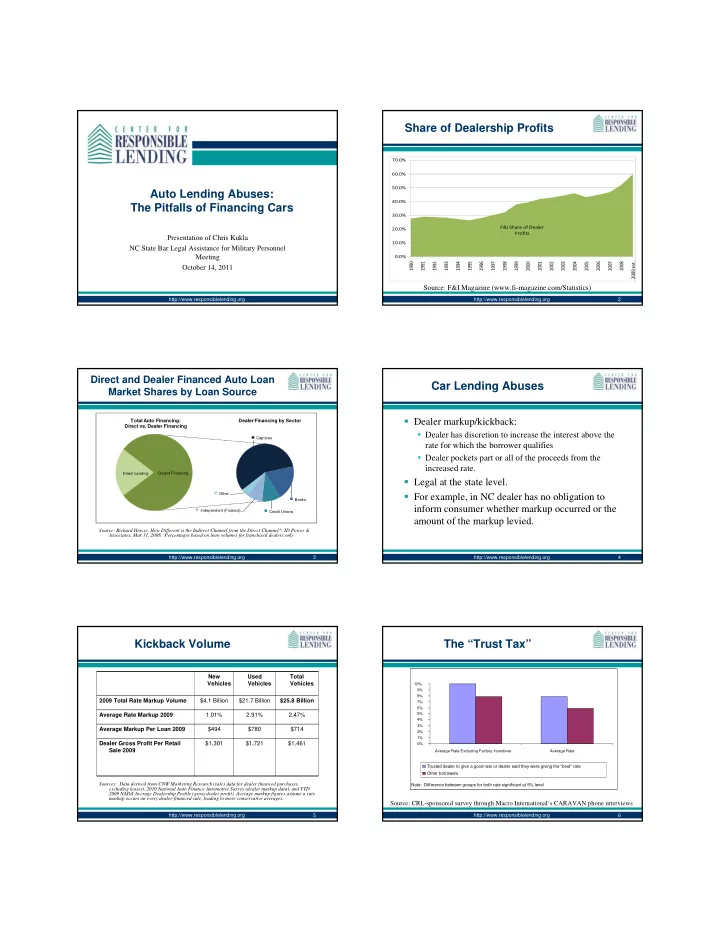

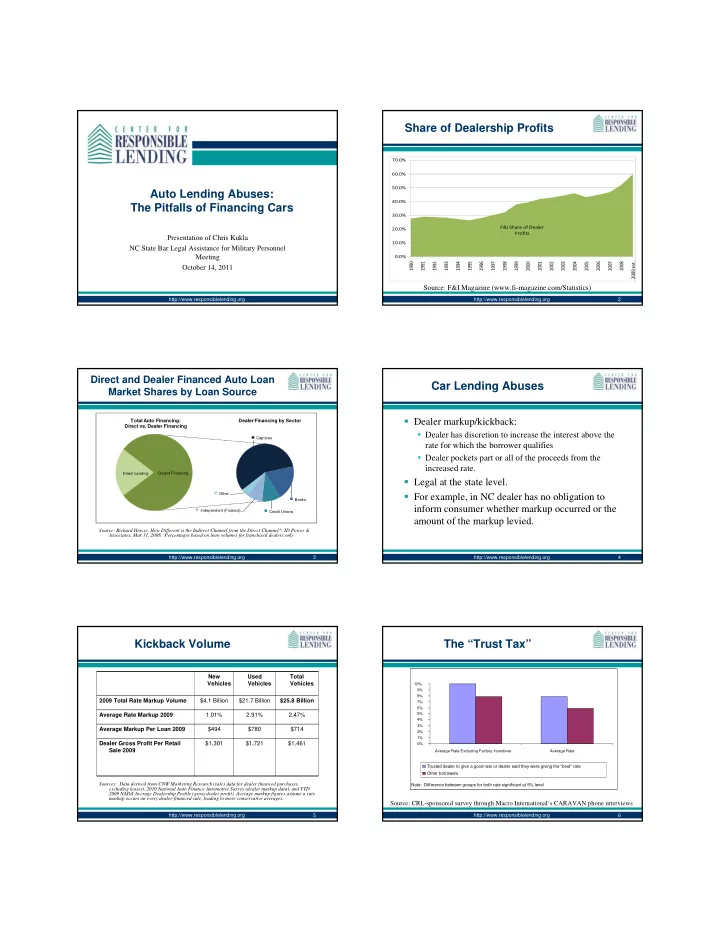

Share of Dealership Profits 70.0% 60.0% 50.0% Auto Lending Abuses: 40.0% The Pitfalls of Financing Cars 30.0% F&I Share of Dealer 20.0% Profits Presentation of Chris Kukla 10.0% NC State Bar Legal Assistance for Military Personnel Meeting 0.0% 2009 est. 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 October 14, 2011 Source: F&I Magazine (www.fi-magazine.com/Statistics) http://www.responsiblelending.org http://www.responsiblelending.org 2 Direct and Dealer Financed Auto Loan Car Lending Abuses Market Shares by Loan Source � Dealer markup/kickback: Total Auto Financing: Dealer Financing by Sector Direct vs. Dealer Financing � Dealer has discretion to increase the interest above the Captives rate for which the borrower qualifies � Dealer pockets part or all of the proceeds from the increased rate. Direct Lending Dealer Financing � Legal at the state level. � For example, in NC dealer has no obligation to Other Banks inform consumer whether markup occurred or the Independent (Finance) Credit Unions amount of the markup levied. Source: Richard Howse, How Different is the Indirect Channel from the Direct Channel?, JD Power & Associates, Mar 31, 2008. Percentages based on loan volumes for franchised dealers only http://www.responsiblelending.org 3 http://www.responsiblelending.org 4 Kickback Volume The “Trust Tax” New Used Total Vehicles Vehicles Vehicles 10% 9% 8% 2009 Total Rate Markup Volume $4.1 Billion $21.7 Billion $25.8 Billion 7% 6% Average Rate Markup 2009 1.01% 2.91% 2.47% 5% 4% 3% Average Markup Per Loan 2009 $494 $780 $714 2% 1% Dealer Gross Profit Per Retail $1,301 $1,721 $1,461 0% Sale 2009 Average Rate Excluding Factory Incentives Average Rate Trusted dealer to give a good rate or dealer said they were giving the "best" rate Other borrowers Sources: Data derived from CNW Marketing Research (sales data for dealer financed purchases, Note: Difference between groups for both rate significant at 5% level . excluding leases), 2010 National Auto Finance Automotive Survey (dealer markup data), and YTD 2009 NADA Average Dealership Profile (gross dealer profit). Average markup figures assume a rate markup occurs on every dealer-financed sale, leading to more conservative averages. Source: CRL-sponsored survey through Macro International’s CARAVAN phone interviews http://www.responsiblelending.org http://www.responsiblelending.org 5 6

Odds of Default Rise When Kickback Changes in Amount of Kickback Included in Subprime Loan 6.00% 33.0% 35.0% 5.04% 5.00% 30.0% Additional APR Due to Rate Markup 4.00% 25.0% 3.44% 3.07% 20.0% (in percentage points) 3.04% 2.84% 3.00% 12.4% 15.0% 2.23% 2.00% 10.0% 5.0% 1.00% 0.0% 0.00% Change in Odds of 60 ‐ Day Change in Odds of Smaller Amount Higher % of Used No Markup Cap Longer Loan Lower Borrower Loan Made by Financed Sales in Portfolio Present Terms FICO Score Subprime Delinquency Cumulative Loss ( ‐ $3,300) (+30%) (+4 months) ( ‐ 47 points) Finance Co. Figures are based on results from regression models using auto ABS securities data. The change in each category is assuming the increase of one standard deviation in the independent variable. Note that the markup increase of each Odds ratios based on coefficients from linear regression models using auto ABS securities data. Changes in odds are variable does not have a cumulative effect if multiple conditions exist on one loan. based on an increase of one standard deviation of rate markup for finance companies (4.55%). Regression model for non-finance companies produced results that were not significant. http://www.responsiblelending.org 7 http://www.responsiblelending.org 8 Direct vs. Dealer Financed Car Lending Abuses Repossession Rates (Repos per 1,000 Loans) 4.00 � Yo-yo Scams: 3.50 3.00 � Dealer sends consumer home with car before financing 2.50 is complete, 2.00 � Consumer is brought back to the dealer with the car, 1.50 1.00 � Consumer is told that interest rate will be much higher 0.50 than previously thought, 0.00 Jan 2009 Feb 2009 Mar 2009 Apr 2009 May 2009 Jun 2009 Jul 2009 Aug 2009 Sep 2009 Oct 2009 Nov 2009 Dec 2009 Jan 2010 Feb 2010 Mar 2010 Apr 2010 May 2010 Jun 2010 � When consumer tries to rescind deal, told that trade-in has been sold and/or down payment is non-refundable. Dealer Financed Loans Direct Loans � Consumer who does not return the car threatened with Source: American Banker Association Consumer Credit Delinquency Bulletin. Figures are repossession and/or criminal charges (theft). seasonally adjusted. http://www.responsiblelending.org 9 http://www.responsiblelending.org 10 Prevalence of Yo-Yo Scams Car Lending Abuses (on average rates 5 percentage points higher) � Loan Packing: 30% 25.0% 25% � Finance and insurance office of car dealers sell a 20% vast number of products: � Extended warranties, vehicle service contracts, GAP 15% 12.0% 11.1% protection, wheel and tire protection, security/anti-theft 10% devices, credit insurance, rustproofing, paint protection, 4.5% 5% roadside assistance…. � Products usually expressed as change to monthly 0% Total Population Credit Score Fair or Income < $40,000 Income $25,000 or less Poor payment, true cost hidden. Note: The difference in frequency between lower income and lower credit score groups and the rest of � Profit margins extraordinarily high. the population was statistically significant Source: CRL-sponsored CARAVAN phone survey http://www.responsiblelending.org http://www.responsiblelending.org 11 12

Industry Data on Add-on Who Gets Add-ons Penetration (sometimes sold as mandatory or without customer knowledge) NEW VEHICLES Cost Per Average F&I Add-On Market Vehicle Per Loan Term Cost Per Product Penetration Month (months) Vehicle GAP Protection 16% $5 62.0 $315 Vehicle Service Contracts 26% $13 62.0 $795 Theft Deterrent/Window Etching 15% $4 62.0 $225 Credit Life and Disability Insurance 3% $8 62.0 $496 USED VEHICLES Cost Per Average F&I Add-On Market Vehicle Per Loan Term Cost Per Month (months) Product Penetration Vehicle GAP Protection 23% $7 60.7 $438 Vehicle Service Contracts 30% $13 60.7 $795 Theft Deterrent/Window Etching 18% $4 60.7 $269 Credit Life and Disability Insurance 5% $8 60.7 $486 Source: F&I Magazine (www.fi-magazine.com/Statistics) Source: CRL-sponsored CARAVAN phone survey http://www.responsiblelending.org 13 http://www.responsiblelending.org 14 Most Consumers Unaware of Car Lending Abuses Mandatory Arbitration � Mandatory Arbitration No-shopped or negotiated to eliminate, 4.9% � Rolling negative equity into new loan. Yes, 10.6% � Failure to pay off lien on trade in. � Powerbooking – using monthly payment target to set price of car and/or number of add-ons. No-never in agreement, 16.7% � Claims that ancillary products are lender Don't Know, 67.8% requirement. Source: CRL-sponsored CARAVAN phone survey http://www.responsiblelending.org 15 http://www.responsiblelending.org 16 North Carolina Law North Carolina Law � Dealer markup of interest rate is legal. � Conditional Delivery Allowed � G.S. 20-101.2 requires that, in order to charge a fee or receive a � A dealer may enter into a contract with a purchaser commission for providing, procuring or arranging financing, a where delivery of the certificate of origin or certificate dealer must: of title is conditioned upon the purchase obtaining – Post a conspicuous notice in the sales or finance area that saus that the dealer may be receiving a fee or commission for providing, procuring financing for the vehicle. or arranging financing and for which the consumer may be � Dealer’s insurance must cover vehicle until such responsible for paying, and – Disclose on the purchase order, buyers order, or separate form financing is approved and certificate of origin or title is providing to the consumer prior to closing of the sale of the vehicle executed in purchaser’s name. that the dealer may be receiving said fee or commission. � And, the dealer is not required to disclose the contractual arrangement between the dealer and potential purchaser of the RISC, nor disclose the amount of the markup, profit or compensation the dealer may receive in the deal. http://www.responsiblelending.org http://www.responsiblelending.org 17 18

Recommend

More recommend