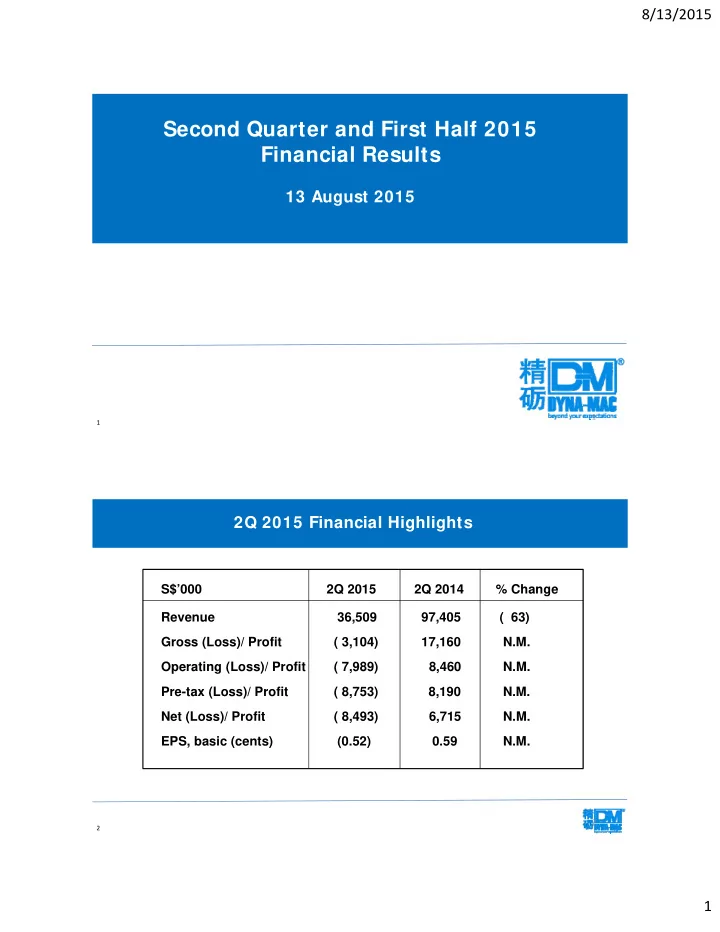

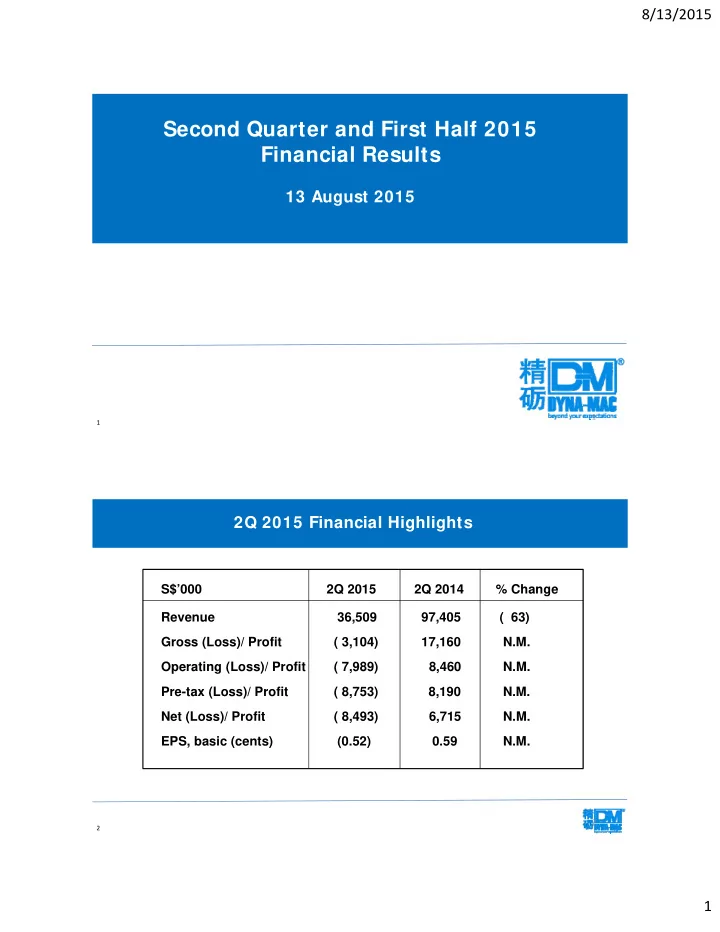

8/13/2015 Second Quarter and First Half 2015 Financial Results 13 August 2015 1 1 2Q 2015 Financial Highlights S$’000 2Q 2015 2Q 2014 % Change Revenue 36,509 97,405 ( 63) Gross (Loss)/ Profit ( 3,104) 17,160 N.M. Operating (Loss)/ Profit ( 7,989) 8,460 N.M. Pre-tax (Loss)/ Profit ( 8,753) 8,190 N.M. Net (Loss)/ Profit ( 8,493) 6,715 N.M. EPS, basic (cents) (0.52) 0.59 N.M. 2 2 1

8/13/2015 1H 2015 Financial Highlights S$’000 1H 2015 1H 2014 % Change Revenue 76,319 176,296 ( 57) Gross (Loss)/ Profit 11,479 34,481 ( 67) Operating (Loss)/ Profit ( 5,017) 18,061 N.M. Pre-tax (Loss)/ Profit ( 6,539) 17,588 N.M. Net (Loss)/ Profit ( 6,906) 14,665 N.M. EPS, basic (cents) (0.35) 1.29 N.M. 3 3 Quarterly Revenue : 2011 to 1H 2015 S$’m 318.6 1Q 2Q 3Q 4Q FY 2011 320 300 62.9 280 269.4 260 240 65.9 215.3 220 79.4 200 180 74.2 66.8 160 140 118.6 97.4 120 - 63% 59.8 100 76.6 $176.3 80 118.6 60 36.5 57.8 $76.3 40 78.9 60.1 20 39.8 - 57% 23.5 0 2011 2012 2013 2014 1H 2015 4 2

8/13/2015 Quarterly Net (Loss) Profit : 2011 to 1H 2015 S$’m 1Q 2Q 3Q 4Q FY 2011 32 30.7 28.4 30 28 26.2 26 10.5 3.8 24 8.8 22 18.1 20 7.8 18 5.9 16 10.2 14 12 6.7 7.5 10 18.1 $14.7m 8 6.1 6 4 8.0 6.7 2 3.3 1.6 0 -2 2011 2012 2013 2014 1H 2015 ($6.9m) -4 (8.5) -6 -8 -10 5 Cashflow : Cash & Bank Balances at $68.7 million Year % Description (S$’m) 1H 2015 1H 2014 change Cashflow from operations before 1,723 21,996 ( 92) working capital changes Net cash inflow/(outflow) from 16,392 (23,072) N.M. operating activities Net cash used in (3,621) ( 2,418) ( 50) investing activities Net cash provided by 13,915 16,156 ( 14) financing activities Cash & cash equivalents (a) 42,411 21,557 97 Bank Deposits with maturity (b) 26,312 25,704 2 more than 3 months Cash and bank balances (a) + (b) 68,723 47,261 45 6 3

8/13/2015 Capex : 1H 2015 Capex at $3.6 million Year Actual Actual Description (S$’m) 1H 2015 FY 2014 Buildings & Land Enhancement - 0.3 Site Equipment and Tools - 2.8 Others - 2.2 Sub-total - 5.3 Singapore Yard 3.0 0.9 Johor Yard 0.6 6.9 China Yard - 4.0 Grand Total 3.6 17.1 7 7 Quarterly Gross (Loss) & Net (Loss) Profit Margin : dependent on timing in project recognition Percentage 40 Gross (Loss) Profit Margin Net (Loss) Profit Margin 36.6 33.0 30.2 31.4 30 28.8 26.5 24.4 22.5 23.1 22.0 22.2 20.5 20 17.7 17.6 17.0 15.9 14.2 11.8 11.2 10.5 10.1 9.8 9.8 10 7.9 8.8 6.9 6.1 4.0 0 4Q 11 1Q 12 2Q 12 3Q 12 4Q 12 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 -10 (8.5) -20 (23.3) -30 8 4

8/13/2015 Breakdown of Business Segment : offshore modules largest contributor Others Others 2% 3% 1,623 8,925 FY 2014 1H 2015 74,696 309,641 Offshore Modules Offshore Modules 97% 98% Segment 1H 2015 1H 2014 FY 2014 (S$’000) (S$’000) (S$’000) Offshore Modules 74,696 175,129 309,641 Others 1,623 1,167 8,925 Total 76,319 176,296 318,566 Deliveries & Completions as at 1H 2015 : 2 units delivered in 2Q 15 CDS Main Compression B Module Type No. of Units (1Q15) No. as at 2Q15 FPSO Topsides Modules FPSO Cidade De Saquarema 4 - FPSO Ten Tullow 2 1 Total No. of FPSO Modules 6 1 Non-FPSO Modules Malampaya – Bridge Module 1 - Malampaya Bridge Module Structural Block - 1 Total No 1 1 Grand Total 7 2 Ten Tullow TS Power Generation Ten Tullow Mod BS Power Generation CDS Main Compression B Module CDS Main Compression A Module 10 5

8/13/2015 Contracts Secured as at 1H 2015 Type & Delivery Contract Value Deployment Location Client - 10 units FPSO topside S$ 89 million Premier Oil’s Catcher oil BW Offshore modules fields, UK Sector of North - Delivery 1Q 2016 Sea - 6 units FPSO topside S$ 60 million Eni’s Block 15/06 East Hub Armada Cabaca, modules located in deep water an affiliate of - Delivery 1Q 2016 offshore Angola Bumi Armada Berhad Total as at 1H 2015 S$149 million 11 Contracts secured 2011 to 1H 2015 S$’m 340 316 320 300 280 260 240 220 200 178 180 149 160 132 140 120 92 100 80 60 40 20 0 2011 2012 2013 2014 1H 2015 6

8/13/2015 Net Order Book : We expect to grow order book amid challenging market environment S$’m 360 353.7 349.4 346 342 340 324 312.5 320 300 280 266 260 246 240 223 220 215 201 203 200 180 160 140 134 120 113 100 80 60 40 20 0 2 2 2 2 3 3 3 3 4 4 4 4 5 5 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 2 2 2 2 2 2 2 2 2 2 2 2 2 Q Q Q Q Q Q Q Q Q Q Q Q Q Q 1 2 3 4 1 2 3 4 1 2 3 4 1 2 13 Market Outlook : Long-term fundamentals remain sound despite current low oil price environment US$ per barrel 160 $134/bbl 140 $125/bbl 120 $117/bbl $111/bbl $109/bbl $102/bbl 100 $95/bbl $83/bbl 80 $72/bbl $64/bbl $61bbl 60 $56/bbl $47bbl $49/bbl 40 $40/bbl 20 0 J-04 J N A S F J D M O M A J-09 J N A S F J D M O M A J14 J N A 14 7

8/13/2015 Current Market Status : FPS Order Backlog (FPSOs, Semis, Spars, TLPs, FLNGs and FSRUs) 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 70 63 64 63 60 50 Order Backlog (excluding MOPU & FSOs) 40 30 20 10 0 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q1 Q4 Q3 Q1 Q4 Q3 Q1 Q4 Q3 Q2 Q4 Q3 Q1 Q3 Q1 Q3 15 Source : EMA Offshore Production Market : 251 Projects in Appraisal, Planning, Bidding & Final Design Stage , an increase of 13 units 238 Projects in Appraisal, Planning, 251 Projects in Appraisal, Planning, Bidding Bidding & Final Design as at 1Q 2015 & Final Design as at 2Q 2015 56 Projects in the 56 Projects in the 57 Projects in the Appraisal Stage 61 Projects in the Bidding/Final Bidding/Final Appraisal Stage Design Stage Design Stage 56 61 56 57 134 125 134 Projects in 125 Projects in the Planning Stage the Planning Stage Bidding/Final Design Planning Appraisal Bidding/Final Design Planning Appraisal 16 16 Source : EMA 8

8/13/2015 Offshore Production Market : 251 Projects I dentified & in different stages of the planning cycle I ncreasing no. of gas projects : 74 FSRU & FLNG developments 49 50 44 45 <1000m water depth Deepwater 1000 - 1500m Ultra-Deepwater >1500m 39 40 8 19 No. of FPS Projects 35 4 30 27 26 25 12 35 20 14 15 32 15 26 13 12 9 10 5 18 7 7 14 11 9 5 9 1 6 6 7 2 1 3 3 2 2 1 1 1 1 1 0 Gulf of Africa SEA Brazil Australia/NZ N.Europe SWAME Medit Canada Sw ame TBD Carib China Mexico 17 17 Source : EMA Summary Net Order book at S$312.5 million as at 2015 to-date with completions & deliveries extending into 2016 New orders secured to-date stood at S$149 million Market environment remains challenging Focus in executing and delivering projects secured to-date Continue to see demand in niche segment of the production market 18 18 9

8/13/2015 This release may contain certain forward-looking statements which are subject to risks and uncertainties that could cause actual results to differ materially from such statements. Such risks and uncertainties include industry and economic conditions, competition, and legal, governmental and regulatory changes. The forward-looking statements reflect the current views of Management on future trends and developments. 19 19 10

Recommend

More recommend