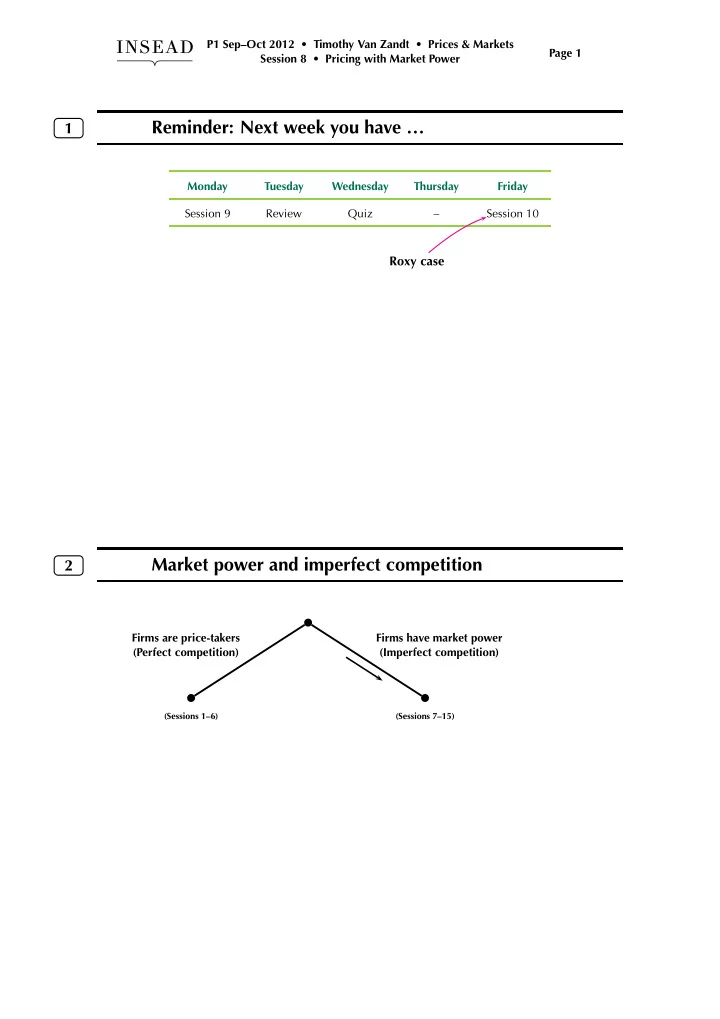

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 1 Session 8 • Pricing with Market Power Reminder: Next week you have … 1 Monday Tuesday Wednesday Thursday Friday Session 9 Review Quiz – Session 10 Roxy case Market power and imperfect competition 2 Firms are price-takers Firms have market power (Perfect competition) (Imperfect competition) (Sessions 1–6) (Sessions 7–15)

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 2 Session 8 • Pricing with Market Power Pricing with market power 3 Firms are price-takers Firms have market power (Perfect competition) (Imperfect competition) (Sessions 1–6) Individual Equilibrium decisions (Sessions 7–11) (Sessions 12–15) From the individual firm’s viewpoint 4 P i “Demand curve” for i ’s output 5 Price taker: 4 No trade-off P 3 2 1 Q i 1 2 3 4 5 6 7 P i Demand curve for i ’s output Market power: 5 volume–price 4 trade-off 3 2 1 Q i 1 2 3 4 5 6 7

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 3 Session 8 • Pricing with Market Power Where are the other firms? 5 P i “Demand curve” for i ’s output Price taker: 5 perfect 4 competition P 3 2 1 Q i 1 2 3 4 5 6 7 P i Demand curve for i ’s output Market power: 5 imperfect 4 competition 3 2 1 Q i 1 2 3 4 5 6 7 Quantity choice? It’s about MR vs MC 6 P 5 Price taker: 4 3 Demand 2 1 Q 1 2 3 4 5 6 7 P 5 Market power: 4 3 2 1 Demand Q 1 2 3 4 5 6 7

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 4 Session 8 • Pricing with Market Power Marginal revenue versus price 7 (Data are from Exercise 7.3) What is your marginal revenue for unit 8? € 57 (1000s) 54 Demand 51 48 45 42 39 36 33 30 27 24 21 18 15 12 9 6 3 1 2 3 4 5 6 7 8 9 10 11 12 13 Q Marginal revenue for linear demand 8 Demand: Q = 16 − (2 / 3) P d ( P ) Inverse demand: p ( Q ) Revenue: r ( Q ) = p ( Q ) × Q Marginal revenue: MR = r ′ ( Q )

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 5 Session 8 • Pricing with Market Power Graph of the demand and MR curves for linear demand 9 € d ( Q ) = 16 − (2 / 3) P 24 p ( Q ) = 24 − (3 / 2) Q 22 20 mr ( Q ) = 24 − 3 Q p ( Q ) 18 16 14 12 10 8 6 4 2 2 4 6 8 10 12 14 16 − 2 Q − 4 − 6 Linear demand and constant MC 10 € 24 22 20 p ( Q ) 18 16 14 12 10 8 mc ( Q ) 6 4 2 2 4 6 8 10 12 14 16 − 2 Q − 4 mr ( Q ) − 6

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 6 Session 8 • Pricing with Market Power The markup over MC 11 $ 25 20 15 MC 10 d ( P ) 5 20 40 60 80 100 120 140 160 Q MR Markup is the gap between P and MR 12 € 57 (1000s) 54 Demand 51 48 45 42 39 36 33 30 27 24 21 18 15 12 9 6 3 1 2 3 4 5 6 7 8 9 10 11 12 13 Q

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 7 Session 8 • Pricing with Market Power Session 8: Pricing with Market Power 13 1. The quantity choice. ✓ ➥ 2. Entry and exit. 3. Business-plan example (P&M meets FMV & UDJ & Man. Acc.) Exit/Entry: Effect of a LR fixed cost 14 FC affects shut-down option, not whether you produce 10 or 12 units (or whether you charge 20 or 24). Recipe: 1 Calculate profit-maximizing price/quantity ignoring the fixed cost. 2 Calculate profit ignoring the fixed cost (“variable profit”). 3 Check whether it is higher than the fixed cost. If so, go ahead and produce; otherwise shut down or don’t start up. Patent protection Cash flow Patent expires, Product competition with generics launch 0 Time Entry of similar R&D Testing patented molecules & approval

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 8 Session 8 • Pricing with Market Power Graphically 15 € Consumer surplus ¯ P 30 25 P e Deadweight loss 20 Variable profit Marginal cost 15 mc ( Q ) MC 10 Inverse demand Variable cost 5 p ( Q ) 1 2 3 4 5 6 7 8 Q π Q (millions) Socially efficient benchmark 16 € ¯ P 30 Marginal valuation mv ( Q ) (i.e., inverse demand p ( Q ) ) 25 20 Gains from trade (variable surplus) Marginal cost 15 mc ( Q ) MC 10 Variable cost 5 1 2 3 4 5 6 7 8 Q e Q (millions)

P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets Page 9 Session 8 • Pricing with Market Power Session 8: Pricing with Market Power 17 1. The quantity choice. ✓ ✓ 2. Entry and exit. ➥ 3. Business-plan example (P&M meets FMV & UDJ & Man. Acc.) Monday: How pricing depends on demand 18 Finally see elasticity in action! …and we get some nice qualitative (low data) conclusions: 1. Volume effect: higher volume ⇒ higher price. 2. Price-sensitivity effect: less elastic ⇒ higher price. FPM reading. Chapter 9. Article. “Airlines Hold Back”. Deliverables. Exercise 9.3. (The demand exercise that I sent by email—also on course website under “Extras”— is good preparation.)

Recommend

More recommend