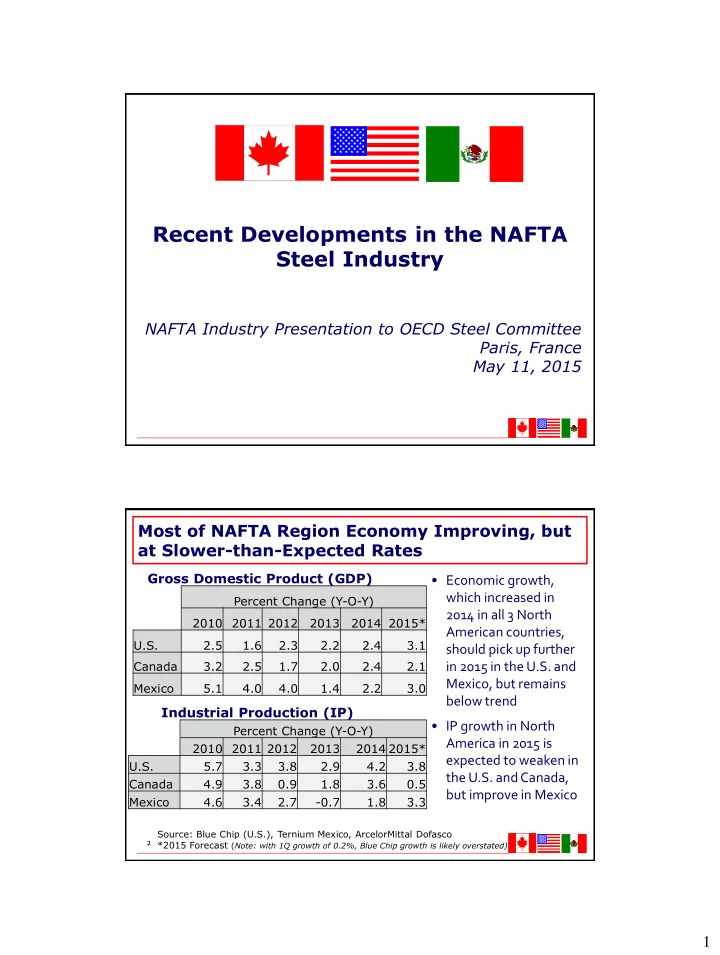

Recent Developments in the NAFTA Steel Industry NAFTA Industry Presentation to OECD Steel Committee Paris, France May 11, 2015 Most of NAFTA Region Economy Improving, but at Slower-than-Expected Rates Gross Domestic Product (GDP) • Economic growth, which increased in Percent Change (Y-O-Y) 2014 in all 3 North 2010 2011 2012 2013 2014 2015* American countries, U.S. 2.5 1.6 2.3 2.2 2.4 3.1 should pick up further Canada 3.2 2.5 1.7 2.0 2.4 2.1 in 2015 in the U.S. and Mexico, but remains Mexico 5.1 4.0 4.0 1.4 2.2 3.0 below trend Industrial Production (IP) • IP growth in North Percent Change (Y-O-Y) America in 2015 is 2010 2011 2012 2013 2014 2015* expected to weaken in U.S. 5.7 3.3 3.8 2.9 4.2 3.8 the U.S. and Canada, Canada 4.9 3.8 0.9 1.8 3.6 0.5 but improve in Mexico Mexico 4.6 3.4 2.7 -0.7 1.8 3.3 Source: Blue Chip (U.S.), Ternium Mexico, ArcelorMittal Dofasco 2 *2015 Forecast ( Note: with 1Q growth of 0.2%, Blue Chip growth is likely overstated) 1

Recent and Significant Changes in Currencies and Oil Prices Will Impact Global/Regional Trade and Consumption Patterns North American Rig Count and Price of Oil 2,500 $160 Total U.S. Oil and Gas Rig $140 2,000 $120 $ Barrel of Oil $100 1,500 Count $80 1,000 $60 $40 500 $20 0 $0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 Rig Count $ Barrel of Oil Source: Baker Hughes, West Texas Intermediate (WTI) 3 NAFTA Production in 2014 Grew Only 2%, While Utilization Rates Tracked Below Global Rate NAFTA Crude Steel Production (2011-14) 12,000 Metric Tons (Thousands) 10,000 8,000 6,000 4,000 2,000 - JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR APR MAY JUN JUL AUG Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2011 2012 2013 2014 Mexico Canada U.S. NAFTA vs. World Utilization Rates in 2014 79% 77% 75% 73% 71% 69% 67% 65% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec NAFTA World 4 Source: American Iron and Steel Institute 2

NAFTA Apparent Steel Demand Significantly Outpacing Crude Steel Production • The 2.2% NAFTA Crude Steel Production NAFTA increase Thousands MT in production in 2014 (vs. a 2013 2014 % Change slower-than- Canada 12,471 12,952 +3.9% expected 2013), U.S. 86,877 88,174 +1.5% should be put Mexico 18,208 18,995 +4.3% into perspective NAFTA 117,556 120,121 +2.2% • Apparent steel NAFTA Apparent Steel Demand demand in 2014 Thousands MT was up more than 11% over 2013 2014 % Change 2013, mostly Canada 14,095 15,223 +8.0% due to surging U.S. 95,686 106,921 +11.7% imports, which Mexico 20,131 22,487 +11.7% led to higher NAFTA 129,912 144,631 +11.3% inventories Source: AISI, Statistics Canada/CSPA, Canacero 5 NAFTA Apparent Demand is Increasing, but Raw Steel Production Remains Flat NAFTA Apparent Demand NAFTA Raw Steel Production 40,000 40,000 38,000 38,000 36,000 36,000 Million Metric Tons (MT) 34,000 34,000 32,000 32,000 30,000 30,000 28,000 28,000 26,000 26,000 24,000 24,000 22,000 22,000 20,000 20,000 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 2013 2014 2013 2014 6 Source: U.S. Census Bureau (Commerce), Statistics Canada, AISI, Canacero 3

Finished Imports are Capturing Growth in Apparent Demand in NAFTA Region NAFTA Finished Imports • Offshore imports of 10,000,000 35% finished steel into 9,000,000 North America 30% increased 45% in 8,000,000 2014 vs. 2013 25% 7,000,000 Finished Imports (MT) • Finished import Market Share (%) 6,000,000 20% market shares in 5,000,000 NAFTA are at record 15% levels, as imports 4,000,000 took 21 percent of 3,000,000 10% the North American steel market in 2,000,000 5% 2014, up from 16 1,000,000 percent in 2013 - 0% 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 2013 2014 Finished Imports Market Share 7 Source: U.S. Census Bureau (Commerce), Statistics Canada, AISI, Canacero NAFTA Direct Steel Trade Deficit Surged in 2014; Finished Steel Deficit at 28 MMT vs. 18 MMT in 2013 NAFTA Trade Balance 2008 2009 2010 2011 2012 2013 2014 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 0.5 0.0 -0.5 -1.0 -1.5 -2.0 -2.5 -3.0 Metric Tons (million) -3.5 -4.0 -4.5 -5.0 -5.5 -6.0 -6.5 -7.0 -7.5 -8.0 -8.5 NAFTA Semi-finished Trade Deficit -9.0 NAFTA Finished Steel Trade Deficit -9.5 -10.0 -10.5 8 Source: AISI, Statistics Canada, Canacero 4

NAFTA Indirect Steel Trade Deficit in Manufactured Goods Over 21 Million MT in 2014 (total deficit = 49 MMT) Source: AISI, Global Trade Atlas 9 Implications of NAFTA Steel Market Conditions • While apparent demand increased 11% in 2014, crude steel production grew only 2%. The slowdown in global steel demand growth elsewhere, combined with growing global overcapacity, has led to a steel import surge crisis in NAFTA markets • These developments have damaged and disrupted North American steel markets, and NAFTA steel producers have not been able to participate in the NAFTA steel demand growth story • Facing an historic surge in import market share and uncertainties regarding energy and other key markets, NAFTA steel producers saw both capacity utilization and employment fall in 2014 • In 2015, as record steel import levels continue, the NAFTA steel industry crisis is deepening, and injury due to growing imports is reflected in a deteriorating NAFTA market; today, there are plant closures and layoffs throughout NAFTA steel producing countries • Efforts to remedy and address chronic unfair trade are paramount to economic recovery in the NAFTA region to ensure “market - based” and WTO-compliant results are attained 10 5

Recommend

More recommend