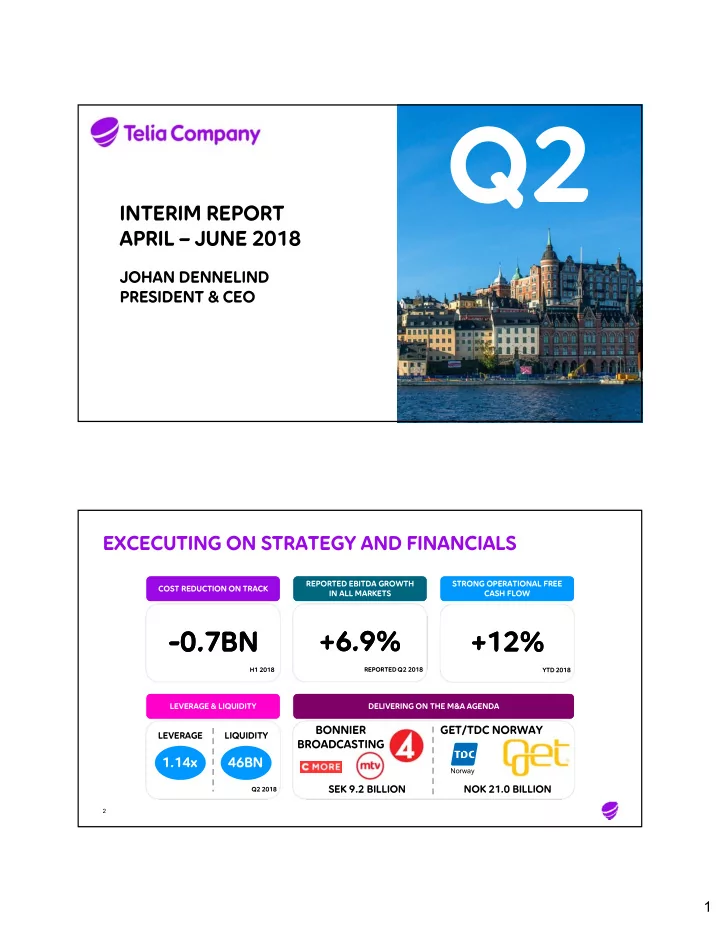

Q2 INTERIM REPORT APRIL – JUNE 2018 JOHAN DENNELIND PRESIDENT & CEO EXCECUTING ON STRATEGY AND FINANCIALS REPORTED EBITDA GROWTH REPORTED EBITDA GROWTH STRONG OPERATIONAL FREE STRONG OPERATIONAL FREE COST REDUCTION ON TRACK COST REDUCTION ON TRACK IN ALL MARKETS IN ALL MARKETS CASH FLOW CASH FLOW -0.7BN -0.7BN +6.9% +6.9% +12% +12% H1 2018 REPORTED Q2 2018 YTD 2018 LEVERAGE & LIQUIDITY LEVERAGE & LIQUIDITY DELIVERING ON THE M&A AGENDA DELIVERING ON THE M&A AGENDA BONNIER GET/TDC NORWAY LEVERAGE LIQUIDITY BROADCASTING 1.14x 46BN Norway SEK 9.2 BILLION NOK 21.0 BILLION Q2 2018 2 1

A STRONGER TELIA COMPANY WITH KEY AMBITIONS INTACT RUN-RATE GET/ BONNIER COMBINED SYNERGIES TDC NORWAY** BROADCASTING PRO FORMA 2017 (SEK BILLION) (PER YEAR) 1.8 0.5 3.5 EBITDA EBITDA 1.2 (margin) (margin) 43.4% 6.8% >28.5% EBITDA-CAPEX* EBITDA-CAPEX* 1.0 0.4 2.7 1.3 53.1% 82.4% 76.5% (cash conversion) (cash conversion) Net debt/EBITDA Net debt/EBITDA 0.7x 0.2x -0.1x 0.8x (x) (x) OUR BALANCE SHEET TARGETS AND ANNOUNCED SHAREHOLDER RETURNS REMAIN INTACT OUR BALANCE SHEET TARGETS AND ANNOUNCED SHAREHOLDER RETURNS REMAIN INTACT • GROW DIVIDEND OVER TIME • LEVERAGE TARGET OF 2x PLUS/MINUS 0.5x • SEK 15 BILLION IN SHARE BUY-BACK • SOLID CREDIT RATING A-/BBB+ * Excluding licenses 3 ** SEK/NOK rate of 1.04 SWEET-SPOT ACQUISITION OF GET AND TDC NORWAY TRANSACTION RATIONALE TRANSACTION OVERVIEW COMPANY OVERVIEW NOK billion 2017 STRATEGIC SWEET-SPOT STRATEGIC SWEET-SPOT • High stickiness with low- Revenues 4.0 Homes passed* 800k single digit churn Revenue CAGR 2015-2017 3.2% Homes connected 518k • High speed broadband, BEST IN CLASS STAND BEST IN CLASS STAND EBITDA 1.7 RGUs 950k advanced TV ALONE OPERATION ALONE OPERATION EBITDA margin entertainment and smart 43.4% home services EBITDA CAGR 2015-2017 7.6% FINANCIALLY ACCRETIVE FINANCIALLY ACCRETIVE B2B customers • Multiservice network 2k EBITDA-CAPEX 0.9 with a range of as-a- RGUs 77k Cash conversion 53.1% service products * Including 24 Partners • • Purchase price of NOK 21 billion Convergence in both B2C and B2B (EV/EBITDA 9.0x including synergies) • Extensive reach from connecting ~1.8 • million Norwegians every day Cash flow accretive day one • • EBITDA synergies of NOK 0.6 billion Strong operational track record 50/50 split between revenues and OPEX • Highly synergetic and cash flow accretive • Proven track record and value creation transaction from M&A in Norway 4 2

GROWTH IN GET TO CONTINUE REVENUE DEVELOPMENT GET BROADBAND GET TV Growth y-o-y, adjusted** Subs. in 000’, ARPU in local currency Subs. in 000’, ARPU in local currency Subscriptions ARPU Get TDC Norway Subscriptions ARPU 375 410 3% 257 318 2016 2017 H1 2018 -10% Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q2 18* Q1 Q2 Q3 17 Q4 17 Q1 18 Q2 18* 17** 17** • Continuous growth in Get driven by • Broadband subscriptions steadily growing • Subscription base stabilizing - flat broadband and TV sequential development Q2 • 3,000 net adds Q2 and 4 percent base • Decline in TDC Norway mainly • expansion Q2 y-o-y Rather stable ARPU development attributable to loss of low ARPU mobile • Price management and upsell supported and fixed voice subscriptions ARPU 2018 AMBITION OF LOW SINGLE DIGIT REVENUE GROWTH GOING FORWARD AMBITION OF LOW SINGLE DIGIT REVENUE GROWTH GOING FORWARD * Preliminary numbers per May 2018 5 ** Adjusted for one-offs Q1-Q2 2017 CONTINUED STRONG EBITDA DEVELOPMENT SERVICE REVENUE DEVELOPMENT EBITDA DEVELOPMENT Organic growth, external service revenues Organic growth, reported Q2’18, excluding adjustment items 6.9% 3.9% -2.3% -2.3% Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 Q2 18 reported • Drop Q2 to approx. half driven by less low-margin • Organic EBITDA growth in 6 of 7 markets - transit service revenues reported growth in all markets • B2C rather flat while still pressure in B2B • Support from lower costs • Mobile still growing in majority of markets • Still FX and M&A tailwind 6 3

DELIVERING ON THE COST PROGRAM COST SAVINGS REALIZATION – H1 2018 COST SAVINGS BREAKDOWN – H1 2018 SEK in billions OTHER EST 1.1 LIT SWE 0.7 DEN NOR H1 2018 Full year target • Executing according to plan • Sweden down SEK 0.4 billion from mainly lower resource costs – saving pace expected to come • Continues to work on getting cost awareness as down H2 part of the organizational culture • ICT growth offsets savings in Finland COST SAVINGS ON TRACK HALF WAY THROUGH COST SAVINGS ON TRACK HALF WAY THROUGH 7 GROWING MOBILE ARPU IN ALL MARKETS MOBILE SERVICE REVENUE GROWTH MOBILE ARPU GROWTH Q2 Organic growth In local currency, y-o-y SWEDEN SWEDEN NORWAY NORWAY +3.9% +3.9% +0.5% +0.5% 3% 2% FINLAND FINLAND THE BALTICS THE BALTICS +0.6% +0.6% +2.7% +2.7% +3.6% +3.6% 1% 0% Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 • Mobile revenue growth in 5 of 7 markets • Mobile ARPU growth in all markets • Mixed Nordic picture • Sweden strong despite B2B price pressure • Solid performance in the Baltics 8 4

DIGITALIZATION TO DRIVE SUSTAINABILITY EXAMPLES OF HOW WE CONTRIBUTE Construction site digitalization to enable best use of resources, efficiency and better safety Partnership in smart temperature control to get more energy efficient buildings in Stockholm Connected wearable devices to increase safety and quality of elderly care in Denmark Empowering and interacting with children/youth via YOUNITE and protecting children via CSAM Reduced energy consumption as an integral part of our sustainability agenda 9 OUTLOOK FOR 2018 IS UNCHANGED Above SEK 9.7 billion OPERATIONAL FCF* Operational FCF together with dividends from associated companies should cover a dividend around the 2017 level EBITDA** In line or slightly above the 2017 level of SEK 25.2 billion * Free cash flow from continuing operations, excluding licenses and dividends from associated companies ** Based on current structure, i.e. including M&A made so far, excluding adjustment items, in local currencies 10 5

Q2 INTERIM REPORT APRIL – JUNE 2018 CHRISTIAN LUIGA EXECUTIVE VICE PRESIDENT & CFO REVENUE PRESSURE ONLY PARTIALLY IMPACTING EBITDA NET SALES DEVELOPMENT SERVICE REVENUE GROWTH – BY MARKET Organic growth Organic growth Q2, external service revenues +1.3% Total underlying* 0% -2.3% Service revenues -5% -2.3% -2.3% -10% SE FI NO DK Baltics Carrier Total Equipment Mobile Fixed Other Q2 17 Q2 18 • Decline in low-margin transit revenues represented • Significant step-up in equipment sales approx. half of the decline - part of strategy and • Mobile revenue growth not enough to results in no material EBITDA impact compensate for legacy and low-margin fixed transit revenues * Excluding impact from low margin revenues in Lithuania and 12 Telia Carrier 6

SOLID ORGANIC EBITDA PERFORMANCE EBITDA DEVELOPMENT – REPORTED EBITDA DEVELOPMENT – ORGANIC Reported growth, excluding adjustment items Organic growth, y-o-y, excluding adjustment items +3.9% +6.9% SWE FIN NOR DEN LIT EST LAT Other Organic M&A FX Q2 Q2 Q2 17 Q2 18 17 18 • EBITDA growth of 6.9 percent driven by • EBITDA growth in 6 of 7 markets • Significant reduction in Swedish resource costs • Solid organic growth • FX tailwind mainly from stronger EUR & NOK • Synergies from Phonero in Norway • Solid cost control on group level 13 POSITIVE EBITDA IN SWEDEN DUE TO LOWER COSTS EBITDA SERVICE REVENUES MOBILE POSTPAID – B2C Organic growth, excl. adj. items Organic growth, external revenues In local currency Mobile B2C postpaid ARPU B2C incl. fiber installation revenues Mobile B2C revenue growth B2C excl. fiber installation revenues 0.9% 260 +1.3% +1.3% +0.4% +0.4% +5% +5% B2B -3.3% -3.3% B2C Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 • Solid growth in ARPU key driver • Stable and growing B2C for • Cost savings more than behind strong revenue growth second consecutive quarter compensated for revenue pressure from legacy services • Less tailwind expected from • Somewhat intensified price VAS and invoicing fees in H2 pressure in B2B 14 7

Recommend

More recommend