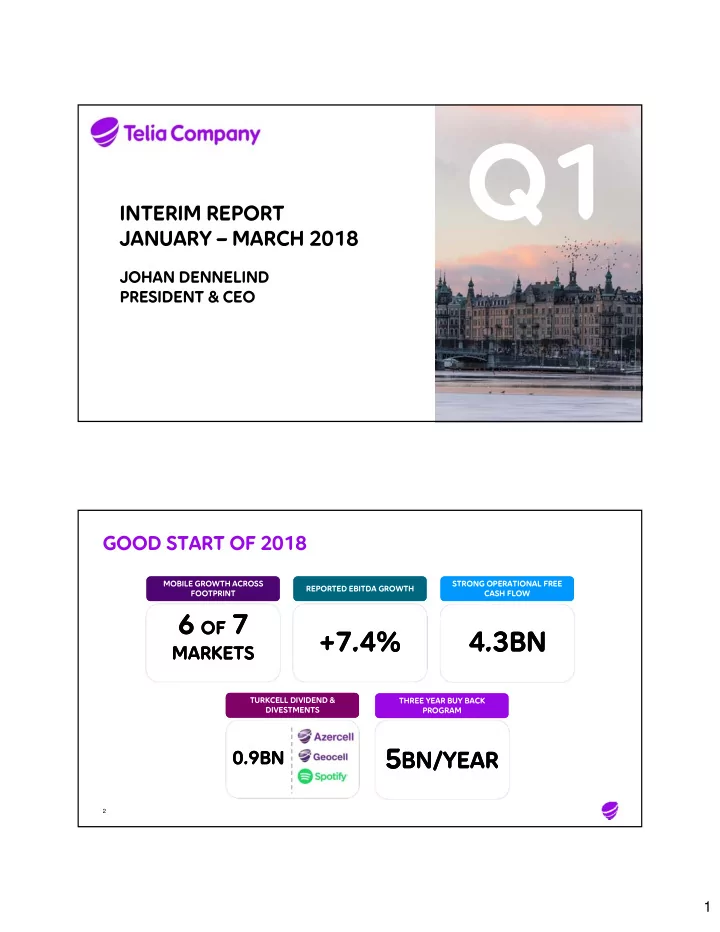

Q1 INTERIM REPORT JANUARY – MARCH 2018 JOHAN DENNELIND PRESIDENT & CEO GOOD START OF 2018 MOBILE GROWTH ACROSS MOBILE GROWTH ACROSS STRONG OPERATIONAL FREE STRONG OPERATIONAL FREE REPORTED EBITDA GROWTH REPORTED EBITDA GROWTH FOOTPRINT FOOTPRINT CASH FLOW CASH FLOW 6 OF 7 6 OF 7 +7.4% +7.4% 4.3BN 4.3BN MARKETS MARKETS TURKCELL DIVIDEND & TURKCELL DIVIDEND & THREE YEAR BUY BACK THREE YEAR BUY BACK DIVESTMENTS DIVESTMENTS PROGRAM PROGRAM 5 BN/YEAR 5 BN/YEAR 0.9BN 0.9BN 2 1

LAUNCH OF A THREE YEAR BUYBACK PROGRAM SEK 15BN 9% SEK 3.45 0.5x AMBITION OF OUTSTANDING PER SHARE IMPACT ON SHARES LEVERAGE 3 STABLE REVENUES WITH GROWING EBITDA IMPROVED SERVICE REVENUE TREND STRONG EBITDA DEVELOPMENT Organic growth, external service revenues Organic growth, reported Q1’18, excluding adjustment items 7.4% Service revenues Service revenues excl. fiber installation revenues 4.2% -0.5% -0.5% -0.9% -0.9% Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q1 18 reported • Mobile revenue growth in 6 of 7 markets • EBITDA growth in 6 of 7 markets • Legacy and fiber headwind in Sweden • Support from lower costs 4 2

MOBILE REVENUES CONTINUED TO GROW MOBILE SERVICE REVENUE GROWTH MOBILE ARPU GROWTH Q1 Organic growth In local currency, y-o-y SWEDEN SWEDEN NORWAY NORWAY +4% +4% FLAT FLAT 4% 3% +1.5% +1.5% 2% FINLAND FINLAND THE BALTICS THE BALTICS +5% +5% +4% +4% 1% 0% Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 • Mobile revenue growth in 6 of 7 markets • Growth in ARPU key part of strategy - not SIM cards • Norway impacted by lower special number revenues 5 ARPU GROWTH IN FOCUS ON SWEDISH MOBILE MOBILE SUBSCRIPTION GROWTH – B2C POST-PAID ARPU GROWTH – B2C Postpaid mobile base, excl. mobile broadband, in 000’ In local currency 2,250 +5% +5% 2,000 1,750 1,500 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Mobile B2C postpaid ARPU Mobile B2C revenue growth • Stable growth of postpaid subscriptions • ARPU increasingly driven by subscription and usage • Focus on value and revenue market share • VAS more “normal” growth vs. Q3/Q4 2017 6 3

CONVERGENCE IN OUR VALUE PROPOSITIONS LIIGA PACKAGING TAKING SHAPE STRONG B2B PIPELINE AHEAD TEAM PASS LIIGA PASS GAME PASS TO BE LAUNCHED EUR 19.90/MONTH EUR 24.90/MONTH • Pre-sales exceeds expectations • B2B convergence via a broader portfolio • Both existing and new customers • Increased B2B interest from stronger proposition • Much more to come • Data center to open in June 7 LEVERAGING ON STRONG B2B POSITION IN NORWAY MOBILE B2C – CORE ARPU GROWTH PHONERO READY FOR NEXT PHASE In local currency, B2C Consolidated Customer migration Customers 300 from started migrated 2017 2017 2017 2017 2018 2018 200 Q2 Q2 Q3 Q3 Q1 Q1 +6% 100 SYNERGY RUN RATE SYNERGY RUN RATE 0 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 NOK 400m NOK 400m Monthly fee Special numbers Other Roaming • Churn in line with expectations • Focus on value to drive ARPU • Improved product mix - focus on segment Young • Monthly fees mitigated for special numbers 8 4

OUR SEK 1.1 BILLION COST PROGRAM 2018 ON TRACK COST SAVINGS REALIZATION – Q1 COST REDUCTION AMBITION 2018 SEK in billions, cost base* in scope -0.2 SEK SEK +0.2 -0.3 1.1BN 1.1BN -0.1 Q1 17 Savings Disposals Acquisitions Q1 18 excl. FX 9 * Equipment related costs are not included in the SEK 1.1 billion cost savings target for 2018 INTEGRATED APPROACH TO SUSTAINABILITY CLEAR FRAMEWORK & TARGETS EXAMPLES OF RESPONSIBLE BUSINESS STRONG ESG PERFORMANCE • MSCI ESG “AAA” • EcoVadis “Gold Supplier” TELIA - STATEMENT OF MATERIALITY TELIA - STATEMENT OF MATERIALITY CHILDRENS RIGHTS • Facilitate cooperation with others to spread learnings • Sharing experience how to protect children from abuse RESPONSIBLE RESPONSIBLE SHARED VALUE SHARED VALUE SHARED VALUE CREATION BUSINESS BUSINESS CREATION CREATION • Smart transportation • Connected water taps ENVIRONMENTAL RESPONSIBILITY EMPLOYEE ENGAGEMENT & YOUNITE EMPLOYEE ENGAGEMENT & YOUNITE • 148,000 tons CO2e abated, equivalent of 30,000 cars • 87 percent of electricity from renewable sources 2017 ETHICS AND COMPLIANCE ETHICS AND COMPLIANCE 10 5

OUTLOOK FOR 2018 (REVISED UP) Above SEK 9.7 billion (previously: Around SEK 9.7 billion) OPERATIONAL FCF* Operational FCF together with dividends from associated companies should cover a dividend around the 2017 level EBITDA** In line or slightly above the 2017 level of SEK 25.2 billion (unchanged) * Free cash flow from continuing operations, excluding licenses and dividends from associated companies ** Based on current structure, i.e. including M&A made so far, excluding adjustment items, in local currencies 11 Q1 INTERIM REPORT JANUARY – MARCH 2018 CHRISTIAN LUIGA EXECUTIVE VICE PRESIDENT & CFO 6

EBITDA GROWTH BOTH FROM ORGANIC AND M&A EBITDA DEVELOPMENT – REPORTED EBITDA DEVELOPMENT – ORGANIC Reported growth, excluding adjustment items Organic growth, y-o-y, excluding adjustment items +7.4% +4.2% Q1 SWE FIN NOR DEN LIT EST LAT Other Q1 Q1 17 Organic M&A FX Q1 18 17 18 • Revenue growth coupled with EBITDA leverage in • EBITDA growth of 7.4 percent driven by majority of markets • Solid organic growth • M&A in Finland and Norway • FX tailwind from stronger EUR 13 LOWER COGS & RESOURCE COST KEY FOR COST SAVINGS COST 2018 SAVINGS OVERVIEW COST 2018 SAVINGS BY TYPE Illustrative only Cost savings components as % of total savings SEK 1.1 BILLION 5% Resources COGS Marketing IT Other 2017 Equipment Cost Acqui- Dispo- Savings Target COGS base in sitions sals excl. FX cost scope base** • Equipment COGS and FX excluded • Improved sourcing and efficiency measures to drive down COGS • All other costs incl. salary and other inflation included • Process improvements to drive down resource costs * 2017 M&A refers to the disposal of Sergel and acquisitions of Phonero and Nebula 14 ** Adjusted for changes in FX 7

EBITDA GROWTH IN SWEDEN DRIVEN BY LOWER COSTS SERVICE REVENUES EBITDA* FIBER REVENUES Organic growth, external revenues Organic growth SEK million, reported currency 3.0% 300 B2C incl. fiber installation revenues B2C excl. fiber installation revenues 200 B2C +1.4% +1.4% -42% 100 -0.1% -0.1% B2B -2.4% -2.4% 0 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Fiber installation revenues Fiber installation revenue growth Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 • Continued growth in SME/SoHo • Permit issues remains • Cost savings more than mitigate the lower revenues • Recovery in Large enterprises • We remain committed despite uncertainty 15 * Excluding adjustment items CONTINUED STRONG EBITDA GROWTH IN FINLAND SERVICE REVENUES* & EBITDA** MOBILE DEVELOPMENT SEK million, reported currency & organic growth Organic growth, ARPU growth in local currency -0.7% -0.7% Total mobile service revenues 3,084 Mobile ARPU 2,837 +8.7% +8.7% 4.8% 1,151 964 2.4% Q1 17 Q1 18 Q1 17 Q1 18 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Service revenues EBITDA • Reported numbers boosted by M&A and FX • Mobile ARPU still growing by around 5 percent • EBITDA uplift from less resource costs and marketing • Mobile growth impacted by loss of subscriptions 16 = Organic growth * External service revenues ** Excluding adjustment items 8

REVENUE AND EBITDA GROWTH IN NORWAY SERVICE REVENUES* & EBITDA** EBITDA** DEVELOPMENT SEK million, reported currency & organic growth SEK million, reported EBITDA growth +1.1% +1.1% +16.8% 2,129 1,943 +5.0% +5.0% 1,008 862 Q1 17 Q1 18 Q1 17 Q1 18 Q1 17 Organic M&A FX Q1 18 Service revenues EBITDA • Wholesale continued to be the main revenue driver • Revenues and cost control behind organic growth • Special number revenues down by SEK ~30 millions • Phonero synergies drove double digit reported growth • Slight y-o-y headwind from FX 17 = Organic growth * External service revenues ** Excluding adjustment items SOLID BALTICS – CHALLENGING MARKET IN DENMARK SERVICE REVENUE DEVELOPMENT EBITDA* DEVELOPMENT Organic growth, external service revenues SEK million, reported currency & organic growth Estonia Lithuania Denmark +9.5% +9.5% +8.8% +8.8% 318 +4.7% +4.7% 277 -6.9% -6.9% 234 206 +2.5% +2.5% 145 141 -4.2% -4.2% Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q1 17 Q1 18 Q1 17 Q1 18 Q1 17 Q1 18 Estonia Lithuania Denmark • Mobile growth of 12 percent in Lithuania • EBITDA leverage in the Baltics from revenue growth and lower costs • Solid fixed development in Estonia • Good efforts on cost in Denmark left absolute • Denmark still challenging- unlimited offering launched EBITDA more or less flat 18 = Organic growth * Excluding adjustment items 9

Recommend

More recommend