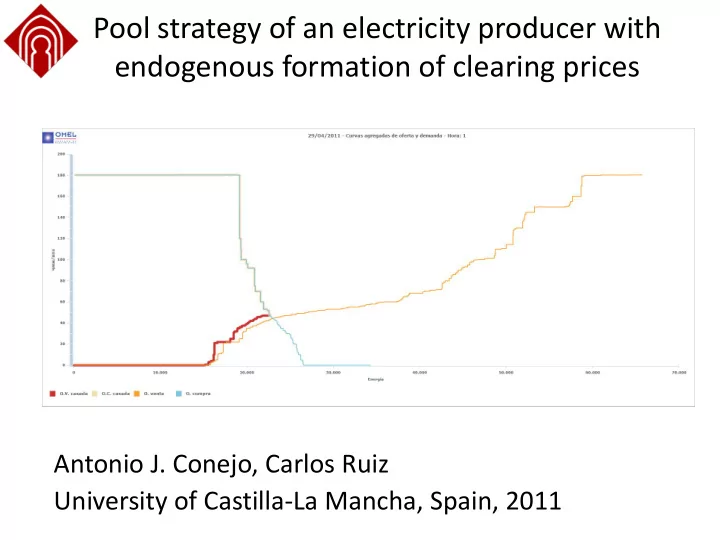

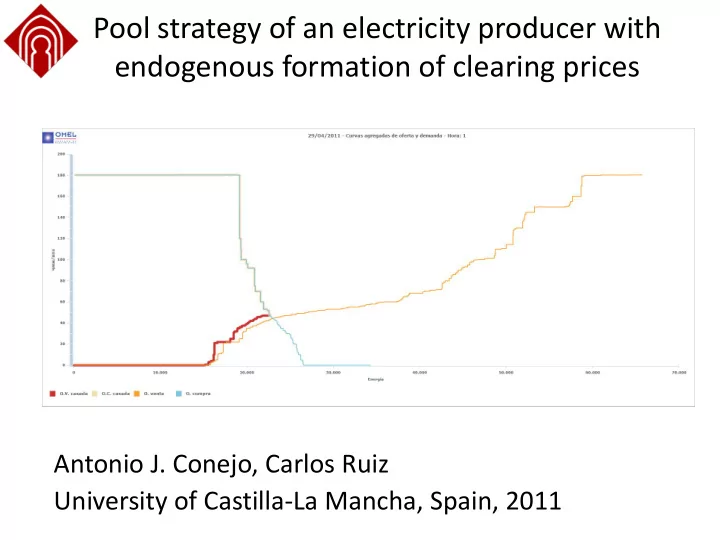

Pool strategy of an electricity producer with endogenous formation of clearing prices Antonio J. Conejo, Carlos Ruiz University of Castilla-La Mancha, Spain, 2011

Contents • Background and Aim • Approach • Model Features • Model Formulation – Deterministic – Stochastic • Examples • Conclusions 29/04/2011 2

Contents • Background and Aim • Approach • Model Features • Model Formulation – Deterministic – Stochastic • Examples • Conclusions 29/04/2011 3

Background and Aim Strategic power producer • Comparatively large number of generating units • Units distributed throughout the power network 29/04/2011 4

Background and Aim Pool-based electricity market • Cleared once a day, one-day ahead and on a hourly basis • DC representation of the network including first and second Kirchhoff laws • Hourly Locational Marginal Prices (LMPs) 29/04/2011 5

Background and Aim Strategic power producer Best offering strategy to maximize profit Pool-based electricity market 4/29/2011 6

Background and Aim • Considering the market: MPEC formulation • Considering the real-world: Stochastic formulation • Stochastic MPEC! 29/04/2011 7

Contents • Background and Aim • Approach • Model Features • Model Formulation – Deterministic – Stochastic • Examples • Conclusions 29/04/2011 8

Approach Bilevel model: Profit Maximization Upper-Level Offering LMPs subject to curve Dual Variables Social Welfare Maximization Lower-Level (Market Clearing) 4/29/2011 9

Approach • Bilevel model: Optimization problem constrained by other optimization problem (OPcOP)!

OPcOP 11

Approach MPEC: Profit Maximization Upper-Level Offering subject to LMPs curve KKT Conditions 4/29/2011 12

MPEC 13

MPEC 14

Contents • Background and Aim • Approach • Model Features • Model Structure – Deterministic – Stochastic • Examples • Conclusions 29/04/2011 15

Features 1) Strategic offering for a producer in a pool with endogenous formation of LMPs. 2) Uncertainty of demand bids and rival production offers. 3) MPEC approach under multi-period, network- constrained pool clearing. 4) MPEC transformed into an equivalent MILP. 29/04/2011 16

Contents • Background and Aim • Approach • Model Features • Model Formulation – Deterministic – Stochastic • Examples • Conclusions 29/04/2011 17

Deterministic Model Upper- Level → Profit Maximization: Costs - Revenues Ramping Limits Price = Balance dual variable 4/29/2011 18

Deterministic Model Upper- Level → Profit Maximization: Dual variable 29/04/2011 19

Deterministic Model Lower- Level → Market Clearing Maximize Social Welfare Power Balance 29/04/2011 20

Deterministic Model Lower- Level → Market Clearing Price 29/04/2011 21

Deterministic Model Lower- Level → Market Clearing Production / Demand Power Limits Transmission Capacity Limits Angle Limits 4/29/2011 22

Deterministic Model Lower- Level → Market Clearing 29/04/2011 23

Deterministic Model Lower- Level → Market Clearing → KKT conditions 29/04/2011 24

Deterministic Model Lower- Level → Market Clearing → KKT conditions 29/04/2011 25

Deterministic Model MPEC model KKT Lower-Level 29/04/2011 26

Deterministic Model Linearizations The MPEC includes the following non-linearities: 1) The complementarity conditions ( ). 0 a b 0 2) The term in the objective function. 4/29/2011 27

Deterministic Model Linearizations → Complementarity Conditions 0 a b 0 Fortuny-Amat transformation a 0 b 0 a uM b ( 1 u ) M u 0 , 1 M Large enough constant (but not too large) 4/29/2011 28

Deterministic Model Linearizations → Term: Based on the strong duality theorem and some of the KKT equalities 29/04/2011 29

Contents • Background and Aim • Approach • Model Features • Model Formulation – Deterministic – Stochastic • Examples • Conclusions 29/04/2011 30

Stochastic Model Uncertainty incorporated using a set of scenarios modeling different realizations of: • Consumers’ bids • Rival producers’ offers 29/04/2011 31

Stochastic Model Deterministic model for each scenario S Pairs of production quantities ( ) and P tib tn market prices ( ). Building of the optimal offering curve 4/29/2011 32

Stochastic Model Optimal offering curve 29/04/2011 33

Stochastic Model To ensure that the final offering curves are increasing in price some additional constraints are needed: These constraints link the individual problems increasing the computational complexity of the model. 4/29/2011 34

Stochastic Model Math Structure 4/29/2011 35

Stochastic Model Math Structure 4/29/2011 36

Stochastic Model Math Structure 1. Direct solution: CPLEX, XPRESS 2. Decomposition procedures (Lagrangian Relaxation) 4/29/2011 37

Contents • Background and Aim • Approach • Model Features • Model Formulation – Deterministic – Stochastic • Examples • Conclusions 29/04/2011 38

Examples Six- bus test system→ electricity network 29/04/2011 39

Examples Six- bus test system→ demand curve 29/04/2011 40

Examples Six- bus test system→ generating units 29/04/2011 41

Examples Six- bus test system→ uncongested network results The maximum power flow through lines 2-4, 3-6 and 4-6 are 269.62, 229.44 and 39.6933 MW respectively 4/29/2011 42

Examples Six- bus test system→ uncongested network results 29/04/2011 43

Examples Six- bus test system→ congested network results Capacity of line 3-6 limited to 230 MW: 29/04/2011 44

Examples Six- bus test system→ congested network results Capacity of line 3-6 limited to 230 MW: 29/04/2011 45

Examples Six- bus test system→ congested network results Capacity of line 4-6 limited to 39 MW: 29/04/2011 46

Examples Six- bus test system→ stochastic model • Uncongested network case • 8 equally probable scenarios • They differ on the rival producer offers ( ) and O tjb D on the consumer bids ( ) tdk • Selected to obtain a wide range of prices 29/04/2011 47

Examples Six- bus test system→ stochastic model results 29/04/2011 48

Examples Six- bus test system→ stochastic model results Offering curves for strategic generator 1 29/04/2011 49

Examples Six- bus test system→ stochastic model results Offering curves for strategic generator 1 29/04/2011 50

Examples IEEE One Area Reliability Test System • 24 Nodes • 8 strategic units • 24 non-strategic units • 17 consumers • 24 hours 29/04/2011 51

Examples IEEE One Area Reliability Test System → Results 29/04/2011 52

Examples IEEE One Area Reliability Test System → Results Marginal cost offer Strategic offer 29/04/2011 53

Examples Computational issues • Model solved using CPLEX 11.0.1 under GAMS on a Sun Fire X4600 M2 with 4 processors at 2.60 GHz and 32 GB of RAM. 6-bus 6-bus 6-bus Model IEEE RTS uncongested congested stochastic CPU Time [s] 2.91 5.82 204.77 449.33 4/29/2011 54

Contents • Background and Aim • Approach • Model Features • Model Formulation – Deterministic – Stochastic • Examples • Conclusions 29/04/2011 55

Conclusions • Procedure to derive strategic offers for a power producer in a network constrained pool market. – LMPs are endogenously generated: MPEC approach. – Uncertainty is taken into account. – Resulting MILP problem. • Exercising market power results in higher profit and lower production. • Network congestion can be used to further increase profit. 29/04/2011 56

Thanks for your attention! http://www.uclm.es/area/gsee/web/antonio.htm 29/04/2011 57

Appendix A Computational Issues • Model has been solved using CPLEX 11.0.1 under GAMS on a Sun Fire X4600 M2 with 4 processors at 2.60 GHz and 32 GB of RAM. • The computational times are highly dependent on the values of the linearization constants M . 6-bus 6-bus 6-bus Model IEEE RTS uncongested congested stochastic CPU Time [s] 2.91 5.82 204.77 449.33 4/29/2011 58

Appendix A Computational Issues Heuristic to determine the value of M: 1. Solve a (single-level) market clearing considering that all the producers offer at marginal cost. 2. Obtain the marginal value of each relevant constraint. 3. Compute the value of each relevant constant as: 100 M dual variable value 1 4/29/2011 59

Appendix B Stochastic model 29/04/2011 60

Appendix B Stochastic model 29/04/2011 61

Appendix B Stochastic model 29/04/2011 62

Recommend

More recommend