O I L S E A R C H L I M I T E D 1 Strategies for Growth Optimise performance of existing producing PNG oil fields Support ExxonMobil in delivering PNG LNG Project on schedule Aggregate gas resources in PNG Highlands to underpin LNG expansion Establish gas resources in Gulf of Papua for potential standalone LNG project Evaluate and pursue international growth opportunities Optimise capital and financial structure Operate safely and sustainably 2

Core Strategies Deliver Consistent Share Price Appreciation Share price (A$) 8 7 6 5 4 3 2 1 0 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 January 2003 – April 2013 3 Performance vs Peers Total Shareholder Return for five years to December 2012 of 52%, 14th in S&P/ASX 200 Targeting continued top quartile performance Share price 02/01/08 – 29/04/13 (A$, rebased to OSH) Performance (%) 8 Oil Search +53.8% 7 6 Brent +5.2% 5 Santos -7.4% Beach -8.3% ASX 200 Energy -17.2% 4 ASX 100 -17.3% Woodside -23.7% 3 2 1 Apr-13 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 4

Changing Face of Oil Search Delivery of PNG LNG Trains 1 & 2 approaches: Project over 80% complete Increasing confidence in delivering on schedule and within revised budget Start of substantial long term (20 years+) cash flow stream getting closer Resource underpinning for further growth. Progressive results delivery to end 2014: Comprehensive exploration and appraisal programme underway P’nyang important underpinning volume for expansion PNG Highlands gas resource being fully evaluated Gulf Area drilling taking place Continued PNG oil field drilling, with Mananda upside Material oil the focus with Taza discovery Preparing for LNG production and beyond: Oil operations review and sustainability Understand growth potential in core PNG areas 5 Committed to Achieving World Class Safety Performance 9 Total Recordable Injury Frequency Rate of 2.64 for 2012 8 Australian Companies (APPEA) 7 TRI / 1,000,000 Hours 6.0 6 5.2 5 4.7 International Companies 4 (OGP) 3 2.64 1.96 1.85 2 1.75 1.76 Oil Search 1.68 1 1.16 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 6

PNG LNG Project Angore Hides Juha Juha Facility Moran 6 ° S Hides Gas Conditioning Plant Komo Airfield Kutubu Agogo Gobe Main 7 ° S Onshore pipeline and Infrastructure Oil Pipeline 8 ° S PNG LNG Kumul Terminal Gas Pipeline OSH Facility PNG LNG Project Facility Offshore pipeline LNG Facility 9 ° S 100km Port Moresby 7 141 ° E 142 ° E 143 ° E 144 ° E 145 ° E 146 ° E 147 ° E PNG LNG Project Overview More than 80% complete at end March 2013 Operator has confirmed Project remains on track for first LNG sales in 2014 Have passed peak for logistics and workforce Capital cost increased to US$19.0 billion last year, comfortable that Operator can deliver within revised budget: Cost increase to be funded 70:30, debt:equity. Discussions progressing well to secure US$1.5bn supplemental debt available under existing project finance agreement OSH has ample capacity to fund its equity share of additional costs (~US$300m) Capacity of LNG Plant increased to 6.9 MTPA Despite cost increase, Project remains economically robust 8

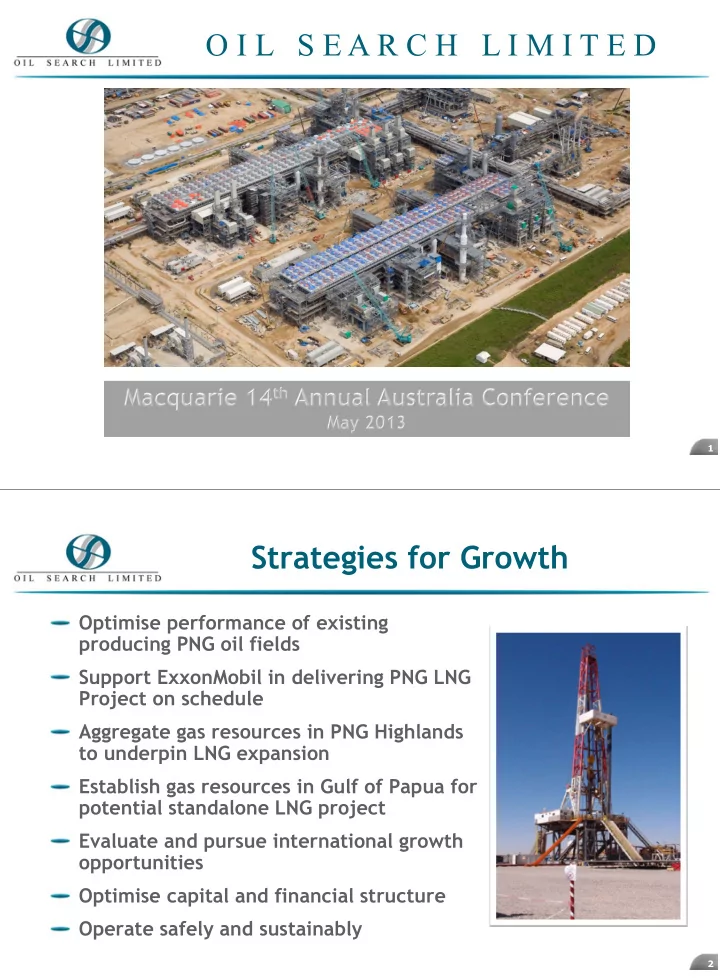

PNG LNG Plant Site LNG Facility PNG LNG plant site, March 2013 Engineering and procurement substantially complete. Preparations underway to ready plant for receipt of commissioning gas 9 PNG LNG Plant Site LNG Facility Export Jetty 10

PNG LNG Plant Site Storage tanks LNG Facility 11 PNG LNG Offshore Pipeline Offshore Pipeline Offshore pipelay – SEMAC I Offshore pipelay – SEMAC I Offshore pipeline completed in 2012 12

PNG LNG Onshore Pipeline Highlands section pipeline Onshore Pipeline Pipeline burial Onshore pipeline welding 258km of onshore pipeline welded at end March 2013, with 197km of pipeline hydrotested 13 Associated Gas/PL 2 Life Extension TEG Dehydration Unit installation Kutubu Kutubu Kumul Upgrade of Kumul Marine Terminal New CALM Buoy at Kumul Completed Phase 1 of PL 2 Liquids Export Life Extension Project Associated Gas (oil fields) well advanced and readying for supply of commissioning gas in 2013 14

PNG LNG Project - Upstream HGCP Hides Gas Conditioning Plant (HGCP) Mar 2013 Dec 2012 Mar 2013 Completed HGCP foundations and erection of structural steel substantially complete 15 PNG LNG Project - Upstream Komo Airfield South Terminal North Terminal North Komo Airfield South Dec 2012 Komo Airfield – March 2013 Construction of Komo approaching completion. First aircraft movements expected shortly 16

PNG LNG Project - Drilling PDL 1/7 – Hides Field 8 New Production Wells Hides GTE Plant Drilling 2012+ Hides Nogoli Camp PDL 8 – Angore Field 2 New Wells Hides Gas Conditioning Plant Komo Airstrip 10km PNG LNG development drilling programme commenced in July 2012 with Rig 702 at well pad B Access roads and wellpad construction nearly complete Second rig, Rig 703 commenced drilling at well pad C in April 2013 17 PNG LNG Project Timetable Unchanged » Continued early works » Continue onshore » Detailed design pipe lay » Order long leads and » Complete offshore pipe place purchase orders lay » Open supply routes » Start Hides plant First Gas from » Contractor mobilisation installation Train 1, » Commence AG » Start Hides drilling then Train 2 construction » Complete key AG items 2010 2011 2012 2013 2014 » Ongoing procurement Financial » Complete pipe lay and mobilisation » Ongoing drilling Close » Airfield construction » Construction of » Drilling mobilisation HGCP » Start offshore » Commission LNG pipeline plant with Kutubu construction gas » Onshore line clearing and laying » Start LNG equipment installation 18

Gas Growth - PNG Highlands Comprehensive exploration PNG LNG PPL260 Project and appraisal in PNG Gas Resources Non PNG LNG Hides PRL3 Gas Resources Juha North Wabag Highlands, to fully understand 260 gas resource picture Angore PDL8 PRL11 Juha PDL9 P’nyang Mt. Hagen PDL1 Moran Significant progress in 2012 6 ° S PRL02 PDL6 PDL5 Hides Gas PPL233 PDL7 Mendi with discovery of gas at Conditioning Plant PPL233 & Komo Airfield PPL219 P’nyang South PPL277 Gobe Main Kutubu Agogo PDL2 SE Gobe Upside at Hides to be tested PPL277 PDL4 PRL14 by PNG LNG drilling PDL3 Iehi/Cobra 7 ° S programme PRL09 338 PRL08 Kimu Barikewa Seismic underway/planned in 338 other Highlands areas. Aiming to mature prospects for possible drilling in late 100km PPL276 8 ° S 2013/2014 Kumul Terminal 142 ° E 143 ° E 144 ° E 19 P’nyang Gas Field PRL 3 JV (OSH 38.5%, ExxonMobil 49.0%, JX Nippon 12.5%) advancing with concept selection studies, optimal development concept expected to be finalised in 2013 Oil Search estimates total 2C gas resources in P’nyang field of 2.5 – 3.0 tcf, sufficient to underpin potential LNG expansion. Believes further upside potential exists in PRL 3, requires appraisal Additional seismic in PRL 3 underway, to support potential development and resource evaluation Juha 100km 5km Hides Angore P’nyang 6 ° S Moran Kutubu Agogo Gobe 8 ° S 142 ° E 144 ° E 20

Gas Growth - Gulf of Papua Exploration programme for gas to 100km support possible new LNG hub recently Elk/Antelope commenced: 2D Seismic 2D Seismic 2011 Lines 2011 Lines Development options include standalone LNG, floating LNG or integration with Uramu existing infrastructure Kerema 8 ° S Kumul Terminal In 2012, introduced Total SA as our 2012 3D Seismic Region 2011 3D 2011 3D strategic partner: Seismic Seismic Regions Regions Share costs and risks Experienced LNG operator 9 ° S If exploration is successful, potential LNG Facility to rapidly build resource base: Port Moresby 144 ° 145 ° 146 ° E E E Proven hydrocarbon province, with over 30 opportunities identified across multiple play types 21 2013 Gulf of Papua Programme Drilling programme (two firm offshore wells, with two options), recently commenced with Stena Clyde semi sub drilling rig: Flinders 1 in PPL 244 (OSH 40%, Total 40%, Nippon 20%) drilling ahead. Targeting gas in Plio-Pleistocene-age, submarine fan sands. Mean resource of 1 – 1.5 tcf Hagana 1 in PPL 244 to follow. Stacked objectives, mean resource 1.1 tcf Possible third well, Kidukidu, in PPL 244/PPL 385. Mean resource of 1.3 tcf In 2013, will also acquire gravity and seismic data in onshore licences and decide whether to take up equity Flinders 1 Hagana 1 Pleistocene Pleistocene Pliocene Pliocene Hagana Miocene Miocene Hagana Flinders Prospect Jurassic & Cretaceous Jurassic & Cretaceous Late Late Kidukidu Prospect Miocene Miocene Flinders Prospect Pasca Pasca Triassic & older Triassic & older 50km Ridge Ridge 22

Recommend

More recommend