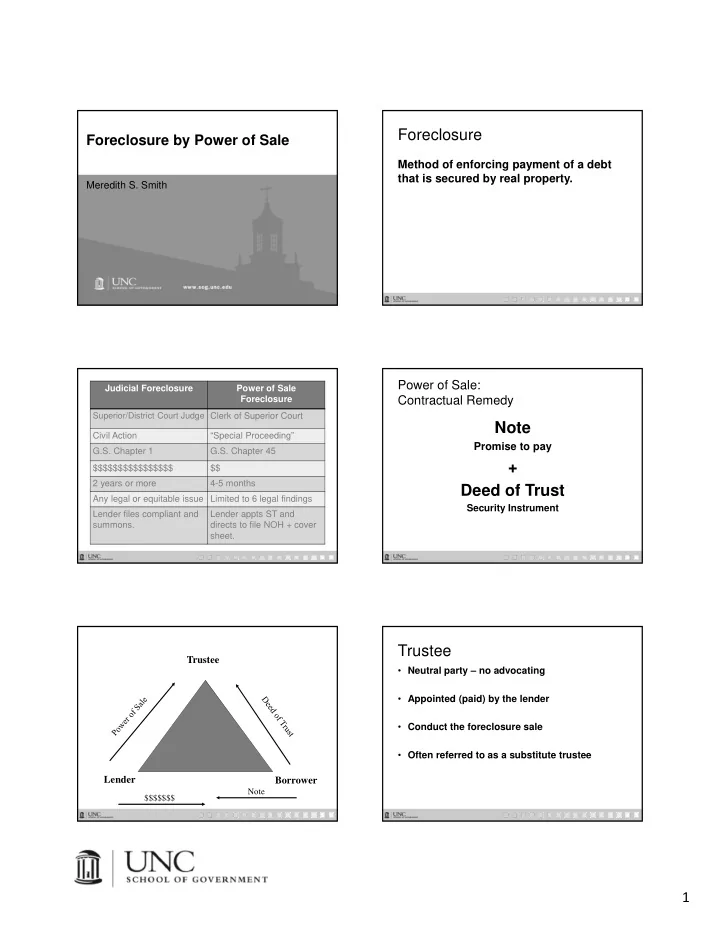

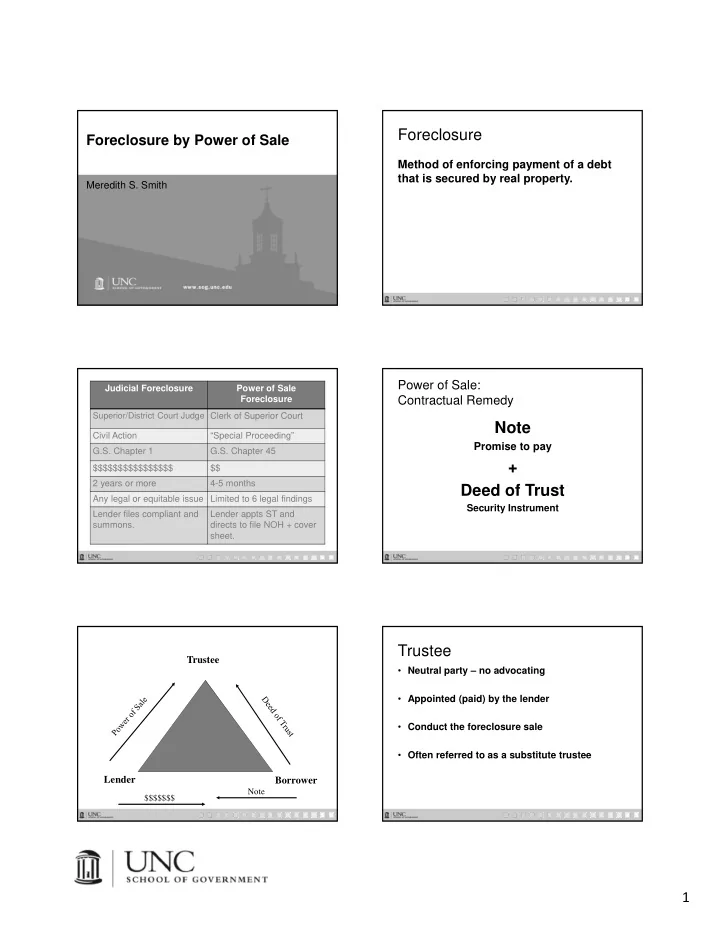

Foreclosure Foreclosure by Power of Sale Method of enforcing payment of a debt that is secured by real property. Meredith S. Smith Power of Sale: Judicial Foreclosure Power of Sale Foreclosure Contractual Remedy Superior/District Court Judge Clerk of Superior Court Note Civil Action “Special Proceeding” Promise to pay G.S. Chapter 1 G.S. Chapter 45 + $$$$$$$$$$$$$$$$ $$ 2 years or more 4-5 months Deed of Trust Any legal or equitable issue Limited to 6 legal findings Security Instrument Lender files compliant and Lender appts ST and summons. directs to file NOH + cover sheet. Trustee Trustee • Neutral party – no advocating • Appointed (paid) by the lender • Conduct the foreclosure sale • Often referred to as a substitute trustee Lender Borrower Note $$$$$$$ 1

Lender Borrower • Person or entity that makes the loan, typically • Borrowed the $$, the beneficiary under the DOT • May be referred to as • Original lender typically considered – Debtor “originator” of the loan – Maker of the Note – Grantor of the deed of trust • May transfer or sell the loan, therefore may not • May not be the owner of the property, grantor necessarily be the party directing the ST to under the DOT foreclose – Holder of the note may change Guarantor Review Note and DOT Identify: • Person or entity that agrees to pay a debt in 1. Borrower the event the original borrower is unable to pay 2. Lender 3. Property owner • Typically sign a guaranty agreement 4. Beneficiary 5. Amount of the loan 6. Date of the loan 7. Property that secures the note Review Note and DOT Identify: 1. Borrower – Bob and Belinda Barker Chapter 45 controls in procedure* and 2. Lender – Countrywide Loans LLC* substance. 3. Property owner – Showcase Showdown, LLC* 4. Beneficiary – Countrywide Loans, LLC 5. Amount of the loan - $417,000 6. Date of the loan – December 5, 2006 7. Property that secures the note – 2334 Price is Right Way, Showdown, NC 25468 2

Power of Sale Foreclosure Power of Sale Foreclosure Substitution Notice of Sale and Substitute Substitution Notice of Sale and Substitute 45/30 Day Notice of Upset Bid 45/30 Day Notice of Upset Bid of Trustee Service of Hearing Prelim Final Report Trustee's of Trustee Service of Hearing Prelim Final Report Trustee's Hearing Hearing Letters Sale Period Letters Sale Period Recorded NOH Report Deed Recorded NOH Report Deed Filed Filed Limited Authority Action to Enjoin SC Judge’s The clerk’s authority is limited but it Authority Any Legal or is not a rubber stamp. Equitable Power of Sale Foreclosure Clerk’s Authority 6 Legal Not a Rubber Stamp How Searching of an Inquiry? The order authorizing sale must be Competent evidence to authorize the sale based on competent evidence and is a judicial act of the clerk. Regardless of whether it is contested or uncontested Clerk may consider affidavits and certified copies. 3

The Big Six: Conclusions of Law Clerk must ask: 1. Holder of a valid debt 1. Do you currently live at the property? 2. Right to foreclose 3. Default 2. Is it your primary residence? 4. Notice – Does not say home loan. 5. Home Loan – Must only appear that they do. 6. Military Service If Yes to both….. Plus one, loss mitigation. Loss Mitigation – Clerk Inquiry What do you ask? • Did you submit an application? 1. Efforts to resolve • Did you receive notices from the lender? • What is your monthly income? • What is your current mortgage payment? 2. Likelihood of resolution without • How far behind are you? foreclosure • What can you afford to pay each month? • Have you had a modification before? • Did you attempt to contact servicer for modification? Good cause? What did they say? • Did you submit an initial package of documents? Then, continuance (not dismissal). – Did you hear back? • Are you in a trial period plan? Are you making payments? Make your job easier Document If, Lender files affidavit of compliance. Loss Mitigation Affidavit • Describe efforts to resolve the default • Results of the efforts to resolve Then, You don’t have to ask *As long as you are satisfied with the affidavit. 4

The Big Six: Conclusions of Law #1: Holder of a Valid Debt 1. Holder of a valid debt Clerk must find Competent Evidence of: 2. Right to foreclose 1. A Valid Debt 3. Default – Usually evidenced by the note, copy ok 4. Notice – Hard to dispute 5. Home Loan 6. Military Service 2. Party seeking to foreclose is the Holder of the note that evidences the debt Plus one, loss mitigation. Holder of a #1: Holder of a Valid Debt Valid Debt Holder - Two Prong Analysis Valid Debt Holder 1. Physical Possession – Copy can suffice unless borrower provides evidence that copy is inaccurate Possession 2. Payable to specific person OR Indorsement in Blank Payable To / Blank Allonge or Indorsement Bob Barker, Note Page 1 Transfers the Note 1. BORROWER’S PROMISE TO PAY In return for a loan that I have received, I promise to pay U.S. $417,000.00 (this amount is called “Principal”), plus interest, to the order of Lender. Lender is Countrywide Loans LLC. - Countrywide is the Holder - Typically proven by Affidavit of Holder 5

Follow the Trail Document Affidavit of Holder • Note + Allonge, if any Legal or Equitable? Legal or Equitable? The borrower argues that the lender The borrower argues that the lender improperly assigned the note because the improperly assigned the note because the borrower did not consent to the assignment. borrower did not consent to the assignment. 1. Legal 1. Legal 2. Equitable 2. Equitable Legal or Equitable? Legal or Equitable? The borrower argues that the lender The borrower argues that the lender promised to modify the loan and then promised to modify the loan and then proceeded with the foreclosure anyway. proceeded with the foreclosure anyway. 1. Legal 1. Legal 2. Equitable 2. Equitable 6

#2: Right to Foreclose Under the The Big Six: Conclusions of Law Instrument 1. Holder of a valid debt 2. Right to foreclose Arises from the power of sale provision in 3. Default the Deed of Trust. 4. Notice 5. Home Loan 6. Military Service Plus one, loss mitigation. Power of Sale Bob Barker, Deed of Trust, Page 2 Grants the authority to the trustee to sell the property to satisfy the debt on behalf of the lender #2: Right to Foreclose under the Document Instrument 1. Review the Deed of Trust Affidavit of Holder • Valid Power of Sale? • Copy of the Deed of Trust and • Legal description of property attached + matches Assignments, if any NOH legal description? • Recorded in county where foreclosure pending? • DOT secure the note? • Signed and notarized by each grantor? 2. Review the NOH and ST • Ensure ST recorded before the NOH 7

Legal or Equitable? Legal or Equitable? The lien of deed of trust is invalid because The lien of deed of trust is invalid because the grantor under the deed of trust did not the grantor under the deed of trust did not own the property at the time the deed of own the property at the time the deed of trust was granted. trust was granted. 1 – Legal 1 – Legal 2 - Equitable 2 - Equitable Legal or Equitable? Legal or Equitable? The property subject to foreclosure is not The property subject to foreclosure is not encumbered by the lien of the deed of trust encumbered by the lien of the deed of trust because the legal description is incorrect or because the legal description is incorrect or missing. missing. 1 – Legal 1 – Legal 2 - Equitable 2 - Equitable The Big Six: Conclusions of Law #3: Default 1. Holder of a valid debt An omission or failure to fulfill a duty, 2. Right to foreclose observe a promise, discharge an obligation, or perform under an agreement. 3. Default 4. Notice - Note 5. Home Loan - DOT 6. Military Service - Other Agreement (Cross-Default) Plus one, loss mitigation. 8

#3: Default Default under DOT, Page 2 Clerk Review Two Questions: 1 – What constitutes a default under the loan documents? 2 – Whether the facts prove a default exists? - Typically shown via Affidavit of Holder #3: Default Default under DOT, Page 2 Two General Rules: 1. Day late and a dollar short is enough, unless documents say otherwise – Could be anything, depends on the terms of the note and deed of trust 2. Each default is a new cause of action – Think: each missed payment #3: Default Document Types of Default Affidavit of Holder or Affidavit of Default • Failure to make payments on time • Copy of Note and Deed of Trust • Failure to pay taxes • Failure to pay insurance • Sale/transfer of property without consent • Misuse/waste on property • Other liens • Failure to meet financial covenants 9

Legal or Equitable? Legal or Equitable? The borrower disputes the amount they are The borrower disputes the amount they are in default. in default. 1. Legal 1. Legal 2. Equitable 2. Equitable Legal or Equitable? Legal or Equitable? The person who executed the affidavit of The person who executed the affidavit of default does not have sufficient personal default does not have sufficient personal knowledge of the loan to attest to the knowledge of the loan to attest to the statements in the affidavit. statements in the affidavit. 1. Legal 1. Legal 2. Equitable 2. Equitable The Big Six: Conclusions of Law #4: Notice 1. Holder of a valid debt 1.What? 2. Right to foreclose 2.Who? 3. Default 4. Notice 3.How? 5. Home Loan 6. Military Service Plus one, loss mitigation. 10

Recommend

More recommend