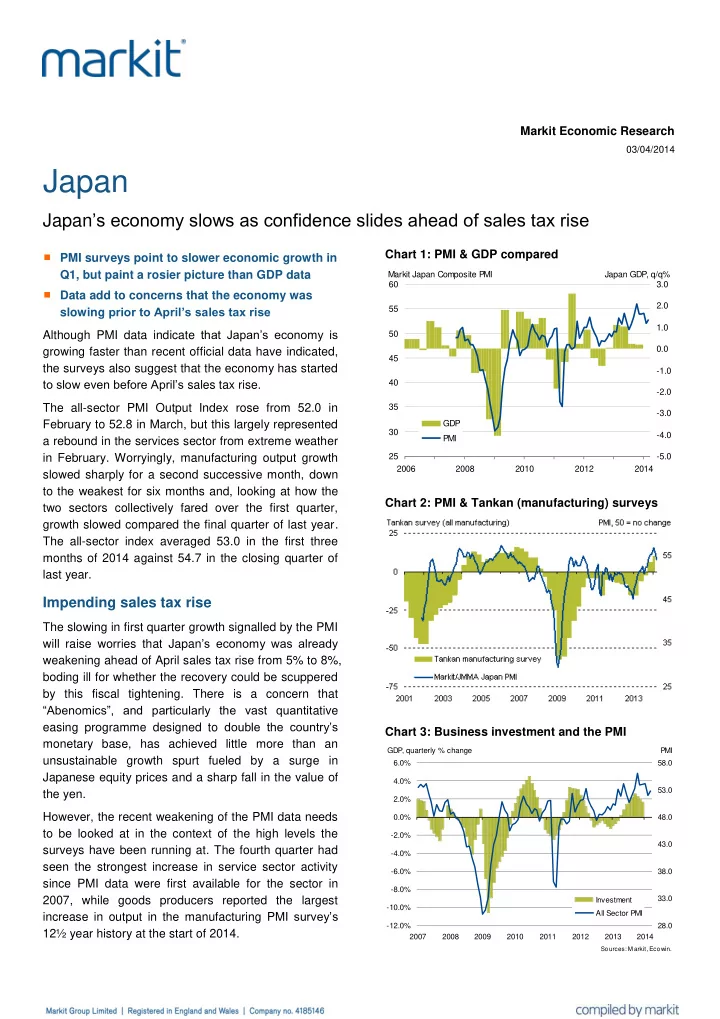

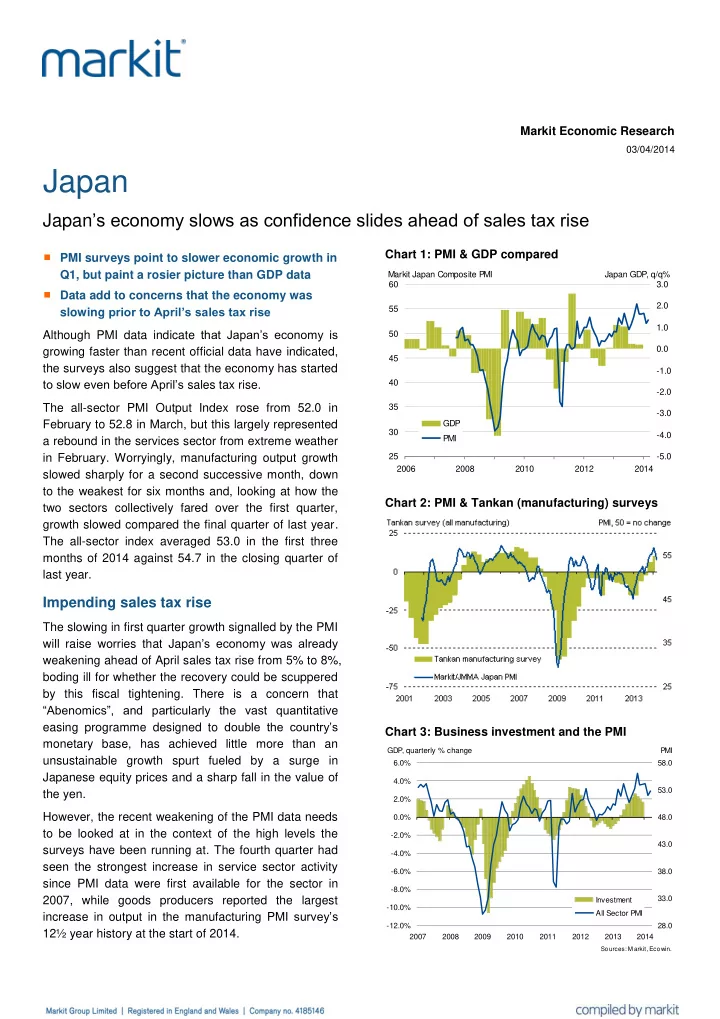

Markit Economic Research 03/04/2014 Japan Japan ’s economy slows as confidence slides ahead of sales tax rise PMI surveys point to slower economic growth in Chart 1: PMI & GDP compared Q1, but paint a rosier picture than GDP data Markit Japan Composite PMI Japan GDP, q/q% 60 3.0 Data add to concerns that the economy was 2.0 slowing prior to April’s sales tax rise 55 1.0 Although PMI data indicate that Japan’s economy is 50 0.0 growing faster than recent official data have indicated, 45 the surveys also suggest that the economy has started -1.0 to slow even before April’s sales tax rise. 40 -2.0 The all-sector PMI Output Index rose from 52.0 in 35 -3.0 February to 52.8 in March, but this largely represented GDP 30 -4.0 PMI a rebound in the services sector from extreme weather in February. Worryingly, manufacturing output growth 25 -5.0 2006 2008 2010 2012 2014 slowed sharply for a second successive month, down to the weakest for six months and, looking at how the Chart 2: PMI & Tankan (manufacturing) surveys two sectors collectively fared over the first quarter, growth slowed compared the final quarter of last year. The all-sector index averaged 53.0 in the first three months of 2014 against 54.7 in the closing quarter of last year. Impending sales tax rise The slowing in first quarter growth signalled by the PMI will raise worries that Japan ’s economy was already weakening ahead of April sales tax rise from 5% to 8%, boding ill for whether the recovery could be scuppered by this fiscal tightening. There is a concern that “Abenomics”, and particularly the vast quantit ative easing programme designed to double the country’s Chart 3: Business investment and the PMI monetary base, has achieved little more than an GDP, quarterly % change PMI unsustainable growth spurt fueled by a surge in 6.0% 58.0 Japanese equity prices and a sharp fall in the value of 4.0% 53.0 the yen. 2.0% However, the recent weakening of the PMI data needs 0.0% 48.0 to be looked at in the context of the high levels the -2.0% 43.0 surveys have been running at. The fourth quarter had -4.0% seen the strongest increase in service sector activity -6.0% 38.0 since PMI data were first available for the sector in -8.0% 2007, while goods producers reported the largest 33.0 Investment -10.0% increase in output in the manufacturing PMI survey’s All Sector PMI -12.0% 28.0 12½ year history at the start of 2014. 2007 2008 2009 2010 2011 2012 2013 2014 Sources: M arkit, Ecowin.

Markit Economic Research The PMI surveys in fact paint a very different picture to Chart 4: Employment the gross domestic product numbers (see chart 1), the Annual % change PMI 2.0 55 latter having sent a worrying signal of economic growth Employment (excluding govt, agriculture & construction) 1.5 losing momentum late last year. Having surged 1.1% PMI Employment Index 1.0 in the first quarter of last year and 1.0% in the second 0.5 50 quarter of last year, buoyed by the initial optimism that 0.0 accompanied the introduction of Abenomics in -0.5 December 29012, GDP growth suddenly slumped to -1.0 45 just 0.2% in both the third and fourth quarters. -1.5 Rather than slumping in the second half of the year, -2.0 the PMI surveys went from strength to strength, -2.5 40 reaching a new all time high in October and signalling 2008 2009 2010 2011 2012 2013 2014 quarterly GDP growth of at least 1% in the third and Sources: Markit, Ecow in. fourth quarters. Even the lower PMI readings in the Chart 5: imports first quarter are historically consistent with the Imports (2005 yen prices) Share of GDP (%) economy growing by as much as 1%. 25000 16.0 Imports as % of GDP 14.0 Interestingly, the trend in the PMI has been followed by Imports 20000 12.0 the Tankan survey, though the latter is available only 10.0 quarterly and tends to lag behind turning points in the 15000 8.0 PMI (see chart 2). 10000 6.0 Particularly encouraging has been the all-important 4.0 feed-though of the stimulus to business investment 5000 2.0 and the jobs market (see charts 3 and 4 respectively). 0 0.0 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 Although the PMI surveys showed the rate of job creation easing in March, the first quarter has Chart 6: Service sector confidence witnessed the most aggressive pace of hiring since the Markit Japan Services PMI (current activity) (future activity) financial crisis. The strong employment index readings 60 60 bode well for a continuation of the upturn in non- 55 government employment growth seen late last year, 55 which accelerated to the highest since 2007 in year- 50 on-year terms, more or less mirroring the PMI hiring 50 trend. 45 45 Official data meanwhile show that business investment 40 jumped 1.7% in the final quarter of last year, building 40 on similarly strong increases seen in the second and 35 Current business activity third quarters. Expected activity in 12 months 30 35 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 PMI and GDP divergence So why have the GDP data been weaker than the PMI readings in recent months? The divergence may lie to GDP also hitting an all-time high of 14.9%, up from just a large extent in Japan’s need to import energy after under 13% prior to Fukushima (see chart 5). domestic nuclear energy plant closures in the It is not likely to be just an import issue though. We aftermath of the March 2011 Fukushima incident. also believe that the official GDP data, which in Japan Imports are of course subtracted from economic are notorious for revisions, are simply understating growth in the GDP calculation. growth and are eventually likely to be revised higher. Imports of goods and services rose to a record high in real terms in the final quarter of 2013, with the share of Conti nued … . 2 03/04/2014

Markit Economic Research Confidence hit Thus, while the PMI provides encouraging news in that growth late last year and in the first quarter was strong, the surveys also provide evidence to suggest that Chris Williamson some waning in growth is now underway, which will no Chief Economist doubt be exacerbated by April’s sales tax rise. In fact, Markit the PMI index measuring services sector firms’ Tel: +44 207 260 2329 confidence for the year ahead fell in March to its lowest Email: chris.williamson@markit.com since June 2012. Click here for more PMI and economic commentary. However, while this fall in confidence was in many For further information, please visit www.markit.com cases attributed to the impending sales tax rise, there is an accompanying concern (see our manufacturing research note) that the recent fall in equity prices could also be hitting confidence, and subdue economic growth at the same time as the sales tax hits. 3 03/04/2014

Recommend

More recommend