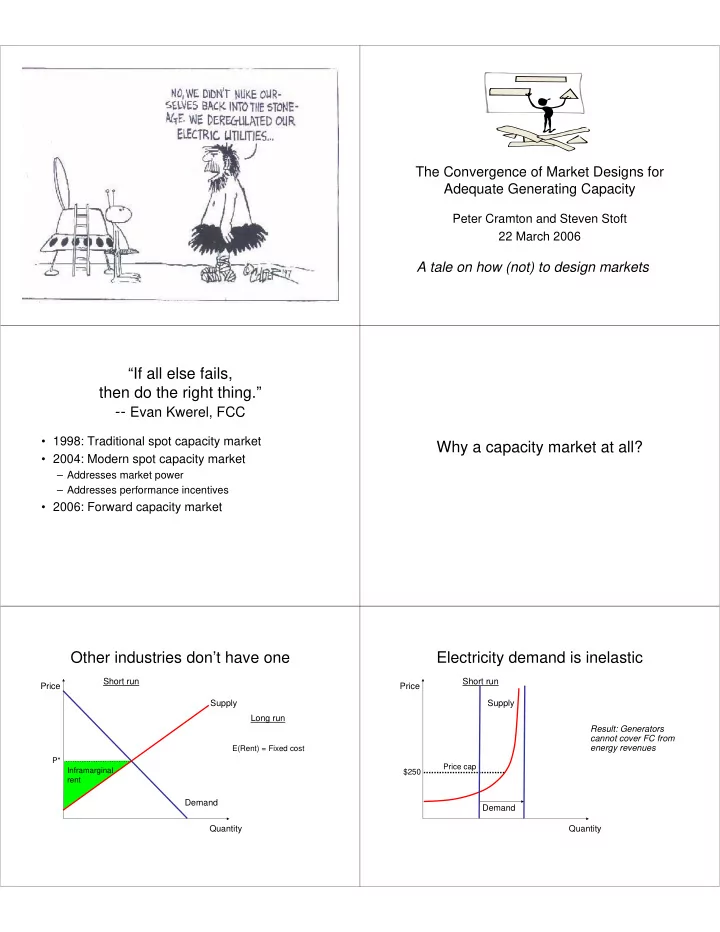

The Convergence of Market Designs for Adequate Generating Capacity Peter Cramton and Steven Stoft 22 March 2006 A tale on how (not) to design markets “If all else fails, then do the right thing.” -- Evan Kwerel, FCC • 1998: Traditional spot capacity market Why a capacity market at all? • 2004: Modern spot capacity market – Addresses market power – Addresses performance incentives • 2006: Forward capacity market Other industries don’t have one Electricity demand is inelastic Short run Short run Price Price Supply Supply Long run Result: Generators cannot cover FC from energy revenues E(Rent) = Fixed cost P* Price cap Inframarginal $250 rent Demand Demand Quantity Quantity

Purpose of market • Induce just enough investment to maintain “Everything should be made adequate resources as simple as possible • Induce efficient mix and operation of resources ... but not simpler.” -- Einstein • Reduce market risk • Avoid market power in capacity market • Reduce market power in energy market Round 1 Traditional Spot Capacity Market Traditional Spot Capacity Market “Pick the Biggest Number” Demand Demand Price Price True supply True supply Bid supply $999 Profit from exercise of market power Competitive Competitive = $0 = $0 price price Quantity Quantity Round 2 Round 3 Modern Spot Capacity Mechanism (LICAP) Forward Capacity Market LICAP market clearing • Suppliers bid as they wish • Why forward capacity market? • Clearing price determined by actual capacity Price • Auction mechanics 2 × CONE • Price formation • Performance incentives Supply offered CONE Clearing Price Administrative Demand Capacity Criterion Target Actual CONE = Cost of New Entry

Why forward procurement? • New projects compete in advance of entry – Coordinated entry • Less uncertainty in achieving target (buy less) – New capacity sets price directly • Less reliance on demand curve for price setting • Long-term commitment for new capacity – Reduced investor risk – Better price signal for new investment Planning period Commitment period • Existing capacity: one year • Annual auction occurs three years before – Already invested. No need for long commitment commitment begins – Shorter commitment reduces risk • Allows new projects to compete – No need to arbitrage across years • New capacity: five years (at most) – Longer commitment reduces investment risk – Price better reflects cost of new entry – New capacity can select shorter commitment in qualification • New and existing capacity paid the same price in first year of commitment • New capacity price is indexed after first year Descending clock auction Capacity requirements • Before auction, ISO determines for first year of • Auctioneer announces high starting price commitment period • Suppliers name quantities – Minimum capacity in each zone and system • Excess supply is determined – Transfer limits between zones • Auctioneer announces a lower price • System requirement is set at Installed Capability Requirement (ICR) • Process continues until supply equals demand – Safety margin beyond ICR not needed • Entry is coordinated • Adjustments are possible

Starting price Zone selection criterion • Starting price must be set sufficiently high to • Zones determined before auction based on create significant excess supply transfer limits that may bind in auction • Setting too high a starting price causes little harm • Potential import constrained zone – Competition among potential projects determines clearing price; high start quickly bid down – Not a separate zone if installed capacity exceeds • Setting too low a starting price destroys auction local sourcing requirement – Inadequate supply or insufficient competition • Potential export constrained zone • Price of $16/kW-month is recommended – Modeled in auction • Note clearing price will exceed cost of new entry in some years to the extent it is below cost of new entry in other years (of surplus) Individual Supply Bid, Round 6 Mechanics: Single zone Price start-of-round $11.00 price • Clock auction done in discrete rounds $10.63 • In each round, – Auctioneer announces $10.17 • Excess supply at end of prior round $10.00 end-of-round • Start of round price price • End of round price Quantity 800 350 600 – Each bidder then names (MW) • Supply at all prices between start of round price and end of • Bidders can only maintain or reduce quantity as price falls round price • “Intraround bids” – Auctioneer determines excess supply at end of round – Better expression of bidder preferences price – Better control of pace of auction • If excess supply, auction continues – Larger bid decrements do not reduce efficiency • If no excess supply, clearing price determined – Ties are reduced Descending clock auction Mechanics: Multiple zones Aggregate Supply Curve • Auction begins just as with a single zone: a Price starting price single price for all capacity $20.00 = P0 excess supply • Price separation only occurs if and when transfer Round 1 P1 limits bind P2 Round 2 P3 Round 3 P4 Round 4 P5 Round 5 $10.17 = P6 $10.00 = P6’ clearing price Demand Quantity

Three zone example Prices depend on binding constraints • Neither Connecticut nor Maine bind 1. Connecticut potentially import constrained – Prices decline until system requirement met 2. Maine potentially export constrained – Prices: Connecticut = Rest of Pool = Maine • Only Connecticut constraint binds 3. Rest of pool – Prices decline until Connecticut binds, remaining prices decline until • Auction finds prices and supply levels such that system met – Prices: Connecticut > Rest of Pool = Maine – System requirement is met • Only Maine constraint binds – Connecticut requirement is met with local capacity and imports – Prices decline until system requirement met, Maine price declines until Maine constraint met – Maine does not supply more than its local need plus export limit – Prices: Connecticut = Rest of Pool > Maine • Both Connecticut and Maine constraints bind – Prices decline until Connecticut binds, remaining prices decline until system met, then Maine declines until Maine constraint met – Price: Connecticut > Rest of Pool > Maine No rationing, except imports/exports and Information policy existing capacity • What happens if a bidder drops from 800 MW to • Demand curve and starting price announced 600 MW at the clearing price? Either 800 MW or before auction 600 MW is accepted • After every round, auctioneer reports • No rationing respects lumpy investments – System excess supply at end of round price • If multiple bidders drop at the clearing price, the • System excess supply calculation respects export limits for bids are accepted to minimize excess supply export constrained zones • Import/export bids may be rationed – Oversupply in export constrained zones – Zone-specific excess supply in import constrained • Existing capacity may be rationed zones is not reported Market power Market power solution • New capacity • Addressing market power in capacity market is essential – New capacity bids are not mitigated in any way • Strong incentive to exercise market power (except starting price) – Assumes competition for new capacity – Existing capacity has substantial sunk costs • Existing capacity – New capacity is only a tiny fraction of total – For purposes of price setting, all existing capacity, except for retirements and imports/exports, is considered bid in at a price of zero – Market is concentrated, especially in zones – Capacity can opt out of capacity market with exit bid above the clearing • Any of top-4 suppliers could unilaterally set price price • Long-term price signals are more stable and efficient if – Retirement bids submitted at start of auction • Accepted retirements excluded from any future capacity auction determined from competitive forces, rather than market • Retirements may be rejected for reliability reasons, but only if the reliability power problem cannot be resolved during the planning period with alternative actions, such as transmission upgrades or new capacity – Import/Export bids submitted at start of auction • Accepted imports/exports must respect import/export limits • Exports in constrained zones limited to quantity that cannot be supplied by unconstrained zones • Import/exports must be backed up by contract

Recommend

More recommend