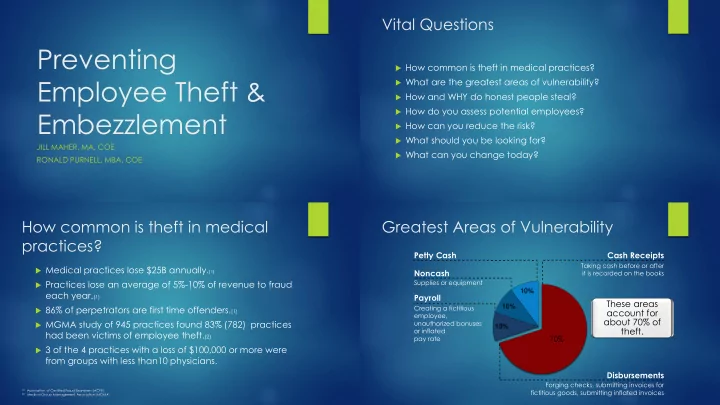

Vital Questions Preventing How common is theft in medical practices? Employee Theft & What are the greatest areas of vulnerability? How and WHY do honest people steal? How do you assess potential employees? Embezzlement How can you reduce the risk? What should you be looking for? JILL MAHER, MA, COE What can you change today? RONALD PURNELL, MBA, COE How common is theft in medical Greatest Areas of Vulnerability practices? Petty Cash Cash Receipts Taking cash before or after Medical practices lose $25B annually. (1) Noncash it is recorded on the books Practices lose an average of 5%-10% of revenue to fraud Supplies or equipment 10% each year. (1) Payroll These areas 10% Creating a fictitious 86% of perpetrators are first time offenders. (1) account for employee, about 70% of MGMA study of 945 practices found 83% (782) practices unauthorized bonuses 10% theft. or inflated had been victims of employee theft. (2) 70% pay rate 3 of the 4 practices with a loss of $100,000 or more were from groups with less than10 physicians. Disbursements Forging checks, submitting invoices for (1) Association of Certified Fraud Examiners (ACFE) fictitious goods, submitting inflated invoices (2) Medical Group Management Association (MGMA)

Case Study #1: Receptionist receives $30 copayment Case Study #1: Pocketing in cash from patient. Pocketing Copayments Receptionist gives a written receipt for Copayments ALL transactions, AND…documented Receptionist receives $30 copayment on encounter form. in cash from patient. What was “Cash Out” occurs twice per day Receptionist writes off $30 from missing? ( Employee 2 ) patient account. “Big Cash Out” at the end of day ( Employee 3 ) Receptionist pockets $30 cash. Reconciled and deposited After $400 was taken, the theft ( Employee 4 ) was discovered during audit. Employee reprimanded, but not terminated. Pocketing Copays Case Study #2: Frames needing Referred to law enforcement? lenses Patient presents to Optical with frames and a prescription Referred 61% of the time, not referred 39% of the time Why not? Frames have our barcode and stock Bad PR lenses. Handled internally Private Settlement Inventory show frame in stock Too Costly Lack of Evidence When queried, patient states frame Civil Suit was given to her by a friend Perpetrator Disappeared Police determine friends boyfriend Nothing recovered 58% of the time stole frame, girlfriend did not like them, gave them to her friend. * Association of Certified Fraud Examiners 2014

Case Study #2: Payments Received in the Mail No video surveillance. Frames Patient chose the wrong optical to have needing lenses How are your insurance and patient payments received? them filled. Post office box What was “Someone” forgot to remove the tags Delivery to the office missing? from stolen goods. Electronic Deposit Lock Box Boyfriends should not pick out frames. Checks should be endorsed and totaled upon receipt. All of the above This should be a two person job. Deposit slip to bank must match total. Case Study #3: Opening the Mail Case Study #3: Opening Temporary person is assigned to open and Oversight of the temporary employee sort the mail. the Mail Checks are electronically deposited daily Checks are electronically deposited daily What was into practice account. into practice account. Missing? Person pocketed a few checks made out Person pocketed a few checks made out to an individual physician. to an individual physician. Lock Box not used Person endorsed these checks to herself Person endorsed these checks to herself on behalf of physician and deposited into on behalf of physician and deposited into her personal account. her personal account. Pattern discovered a week later when Pattern discovered a week later when checking status of payment and discovering checking status of payment and discovering payment was made and check deposited. payment was made and check deposited. Total loss: $2,700, recovered from insurance. Total loss: $2,700, recovered from insurance.

Case Study #4: Pocketing Cash Case Study from Orders #4: Pocketing The practice does not monitor contact lens inventory . Cash from Patient calls in to order contact lenses. Orders Practice does not have a mandatory What was receipt policy Patient stops in to pick up contact lenses and pays $150 cash. missing? No corresponding charge entered Practice does not have a second employee into patient account. Employee pockets $150 cash. Practice does not have a camera system How and why do honest people How to Assess Potential Employees steal? Rule of thumb among forensic accountants and auditors: The Challenge: 10% of employees will always steal, 86% of perpetrators were terminated (1) 10% will never steal, 10-10-80 Rule: 62% were not prosecuted (1) 80% will steal under the right set of circumstances. The Solution: All potential employees must be screened: Right set of circumstances for honest people to steal: Verify past employment and references Financial pressure : Could be an addiction, loss of 1. Check criminal history household income, medical bills, debt, accident, or greed. Check civil history Rationalization : Begins with “just borrowing.” 2. Driver license violations Credit checks (76% of practices did not perform Opportunity : Perception of borrowing or stealing without 3. getting caught. credit checks (1) ) (1) MGMA Study

Use of Credit Information How to Mitigate Risk: Trust but Verify As of 2015, Eleven states limit employers’ use of credit information: 1. Screen job applicants thoroughly. California Maryland Assess high-risk areas: co-pays, mail receipts, 2. Colorado Nevada disbursements, patient refunds, payroll. Connecticut Oregon 3. Segregate duties. Delaware Vermont Conduct unscheduled audits: create a perception of Hawaii Washington 4. detection by monitoring processes and testing compliance. Illinois Be alert to disgruntled or stressed employees, also those 5. whose lifestyle seems beyond their means. Contact your state department of labor before conducting Implement strong accounting controls with proper credit checks on potential employees. 6. checks/balances. Consider annual outside audit. Case Study #5: The Weekend Case Study #5 Continued: The Optician Weekend Optician The practice has a weekend optician, This was the practice BEFORE we hired skilled qualified and willing to work on her Saturdays Patient stops in purchases Maui Jim Undercover police officer hired Sunglasses. No corresponding charge entered Marked bills in her purse into patient account. Arrested and ordered restitution Employee pockets $400 cash. We hire her “to do the same thing”

Case Study An Ounce of Prevention … #5: The A certified employee presented at a Weekend Require that deposits must be made daily. time we could really use her. We hired her based on her certification Optician Assign different people to open and close the office. and a reasonable explanation on her application. What was Implement automated inventory controls. missing? We did NOT check references Observe/investigate territorial behavior. We did not perform a background check Check all refunds with PO Box addresses. We did not contact her previous employer (awkward) An Ounce of Prevention An Ounce of Prevention … Honesty starts at the top…. Set the right atmosphere. We wary of employees who NEVER take time off. Watch COGS carefully. Change protocols periodically.

Characteristics of Embezzlers.. Characteristics of Embezzlers.. What characteristics should alert you? Know “Who is the typical thief?” This person never takes a vacation A long time employee They are very protective of their job Has the full trust of the doctor and is a Work many hours of overtime, often alone devoted employee Never cross-trains a substitute The doctor often depends on this person in office emergencies Usually living beyond their means Lifestyle and behavioral changes Guidance from the FDIC Case Study #6 – Mainely Payroll Don’t forget the “outside threat” “Such a policy is considered an important internal safeguard largely because of the fact that perpetration of an embezzlement of any substantial size usually requires the constant presence of the embezzler in order to manipulate records, respond to inquiries from customers or other employees, and otherwise prevent detection. It is important for examiners and bank management to recognize that the benefits of this policy may be substantially, if not totally, eroded if the duties performed by an absent individual are not assumed by someone else.”

Recommend

More recommend