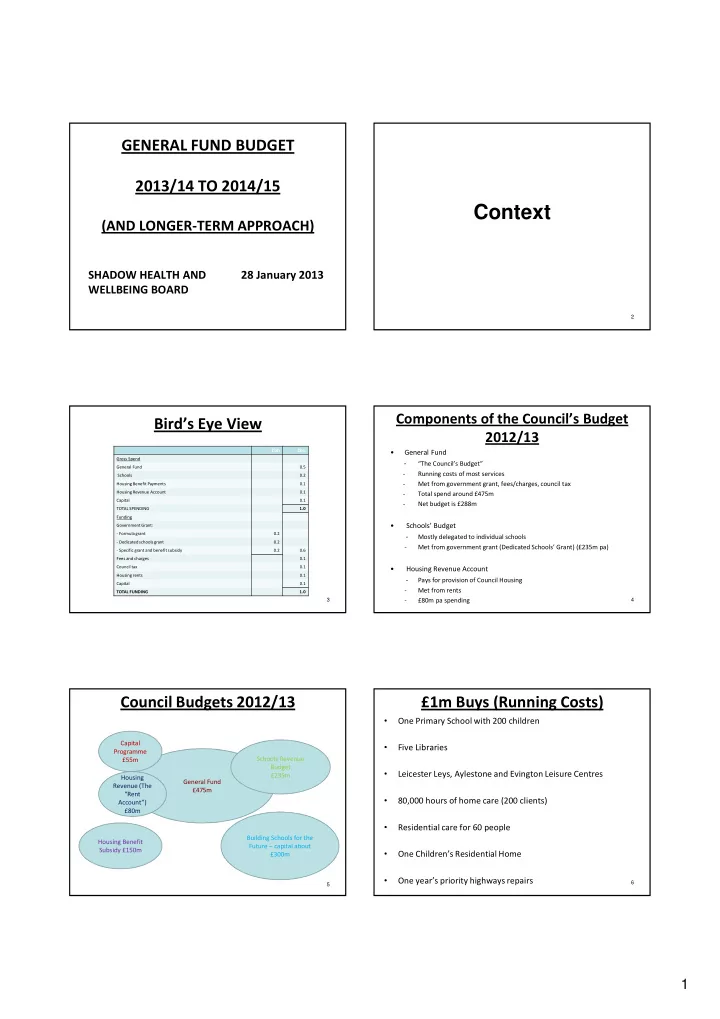

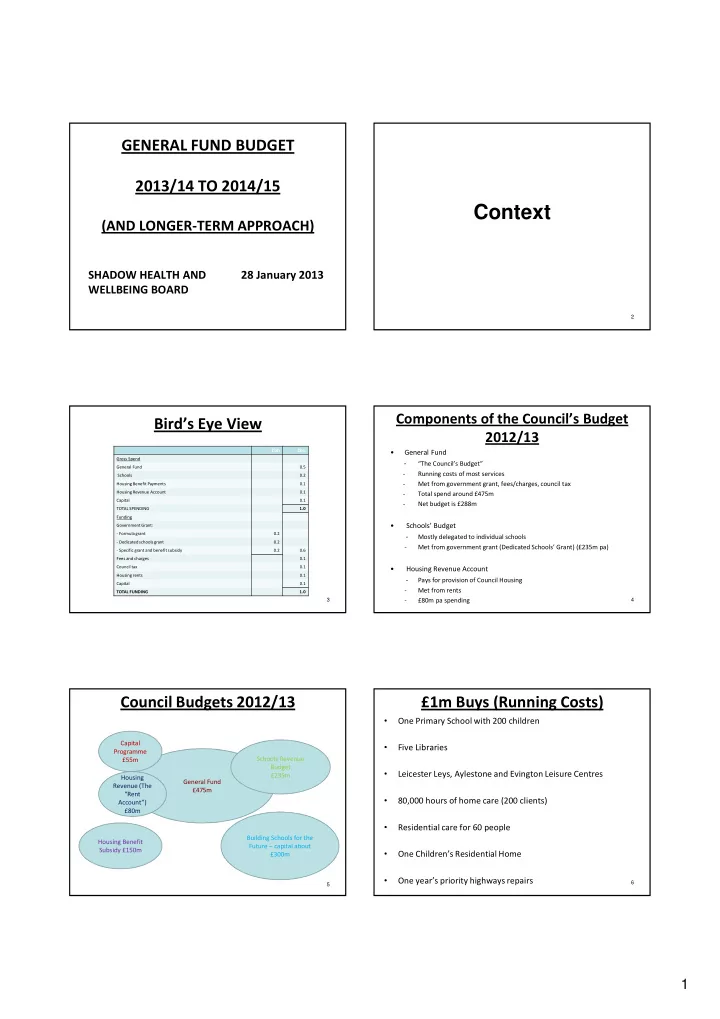

GENERAL FUND BUDGET 2013/14 TO 2014/15 Context (AND LONGER-TERM APPROACH) SHADOW HEALTH AND 28 January 2013 WELLBEING BOARD 2 Components of the Council’s Budget Bird’s Eye View 2012/13 £bn £bn • General Fund Gross Spend - “The Council’s Budget” General Fund 0.5 - Running costs of most services Schools 0.2 - Met from government grant, fees/charges, council tax Housing Benefit Payments 0.1 Housing Revenue Account 0.1 - Total spend around £475m Capital 0.1 - Net budget is £288m TOTAL SPENDING 1.0 Funding • Schools’ Budget Government Grant: - Formula grant 0.2 - Mostly delegated to individual schools - Dedicated schools grant 0.2 - Met from government grant (Dedicated Schools’ Grant) (£235m pa) - Specific grant and benefit subsidy 0.2 0.6 Fees and charges 0.1 Council tax 0.1 • Housing Revenue Account Housing rents 0.1 - Pays for provision of Council Housing Capital 0.1 - Met from rents TOTAL FUNDING 1.0 3 - £80m pa spending 4 Council Budgets 2012/13 £1m Buys (Running Costs) • One Primary School with 200 children Capital • Five Libraries Programme Schools Revenue £55m Budget • Leicester Leys, Aylestone and Evington Leisure Centres £235m Housing General Fund Revenue (The £475m “Rent • 80,000 hours of home care (200 clients) Account”) £80m • Residential care for 60 people Building Schools for the Housing Benefit Future – capital about Subsidy £150m • One Children’s Residential Home £300m • One year’s priority highways repairs 6 5 1

2012/13 Budget • The most severe government cutbacks in decades. • Second year of four year government spending review. • Gross cuts of £40m p.a. by 2014/15. Where were we in • Budget “balanced” to 2014/15, but environment extremely volatile:- February? - No grant certainty beyond 2012/13 - No national plans beyond 2014/15 - Localisation of business rates in 2013/14 - Council tax reduction scheme - National cuts likely beyond 2014/15 7 8 General Fund Budget 2012/13 Finance Settlement New Homes Reserves Bonus £7m £3m Formula Grant Council Tax 2013/14 £177m £98m Council tax freeze grant to £2m 2014/15 Specific grant, fees, charges £188m Total £475m Net Budget £288m 9 10 Local Government Finance Local Government Finance Settlement - Headlines Settlement – The New System • Finally published (with gaps) late on 19 th • Formula grant has ceased December • Replaced by: • Two year settlement – 2013/14 and 2014/15 – Business rates retention • Our key grant figures:- – Revenue Support Grant - 2013/14 £175m • Some specific grants have transferred to mainstream funding - 2014/15 £153m • Now over £70m cuts 2011/12 to 2014/15 • Education Services Grant • No changes to trajectory of cuts after 2014/15 – • Early Intervention Grant massive reductions likely in each of 2015/16, 2016/17 and 2017/18 • New Spending Review in “first half of 2013” 11 12 2

How the New System Works (2) How the New System Works (1) £m Start Up Funding Allocation is split between: £m £m “Baseline funding level” 88.5 What we would have had if formula grant continued 178.2 Revenue Support Grant 133.1 Add former specific grants: 221.6 - Early Intervention Grant 13.6 Business Rates Retention Scheme - Homelessness Prevention Grant 0.5 Baseline funding level 88.5 - Flood Grant 0.1 Minus Business rates baseline (46.3) - Learning Disability Health Reform Grant 10.7 Equals top up grant 42.2 Less Education Services Grant (6.6) 18.3 We now receive: Other changes: 50% of local rates Council tax reduction scheme 22.7 + Top up grant 2011/12 Council Tax Freeze Grant 2.3 + Revenue Support Grant “Start Up Funding Allocation” 221.6 This replaces formula grant 13 14 Local Government Finance Settlement – Early Intervention Grant • This grant is being added to our mainstream funding Budget Approach • Prior to the transfer, it has been cut by the DFE:- - to pay for two year old nursery places - to provide a national bidding pot of £150m • Our grant will fall from £19.4m to £13.6m. On a like for like basis this amounts to a £4.6m reduction 15 16 Our Approach to 2013/14 Our Approach to 2014/15 • Three year budget approved last year to 2014/15 • Protect front-line services wherever possible • Make sensible savings in-year to reduce burden of cuts. This is heavily • Savings needed in 2015/16 and 2016/17 will mean a radical review directed to back office. of our services • Protect our facilities. No closures to:- - Community Centres • Two year proposals published now - Museums - Sports Facilities • Gives time for further consideration over next 12 months - Arts Venues - Libraries • Financial climate necessitates change of emphasis: • Protect and increase funding for safeguarding • No changes to adult care criteria – budget a continuous process, not just once a year • Redesign and protect direct services to vulnerable children and families – sensible savings decisions already taken • Some changes of focus:- - Children’s Centres – some facilities in least deprived areas will have • Some changes in future budget policy reduced activity - Homelessness – focus on prevention not temporary accommodation 18 17 3

Actions being taken to reduce Budget – Total Savings budget pressures 2013/14 2014/15 £m £m Examples Action in hand 3.9 5.4 Gross savings 4.0 9.3 • Further savings across all divisions in Less budget pressures (3.1) (2.6) Corporate Resources Department (£2.6m) 4.8 12.0 • Increased use of assistive technology (£0.1m) Less savings already accounted for (0.2) (1.2) • Renegotiation of contract to clean community 4.6 10.9 centres (£0.1m) • Re-negotiation of Children’s Centre external contracts (£0.2m) NB: £4m support to EiG • Property Services Savings (£0.9m) • Management Savings 19 20 Estimated Posts Deleted Other Policy Changes • City Development and Neighbourhoods 7 • Building Schools for the Future • Education and Children’s Services 62 • Adult Social Care 6 • Inflation • Housing 34 TOTAL 109 Plus actions in hand:- • Managed Reserves Strategy • Review of Property Services • Review of Corporate Resources divisions 67 • Other 6 21 22 Spending Forecasts 2013/14 to 2016/17 Managed Reserves Strategy 2013/14 2014/15 2015/16 2016/17 £m £m £m £m • A strategy for building up then using reserves over 4 Divisional Budgets as agreed in February 236.1 230.9 230.9 230.9 years Capital Financing & Corporate Budgets 14.3 12.9 14.6 14.9 Inflation 5.5 10.4 13.7 17.0 Other Changes:- Market Prudential Borrowing 0.2 0.2 0.2 0.2 • Addresses the huge government cuts faced in medium BSF Affordability Contribution 0.6 1.0 1.0 1.0 term CLABS 3.1 3.1 3.1 3.1 Adults’ Demographic Growth 2.5 5.0 One off Provisions agreed in 2012/13 Budget (largely severance) 12.5 • Reserves topped up by one-off monies in 2013/14 and Planning Provision 3.0 6.0 9.0 2014/15 In-year Contingencies against Slippage 3.0 3.0 Energy Cost Reduction Schemes 1.5 1.5 Service Transformation Provisions 1.0 5.0 • Reserves drawn down in 2015/16 and 2016/17 Council Tax Reduction Scheme – Hardship Fund 0.5 0.5 0.5 0.5 Former Specific Grants 18.4 18.7 19.0 19.4 Cuts Package 2013/14 Budget (4.7) (10.8) (10.8) (10.8) • Maintain a minimum working balance of £15m Growth – Cuts in Early Intervention Grant 4.0 Managed Reserves Strategy 6.4 8.8 (8.8) (7.8) 23 NET BUDGET 302.4 288.2 271.9 282.4 24 4

Recommend

More recommend