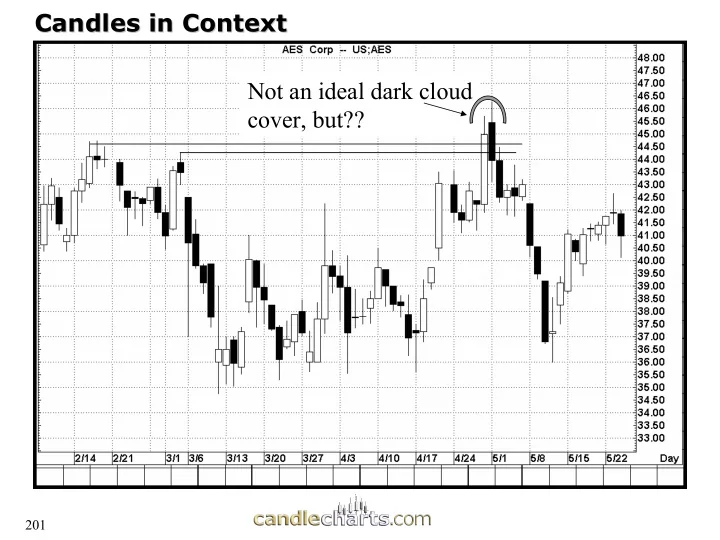

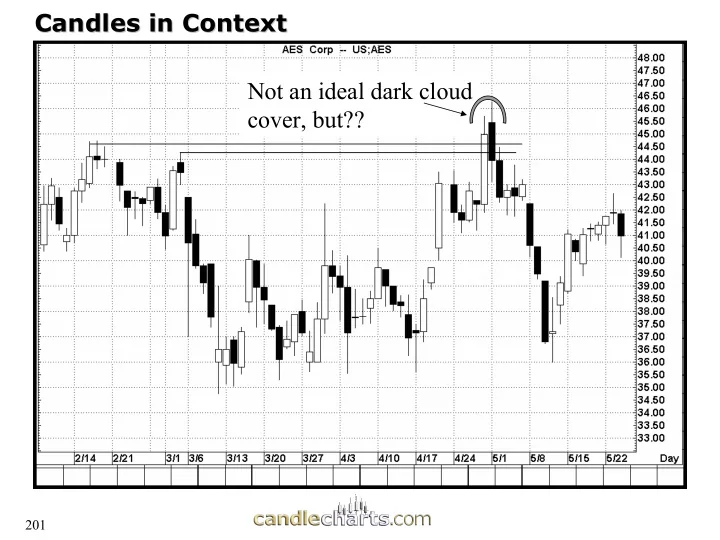

Candles in Context Candles in Context Not an ideal dark cloud cover, but?? 201

Trading Tactics - - Candles in Context Candles in Context Trading Tactics 1 a) What are the candle lines at the arrows at 1 and 2 ? b) Where would you be more bullish, at 1 or 2, and why? c) On what candle line would you buy after the signals at 1 and 2? d) If you buy at 1 or 2 where is a potential protective sell 2 stop? 202

Nison Trading Nison Trading Principle Principle Do not only consider the Do not only consider the market’s price. Analyze the market’s price. Analyze the shape and size of candle shape and size of candle lines at that price. lines at that price. 203

How are new highs are made 204 204

How are new highs or lows made How are new highs or lows made New High Close Bulls’ can’t sustain rallies for more than one session as shown my the red arrow. 205

How are new highs made? How are new highs made? 206

How are new highs/lows made? How are new highs/lows made? � � � 207

The water looks fine! The water looks fine! 208

“Those knowing when Those knowing when “ to fight and when not to fight and when not Candlecharts.com will be victorious” will be victorious” Consider risk-reward 209

Nison Trading Nison Trading Principle Principle Even a “perfect” candle signal Even a “perfect” candle signal does not equal a good trade! does not equal a good trade! YOU MUST ALWAYS YOU MUST ALWAYS JUDGE THE POTENTIAL JUDGE THE POTENTIAL TRADE’S RISK- -REWARD. REWARD. TRADE’S RISK 210

Stops Stops 211

Stops Stops window Window as support shown by bullish shadows and hammers at the arrows. Once the support is broken we must readjust our bullish view. 212

Obtaining targets Obtaining targets Buy on the hammer during the week of April 8, an obvious resistance area would hammer be towards 615. 213

Obtaining Price Targets Obtaining Price Targets Shooting Star Shooting star confirms resistance at top end of box range. Sell on the shooting star with a potential target at bottom of the box range near 55. 214

Using Western TA for target Using Western TA for target DJ INDU AVERAGE 1075 1070 1065 1060 1055 1050 1045 1040 1035 1030 1025 1020 1015 1010 1005 1000 Bullish engulfing 995 pattern gives a turning 990 985 signal with falling 980 resistance line as a 975 target 970 x10 19 25 4 11 18 25 1 8 15 22 29 6 March April May 215

Trading Tactics- - Case Study Case Study Trading Tactics COMVERSE TECH 13.5 13.4 13.3 Bearish Bullish shadows at arrows show demand. A hammer is 13.2 a potential buy signal. If the trader feels that the engulfing 13.1 market was to high to buy on the next session’s open, pattern 13.0 there is now a window as support. On a correction, we 12.9 can buy within the window. A potential target is the 12.8 April highs near 13.4. Once there a bearish engulfing 12.7 pattern confirms this resistance. 12.6 12.5 12.4 12.3 12.2 12.1 12.0 11.9 11.8 11.7 11.6 Rising 11.5 11.4 window 11.3 11.2 Hammer 11.1 11.0 10.9 15 22 29 6 13 20 28 May 216

Trading Tactics- - Targets Targets Trading Tactics FIDELITY NATL 32.0 31.5 31.0 30.5 30.0 29.5 29.0 28.5 28.0 hammers 1) Buy on first hammer, exit at bearish engulfing 27.5 pattern (circled). This bearish engulfing pattern 27.0 took on extra significance since it also confirmed resistance. 26.5 Or 26.0 2) Sell short at bearish engulfing pattern and exit Volume 1000 at second hammer (which confirmed the first 900 800 hammer’s support area). 700 600 500 400 300 x1000 3 20 28 3 10 17 24 1 8 15 June July 217

Trading Tactics- - Targets Targets Trading Tactics Use hammer to buy and window to exit Falling window hammer 218

Hammer and Risk/Reward Hammer and Risk/Reward reward Risk 219

Risk/Reward Risk/Reward INTL GAME TECH 69.5 Morning doji star as support. Buy on 69.0 hammer, target is recent pivot high. This 68.5 represents an attrive r/r. 68.0 67.5 67.0 Pivot 66.5 high 66.0 65.5 65.0 64.5 64.0 63.5 63.0 62.5 62.0 61.5 61.0 60.5 60.0 14 22 28 4 11 19 25 February Ma 220

Recommend

More recommend