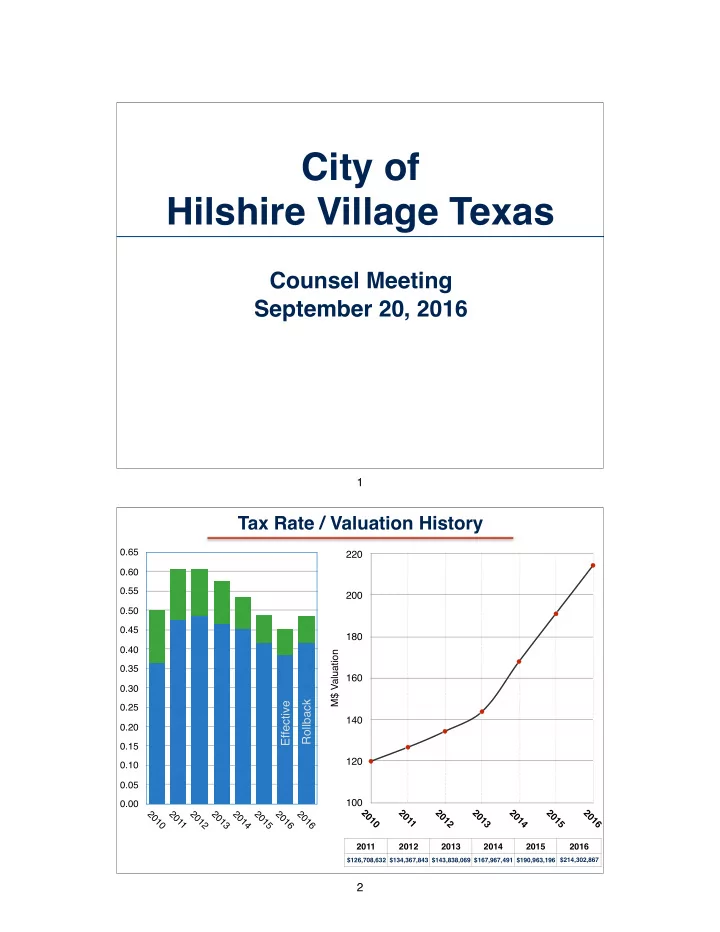

City of Hilshire Village Texas Counsel Meeting September 20, 2016 1 Tax Rate / Valuation History Title 0.65 220 0.60 0.55 200 0.50 0.45 180 0.40 M$ Valuation Value Axis 0.35 160 0.30 Rollback Effective 0.25 140 0.20 0.15 120 0.10 0.05 100 0.00 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 1 2 3 4 5 6 0 1 2 3 4 5 6 6 2011 2012 2013 2014 2015 2016 $126,708,632 $134,367,843 $143,838,069 $167,967,491 $190,963,196 $214,302,867 2

2016 Tax Rate Comparison Effective Median Roll Back 2014 2015 2016 Base 0.449828 0.415397 0.384876 0.400123 0.415369 Debt 0.083613 0.072683 0.066933 0.066933 0.066933 Tax Rate 0.533441 0.488080 0.451809 0.467056 0.482302 Property Value 2014 Tax $ 2015 Tax $ 2016 Tax $ $500,000 $2,667 $2,440 $2,259 $2,335 $2,412 Diff vs 2015 -$181 -$105 -$29 $1,000,000 $5,334 $4,881 $4,518 $4,671 $4,823 Diff vs 2015 -$363 -$210 -$58 $1,500,000 $8,002 $7,321 $6,777 $7,006 $7,235 -$544 -$87 Diff vs 2015 -$315 3 2016 Impact of Increasing Assessed Value Assume assessed value increases by 10% 2016 2015 Effective Median Roll Back Tax Rate 0.488080 0.451809 0.467056 0.482302 2015 Assessed Value 2015 Tax $ 2016 Tax $ $500,000 $2,440 $2,485 $2,569 $2,653 Diff vs 2015 $45 $128 $212 $1,000,000 $4,881 $4,970 $5,138 $5,305 Diff vs 2015 $89 $257 $425 $1,500,000 $7,321 $7,455 $7,706 $7,958 Diff vs 2015 $134 $385 $637 4

2017 Fund Contributions 2016 Utility Fund 2016 General Fund Amegy Bank Checking $ 454,444 Amegy Savings $ 973,299 Receivables $ 42,063 Amegy Checking $ 17,049 Total $ 496,507 Total $ 990,348 Operating Reserve $ 200,000 $ 900,000 Operating Reserve Balance $ 296,507 Balance $ 90,348 2017 General Fund Contribution Effective Median Rollback Rate(- debt component) 0.384876 0.4001225 0.415369 Valuation $214,303 K Capital Improvement Property Tax Income $825 K $857 K $890 K Franchise & Sales Tax $109 K Other Income Sources $182 K Income Total $1,116 K $1,148 K $1,181 K General Expenses Est. $1,073 K Net Contribution $43 K $76 K $109 K 5 Title Utility Income Analysis over Time 5.8 4.8 3.8 2.8 Houston Rate Hilshire Rate 1.8 2009 2010 2011 2012 2013 2014 2015 $500 K $400 K Revenue Expense $300 K $100 K Value Axis $50 K Net Contribution to Utility Fund $0 K -$50 K -$100 K 2009 2010 2011 2012 2013 2014 2015 6

Recommend

More recommend