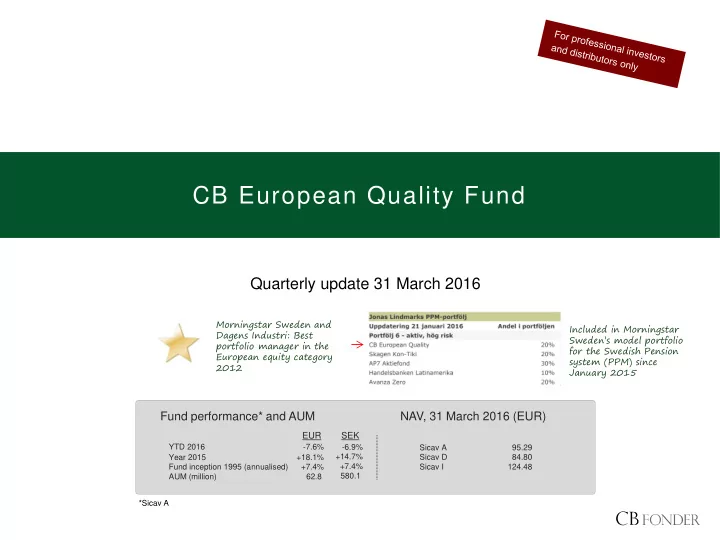

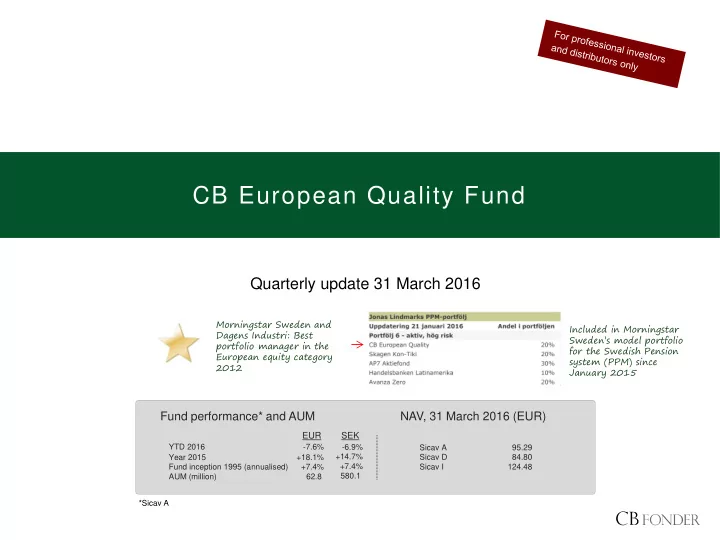

CB European Quality Fund Quarterly update 31 March 2016 Morningstar Sweden and Included in Morningstar Dagens Industri: Best Sweden’s model portfolio portfolio manager in the for the Swedish Pension European equity category system (PPM) since 2012 January 2015 Fund performance* and AUM NAV, 31 March 2016 (EUR) EUR SEK YTD 2016 -7.6% -6.9% Sicav A 95.29 +14.7% Sicav D 84.80 Year 2015 +18.1% +7.4% Fund inception 1995 (annualised) +7.4% Sicav I 124.48 580.1. AUM (million) 62.8. *Sicav A

The strategy and the team CB European Quality Fund The team Overview - CB European Quality Fund Carl Bernadotte, Portfolio manager & owner A long-only equity fund with a focus on European quality growth >25 years’ experience companies Born 1955 Owns shares in CB European Quality Fund The strategy was launched in 1995 Concentrated portfolio (20-33 holdings) and a long-term perspective Marcus Grimfors, Portfolio manager Benchmark: MSCI Europe Net 7 years’ experience Born 1981 Objectives: Owns shares in CB European Quality Fund Lower standard deviation than benchmark Outperform benchmark over 12 months Alexander Jansson, Portfolio manager & CEO 7 years’ experience Born 1983 Overview - CB Fonder Owns shares in CB European Quality Fund Company founded in 1994 Erik Allenius Somnell, Business development Family owned, acting under the supervision of the Swedish 3 years’ experience Born 1984 Financial Supervisory Authority Owns shares in CB European Quality Fund Guidelines: active, ethical and long-term Viktor Sonebäck, Intern An ethical and sustainable framework is applied in the portfolio Royal IT (KTH) 2012-2017 management Born 1993 The team is based in Stockholm, Sweden; all fund administration is performed in Luxembourg 2

Strategy: Investment criteria CB European Quality Fund Large/mid caps - Min. market cap EUR 1 bn - Mature industries Resilient profit growth Primary - Proven management - - In any econ. environment - Stable dividend yield Conservative valuation Internal recruiting Secondary “ GARP” - Not necessarily high - - Subject to tradition - 3

Strategy: Structural growth CB European Quality Fund - Structural growth is more value generating than cyclical growth and less dependent on the economic cycle Structural vs. cyclical growth Structural growth is independent of the economic cycle Drivers: Strong multiple Structural Secular trends growth expansion relative Leading business component to the market model Stable profit growth Technical leadership Limited multiple Cyclical Purely driven by growth expansion relative macro factors component Cyclical model Structural model to the market Credit: Allianz GI 4 Design: CB Fonder

Strategy: High barriers to entry CB European Quality Fund protected growth Competetiveness: Porter’s 5 forces -model Barriers to entry Threat of new entrants • Cost, time, knowledge Negotiating power versus suppliers • Economies of scale • Fragmentation of suppliers • Technologies, patents etc. - monopoly to perfect competion • Degree of specialisation Competitive Bargaining power Bargaining power of rivalry among of suppliers incumbents customers (buyers) Customer/client relationship • Degree of customer loyalty • Switching costs Barriers to substitution Threat of substitute • • products or services Pricing power Brand recognition • Product complexity, patents etc. Source: Competitive Strategy: Techniques for Analyzing Industries and Competitors, 5 Michael E. Porter, 1980. Design: CB Fonder

Strategy: Stock selection according to a CB European Quality Fund bottom-up-strategy Quantitative analysis Fundamental analysis Technical analysis • • • Momentum factors – is the short-term Structural growth and barriers to Internally developed models for entry/moat – see p. 4 and 5. screening and ranking based on trend supportive of the sector/style? quantitative variables. • Business idea – robust enough to • No target prices: ” let the trend be • your friend ”. deliver stable profit growth over an Valuation: in comparison to peers entire economic cycle? and the company's own history and • growth rate. Timing for entry and exit levels; • Management – do they deliver as increasing and reducing portfolio • promised? Main multiples: P/E, P/B and PEG. positions. The fundamental and quantitative analysis form the investment universe. The technical analysis plays a crucial role for the weighting of the portfolio. 6

Performance: The fund and the index CB European Quality Fund The fund has returned -6.8% during the last 12 months; significantly better than benchmark, MSCI Europe, which during the same period had a -13.7% return. The last three months the fund has returned -7.6%, which is 0.6% lower than benchmark. The fund and the benchmark index, 1 year (EUR) The fund and the benchmark index, 3 months (EUR) 110 105 CB European Quality Fund A (EUR) 105 100 MSCI Europe Net (EUR) 100 95 -7.1% 95 -6.8% 90 -7.6% 90 -13.7% 85 CB European Quality Fund A (EUR) 85 80 MSCI Europe Net (EUR) 75 80 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 Dec-15 Jan-16 Feb-16 Mar-16 12% 2% 11% 10% 9% 1% +8.0% 8% 7% 6% 0% 5% -0.6% 4% 3% -1% 2% 1% -2% 0% CB European Quality Fund A -1% CB European Quality Fund Sicav A vs MSCI Europe Net vs MSCI Europe Net -2% -3% -3% Dec-15 Jan-16 Feb-16 Mar-16 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 Source: MSCI, CB Fonder 7 *Data as of 31 March 2016

Performance: The fund and the index CB European Quality Fund The fund (EQF) and the benchmark index, 10 years (EUR) 175 175 CB European Quality Fund SICAV A 150 150 MSCI Europe Net 125 125 100 100 75 75 50 50 Mar-06 Mar-08 Mar-10 Mar-12 Mar-14 Mar-16 Key ratios (10 years)* EQF Europe +30.1 Performance, % +33.7 The fund has outperformed the benchmark index, and has Standard deviation, % 13.14 15.38 due to its lower risk (beta: Sharpe (0%) +0.22 +0.17 0.70) generated a significant -54.10 Max drawdown, % -45.78 positive alpha. The fund’s Beta against MSCI Europe +0.70 risk-adjusted return, Sharpe, Alpha against MSCI Europe, % p.a. +1.07 is higher than that of the index. Consistency with MSCI Europe, % 50.0 Tracking error, % 8.72 Information ratio +0.03 Source: MSCI, CB Fonder 8 *Data as of 31 March 2016

The Portfolio: Contributors and detractors CB European Quality Fund Top three quarterly contributors and detractors, Q1 2016 (EUR) -1,2% -1,0% -0,8% -0,6% -0,4% -0,2% 0,0% 0,2% 0,4% Company Contr./Detr. % Avg. weight*, % Performance, % Kerry +0.30 +7.3 4.2 Geberit +0.16 +5.2 3.9 TKH Group +0.12 +0.5 0.3 Shire -0.78 3.1 -21.3 Prudential -0.78 1.2 -23.1 Next Plc -1.14 3.9 -30.5 *Average values in Q1 2016. Source: Bloomberg, CB Fonder • Ireland’s Kerry – a global supplier of additives/ingredients to the food industry – benefit from the increasing outsourcing in terms of manufacturing and product innovation by the major players (Nestle, Unilever etc.). The company offers its customers complete solutions in taste, texture and nutrition and has delivered an annual profit growth of over 9% per year since 2006. Shares rose 7% during the quarter, in EUR. • Swiss Geberit is a market leading producer of products for the sanitation and HVAC industries. The company is exposed to a weak business cycle in the construction sector but have managed to deliver an organic growth of 4-6% annually over the last couple of years through a large market share and exposure to ”the right” markets (Germany and Switzerland). Since their acquisition of Sanitec in 2015 they are also behind well known Nordic brands such as IDO and lfö. The growth is in line with their medium-term objective and the stock rose 5% during the quarter, in EUR. • TKH Group – a Dutch tech company which delivers telecom, building and industry solutions – was added to the fund in the first quarter. The company is rather independent of the macro climate; their success builds on more company specific factors (such as increased market share through innovation and acquisition), something they historically have succeeded well with. Their average annual organic revenue growth has been 6% during the period 2006-2015 and their EPS growth has been 14% during the same period. The stock rose 1% during the quarter, in EUR. • . • British Shire – market leading in the treatment of ADHD, Gastroenterology and rare genetic disorders – experienced a weak quarter as a result of a weak stock price development within the biotech and health care sectors. The company has an appealing valuation as a result of the recent decrease in the stock price. The stock lost 21% during the quarter, in EUR. • Prudential – a British insurance company with a focus on Asia, the US and the UK – was hit hard by the general uncertainty regarding the financial stability in Asia and in China particularly. The stock lost 23% during the quarter, in EUR. • The British retail company Next – ”the H&M of the UK” – reported in line with expectations regarding the full year 2015 but expressed themselves very carefully regarding 2016. As a result, the stock lost 31% during the first quarter, in EUR. 9

Recommend

More recommend