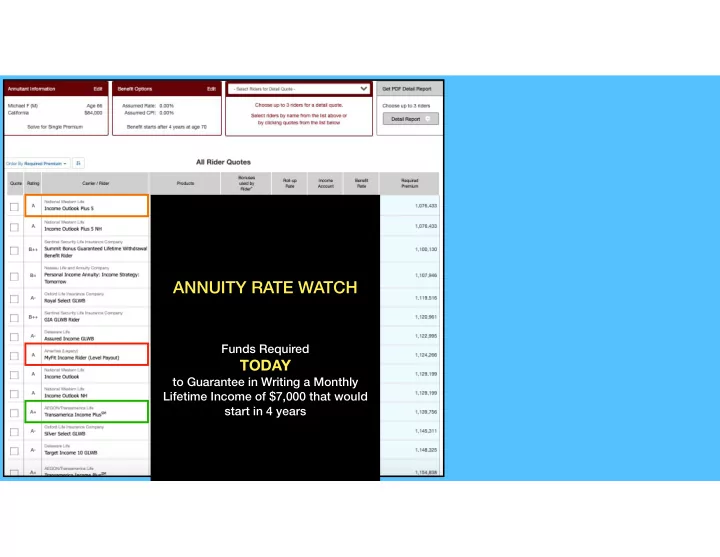

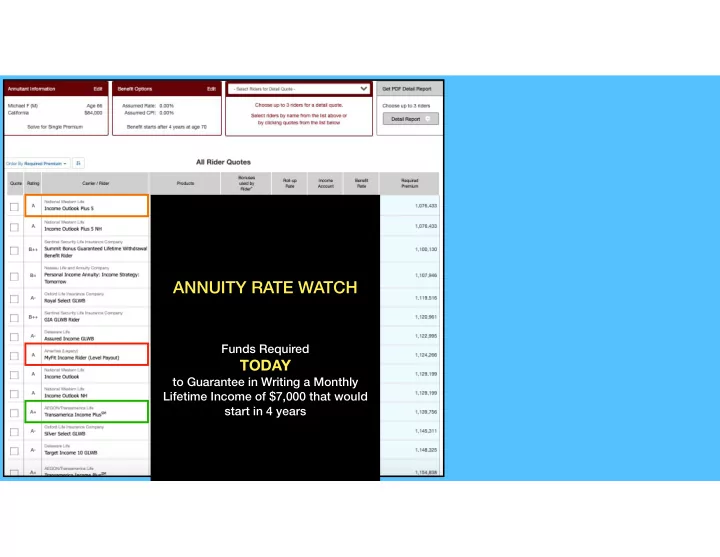

ANNUITY RATE WATCH Funds Required TODAY to Guarantee in Writing a Monthly Lifetime Income of $7,000 that would start in 4 years

COMPOUND INFLATION INDEX $1,076,433 0% ON ANNUAL PAYMENTS: TOTAL FUNDS YEAR AGE Monthly Annual RECEIVED 1 70 $7,000 $84,000 $84,000 2 71 $7,000 $84,000 $168,000 3 72 $7,000 $84,000 $252,000 4 73 $7,000 $84,000 $336,000 5 74 $7,000 $84,000 $420,000 6 75 $7,000 $84,000 $504,000 7 76 $7,000 $84,000 $588,000 8 77 $7,000 $84,000 $672,000 9 78 $7,000 $84,000 $756,000 10 79 $7,000 $84,000 $840,000 11 80 $7,000 $84,000 $924,000 12 81 $7,000 $84,000 $1,008,000 13 82 $7,000 $84,000 $1,092,000 14 83 $7,000 $84,000 $1,176,000 15 84 $7,000 $84,000 $1,260,000 16 85 $7,000 $84,000 $1,344,000 17 86 $7,000 $84,000 $1,428,000 18 87 $7,000 $84,000 $1,512,000 19 88 $7,000 $84,000 $1,596,000 20 89 $7,000 $84,000 $1,680,000 21 90 $7,000 $84,000 $1,764,000 22 91 $7,000 $84,000 $1,848,000 23 92 $7,000 $84,000 $1,932,000 24 93 $7,000 $84,000 $2,016,000 25 94 $7,000 $84,000 $2,100,000 26 95 $7,000 $84,000 $2,184,000 27 96 $7,000 $84,000 $2,268,000 28 97 $7,000 $84,000 $2,352,000 29 98 $7,000 $84,000 $2,436,000 30 99 $7,000 $84,000 $2,520,000 31 100 $7,000 $84,000 $2,604,000 32 101 $7,000 $84,000 $2,688,000

1 14 27 40 53 2 15 28 41 54 3 16 29 42 55 4 17 30 43 56 5 18 31 44 57 6 19 32 45 58 7 20 33 46 59 8 21 34 47 59 annuity 9 22 35 48 providers offering 154 10 23 36 49 any or all insurers of the 4 nationwide 11 24 37 50 types of safe 12 25 38 51 annuities. 13 26 39 52

ANNUITY RATE WATCH Funds Required TODAY to Guarantee in Writing a Monthly Lifetime Income of $7,000 that would start in 4 years

POINTS OF CONSIDERATION Is there a joint payee ? Are you really retiring at age 70, or 72? Will you be adding funds till then? Inflation quotes can follow, but $$$ Ameritas, Transamerica quotes to follow “Growth” annuities versus “Income” annuities

Recommend

More recommend