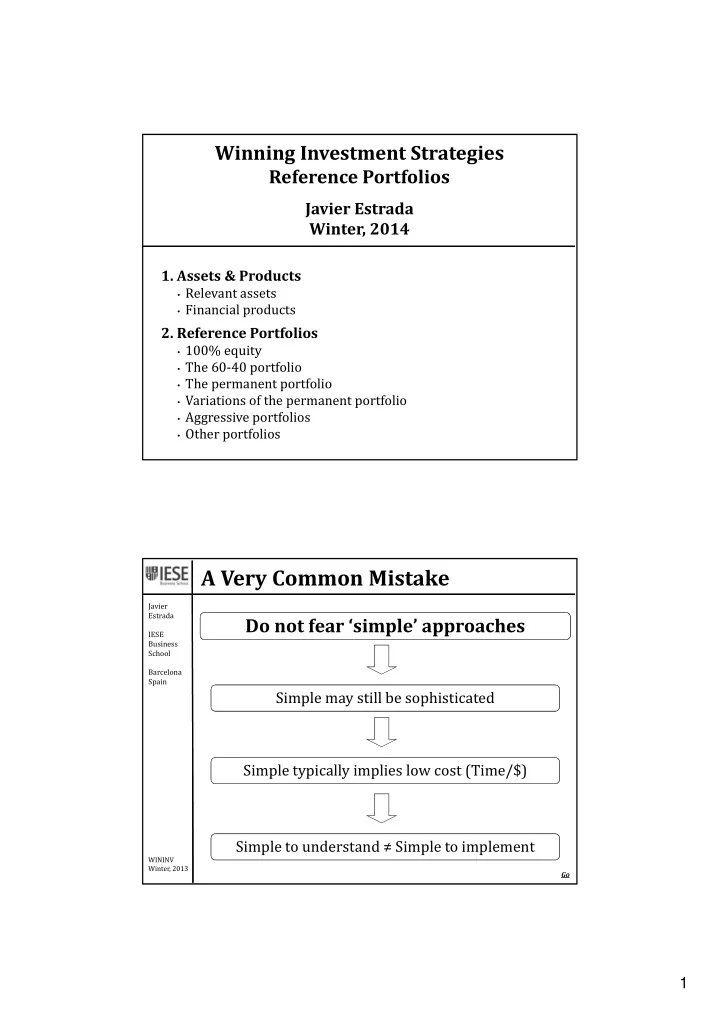

Winning Investment Strategies Reference Portfolios Javier Estrada Winter, 2014 1. Assets & Products • Relevant assets • Financial products 2. Reference Portfolios • 100% equity • The 60‐40 portfolio • The permanent portfolio • Variations of the permanent portfolio • Aggressive portfolios • Other portfolios A Very Common Mistake Javier Estrada Do not fear ‘simple’ approaches IESE Business School Barcelona Spain Simple may still be sophisticated Simple typically implies low cost (Time/$) Simple to understand ≠ Simple to implement WININV Winter, 2013 Go 1

Assets & Products Javier Estrada Focus on three (four) assets IESE Business School Barcelona Spain ∙ iShares MSCI ACWI ( ACWI ) Stocks ∙ Vanguard Total World Stock ( VT ) ∙ iShares Global Inflation Linked Bonds Bond Fund ( GTIP ) ∙ iShares Gold Trust ( IAU ) Gold ∙ SPDR Gold Shares ( GLD ) ∙ Money market fund Cash WININV ∙ Bank deposit Winter, 2013 100% Equity Javier Estrada An ‘aggressive/conservative’ portfolio IESE Business School Barcelona Spain Fully invested in stocks / Broadly diversified WININV Winter, 2013 2

The 60 ‐ 40 Portfolio Javier Estrada The ‘industry standard’ IESE Business School Barcelona Spain Blend of the two major asset classes WININV Winter, 2013 Go The Permanent Portfolio Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2013 3

The Permanent Portfolio Javier Estrada Prosperity ∙ Stocks IESE Business ∙ Cash School Recession Barcelona Spain Inflation ∙ Gold Deflation ∙ Bonds WININV Winter, 2013 Go The PP Without Cash Javier Estrada 25% in cash?! IESE Business School Barcelona Spain Equally‐weighted portfolio of stocks/bonds/gold WININV Winter, 2013 4

The 60 ‐ 30 ‐ 10 Portfolio Javier Estrada Same three assets as PP without cash IESE Business School Barcelona Spain Different weighting (60S ‐ 30B ‐ 10G) WININV Winter, 2013 Reference Portfolios Javier Estrada IESE Business School Barcelona Spain (*) Annual rebalancing WININV Winter, 2013 5

A More Aggressive Portfolio? Javier Estrada Enhancing the return of 100% equity IESE Business School Barcelona Spain An investor may need/want a higher return than that expected from the (world) equity market Core Satellites + (Neutral position) (Tilts) ‘Core‐satellite’ approach WININV Winter, 2013 A More Aggressive Portfolio? Javier Estrada Neutral position: World market IESE (Avoid the ‘home bias’) Business School Barcelona iShares MSCI ACWI Vanguard Total World Spain (0.34%) Stock (0.19%) Introduce tilts to enhance the return ( and risk ) of the portfolio Small‐caps Emerging markets Value Frontier markets WININV Winter, 2013 6

The KISS Portfolio Javier Estrada Keep It Simple, Saver IESE Business School Barcelona Spain Same general idea: Buy / Hold / Rebalance US stocks International stocks US Bonds In varying ‘personalized’ proportions WININV Winter, 2013 Go The Gone Fishin’ Portfolio Javier Estrada Buy / Hold / Rebalance (60 ‐ 30 ‐ 10) IESE Business School 15% Vanguard Total Stock Market Index Barcelona 15% Spain Vanguard Small‐Cap Index Vanguard European Stock Index 10% Vanguard Pacific Stock Index 10% 10% Vanguard Emerging Markets Index 10% Vanguard Short‐Term Bond Index Vanguard High‐Yield Corporates Fund 10% 10% Vanguard Inflation‐Protected Securities Fund Vanguard REIT Index 5% WININV 5% Vanguard Precious Metals Fund Winter, 2013 Go 7

Keep In Mind Javier Estrada Simple may be good … IESE Business School Barcelona Spain … and even better than many (very) costly alternatives offered in the industry … for you , which is what really matters … and yet difficult to implement WININV Winter, 2013 In Short Simple may be good – and even better than many Javier Estrada very costly alternatives offered in the industry IESE Business Few assets/products are often more than enough School for individual investors Barcelona Spain Always ask: What do I gain by making my portfolio more complex than some of these simple portfolios? Model portfolios Are simple and sophisticated at the same time Have performed well (though you should ask whether that is good performance for you ) Can be implemented at a very low cost Consider them only a reference (that may or may not be appropriate for you) WININV Winter, 2013 8

Appendix Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2013 Simple Approaches Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2013 Back 9

The 60 ‐ 40 Portfolio Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2013 Back The Permanent Portfolio Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2013 Go 10

The Permanent Portfolio Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2013 Go Back The KISS Portfolio Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2013 11

The KISS Portfolio Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2013 Back The Gone Fishin’ Portfolio Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2013 Go Back 12

Recommend

More recommend