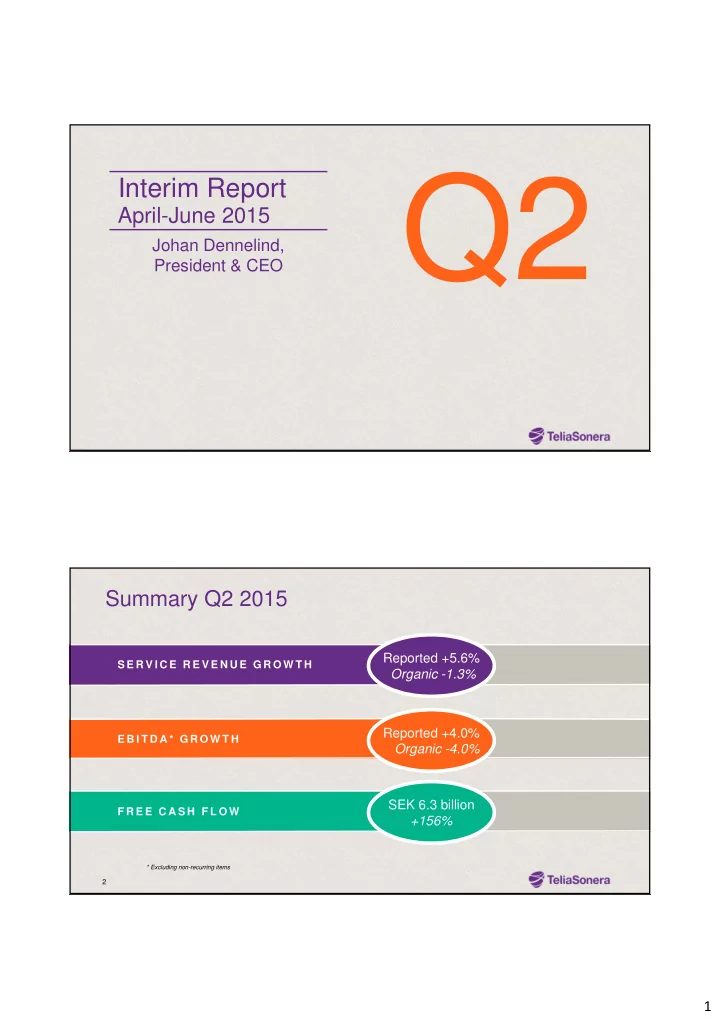

Q2 Interim Report April-June 2015 Johan Dennelind, President & CEO Summary Q2 2015 Reported +5.6% S E R V I C E R E V E N U E G R O W T H Organic -1.3% * Reported +4.0% E B I T D A * G R O W T H Organic -4.0% SEK 6.3 billion F R E E C A S H F L O W +156% * Excluding non-recurring items 2 1

Strengthened competitive position in Norway • Mobile market share around 40 percent >90% 4G population • Superior 4G network position coverage in June • Organic service revenue growth 3 percent • Target 98 percent 4G population coverage by end 2016 3 Faster and better integration - raised synergy target Norway - service revenues* SEK million Norway - EBITDA** SEK million 731 1,996 M&A M&A 516 1,409 Organic Organic Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q2 14 Q2 15 • Tele2 synergy execution ahead of plan, • Service revenues supported by Tele2 acquisition more than SEK 200 million M&A effect in Q2 • Consumer segment driving organic service • Synergy target increased from SEK 800 million revenue growth to SEK 1 billion net, of which approximately SEK 700 million net to be achieved in 2015 * External service revenues **Excluding non-recurring items 4 2

Improved earnings trend in Sweden Service revenue growth* y-o-y Organic EBITDA** growth y-o-y Q1 15 Q2 15 B2C +2.6% +2.6% Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 -5.1% -5.1% B2B -9.6% -9.6% -3.8% -3.8% • Service revenues declined organically • Optimizing market investments behind improved by 1 percent, stable trend vs Q1 trend • Mobile and fiber support growth in consumer, • Profitability still burdened by continued decline in while price pressure remains within enterprise fixed telephony * External service revenues **Excluding non-recurring items 5 Managing a challenging environment in Eurasia Service revenues* and EBITDA** Q2 Organic service revenue growth* y-o-y Organic EBITDA Organic service Nepal 21.6% growth revenue growth Uzbekistan 7.2% Georgia -1.9% Azerbaijan -4.1% -2.0% -2.7% Tajikistan -8.3% Kazakhstan -14.6% Moldova -15.0% • Revenues and earnings impacted by intensified • Higher uncertainty for the second half of the year competition and macro weakness in most parts of • The service revenue decline in Moldova is entirely the region explained by one-off adjustments * External service revenues **Excluding non-recurring items 6 3

Major efforts made in Nepal following the earthquake • Ncell provided customers with free services post the earthquake • Heroic efforts from Ncell employees to get network up and running - most part is now back in operation • TeliaSonera and Ncell have donated and committed funds to support the rebuilding of Nepal • Solid operational performance despite tough conditions 7 Intensified competition in Kazakhstan Mobile ARPU • Ongoing price war with highly aggressive bundled offerings -10% • Kcell remains market leader with EBITDA margin above 50 percent • Kcell launched new competitive nationwide all-net tariff plan “Hello Kazakhstan” in June Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Number of mobile subscriptions -6% Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 8 4

Executing on our strategic agenda E N H A N C E T H E C O R E C O N N E C T I V I T Y C O N V E R G E N C E C O M P E T I T I V E Develop the core business in the Nordics & Baltics #1 Take Eurasia to the next level O P E R A T I O N S E X P L O R E O P P O R T U N I T I E S C L O S E T O T H E C O R E I O T E - H E A L T H M U S I C S E C U R I T Y F I N A N C I A L T V Invest in areas that complement and/or strengthen the core business S E R V I C E S 9 Innovation key to differentiate and drive core business 4G smartphone penetration and mobile data volume 52% 4G smartphone 43% penetration* 22% Mobile data volume growth** 15% M U S I C • Enhanced Spotify partnership to improve skills in media distribution, customer insights and data analytics • Strengthened B2B offerings thanks to Soundtrack Your Brand • Partnership within accessories to differentiate and attract customers 10 * Refers to Sweden ** Refers to Sweden, 12 month rolling 5

Transformation pace beginning to pick up Investments and savings, SEK billion Area Status Targets 2017/2018 Fewer products and offerings 4% 80% Net savings run-rate to be reached 2017 Fewer IT systems 1% 50% 2.0 Share of services and sales online 24% >50% Fewer products and offerings 4% 80% Fewer IT systems 1% 80% Share of services and sales online 15% >50% • Approximately SEK 300 million invested in H1, to be -2.0 further stepped-up during H2 Accumulated • Good progress with increasing online share of sales, investments IT systems and product portfolio transformation still 2015-2016 in early stage • Targets will be achieved stepwise 11 Senior Vice President & CFO Q2 Interim Report April-June 2015 Christian Luiga, 6

Summary Q2 2015 Apr-Jun 2015 Apr-Jun 2014 Change (%) Net sales (SEK million) 27,115 24,985 +8.5 Change local organic (%) +1.9 Service revenues (SEK million) 23,645 22,384 +5.6 Change local organic (%) -1.3 EBITDA* (SEK million) 9,190 8,836 +4.0 Change local organic (%) -4.0 EBITDA* Margin (%) 33.9 35.4 EPS (SEK) 0.75 0.82 -8.1 Free cash flow (SEK million) 6,307 2,469 +155.5 * Excluding non-recurring items 13 FX and M&A support revenue growth in the quarter Q2 Reported service revenue* growth y-o-y Q2 FX change y-o-y versus SEK** 23.5% Kazakhstan +5.6% +5.6% + 4.1 % + 4.1 % Nepal 18.0% Uzbekistan 13.7% + 2.8 % + 2.8 % Euro 2.8% Turkey 0.9% - 1.3 % - 1.3 % Norway -1.5% Azerbaijan -6.2% Russia -15.0% Q2 14 Organic M&A FX Q2 15 • Reported service revenue growth boosted by • The Swedish krona weakened against the majority currency tailwind and Tele2 Norway acquisition of key currencies y-o-y, with the Russian ruble as the main exception * External service revenues ** Q2 FX average 14 7

Continued high growth in equipment sales Group net sales growth* impact Equipment sales growth** Sweden Europe +1.9% +1.9% +3.0% +3.0% 40% 20% +0.1% +0.1% -0.5% -0.5% -0.0% -0.0% -0.2% -0.2% -0.5% -0.5% 0% -20% -40% Net sales Billed Interconnect Other mobile Fixed service Other service Equipment Net sales Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q2 14 revenues revenues service revenues revenues sales Q2 15 revenues • Continued high demand for mobile handsets • Equipment sales continues to grow in both Sweden and Europe • Mobile billed revenues increased in Sweden and Finland, supported by consumer segment, but declined • Q2 2015 group equipment sales increased almost in Eurasia by SEK 900 million y-o-y * In local currencies, excluding acquisitions and disposals ** Growth year-on-year in reported currency 15 Reported EBITDA growth supported by M&A and FX Group EBITDA* growth y-o-y Q2 Organic EBITDA* growth y-o-y Sweden Europe Eurasia Group +4.0% +4.0% +5.0% +5.0% +3.0% +3.0% -2.7% -2.7% -4.0% -4.0% -4.0% -4.0% -5.1% -5.1% -7.5% -7.5% Q2 14 Organic M&A FX Q2 15 • Organic drop explained by revenue pressure in Kazakhstan, • Synergies from Tele2 Norway acquisition almost subscriber acquisition costs in Spain and decline in Swedish compensate for organic EBITDA decline fixed telephony * Excluding non-recurring items 16 8

Investing in superior connectivity CAPEX*, SEK million 4G population SDU fiber roll-out in coverage above 90% Sweden to increase Q2 14 Q2 15 in all Nordic countries 50% in 2015 4,596 4,596 >90% 50% 1,577 1,577 1,410 1,410 903 903 Region Sweden Region Europe Region Eurasia Group • Higher CAPEX in line with invest-to-save and • Expanding mobile coverage across our footprint invest-to-growth initiatives • Solid fiber orders in Sweden - more than 50,000 new single-family homes to be connected in 2015 * Excluding license and spectrum fees 17 Strong free cash flow boosted by Turkcell dividend Free cash flow H1, SEK billion +0.2 +0.2 +0.0 +0.0 + 0.4 + 0.4 + 5.2 + 5.2 -0.1 -0.1 9.2 9.2 • Turkcell dividend of SEK 4.7 billion net -2.0 -2.0 -0.1 -0.1 of tax received in Q2 + 0.6 + 0.6 • Higher CAPEX according to plan 5.0 5.0 * Excluding non-recurring items 18 9

Minor change in net debt year on year Net debt change y-o-y 68.5 68.5 67.1 67.1 +1.2 +1.2 +13.0 +13.0 +0.0 +0.0 • Net debt fairly stable despite +4.3 +4.3 increased CAPEX and M&A activities +18.2 +18.2 • Net Debt/EBITDA 1.91x (1.90x end Q2 2014) - 30.7 - 30.7 - 4.7 - 4.7 Q2 14 CF from Turkcell Cash M&A Dividend Minority FX & Q2 15 operating dividend CAPEX payment dividend Other activities 19 Full year outlook reiterated, but increased uncertainty related to performance in Eurasia Around 2014 level EBITDA* CAPEX** Around SEK 17 billion Target at least SEK 3 per share DIVIDEND * Excluding non-recurring items , in local currencies, excluding acquisitions and disposals ** Excluding license and spectrum fees, currency fluctuations may impact the reported number in Swedish krona 20 10

Q & A Q & A 21 Financial key ratios Jun 30, 2015 Dec 31, 2014 Return on equity* 14.4 15.0 12.2 Return on capital employed* 11.5 Equity/assets ratio 39.0 38.0 Net debt/equity ratio 66.5 57.4 Net debt/EBITDA** ratio 1.91 1.68 Net debt/assets ratio 25.9 21.8 * Rolling 12 months ** Rolling 12 months, excluding non-recurring items 22 11

Recommend

More recommend