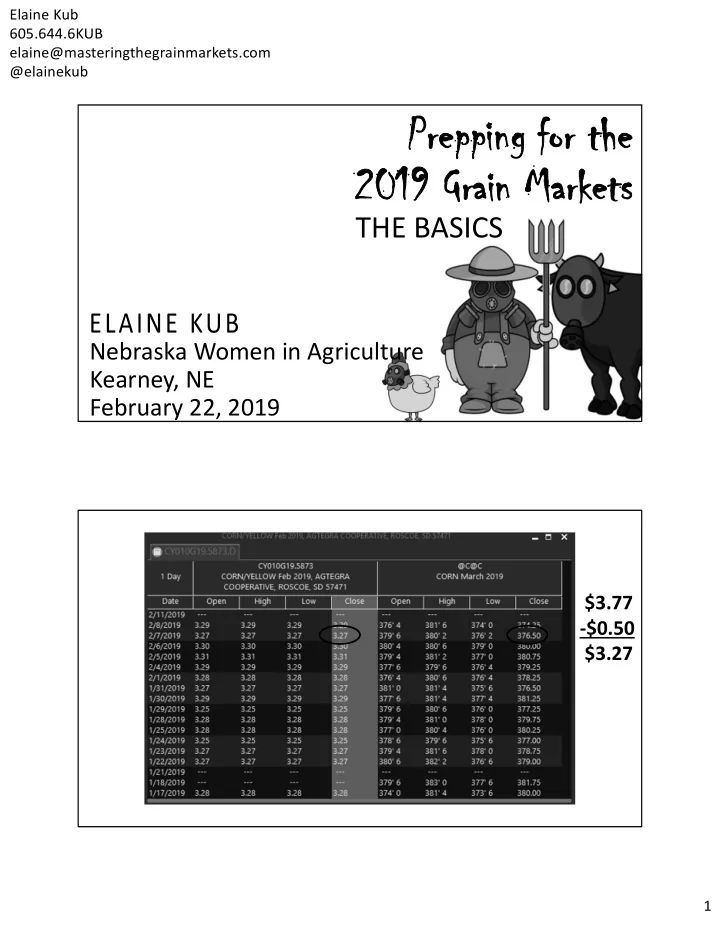

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub Prepping for the Prepping for the 2019 Grain Markets 2019 Grain Markets THE BASICS Nebraska Women in Agriculture Kearney, NE February 22, 2019 $3.77 ‐$0.50 $3.27 1

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub 2

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub 3

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub 4

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub CASH GRAIN CONTRACTS • Spot contracts • Forward contracts • Hedge‐to‐Arrive contracts • Basis‐only contracts Hedging FUTURES CONTRACTS OPTIONS CONTRACTS ‘DESIGNER’ CONTRACTS 5

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub HEDGE: A substitute transaction that will offset future market movements. Example: Corn prices fall from $4 to $3 Lock in $4 per Mathematical January October bushel Result Sell 100,000 bushels at $3 Cash Position +$300,000 per bushel Sell @ $4.00 per $3.00 per bushel x 100,000 bushel x 100,000 bushels Futures bushels (Receive a check for +$100,000 Position (Write a margin $120,000 from your check for trading gains) $20,000) Net $400,000 ($4 per bushel) HEDGE: A substitute transaction that will offset future market movements. Example: Corn prices rise from $5 to $4 Lock in $4 per Mathematical January October bushel Result Sell 100,000 Cash Position bushels at $5 per +$500,000 bushel $5.00 per bushel x Sell @ $4.00 per bushel x 100,000 bushels Futures 100,000 bushels (Send in another ‐$100,000 Position (Write a margin check for $80,000 to cover $20,000) the trading loss) Net $400,000 ($4 per bushel) 6

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub A “put” option: Gives its owner the right but not the obligation to sell an asset at a certain strike price if, at a certain time, the market’s price is lower than that strike price. A “call” option: Gives its owner the right but not the obligation to buy an asset at a certain strike price if, at a certain time, the market’s price is higher than that strike price. Corn Options ‘Put‐Call Parity’ (1/15/2019) Put Price Call Price Disparity March ATM ($3.80) 7.4¢ 7.4¢ 0¢ September ATM 23.4¢ 21.6¢ ‐1.8¢ ($4.00) Soybean Options ‘Put‐Call Parity’ (1/15/2019) Put Price Call Price Disparity March ATM ($9.00) 14¢ 16¢ 2¢ September ATM 44.1¢ 42.5¢ ‐1.6¢ ($9.40) 7

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub 8

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub Will the grain exist Should you sell SELL THE GRAIN! or be covered by some grain today? insurance? Yes Is it a good price? Sell the grain anyway. No No Is it highly likely to go up in the You have my future? limited permission Yes to procrastinate. 9

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub 8¢ 10

Elaine Kub 605.644.6KUB elaine@masteringthegrainmarkets.com @elainekub 11

Recommend

More recommend