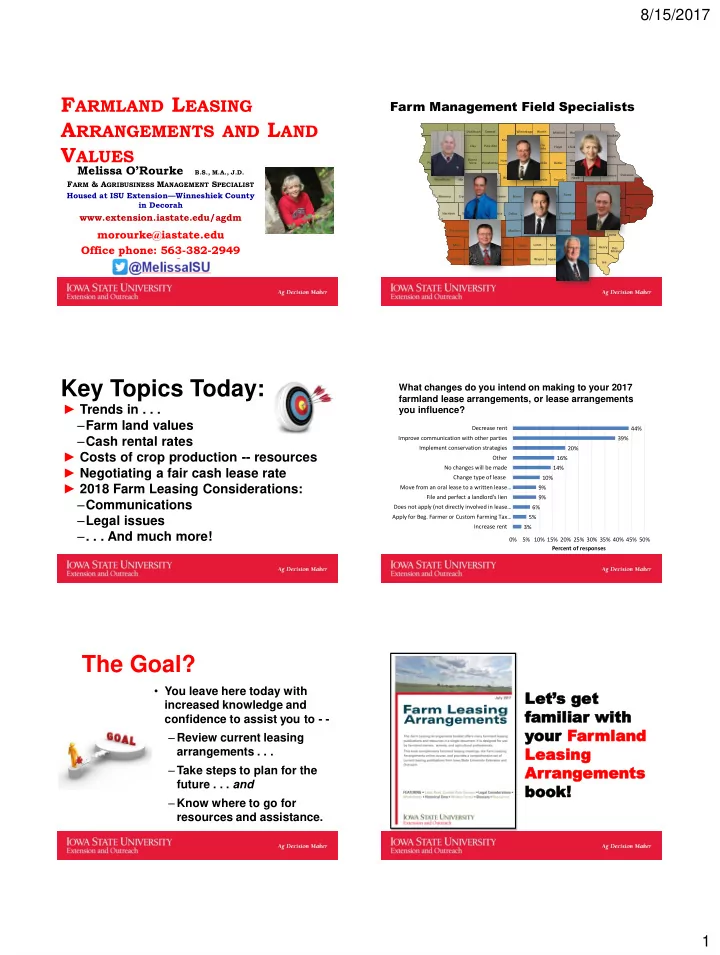

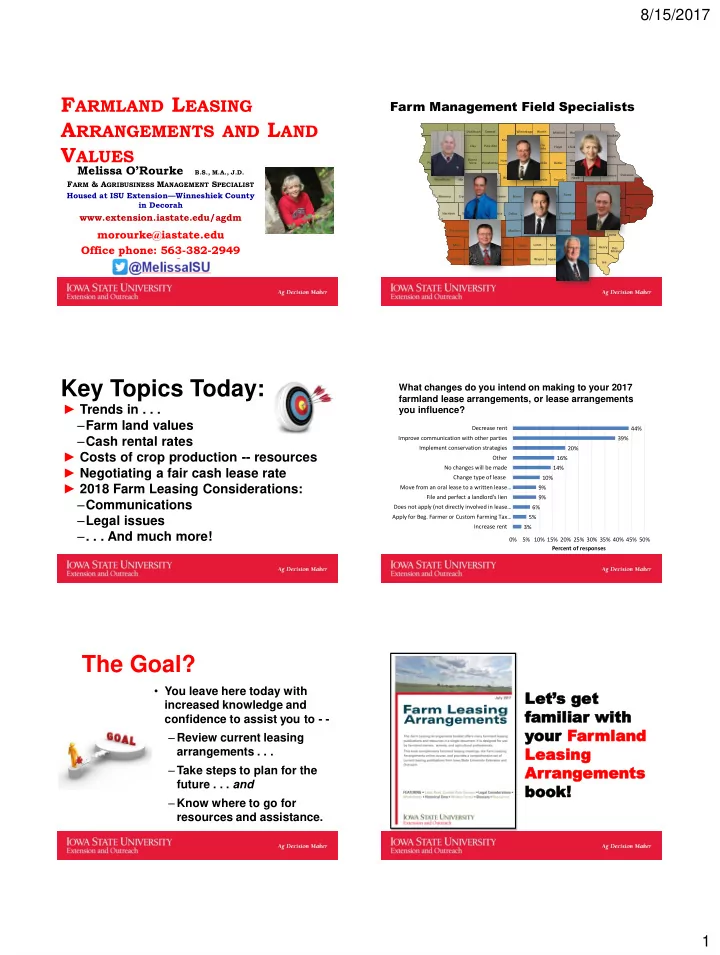

8/15/2017 F ARMLAND L EASING Farm Management Field Specialists A RRANGEMENTS AND L AND Lyon Osceola Dickinson Emmet Winnebago Worth Mitchell Howard Winneshiek Allamakee Kossuth MO V ALUES Sioux O'Brien Clay Palo Alto Hancock Cerro Floyd Chickasaw Gordo GW Fayette Clayton Buena Humboldt Bremer Plymouth Cherokee Vista Pocahontas Wright Franklin Butler Melissa O’Rourke B.S., M.A., J.D. Black Dubuque Buchanan Delaware Webster Hawk Woodbury Ida Sac Calhoun Hamilton Hardin Grundy F ARM & A GRIBUSINESS M ANAGEMENT S PECIALIST Jackson Housed at ISU Extension — Winneshiek County Jones Tama Benton Linn Monona Crawford Carroll Greene Boone Story Marshall SE SJ in Decorah RD Clinton Cedar www.extension.iastate.edu/agdm Harrison Shelby Audubon Guthrie Dallas Polk Jasper Poweshiek Iowa Johnson Scott Mus- catine morourke@iastate.edu Pottawattamie Cass Adair Madison Warren Marion Mahaska Keokuk Washington Louisa CB Mont- Office phone: 563-382-2949 Mills Adams Union Clarke Lucas Lucas Monroe Wapello Jefferson gomery Henry Des Moines Fremont Page TE Taylor Ringgold Decatur Wayne Appanoose Davis Van Buren Lee Key Topics Today: What changes do you intend on making to your 2017 farmland lease arrangements, or lease arrangements ► Trends in . . . you influence? – Farm land values Decrease rent 44% – Cash rental rates Improve communication with other parties 39% Implement conservation strategies 20% ► Costs of crop production -- resources Other 16% ► Negotiating a fair cash lease rate No changes will be made 14% Change type of lease 10% ► 2018 Farm Leasing Considerations: Move from an oral lease to a written lease… 9% File and perfect a landlord's lien 9% – Communications Does not apply (not directly involved in lease… 6% – Legal issues Apply for Beg. Farmer or Custom Farming Tax… 5% Increase rent 3% – . . . And much more! 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Percent of responses The Goal? • You leave here today with Let’s get increased knowledge and familiar amiliar with ith confidence to assist you to - - your our Far armland mland – Review current leasing Leas Leasing ing arrangements . . . Ar Arran ange geme ments nts – Take steps to plan for the future . . . and book! book! – Know where to go for resources and assistance. 1

8/15/2017 ww www.exte tension.iasta tate te.edu/a /agdm Get familiar with Ag Decision Maker!! For this Iowa program, the Program Purpose Beginning Farmer must . . . • Created in 2009 to encourage agricultural asset owners to • Have education, training and/or lease to qualifying beginning experience for the type of farming farmers. required for the lease. • Make all operational & managerial • Provides asset owner with decisions credit on Iowa income taxes. • Perform labor necessary to fulfill lease • Beginning Farmer must have conditions. low – moderate net worth. • Have access to working capital, farm For 2017 – the cap is equipment, machinery and/or livestock $645,284. to fulfill the lease. • Financial statement required • Be responsible for all financial expenses necessary to lease and with application. manage the property. Basic Provisions: Tax Credit Example: xample: Calcula Calculating ting Cas Cash h Calculations for 2017 Rent ent Tax ax Cr Credit edit for or 2017 2017 • Cash lease – 7% • 160 acres cash rented • Cash/flex lease – 7% on • $250 per acre base rent amount (but not • $40,000 gross lease the bonus) income • Crop Share – 17% of asset • $40,000 x 7% = $2800 owner’s share of the crop Iowa income tax credit • 1% bonus for military • Can be used for flexible veterans & crop-share leases too. • Examples on the website. 2

8/15/2017 What about 2018? — Changes For or Mor More Inf e Infor orma mation ion and and to o Appl pply: y: down the road . . . . . • See 3-page application and instructions at: 2017 Iowa Legislature failed to act. • IowaFinanceAuthority.gov Unless 2018 Legislature acts, big • For 2017 Crop Year: program changes. applications accepted until the Cash lease credit – to 5% limit of $6 million in tax credits is reached – or – September 1, Crop Share – to 15% of asset 2017 (whichever occurs first). owner’s share of crop • Beginning farmer’s financial NO 1% bonus for military veterans statement • Beginning farmer’s Custom Farming Contract Tax Credit program background letter created in 2013 will expire in 2018. (Taxpayer hiring Beginning • Fees = start at $300 and Farmer to complete agricultural contract work for production of crops or depend on the length of the livestock may qualify for a tax credit of 7% of the custom contract amount (8% lease for veterans)). Why is it important for Farmland Owners and Farm Producers to think about farmland values? What are some sources of Iowa Farmland Value Data? County Assessors’ Offices • Some county assessors maintain public (Pdf or Excel spreadsheet) document of ag land sales: • http://siouxcounty.org/wp-content/uploads/2016/05/agsales.pdf 3

8/15/2017 Federal Reserve Bank — Chicago Realty & Auction Websites • www.chicagofed.org – Quarterly survey of ag lenders by state – Annual Land Values Conference – AgLetter: Quarterly Newsletter re: ag land values & credit – Go to chicagofed.org and click on publications AgLetter Federal Reserve Bank of Chicago FARMLAND VALUES AND CREDIT CONDITIONS Summary In the first quarter of 2017, agricultural land values for the Seventh Federal Reserve District were unchanged from a year ago — the first pause in the current downturn since the third quarter of 2015. Moreover, “good” farmland values in the first quarter of 2017 were largely the same as in the fourth quarter of 2016, according to the survey responses of 198 District agricultural bankers. Cash rental rates for District farmland continued their decline in 2017, falling 7 percent from 2016. The demand to purchase agricultural land in the three- to six-month period ending with March 2017 was lower than in the same period ending with March 2016. Additionally, the amount of farmland for sale, the number of farms sold, and the amount of acreage sold were down during the winter and early spring of 2017 compared with a year ago. The responding bankers leaned heavily toward the view that farmland values would remain stable during the second quarter of 2017 — a shift from the sentiment that farmland values would continue to decline held widely a year earlier. Realtors Land Institute March 2017 RLI Survey – Semi-annual survey (March and September) – Compares land classification by corn production – Most recent survey always available on Ag Decision Maker 4

8/15/2017 - Dollars/acre and percent change “The Iowa farmland market is showing weakness following from 2016 significant increases in value over the past decade. Based on the Iowa State University Farmland Value Survey, 2015 Iowa http://usda.mannlib.cornell.edu/usda/current/AgriLandVa/AgriLandVa-08-03-2017.pdf land values have decreased two years in a row since 2000. However, despite these decreases , current Iowa farmland values are still more than double what they were 10 years ago, 75 percent higher than the 2009 values and 14 percent Iowa State University Timely Farmland Value Survey topics in – Conducted annually since 1941 Newsletters – free to – Mailed to 1100 licensed real estate brokers; 500-600 responses you on Ag – Released annually in mid-December Decision – November 1 to November 1 Maker – Latest and historical surveys found on Ag Decision Maker website – www.extension.iastate.edu/agdm SEE YOUR BOOK – page 23 “The survey is intended to provide information on general land value trends, geographical land price relationships, and factors influencing the Iowa land market. The survey is not intended to provide a direct estimate for any particular piece of http://www.card.iastate.edu/land-value/ property.” Land Value Survey Publication - Book Page 23 5

8/15/2017 2015 and 2016 Farmland Values Northeast counties – 2015 (bottom Percent #) & 2016 (top #) farmland values change – 2015 to 2016 Crop Reporting District 3 Crop Reporting District 2 6

Recommend

More recommend