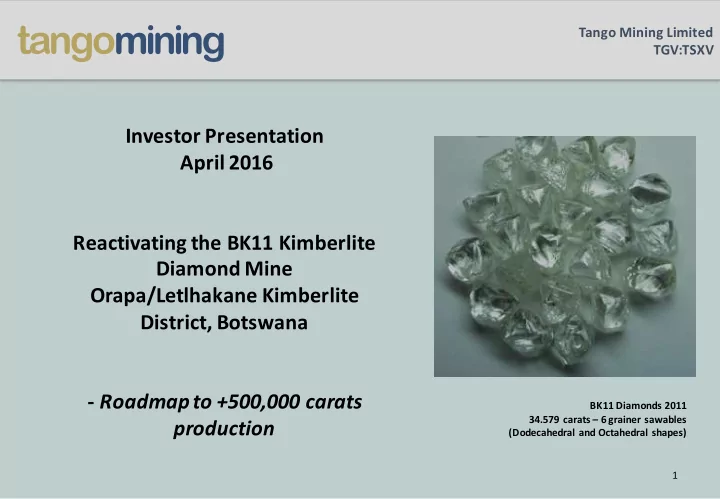

Tango Mining Limited TGV:TSXV Investor Presentation April 2016 Reactivating the BK11 Kimberlite Diamond Mine Orapa/Letlhakane Kimberlite District, Botswana - Roadmap to +500,000 carats BK11 Diamonds 2011 34.579 carats – 6 grainer sawables production (Dodecahedral and Octahedral shapes) 1

Forward Looking Statement Certain information set forth in this presentation contains “forward-looking statements” and “forward-looking information” under applicable securities laws. Except for statements of historical fact, certain information contained herein constitutes forward-looking statements, which include management’s assessment of future plans and operations and are based on current internal expectations, estimates, projections, assumptions and beliefs, which may prove to be incorrect. Someofthe forward-looking statements may be identified by words such as “forecasts”, estimates”, “expects” “anticipates”, “believes”, “projects”, “plans”, “outlook”, “capacity” and similar expressions. These statements are not guarantees of futureperformanceand unduerelianceshould not beplaced on them. Such forward-looking statements necessarily involveknown and unknown risks and uncertainties, which may cause Tango Mining Limited (the “Company”) actual performance and financial results in future periods to differ materially from any projections offutureperformanceor results expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: risks that the presence of economic mineral deposits mentioned nearby the Company's property are not indicative of mineralization on the Company's properties, the supply and demand for, deliveries of and the level and volatility of prices of rough diamonds, risks that the actual revenues will be less than projected; risks that the target production for the existing mining contracts will beless than projected or expected; risks that production will not commenceas projected due to delay or inability to receive governmental approval ofthe Company’s acquisition or thetimely completion ofa National Instrument 43-101 report; technical problems; inability of management to secure sales or third party purchase contracts; currency and interest rate fluctuations; foreign exchange fluctuations and foreign operations; various events which could disrupt operations, including labour stoppages and severe weather conditions; and management’s ability to anticipateand managethe foregoing factors and risks. The forward-looking statements and information contained in this presentation and/or website are based on certain assumptions regarding, among other things, future prices for coal and diamonds; future currency and exchange rates; the Company’s ability to generate sufficient cash flow from operations and access capital markets to meet its futureobligations; coal consumption levels; and theCompany’s ability to retain qualified staffand equipment in a cost-efficient manner to meet its demand. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The reader is cautioned not to place undue reliance on forward-looking statements. The Company does not undertake to update any of the forward-looking statements contained in this presentation unless required by law. The statements as to the Company’s capacity to achieverevenue are no assurancethat it will achievetheselevels of revenue. TGV.TSXV 2

Our Board of Directors and Senior Management Terry L Tucker (P.Geo) Executive Chairman and Interim CEO Terry Tucker has over 26 years‘ experience in mineral exploration and development projects and has served on various executive Boards that include CEO and Director of Nyota Minerals Limited (AIM, ASX: NYO) and President, CEO and Director of TSX-listed StrataGold Corporation. His current appointment to the Board of Firestone Ventures (TSXV: FV) also supports his role on strategic, operational and corporate matters of Tango. Mr. Tucker holds a B.Sc. Geology degree from the University of Alberta and is a member of the Association of Professional Engineers and Geoscientists of British Columbia. Kevin Gallagher Director Kevin Gallagher has over 40 years’ experience in the Southern African mining and metallurgical process engineering industry, at various coal, gold and platinum plants that includes Harmony Gold, Rand Mines Group & Rio Tinto and De Beers. He was also the founder and President of the Kwena Mining Group and is a member of the South African Coal Processing Society, and the Mine Metallurgical Managers Association, holds a Diploma (Hon) Mineral, Processing & Extractive Metallurgy from the School of Mines Rhodesia and completed the Management and Executive Development Program with UNISA and UCT respectively. Antonio Ponte Director Antonio Ponte is a Swiss based financier with 25 years of asset management and mining corporate finance experience in Switzerland and Europe. He is the Chairman and Founder of Raifin SA, a European Mining Finance Consultancy, and in the past has held positions at UBS Switzerland and Citibank Switzerland . Mr. Ponte has been a director and consultant to a number of TSXV companies for a number of years. Devin McKay Chief Operating Officer Devin McKay is a metallurgist with 28 years experience, having worked for Anglo American and DeBeers (21 years), Gem Diamonds (3 years), and Centar Limited (4 years). He has worked throughput the mining value chain; exploration, mining, metallurgy, engineering, environmental, finance, strategic planning, and management. Experience includes areas of; operations, R&D, projects, commissioning, mine optimization, feasibility studies, business development, corporate finance, and marketing and sales. He has a National Higher Diploma in Extractive Metallurgy and completed Management Development Program at Gibbs University. Theodor Boshoff General Manager –Plant & Metallurgical Process Engineering Theodor Boshoff has over 11 years diamond mining and processing experience of which 5 years were with De Beers Consolidated Mines at Cullinan, Koffie Fontein, Venetia Mines; AK6 Mothae or Boteti Mine for Lucara Diamonds; and Metallurgical Project Manager on the Projectio Alto Cuilo for Petra Diamonds; Saurimo Projects and Itengo alluvial projects in Angola. A fellow with the South African institute for Mining and Metallurgy and the Coal processing Society of South African, registered with the Engineering Council of SA and holds an Honors and M.Eng. Metallurgical Engineering (2014) with the University of Pretoria. 3 TGV.TSXV

Corporate Profile Tango Mining Limited (“ Tango ” or the “ Company ”) is an TSXV-listed diamond producer with the producing Oena Diamond Mine in South Africa, an option to acquire and reactivate the past producing BK11 Kimberlite Diamond Mine in Botswana and four thermal coal, metallurgicaland processing plant and engineering contracts in South Africa. • African Starholds: • a 100% interest in the Oena Diamond Mine, a producing alluvial diamond mine that has been sold for USD$3M, subject to approvals, to Bothma DiamanteCC; • Kwena Group holds: • four toll treatment contracts for four coal production collieries located within the Ogies and Highveld coalfields, Mpumalanga Province and Kliprivier coalfield, KwaZulu-Natal Province, South Africa. • BK11 Kimberlite Diamond Mine Option: In July 2015, the Company agreed the purchase the BK11 Mine and production facility in Botswana from Firestone and the minority SHARE STRUCTURE (8.4.2016) partner for a total acquisition price of US$8.8M, of which: Total Issued and Outstanding 142,426,710 • US$350,000 was paid on 9 July 2015; Insiders 42,088,713 (29.55%) • US$7,650,000 is payable to Firestone and US$0.8M is payable to the minority partner (US$8.45M total) by 29 July 2016; and Warrants 25.2.2017 (C$0.10) 4,000,000 • Care and maintenance fees of up to US$40,000 per month are payable on closing. Options 7,350,000 • The transaction is subject to Botswana Government approvals Fully Diluted Issued and Outstanding 153,776,710 and financing. The Company has received unconditional approval from the Competition Authority and has made application to the Minister of Mines. 4 TGV.TSXV

South Africa Operations – Locations 5 TGV.TSXV

South Africa Operations – Kwena Group 7,286,981 t processed to year end August 2015 (6,500,000 t budget) South Africa based team of 325 skilled engineering and metallurgical skilled persons. Established 1988 – 27 years experience in the precious metal, base metal, thermal coal and diamond industry. Management has a combined >200 years of mine operating and multi stream processing expertise. Service contracts with 4 plants operating with capacity in excess of 12M tpa under management that allows potential increase of revenue base from current 50% utilization to the historical production results. Clients include Exxaro and Glencore. 6 TGV.TSXV

Recommend

More recommend