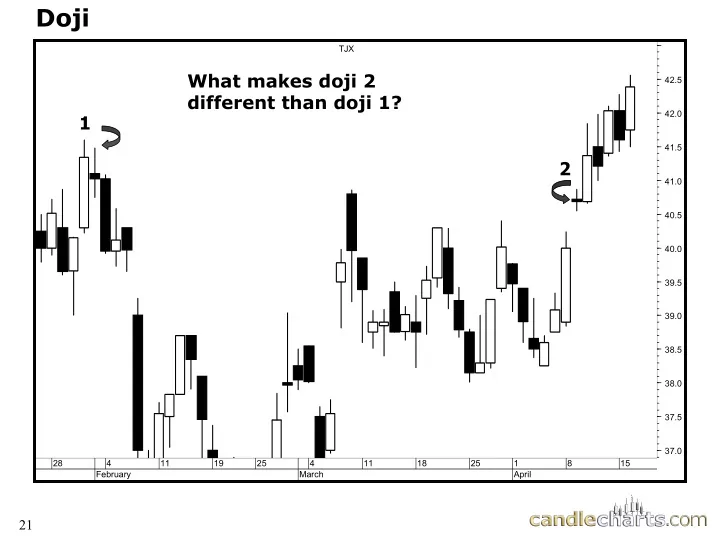

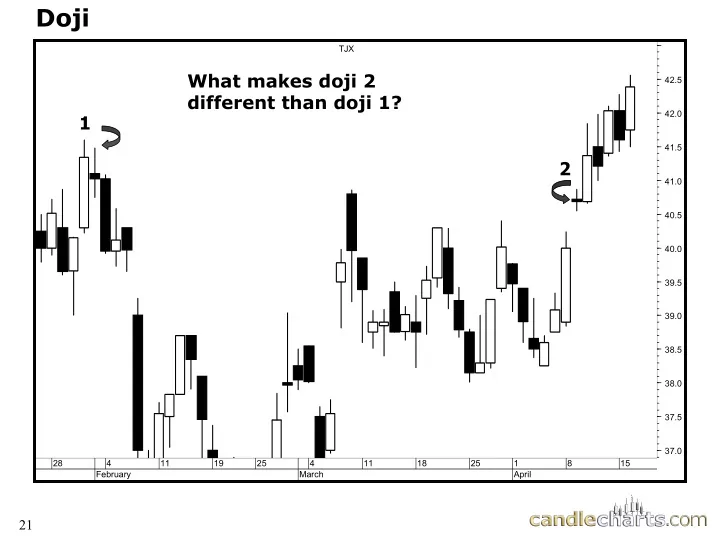

Doji TJX What makes doji 2 42.5 different than doji 1? 42.0 1 41.5 2 41.0 40.5 40.0 39.5 39.0 38.5 38.0 37.5 37.0 28 4 11 19 25 4 11 18 25 1 8 15 February March April 21

Trading Tactics Trading Tactics 1) Name the two reversal signals at the arrows. 2) Would you use these signals to sell short? Liquidate longs? Why? 3) What is bearish confirmation of the reversal signals? 22

Doji as Resistance Doji as Resistance Criteria: Use the highest high of those two sessions (top of upper shadow) as resistance Implication: Close over that area: market is “refreshed” 23

Doji The red arrows show the bulls have complete control. The doji session alters the trend (note also the spinning tops in mid and late June). 24

Small Real Body as a doji 25

Doji after tall white 26

Doji as Resistance 27

Trading Tactics - - Doji Doji Trading Tactics Analyze these doji in the context of what happened before. Are any of these a more likely reversal and why? C-3 A -1 B-2 28

Trading Tactics – – Doji (answer) Doji (answer) Trading Tactics Analyze these doji in the context of what happened before. Are any of these a more likely reversal and why? C-3 � A-1 B-2 Resistance confirmed by Rally may Market not doji just be overextended starting 29

Doji Overview – – Analyze Each Doji in Context of Trend Analyze Each Doji in Context of Trend Doji Overview HEIDRICK STRUGG 20.5 20.0 19.5 19.0 18.5 4 5 18.0 17.5 17.0 6 3 16.5 16.0 15.5 15.0 2 14.5 14.0 13.5 1 15 22 29 5 12 19 26 3 9 16 23 August September 30

Shadows Remember: location and size of the shadow should be considered when analyzing the market psychology. Implication: Bearish long upper shadow offsets “rallying strength.” Bullish long lower shadows hints bears losing force. 31

Upper Shadows and slope of advance 32

The Tools of the West with the The Tools of the West with the Light of the Candles Light of the Candles Scenario 1 Scenario 2 33

Hammer Criteria: • Small real body at, or near top, of range • Lower shadow at least 2x real body • Market in down trend Implication: ‘Groping for a bottom” black or white 34

Shooting Star • Criteria: • Small real body at, or near bottom, of range black or white black or white • Upper shadow at least 2x real body • Market in an up trend • Implication: ‘Signaling Trouble Overhead” 35

High Wave Candles High Wave Candles Criteria: very long shadows and lower small real body - color not important Implication: Trend is losing force 36

High Wave Candle Who’s in Charge? Who’s in Charge Now? 37

High Wave Candle New High Close,but?? 38

Long Legged Doji – “Rickshaw Man” Criteria: very long shadows and lower small real body - color not important Implication: “Market has lost it’s sense of direction” 39

High-wave candle RDY The market is at a new high- but the high wave candle shows the bulls are not in full control. 40

Recommend

More recommend