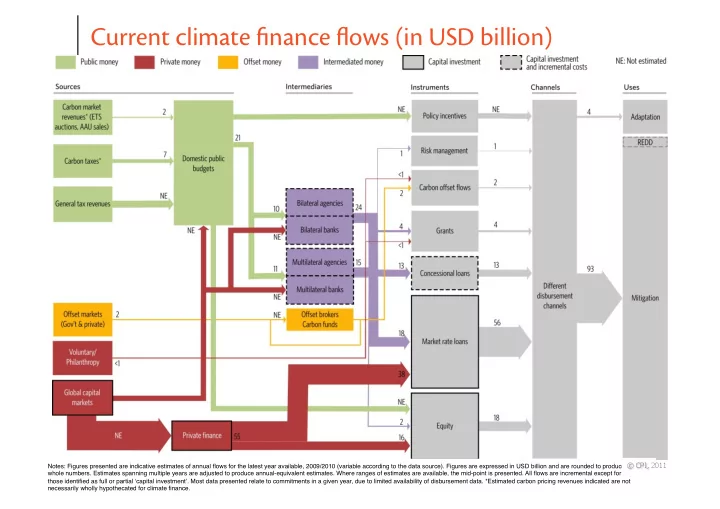

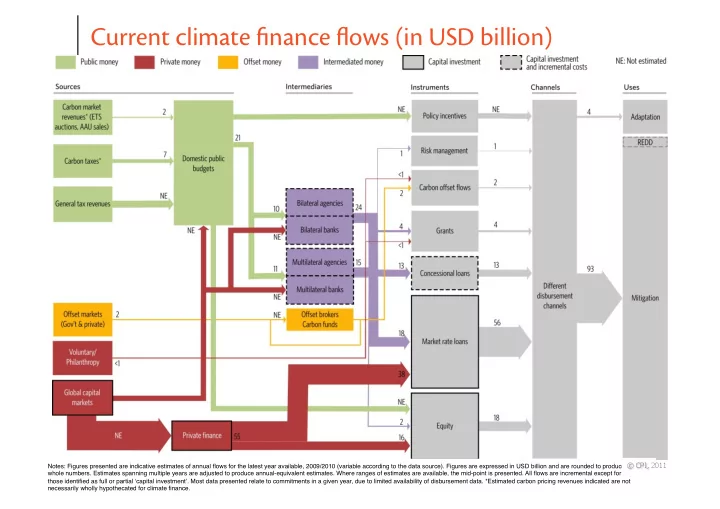

Current climate finance flows (in USD billion) CPI Climate Finance Project October 2012 Notes: Figures presented are indicative estimates of annual flows for the latest year available, 2009/2010 (variable according to the data source). Figures are expressed in USD billion and are rounded to produce whole numbers. Estimates spanning multiple years are adjusted to produce annual-equivalent estimates. Where ranges of estimates are available, the mid-point is presented. All flows are incremental except for those identified as full or partial ʻ capital investment ʼ . Most data presented relate to commitments in a given year, due to limited availability of disbursement data. *Estimated carbon pricing revenues indicated are not necessarily wholly hypothecated for climate finance. �

Some key findings* • Money is flowing – but falls far short of what is needed to finance a low-emissions transition – Important role of domestic & South-South flows (NDBs) – Significant contributions of households in developed countries • Private capital is essential to achieve a transformation – Incidence of public money standing behind private money • Intermediaries’ know-how at different stages of the life cycle of climate flows is fundamental to unlock capital. • Better information about finance flows – but gaps and lack of definition continue to hamper the understanding of what is effective climate finance *including early insights from 2012 update CPI Climate Finance Project October 2012 2 ¡

Short Term... At least $97bn p.a. of climate finance is currently being provided to support low-carbon, climate-resilient development activities. Yet… • Currently, carbon finance plays only a small role in climate finance ($2bn). – EU ETS remains engine of carbon market • Carbon price is essential to address climate change – EU ETS provides lessons – Currently experiments around the world – No global GHG market in short term CPI Climate Finance Project October 2012 3

...and Long Term At least $97bn p.a. of climate finance is currently being provided to support low-carbon, climate-resilient development activities. Yet… • e $97bn needs to be put in perspective of what is needed to finance a transition to a low-emissions future – Don’t confuse the $97bn with the $100bn of the Copenhagen Accord (not necessarily additional, incl. developing countries & domestic money, incremental costs & capital investment) • Total annual investment needed in developing countries by 2015: US$10 trillion* – Economic/energy projections confirm the need for a rising carbon price to reduce GHG emissions to acceptable levels CPI Climate Finance Project October 2012 4 *Source: IMF, World Economic Outlook database, April 2011

e EU Emissions Trading System • Covers currently ∼ 40% of EU GHG emissions ; • Single largest market for GHG emissions ; • True multi-national scheme (25/27 Member States) – Link to Norway, Iceland, Liechtenstein – A “Linking Directive” governs relationships between EU ETS & Kyoto Protocol EU ETS stimulates overall carbon market • A phased approach – Phase I: 2005-07 – “pilot phase” – Phase II: 2008-12 – Dec ‘08: Agreement on Review beyond 2012 EU energy & Jan 1: Start of Jan 1: Start Jan 1: Start of climate policy phase II of phase III phase I objectives 2005 2007 2012 2013 2020 2008 Feb 15: Entry Jan 1: Start of Dec: end of CPI Climate Finance Project October 2012 5 ¡ into force of 1st CP of KP 1st CP Kyoto Protocol

Main features of the EU ETS • A classic cap-and-trade system – But highly decentralized implementation • Covering electric utilities & industry – Aviation from 2012 • Sequential multi-year periods with declining cap – 2005-07; 2008-12; 2013-20; -1.74% annually post-2020 • Offsets allowed up to 13% of emissions – Only from Kyoto CDM and JI mechanisms • Free allocation evolving to full auctioning CPI Climate Finance Project October 2012

EU ETS sector emissions and caps: 1990 - 2020 2,500 2,000 Million Tons 1,500 1,000 500 0 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 Counterfactual Emissions ETS Emissions The Cap CPI Climate Finance Project October 2012 Source:: Ellerman (2012)

Surprises: Abatement in the pilot phase • A significant positive price • Rising GDP and real output – Taking into account also growth in ETS sectors • Weather and relative prices of fossil fuels worked to increase emissions over 2005-07 • Emissions are lower than historical levels (even after allowing for plausible bias) A ¡long ¡posi,on ¡is ¡not ¡a ¡per ¡se ¡indicator ¡of ¡over-‑alloca,on CPI Climate Finance Project October 2012 *Source: : Ellerman et al. (2010)

Surprises: Offset use (early observations) • Only 4% of emissions covered by offsets • Used by only 20% of installations – Highest use among industrials, not utilities • Equal to 42% of available CDM credits • Same composition as supply – 40% from China; 30% from India, S. Korea, & Brazil CPI Climate Finance Project October 2012 Source : Ellerman (2012)

Surprises: Economic effects • Great fears of macroeconomic and trade effects • Trade effects have been imperceptible so far – Continuation of past trends in net imports – Increasing production until Great Recession • Only one price among many – Non-CO 2 prices determining industrial location and production remain as important as before CPI Climate Finance Project October 2012 *Source: : Ellerman (2012)

Early lessons and achievements • A pilot phase is useful. – Trading infrastructure and experience • Limited impact so far on competitiveness. – But: impact may change in the longer term • Major driver of the global carbon market. – Links to other schemes and project-based mechanisms • A price on carbon over 10% of global emissions. – Modest reductions so far; but pervasive signal for investment and innovation • Mechanism in place for achieving further GHG emission reductions – More than anyone else has done • Laboratory for a multi-national system Yet, the recession has led to a EU ETS crisis.... CPI Climate Finance Project October 2012

Bottom Line – Where Next? • Price signal is needed to internalize CO 2 costs – market instruments are essential to transmit it – EU ETS as pioneers: many achievements & lessons – ere are many ways to deliver tons of emission reductions – the carbon market being one important • Slow pace but progress – A price signal – Signals for a stronger GHG market? • Need to strengthen the EU ETS – by understanding what happens – ETS – a cyclical instrument – What about banking? CPI Climate Finance Project October 2012

¡ ¡ …helping nations spend their money wisely BEIJING +39 041 2700 426 BERLIN Island of San Giorgio Maggiore 8 RIO DE JANEIRO 30126 Venice SAN FRANCISCO Italy VENICE climatepolicyinitiative.org

Carbon ¡Market ¡Seminar ¡-‑ ¡Fixing ¡the ¡EU’s ¡ Emissions ¡Trading ¡Scheme ¡ Ins%tute ¡for ¡Interna%onal ¡and ¡European ¡Affairs, ¡8 ¡N. ¡ Great ¡Georges ¡Street, ¡Dublin ¡ 12:00-‑14:00 ¡Monday, ¡October ¡15, ¡2012 ¡ Professor ¡Frank ¡J. ¡Convery, ¡Chair, ¡publicpolicy.ie ¡and ¡ Senior ¡Fellow, ¡UCD ¡Earth ¡Ins%tute ¡ (frank.convery@ucd.ie) ¡ 1 ¡

Acknowledgements ¡ Luke ¡Redmond ¡(UCD) ¡data ¡and ¡graphs ¡ Mar%n ¡Howley ¡(SEAI) ¡data ¡and ¡graphics ¡from ¡‘Ireland’s ¡ Energy ¡Balance ¡2011’, ¡presented ¡at ¡ Ireland’s ¡ Greenhouse ¡Gas ¡Emissions, ¡TCD, ¡October ¡12, ¡2012. ¡ Paul ¡Duffy ¡(EPA), ¡data ¡and ¡graphics ¡from ¡‘Ireland’s ¡ Greenhouse ¡Gas ¡Emissions ¡1990-‑2011 ¡presented ¡at ¡ Ireland’s ¡Greenhouse ¡Gas ¡Emissions , ¡TCD, ¡October ¡12, ¡ 2012. ¡ 2 ¡

Key ¡Conclusion ¡1 ¡‘Fixing’ ¡the ¡price ¡of ¡EU ¡ETS ¡ Needed, ¡but ¡how? ¡ NEED ¡ Ireland ¡ ¡-‑ ¡2 ¡dividends ¡ -‑ ¡Will ¡reduce ¡public ¡service ¡obliga%on ¡subsidy ¡for ¡wind ¡power ¡and ¡commercialise ¡exports ¡ -‑ ¡Narrow ¡the ¡price ¡‘wedge’ ¡between ¡CO 2 ¡tax ¡and ¡allowance ¡price ¡ ¡-‑ ¡efficiency ¡gain ¡ EU ¡– ¡cheap ¡US ¡coal ¡is ¡making ¡coal ¡fired ¡plant ¡abrac%ve ¡ HOW? ¡ Price ¡ Floor ¡price ¡not ¡a ¡runner ¡– ¡precluded ¡by ¡unanimity ¡rule ¡ • Volume ¡ Back-‑loading ¡ ¡-‑ ¡no ¡long ¡term ¡impact ¡on ¡price ¡ • Addi%onal ¡uncertainty ¡to ¡no ¡good ¡effect ¡ • Likely ¡-‑ ¡permanent ¡reduc%on ¡in ¡supply, ¡but ¡when? ¡ ¡ Other ¡OpPons ¡ Linkage ¡to ¡(more ¡binding) ¡non-‑trading ¡emissions ¡cap ¡– ¡but ¡means ¡increasing ¡NETS ¡cap ¡ • • Including ¡road ¡transport ¡in ¡EU ¡ETS ¡ 3 ¡

Recommend

More recommend